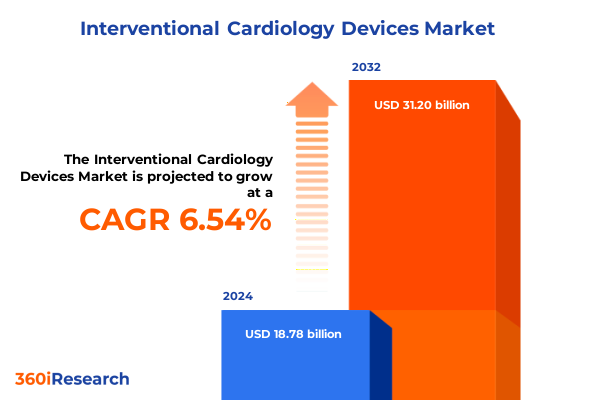

The Interventional Cardiology Devices Market size was estimated at USD 19.96 billion in 2025 and expected to reach USD 21.21 billion in 2026, at a CAGR of 6.59% to reach USD 31.20 billion by 2032.

Unveiling the Critical Role of Interventional Cardiology Devices in Combating Coronary Artery Disease and Revolutionizing Patient Outcomes

The burden of cardiovascular disease remains formidable, as heart disease continues to rank as the leading cause of mortality in the United States, claiming more than 680,000 lives in 2023. Beyond mortality, coronary artery disease affects roughly one in every twenty American adults, reflecting persistent gaps in prevention and chronic care management. This epidemiological backdrop underscores the imperative for advanced therapeutic solutions that can address arterial blockages with minimal invasiveness and optimized patient recovery pathways.

In response to these clinical needs, interventional cardiology has matured into a sophisticated landscape of balloons, stents, catheters, and imaging systems that collectively redefine vascular therapy. From the early days of balloon angioplasty to the integration of intravascular ultrasound and optical coherence tomography, clinicians now possess real-time insights into vessel morphology and lesion composition. These imaging modalities, coupled with evolving materials science, empower precise device deployment, while the rise of radial access techniques facilitates faster ambulation and reduced complication rates.

Exploring How Technological Advancements Like AI Imaging, Robotics, and Bioresorbable Stents Are Redefining Interventional Cardiology Practices

The interventional cardiology arena is witnessing a profound technological renaissance as artificial intelligence and machine learning algorithms are woven into intravascular imaging workflows. These advanced analytics tools offer auto-segmentation of vessels, plaque characterization, and quantitative measures of luminal dimensions, enhancing diagnostic precision and guiding treatment planning with data-driven insights.

Simultaneously, the adoption of robotic-assisted catheterization systems is transforming procedural execution, granting operators enhanced dexterity and stability while minimizing occupational radiation exposure. Robotic platforms now support complex lesion navigation, enabling consistent guidewire manipulation and precise stent positioning under three-dimensional imaging guidance. These innovations, paired with next-generation device designs such as bioresorbable vascular scaffolds and drug-eluting stents, are shifting the paradigm of patient care by delivering targeted therapy with reduced long-term device footprint and superior vessel healing profiles.

Assessing the Far-Reaching Effects of 2025 United States Tariff Policies on Supply Chains, Costs, and the Availability of Cardiology Devices Nationwide

U.S. trade policy developments in 2025 have introduced new tariff layers on imported medical devices, particularly those sourced from major manufacturing hubs in Asia. Device makers report significant increases in component costs and logistical complexity as longstanding supply chains face sudden duty escalations. These policy shifts have compelled several leading manufacturers to reassess global sourcing strategies, although regulatory constraints and facility accreditation requirements limit swift production repatriation.

Industry stakeholders, including the American Hospital Association, have urged federal authorities to carve out exemptions for essential medical devices to avert supply disruptions. The unanticipated cost burdens and uncertainty around future tariff schedules threaten to stall product launches, delay clinical trials, and elevate end-user prices. As a result, many companies are intensifying advocacy efforts while exploring dual-source procurement and incremental tariff mitigation tactics to maintain continuity of patient care delivery.

