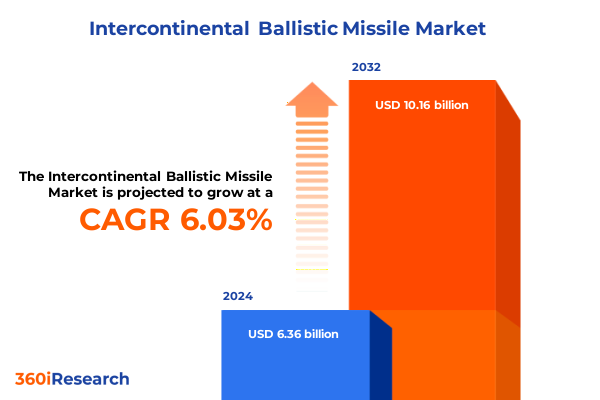

The Intercontinental Ballistic Missile Market size was estimated at USD 6.74 billion in 2025 and expected to reach USD 7.14 billion in 2026, at a CAGR of 6.04% to reach USD 10.16 billion by 2032.

Unveiling the Strategic Evolution of Global Intercontinental Ballistic Missile Capabilities and Their Enduring Security Significance in Modern Defense Ecosystems

The intercontinental ballistic missile has long stood as a cornerstone of strategic deterrence among major global powers, underpinning the concept of mutually assured destruction and shaping high-stakes defense postures. In an era defined by accelerating technology cycles and fluid geopolitical tensions, ICBM systems are experiencing unprecedented upgrades in propulsion, guidance, and payload delivery capabilities. This executive summary provides a concise entry point into the contemporary forces that are directing the evolution of ICBM arsenals worldwide.

Recent years have seen a convergence of advanced materials science, precision navigation technologies, and hardened command architectures that extend range and survivability. Concurrently, shifts in international security frameworks and bilateral defense doctrines have heightened the imperative to modernize legacy missile systems. By situating these developments within a broader strategic context, this introduction sets the stage for a deeper examination of transformative trends, tariff-induced dynamics, and regional variations that define today’s ICBM landscape.

Mapping the Paradigm-Shifting Technological and Geopolitical Transformations Reshaping Intercontinental Ballistic Missile Development Today

The landscape of intercontinental ballistic missile development has been reshaped by a series of paradigm-shifting technological breakthroughs and evolving geopolitical imperatives. Advances in composite solid propellants and cryogenic liquid engines have extended payload capacities and reduced launch preparation times, while satellite-linked guidance systems ensure pinpoint accuracy against hardened targets. These developments are not isolated; they exist alongside strategic doctrines that increasingly emphasize rapid launch readiness and mobile deployment options.

Geopolitical realignments have further amplified these technological shifts, as emerging powers seek strategic parity and established nations reinforce deterrence postures. Investment in redundant command-and-control networks and electronic counter-countermeasure suites reflects a broader emphasis on system resilience under contested conditions. In this way, the interplay of innovation and doctrine is driving a transformative era in which ICBM capabilities are being continuously redefined to address nuanced security challenges.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Policies on Global Intercontinental Ballistic Missile Manufacturing and Supply Chains

United States tariff policies enacted in early 2025 have triggered significant reverberations across the global ICBM industrial base, influencing component sourcing, production timelines, and cost structures. By imposing heightened duties on specialized alloys, precision-machined parts, and electronic guidance subcomponents, the tariffs have compelled manufacturers to reevaluate supply chain strategies and pursue alternate procurement pathways. As a result, lead times for critical materials have lengthened and manufacturers have accelerated efforts to localize production capabilities.

These policy-induced shifts have also catalyzed innovation in materials substitution and in-house fabrication processes. Defense contractors, faced with rising import costs, are investing in domestic foundries and additive manufacturing centers to mitigate dependency on foreign suppliers. While the immediate effect has been increased unit costs and restructured vendor relationships, over the medium term the industry is poised to benefit from enhanced supply chain resilience and deeper vertical integration. In this way, the 2025 tariff measures serve as both a challenge and a catalyst for strategic industrial modernization within the ICBM sector.

