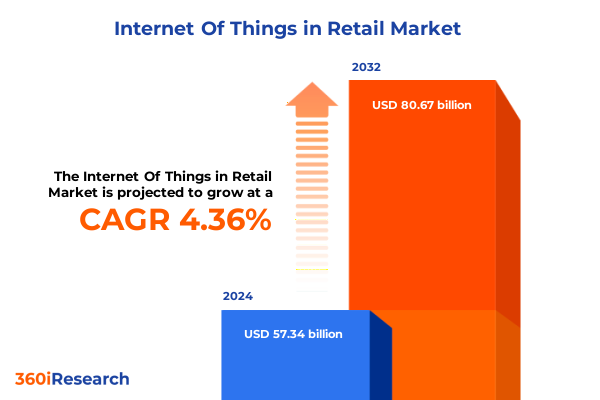

The Internet Of Things in Retail Market size was estimated at USD 59.21 billion in 2025 and expected to reach USD 61.15 billion in 2026, at a CAGR of 4.51% to reach USD 80.67 billion by 2032.

Unlocking the Transformative Potential of IoT to Revolutionize Retail Operations and Enhance Consumer Experiences Across Channels

The retail industry is experiencing a profound transformation driven by the integration of Internet of Things (IoT) technologies at every touchpoint. Connected sensors, smart devices, and edge computing platforms are enabling retailers to capture real-time data on inventory levels, customer behaviors, and environmental conditions. As a result, businesses are unlocking new opportunities to enhance operational efficiency, elevate in-store and online experiences, and achieve unprecedented levels of personalization. With the convergence of physical and digital channels becoming the norm, IoT is poised to redefine how retailers engage with customers, manage supply chains, and optimize workforce productivity.

This executive summary distills the critical findings and insights from our comprehensive research report on IoT adoption in retail environments. Targeted at C-suite leaders, strategy teams, and technology investors, the report examines transformative trends, regulatory and tariff impacts, market segmentation dynamics, regional considerations, and competitive landscapes. By presenting a cohesive narrative of the evolving market forces and strategic imperatives, this introduction sets the stage for a deeper exploration of how retail organizations can leverage connected ecosystems to drive growth and secure long-term resilience.

Disruptive Innovations in IoT Shaping Retail Infrastructures and Consumer Behaviors in the Digital Age

Over the last five years, the retail sector has witnessed several transformative shifts catalyzed by rapid advancements in connectivity and analytics. Edge computing architectures have emerged as foundational enablers, reducing latency for critical applications such as smart shelf monitoring and frictionless checkout systems. Meanwhile, the integration of artificial intelligence into IoT platforms has empowered retailers to derive predictive insights on demand forecasting, personalized promotions, and dynamic pricing. As customer expectations for seamless experiences continue to rise, retailers are increasingly deploying sensor networks and beacon technology to bridge the gap between online browsing and in-store engagement.

In parallel, supply chain processes are being revolutionized by real-time asset tracking, automated warehouse solutions, and blockchain-backed provenance systems. These innovations not only enhance transparency and reduce shrinkage but also support sustainable sourcing and green logistics initiatives. Moreover, the widespread adoption of mobile-enabled applications and contactless payments underscores a broader shift towards fully interconnected ecosystems. Taken together, these disruptive innovations are reshaping traditional retail infrastructures, creating new revenue streams, and redefining what it means to deliver a best-in-class consumer journey.

Assessing the Layered Effects of New United States Tariffs on IoT Hardware, Software, and Services Within the Retail Sector in 2025

The introduction of new United States tariffs in 2025 has created a multilayered impact on the retail IoT supply chain, particularly affecting hardware manufacturers that rely heavily on imported sensors, gateways, and networking equipment. With duties imposed on electronic components sourced from key manufacturing hubs, landed costs for IoT devices have increased, prompting retailers to explore alternative procurement strategies and negotiate volume discounts. In response to rising import expenses, some organizations are shifting towards on-shore assembly partners or regional distribution centers to insulate their operations from further tariff volatility.

At the software and services level, vendors have begun to re-evaluate licensing models and service agreements to maintain customer retention in a cost-sensitive environment. Integration and consulting firms are focusing on modular, scalable solutions that require minimal upfront investment, while support and maintenance providers are offering performance-based contracts to share deployment risks. Moreover, analytics and platform developers are accelerating the rollout of cloud-native architectures to reduce dependency on regionally taxed hardware. Collectively, these measures underscore the importance of agility and strategic sourcing in mitigating the cumulative effects of the 2025 tariff changes.

Unveiling Critical Segmentation Perspectives to Illuminate Hardware, Software, Services, Applications, and Deployment Dynamics in Retail IoT

A granular examination of the IoT retail landscape reveals intricate interdependencies across components, applications, end users, and deployment models. From a component perspective, the ecosystem is underpinned by hardware elements, comprehensive services, and software suites. Hardware remains the tangible bedrock encompassing sensors, gateways, and network devices, while services extend from integration and consulting engagements to ongoing support and maintenance offerings that ensure uninterrupted performance. Software solutions span analytics modules to applications that drive customer interactions, bolstered by underlying platforms that centralize data processing and asset management.