Deriving Strategic Insights from a Comprehensive Segmentation Analysis Spanning Device Types, Materials, Technologies, Applications, and End Users

The interventional cardiology devices ecosystem encompasses a diverse spectrum of catheters, ranging from aspiration and balloon variants to guiding platforms, each tailored to distinct access and lesion-preparation roles. Closure systems, whether active suture-based or passive clip designs, secure vascular entry sites, while diagnostic and interventional guidewires navigate tortuous anatomies with specialized tip configurations and surface treatments. Stent technologies span bare metal constructs, fully biodegradable scaffolds, and drug-eluting platforms that release antiproliferative agents over controlled intervals. Material selection pivots between advanced metal alloys-cobalt-chromium for high radial strength and platinum-chromium for enhanced radiopacity-and novel polymer matrices optimized for bioresorbability and biocompatibility.

Technological modalities range from traditional balloon angioplasty techniques to high-resolution echocardiography, laser-based intravascular imaging, and pyrolytic carbon coatings designed to reduce thrombogenicity. Clinically, devices enable angiographic interventions across neurovascular and peripheral territories, percutaneous coronary interventions including balloon angioplasty and stenting, and structural heart applications such as transcatheter valve repair and replacement. The end-user landscape spans ambulatory surgical centers offering streamlined outpatient procedures, specialized cardiac centers equipped for high-volume percutaneous programs, general hospitals administering comprehensive cardiovascular services, and research institutes pioneering next-generation therapeutic modalities.

This comprehensive research report categorizes the Interventional Cardiology Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Device Type

- Material

- Technology

- Application

- End Users

Unpacking Regional Dynamics in Americas, EMEA, and Asia-Pacific That Shape the Adoption and Evolution of Interventional Cardiology Devices Globally

In the Americas, robust healthcare infrastructure and established reimbursement frameworks have driven widespread adoption of interventional cardiology procedures. The United States, with its advanced catheterization laboratories and proactive regulatory pathways, remains a global leader in procedural volume and device innovation. Canadian centers similarly benefit from integrated healthcare systems that support nationwide training programs and device evaluation networks.

Across Europe, Middle East, and Africa, demographic shifts toward aging populations have amplified demand for minimally invasive cardiovascular therapies. The European Society of Cardiology’s advocacy for a harmonized regulatory framework under the Medical Device Regulation and the European Health Data Space is fostering faster device approvals and data-driven clinical research. Concurrently, Gulf nations are investing in state-of-the-art catheterization suites and clinician education to address rising cardiovascular disease burdens. In Asia-Pacific, high-growth markets contend with cost barriers and regulatory complexity, yet are simultaneously embracing telehealth-enabled post-procedure monitoring and expanding intra-regional manufacturing partnerships. Emerging economies in Southeast Asia are launching public-private initiatives to improve device accessibility and procedural training in underserviced regions.

This comprehensive research report examines key regions that drive the evolution of the Interventional Cardiology Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players’ Strategic Moves, Mergers, Acquisitions, and Innovations Driving Progress in Interventional Cardiology Devices

Major medtech companies are actively reshaping the competitive landscape through strategic mergers, acquisitions, and portfolio realignment. Medtronic has announced supply chain adjustments to absorb tariff-related cost increases while spinning off non-core divisions to sharpen its focus on cardiovascular therapies. Boston Scientific’s acquisition of intravascular lithotripsy pioneers and its investment in renal denervation technology underscore its commitment to expanding treatment options for complex lesions. Abbott, with FDA approvals for its newest resorbable scaffolds, continues to refine drug-elution profiles and polymer formulations to enhance long-term vessel patency.

Innovation pipelines among leading players emphasize AI-driven image analysis, next-generation guidewire designs, and robotic assistance. Edwards Lifesciences’ transcatheter valve platforms and Teleflex’s targeted acquisitions bolster structural heart and vascular intervention portfolios, respectively. Regional specialists and emerging startups are forging partnerships to accelerate commercialization of novel sensor-enabled devices and smart materials, illustrating a dynamic ecosystem where collaborative ventures fuel rapid technology translation from bench to bedside.

This comprehensive research report delivers an in-depth overview of the principal market players in the Interventional Cardiology Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AngioDynamics, Inc.

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Biosensors International Group, Ltd.

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Medical Inc.

- Cordis Corporation by Cardinal Health company

- Edward Lifesciences Corporation

- Endologix, Inc.

- GE HealthCare Technologies Inc.