Uncovering Critical Insights Across Propulsion, Platform, Warhead Type, Guidance Systems, and Payload Capacity Segments in ICBM Markets

Critical segmentation analysis reveals nuanced performance differentials and development priorities across multiple dimensions of ICBM market composition. Propulsion technologies, for instance, bifurcate into liquid and solid offerings, where cryogenic liquid engines deliver superior thrust-to-weight ratios but demand complex support infrastructure, while composite solid formulations enable rapid launch sequencing with minimal logistics burden. Platform diversity further underscores operational flexibility, as rail-mobile and submarine-launched variants offer strategic stealth and survivability distinct from hardened silo installations and tracked tele-operated road mobile launchers.

Warhead configurations, ranging from single-unit reentry vehicles to MIRV arrangements carrying three to five warheads or more than five, highlight divergent targeting doctrines and yield optimization approaches. Guidance systems have evolved from legacy inertial units to astro-inertial hybrids augmented by satellite constellations, including GPS and GLONASS, ensuring enhanced trajectory correction capabilities. Finally, payload capacities spanning under five thousand kilograms up to greater than ten thousand kilograms shape strategic targeting options, forcing a balancing act between range extension and destructive yield. Together, these segments paint a complex mosaic of interdependent technological trade-offs, each with implications for deployment doctrine and lifecycle support models.

This comprehensive research report categorizes the Intercontinental Ballistic Missile market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Propulsion Type

- Platform

- Warhead Type

- Guidance System

- Payload Capacity

Examining Regional Dynamics Driving Intercontinental Ballistic Missile Advancements Across the Americas, Europe Middle East Africa, and Asia-Pacific

Regional dynamics exert a profound influence on the prioritization and advancement of ICBM capabilities, with distinct drivers emerging across the Americas, Europe Middle East & Africa, and Asia-Pacific theaters. In the Americas, sustained investments in modernization reflect a continued emphasis on extending deterrent reach and ensuring rapid response options, especially through road-mobile and silo-based platforms that complement naval strategic assets. Meanwhile, Europe Middle East & Africa presents a mosaic of capability gaps and partnership-driven programs, where multinational cooperation and technology transfers are essential to overcoming domestic industrial constraints.

The Asia-Pacific arena remains a hotbed of strategic competition, marked by accelerated development cycles and high-profile tests of solid-fuel road-mobile launchers. In this region, the convergence of regional security tensions and indigenous technological maturation has catalyzed ambitious programs focused on both range extension and MIRV integration. Overall, regional insights underscore how geopolitical pressures, alliance structures, and domestic industrial capacities converge to shape differentiated paths in ICBM evolution across these major global markets.

This comprehensive research report examines key regions that drive the evolution of the Intercontinental Ballistic Missile market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Strategies and Innovation Leadership Among Leading Intercontinental Ballistic Missile Developers and Suppliers Worldwide

Leading defense contractors and specialized systems integrators occupy prominent positions within the competitive landscape of ICBM development and sustainment. Some firms leverage decades of experience in liquid-propulsion research, channeling deep expertise into next-generation cryogenic engine designs that boost range and reliability. Others have distinguished themselves by pioneering compact, composite solid propellant formulations that reduce logistical footprints and enable responsive launch postures.

A subset of manufacturers has also excelled in integrating astro-inertial and satellite-based navigation suites, forging partnerships with commercial space navigation providers to enhance accuracy under electronic warfare conditions. Concurrently, vertically integrated conglomerates are capitalizing on in-house foundries and additive manufacturing centers to secure critical supply chains for high-strength alloys and precision-guided subsystems. This strategic positioning allows for rapid iteration of design enhancements and streamlines the transition from prototyping to series production.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intercontinental Ballistic Missile market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus SAS

- Aselsan A.Ş.

- BAE Systems

- Boeing Company

- Denel SOC Ltd.