In terms of applications, the breadth of IoT use cases in retail spans customer engagement mechanisms, inventory management systems, security protocols, smart shelf innovations, and supply chain visibility. Customer engagement platforms incorporate beacon networks, interactive digital signage, and mobile apps that deliver targeted promotions and loyalty incentives. Inventory management leverages barcode scanners, RFID-based tracking, and environmental sensors to optimize stock levels and reduce out-of-stocks. Security and loss prevention solutions draw on access control systems and high-definition video surveillance to safeguard assets, while smart shelf implementations combine RFID-enabled shelving and weight-based monitoring to trigger replenishment alerts. Supply chain management utilizes transport monitoring tools and warehouse automation to enhance order fulfillment speed and accuracy.

The end-user segment is categorized by traditional retail formats such as hypermarkets and supermarkets, rapidly growing online retail environments, and specialty retail outlets focused on niche product lines. Deployment preferences range from cloud solutions-delivered via private and public infrastructure-to on-premise implementations for organizations with strict data residency and compliance requirements. Together, these multidimensional segmentation insights provide a comprehensive framework for evaluating market opportunities and tailoring offerings to specific retail archetypes.

This comprehensive research report categorizes the Internet Of Things in Retail market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

- Deployment Type

Probing Regional Dynamics in the Americas, EMEA, and Asia-Pacific Reveals Diverse IoT Adoption Patterns and Growth Drivers

Regional dynamics profoundly shape both the pace and nature of IoT adoption across the retail sector. In the Americas, retailers benefit from mature digital infrastructures, supportive regulatory environments, and strong investment in contactless and mobile commerce innovations. North American chains are piloting advanced use cases such as cashier-less micro-stores and AI-driven personalized marketing, while Latin American markets are capitalizing on mobile-first strategies and hybrid online-to-offline models.

Europe, the Middle East & Africa present a heterogeneous landscape where GDPR compliance and data sovereignty regulations influence deployment preferences. Western European retailers are expanding edge compute footprints to comply with privacy mandates while enhancing in-store analytics. Meanwhile, Gulf Cooperation Council countries are investing in smart mall ecosystems that integrate IoT-driven environmental controls with immersive digital experiences. In sub-Saharan Africa, IoT initiatives prioritize affordable sensor networks to address cold chain challenges in perishable goods distribution.

In Asia-Pacific, adoption is propelled by robust manufacturing sectors and high mobile penetration rates. Leading markets in East Asia and Australia are deploying 5G-enabled IoT solutions for real-time inventory management, while Southeast Asian retailers leverage cloud-native platforms to bridge digital divides. Collectively, these regional insights underscore the need for tailored strategies that account for local regulations, infrastructure maturity, and consumer behaviors.

This comprehensive research report examines key regions that drive the evolution of the Internet Of Things in Retail market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborators Driving Evolution and Competitive Advantage in the Retail IoT Ecosystem

Several industry leaders are driving innovation and shaping competitive dynamics in the retail IoT landscape through robust partnerships and differentiated solution portfolios. Technology giants have expanded their offerings to include end-to-end IoT suites that integrate hardware provisioning, cloud platforms, and advanced analytics. These providers emphasize interoperability and open standards to facilitate seamless integration with existing enterprise resource planning and customer relationship management systems.

At the same time, specialist vendors are focusing on niche applications such as smart shelf sensor networks, RFID analytics, and AI-powered loss prevention tools. By collaborating with system integrators and consulting firms, these companies are embedding vertical expertise into deployment workflows, accelerating time-to-value and reducing operational complexity. Furthermore, emerging start-ups are carving out proprietary capabilities in edge AI, digital twin modeling, and blockchain-backed traceability, compelling established players to continually innovate and adapt pricing structures.

Partnership ecosystems have become critical as hardware manufacturers, software developers, and service providers forge alliances to deliver holistic solutions. Retailers evaluating strategic vendors now prioritize those with demonstrated successes in large-scale rollouts and proven support networks. As a result, companies that invest in co-innovation labs, joint go-to-market initiatives, and cross-industry consortiums are best positioned to capture growing demand and foster long-term client relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Internet Of Things in Retail market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture plc

- Aeologic Technologies Pvt. Ltd.

- Aeron Systems Pvt. Ltd.

- Amazon Web Services, Inc.

- Arm Limited

- Cisco Systems, Inc.

- GE Digital LLC

- Google LLC

- HCL Technologies Limited

- Huawei Technologies Co., Ltd.

- Infosys Limited

- Intel Corporation

- John Deere

- Microsoft Corporation

- Optimo IoT Pvt. Ltd.