- iVascular SLU

- Johnson & Johnson Services, Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Medtronic plc

- Merit Medical Systems, Inc.

- Siemens Healthineers AG

- Teleflex Incorporated

- Terumo Corporation

- Volcano Corporation by Philips Holding USA Inc.

Formulating Actionable Strategies for Industry Leaders to Navigate Supply Chain Challenges, Embrace Innovation, and Influence Policy in Cardiology Devices

Industry leaders should prioritize supply chain resilience by diversifying component sourcing across multiple geographies and engaging with policy stakeholders to secure essential device exemptions. Establishing dual manufacturing footprints and strategic inventory buffers can mitigate the impact of sudden tariff shifts and geopolitical disruptions. Concurrently, companies should advocate for pragmatic regulatory dialogs that balance patient safety with agile innovation pathways, thereby reducing time-to-market for breakthrough therapies.

To sustain competitive advantage, organizations must accelerate investment in digital and imaging platforms that integrate real-time analytics and machine learning. Cross-functional collaborations with academic centers and clinical networks will facilitate iterative device refinements and evidence generation. Moreover, embracing telehealth and remote monitoring solutions can extend procedural follow-up care and unlock value-based reimbursement models. Cultivating talent through targeted training programs in advanced interventional techniques and digital toolsets will be critical to ensuring seamless adoption of emerging technologies across diverse clinical settings.

Outlining a Robust Research Methodology Combining Primary Expert Engagement, Secondary Data Analysis, and Rigorous Validation for Unbiased Insights

This study employed a multi-stage research design combining primary interviews with interventional cardiologists, supply chain executives, and regulatory experts alongside a comprehensive review of peer-reviewed literature, government publications, and financial disclosures. Secondary data sources included U.S. Food and Drug Administration databases, Centers for Disease Control and Prevention statistics, and published analysis from leading industry consultancies.

Quantitative data were triangulated using cross-validation techniques and expert panels convened to resolve discrepancies. Emerging themes were mapped through iterative data coding to identify technology adoption curves, tariff impact thresholds, and regional growth catalysts. All findings underwent rigorous peer review by external subject matter experts to ensure methodological integrity and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Interventional Cardiology Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Interventional Cardiology Devices Market, by Device Type

- Interventional Cardiology Devices Market, by Material

- Interventional Cardiology Devices Market, by Technology

- Interventional Cardiology Devices Market, by Application

- Interventional Cardiology Devices Market, by End Users

- Interventional Cardiology Devices Market, by Region

- Interventional Cardiology Devices Market, by Group

- Interventional Cardiology Devices Market, by Country

- United States Interventional Cardiology Devices Market

- China Interventional Cardiology Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Core Findings on Market Shifts, Tariff Impacts, Segmentation Trends, Regional Dynamics, and Company Strategies in Cardiology Devices

The examination of interventional cardiology devices reveals a sector in the midst of transformative change as technological innovation, geopolitical policy shifts, and regional market dynamics converge. Advanced imaging and AI-enabled analytics are enhancing procedural precision, while tariff-driven supply chain realignments are reshaping manufacturing strategies. Detailed segmentation analysis highlights the nuanced interplay between device characteristics, clinical applications, and end-user settings, underscoring the importance of tailored commercial tactics.

Regional insights demonstrate that no one-size-fits-all approach applies; adaptability to local regulatory landscapes and reimbursement frameworks remains pivotal. Corporate strategies grounded in strategic partnerships and M&A activity are driving portfolio adjuncts that address emerging clinical needs. As the field evolves, actionable recommendations emphasize supply chain resilience, policy advocacy, and sustained investment in digital and procedural innovation to maintain patient-focused excellence in cardiovascular care.

Invitation to Collaborate with Ketan Rohom for Exclusive Access to In-Depth Market Research on Interventional Cardiology Devices and Next Steps

To explore these insights in greater depth and leverage actionable intelligence, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in interventional cardiology research can help you navigate complex market dynamics and accelerate strategic decision-making. Engage with Ketan today to secure your exclusive access to the full market research report, tailored presentations, and customized advisory sessions designed to empower your organization’s growth trajectory in this rapidly evolving field.

- How big is the Interventional Cardiology Devices Market?

- What is the Interventional Cardiology Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?