- Diehl Stiftung & Co. KG

- General Dynamic Corporation

- Israel Aerospace Industries

- L3Harris Technologies Company

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- Saab AB

- Textron Inc

- Thales Group

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Navigate Evolving Intercontinental Ballistic Missile Challenges and Opportunities

Industry leaders must adopt a proactive posture to navigate the complex terrain of technological innovation, supply chain realignment, and evolving geopolitical mandates. Prioritizing investment in dual-use additive manufacturing capabilities can mitigate tariff vulnerability while accelerating component qualification cycles. Simultaneously, forging collaborative research partnerships with satellite navigation service providers will ensure guidance systems remain resilient against jamming and spoofing threats in contested environments.

Decision-makers should also cultivate flexible procurement frameworks that allow rapid scaling of both liquid and solid propulsion lines according to shifting strategic doctrines. Embracing modular payload architectures that support both single-unit and MIRV configurations will enhance deterrence adaptability while optimizing lifecycle sustainment costs. Finally, executives should deepen engagement with regional defense alliances to leverage shared testing infrastructure and joint development programs, thereby diffusing risk and reinforcing collective security interests.

Detailed and Rigorous Research Methodology Employed to Analyze Intercontinental Ballistic Missile Sector Trends and Competitive Landscape

This analysis synthesizes primary data from expert interviews, proprietary technical assessments, and open-source defense procurement records, ensuring a triangulated approach to insight validation. High-level discussions with propulsion engineers, guidance system specialists, and defense policy analysts provided qualitative perspectives on technology maturation and strategic priorities. These interviews were complemented by a structured review of public statements, government budgets, and test launch reports to quantify programmatic shifts and industrial capacity expansions.

In parallel, the research team conducted a comprehensive segmentation analysis, aligning detailed technical specifications with deployment doctrines and geopolitical drivers. Cross-validation occurred through scenario modeling and supply chain mapping exercises, illuminating potential bottlenecks and resilience pathways. Finally, iterative peer review sessions with subject-matter experts ensured that findings reflect current operational doctrines and anticipated fielding timelines.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intercontinental Ballistic Missile market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intercontinental Ballistic Missile Market, by Propulsion Type

- Intercontinental Ballistic Missile Market, by Platform

- Intercontinental Ballistic Missile Market, by Warhead Type

- Intercontinental Ballistic Missile Market, by Guidance System

- Intercontinental Ballistic Missile Market, by Payload Capacity

- Intercontinental Ballistic Missile Market, by Region

- Intercontinental Ballistic Missile Market, by Group

- Intercontinental Ballistic Missile Market, by Country

- United States Intercontinental Ballistic Missile Market

- China Intercontinental Ballistic Missile Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesis of Core Findings Highlighting Transformative Trends and Strategic Takeaways Shaping the Future of Intercontinental Ballistic Missile Capabilities

In summary, intercontinental ballistic missile systems are undergoing a significant transformation shaped by cutting-edge propulsion solutions, precision guidance innovations, and dynamic geopolitical pressures. Tariff-driven supply chain realignments in the United States have accelerated domestic manufacturing initiatives while highlighting the strategic value of in-house production. Segmentation analysis across propulsion, platform, warhead, guidance, and payload typologies reveals a web of interdependencies that defense planners must navigate prudently.

Regional nuances underscore varied modernization imperatives, from alliance-strengthening collaborations in Europe Middle East & Africa to rapid capability expansion in the Asia-Pacific theater. Leading companies are responding with targeted investments in additive manufacturing and satellite navigation integration. By synthesizing these core insights, stakeholders can forge a cohesive strategy that balances immediate deterrence needs with long-term industrial resilience and technological advantage.

Engage with Ketan Rohom to Access In-Depth Intercontinental Ballistic Missile Market Analysis and Drive Strategic Decisions with Expert Insights

Investing in comprehensive analysis empowers decision-makers to respond proactively to emerging security imperatives and technology disruptions within the ICBM domain. To secure your organization’s strategic advantage, contact Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) and unlock access to the full report brimming with expert interpretations, critical data, and actionable insights. Engage directly with our team to explore tailored intelligence solutions that align with your operational objectives and ensure resilience in an increasingly complex defense environment.

- How big is the Intercontinental Ballistic Missile Market?

- What is the Intercontinental Ballistic Missile Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?