- Oracle Corporation

- PTC Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Siemens AG

- Tech Mahindra Limited

Crafting Actionable Intelligence and Strategic Roadmaps to Empower Retail Leaders with IoT Innovations for Operational Excellence

Retail organizations seeking to leverage IoT to its fullest potential should begin by defining clear use cases aligned with core business objectives, whether that be improving inventory accuracy, enhancing customer engagement, or reducing shrinkage. Developing a robust roadmap with phased pilots allows for rapid validation of technology assumptions and builds internal advocacy as success metrics are demonstrated. In tandem, investing in edge compute nodes and scalable network infrastructure is essential to support latency-sensitive applications and ensure data integrity across geographically distributed sites.

Securing executive sponsorship and establishing cross-functional governance are key to addressing organizational silos and aligning IT, operations, and marketing stakeholders. Complementary workforce training programs can equip employees with the skills to interpret IoT-driven insights and drive adoption. Cybersecurity should be embedded by design, leveraging zero-trust architectures and encrypted communication protocols to protect data in transit and at rest. Furthermore, exploring flexible pricing models with vendors-such as consumption-based licensing or outcome-based contracts-can mitigate upfront capital burdens and align incentives around performance outcomes.

Finally, cultivating an ecosystem mindset by forming strategic alliances with vendors, integrators, and research partners will accelerate innovation. Regularly benchmarking emerging technologies, participating in industry consortiums, and iterating based on real-world feedback ensures that IoT investments continuously deliver differentiated value and maintain resilience in a dynamic market environment.

Outlining Rigorously Structured Research Methodologies Integrating Qualitative and Quantitative Analyses for IoT Retail Insights

This research initiative combined rigorous primary and secondary methodologies to ensure a holistic understanding of the retail IoT landscape. Our secondary research encompassed industry white papers, regulatory filings, technical journals, and publicly available financial reports to map historical developments, technology roadmaps, and established best practices. In parallel, we conducted over 50 in-depth interviews with executives, solution architects, and end users across retail segments, capturing firsthand perspectives on adoption challenges, vendor selection criteria, and return on investment considerations.

Quantitative surveys targeted both IT decision-makers and frontline managers to quantify deployment timelines, budgetary priorities, and satisfaction levels across various IoT applications. Additionally, a comprehensive vendor analysis evaluated product feature sets, partnership networks, and global support capabilities. We applied a data triangulation approach to reconcile discrepancies between sources, while scenario modeling techniques were used to stress-test the potential impacts of external factors such as tariff changes and regulatory updates. The result is a forward-looking framework that equips stakeholders with actionable insights and a clear path to successful IoT deployments in retail contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Internet Of Things in Retail market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Internet Of Things in Retail Market, by Component

- Internet Of Things in Retail Market, by Technology

- Internet Of Things in Retail Market, by Application

- Internet Of Things in Retail Market, by End User

- Internet Of Things in Retail Market, by Deployment Type

- Internet Of Things in Retail Market, by Region

- Internet Of Things in Retail Market, by Group

- Internet Of Things in Retail Market, by Country

- United States Internet Of Things in Retail Market

- China Internet Of Things in Retail Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives on the Strategic Imperatives and Evolving Opportunities Fuelling the Convergence of IoT and Retail Innovation

In conclusion, the integration of IoT technologies within the retail sector represents a strategic imperative for organizations aiming to thrive in an increasingly digital marketplace. The convergence of advanced connectivity, real-time analytics, and intelligent automation is redefining customer expectations, operational paradigms, and competitive boundaries. Retailers that embrace a holistic approach-one that balances hardware, software, services, and regulatory considerations-will unlock new avenues for growth, agility, and sustainability.

As external pressures such as tariffs and data privacy regulations continue to evolve, agility and strategic sourcing become paramount. By aligning use cases with business objectives, investing in scalable infrastructure, and fostering collaborative ecosystems, industry leaders can mitigate risks and capitalize on emerging opportunities. Ultimately, success will hinge on an organization’s ability to transform data into actionable intelligence and deliver consistently differentiated experiences across all channels. The insights and frameworks presented in this report are designed to serve as a practical guide for navigating the complexities of IoT adoption and achieving long-term competitive advantage.

Take Decisive Steps Today to Harness Cutting-Edge IoT Retail Research and Secure Your Competitive Edge Through Expert-Guided Insights

For executives seeking a comprehensive understanding of how IoT is reshaping the retail landscape and the strategic implications for their organizations, our in-depth research report provides unparalleled insights, data-driven analysis, and actionable frameworks. To secure your copy of this extensive study and gain a competitive advantage, please reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through the report offerings, pricing options, and customization possibilities.

Don’t miss the opportunity to harness these transformative intelligence assets to drive innovation, optimize operations, and deliver exceptional customer experiences. Connect with Ketan Rohom today to explore how this report can be tailored to your strategic goals and empower your organization to navigate the rapidly evolving IoT retail ecosystem with confidence and clarity

- How big is the Internet Of Things in Retail Market?

- What is the Internet Of Things in Retail Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?