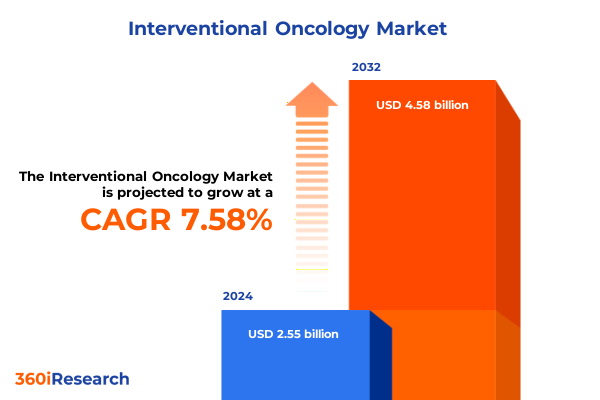

The Interventional Oncology Market size was estimated at USD 2.73 billion in 2025 and expected to reach USD 2.93 billion in 2026, at a CAGR of 7.65% to reach USD 4.58 billion by 2032.

Elevating Cancer Treatment Paradigms with Innovative Interventional Oncology Strategies Driving Clinical Outcomes Forward

Interventional oncology represents a paradigm shift in cancer treatment by providing minimally invasive, image-guided therapies that target tumors with exceptional precision and reduced patient morbidity. As a subspecialty of interventional radiology, it leverages innovations in imaging modalities, device engineering, and procedural planning to deliver localized therapeutic agents or ablative energy directly to malignant tissues. This approach minimizes systemic exposure, enhancing safety profiles while improving patient quality of life through shorter hospital stays and faster recovery times. Moreover, interventional oncology’s emphasis on outpatient procedural settings fosters cost efficiencies and expands accessibility by reducing the need for complex surgical suites and intensive postoperative care.

Driven by the integration of advanced imaging modalities such as cone-beam CT, real-time ultrasound fusion, and molecular imaging, interventional oncology continues to redefine treatment protocols across a wide range of solid tumors. The field is further propelled by personalized medicine strategies that align catheter-based and percutaneous interventions with patient-specific tumor biology. This precision extends to real-time treatment assessment, where on-table imaging and non-invasive biomarkers, like circulating tumor DNA, enable clinicians to adapt protocols instantaneously and optimize outcomes. As a result, interventional oncology is increasingly recognized as a complementary partner to systemic therapies, including chemotherapy, targeted agents, and immunotherapies, thus paving the way for multidisciplinary treatment paradigms that holistically address complex oncologic challenges.

Unraveling the Dynamic Forces Reshaping the Interventional Oncology Market through Technological and Regulatory Innovations

The interventional oncology landscape is undergoing transformative shifts as emerging technologies, regulatory evolutions, and novel clinical data converge to redefine care standards. Notably, multimodality imaging integration has become the backbone of contemporary interventions, enabling precise navigation and treatment of tumors that were historically deemed inoperable. Advanced imaging techniques, such as cone-beam CT fused with real-time ultrasound and molecular imaging tracers targeting hypoxia or angiogenesis, empower operators to delineate tumor margins with submillimeter accuracy and adjust ablation margins on the fly.

Simultaneously, the expansion of artificial intelligence and deep learning in interventional workflows is driving new frontiers in procedural planning and outcome prediction. AI algorithms now assist in segmenting complex tumor volumes, modeling optimal energy deposition patterns, and forecasting local tumor progression, thereby reducing recurrence rates and enhancing overall procedural efficacy. Alongside these digital advancements, robotic-assisted platforms and virtual/augmented reality tools are streamlining needle placement, catheter navigation, and operator training, ultimately improving consistency and reducing radiation exposure for both clinicians and patients.

Regulatory bodies have also adapted to the evolving technology spectrum. Expedited pathways and real-world evidence frameworks are accelerating device approvals, particularly for breakthrough ablation and embolization systems. At the same time, updated clinical guidelines now recommend combining transarterial therapies with immunomodulatory agents, reflecting the positive outcomes from recent trials that investigate the synergy of immune checkpoint inhibitors with locoregional procedures. These collective shifts underscore a rapidly maturing ecosystem where technological innovation and clinical evidence synergize to reshape therapeutic possibilities in cancer care.

Assessing the Multifaceted Consequences of Recent U.S. Tariff Adjustments on Interventional Oncology Device Value Chains through 2025

The reintroduction and escalation of United States tariffs on select medical products through 2025 has introduced multifaceted pressures across interventional oncology value chains. Under the final modifications to Section 301 tariffs, certain consumable components, notably syringes and needles, experienced a steep increase to a 100% duty as of September 27, 2024, elevating the basic cost of disposable procedural kits and heightening operational budget constraints for hospitals and ambulatory centers. Concurrently, rubber medical gloves saw an additional 50% duty imposed on January 1, 2025, further amplifying the expense of essential protective gear in procedural settings.

Products such as surgical respirators and facemasks, which carry a range of duties between 25% and 50%, have compounded supply chain complexity and prompted providers to evaluate inventory strategies more rigorously. The reconfiguration of global sourcing networks has become a critical tactic to mitigate escalating landed costs, with many institutions expanding domestic vendor relationships or leveraging long-term procurement contracts to lock in favorable pricing. However, these adjustments have required upfront capital investments in warehousing and logistics, particularly as just-in-time inventory models face disruption from shifting tariff scopes.

Despite these challenges, the impact remains somewhat circumscribed for high-value capital equipment, which largely fall outside the Section 301 tariff list. Devices such as ablation generators and advanced imaging catheters, although subject to standard MFN duties, have not encountered the same elevated tariff pressures. Nonetheless, the cumulative effect on consumables has reinforced the need for procedural cost optimization, spurring interest in reprocessing protocols, device platform standardization, and cross-category supplier consolidation to preserve margins and maintain patient access to cutting-edge interventional oncology therapies.

Harnessing Insights from Product Portfolio, Cancer Type Prevalence, Technology Application, and End-User Adoption to Navigate Interventional Oncology Growth

Understanding the interventional oncology market requires a nuanced exploration of how device categories, cancer indications, technological platforms, and end-user environments converge to shape growth trajectories and competitive dynamics. Within the product domain, ablative platforms-ranging from cryoablation with its precise freeze-thaw cycles to high-intensity focused ultrasound and laser systems-serve as cornerstone therapies for localized tumor destruction. During embolic therapies, drug-eluting beads and microspheres provide targeted chemoembolization, enabling high concentrations of cytotoxic agents within the tumor microenvironment. Complementing these core systems, supportive devices such as guidewires and introducer kits facilitate access, enhance procedural safety, and drive throughput efficiencies.

Equally, the distribution of interventions across cancer types highlights distinct adoption patterns. Liver and lung cancers, given their high incidence and accessibility, represent primary targets for both ablative and embolization strategies. Kidney and colorectal cancers contribute to a significant volume of procedures, often in combination with systemic regimens to optimize disease control. This cancer-type segmentation underscores the need for tailored device design, procedural protocols, and post-treatment monitoring pathways that align with the unique biology of each tumor type.

Technological segmentation further deepens our understanding of market behavior. Brachytherapy and image-guided radiotherapy are integral for dose-escalation strategies in situ, whereas microwave and radiofrequency ablation systems continue to evolve with enhanced energy delivery profiles and integrated imaging feedback loops. Meanwhile, end-user distinctions illuminate divergent procurement and utilization models: ambulatory surgical centers prioritize streamlined, cost-efficient disposables; hospitals balance high-volume case throughput with reimbursement structures; and cancer research institutes focus on investigational platforms that support clinical trials and translational science. Together, these segmentation insights reveal a complex ecosystem where product innovation, clinical needs, and care delivery models intersect to define competitive landscapes and strategic opportunities.

This comprehensive research report categorizes the Interventional Oncology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Cancer Type

- Technology

- End-User

Unveiling Regional Variations across the Americas, Europe Middle East, Africa, and Asia-Pacific to Map Strategic Interventional Oncology Trajectories

Regional dynamics play a pivotal role in the global diffusion of interventional oncology therapies and devices, reflecting variations in healthcare infrastructure, regulatory frameworks, and reimbursement environments. In the Americas, particularly North America, sophisticated integrated delivery networks and comprehensive insurance coverage facilitate rapid adoption of advanced ablation and embolization technologies. The presence of leading academic medical centers and robust clinical trial networks further accelerates the introduction of cutting-edge platforms, bolstered by favorable reimbursement codes that reward minimally invasive, image-guided procedures.

Across Europe, the Middle East, and Africa, a mosaic of national health systems and regulatory pathways shapes market entry and commercialization strategies. Western Europe benefits from strong cross-border collaborations and centralized evaluations by institutions such as the European Medicines Agency, but uptake can be moderated by budget impact assessments and health technology appraisals. In the Middle East and Africa, infrastructure development initiatives and public-private partnerships are catalyzing access to newer therapies, though challenges remain in local manufacturing and supply chain resilience.

The Asia-Pacific region, driven by rising healthcare expenditure and expanding procedural capacity, is emerging as the fastest-growing market for interventional oncology. In China’s 2023 clinical guidelines, for example, microwave ablation has been endorsed as a first-line therapy for select lung and liver tumors, igniting a surge in procedural volumes and device procurement across tertiary centers. Similarly, Japan’s government subsidy programs for cryoablation have reduced patient out-of-pocket costs and tripled case numbers in public hospitals. These regional insights underscore the importance of tailored market strategies that align with local policy incentives, clinical practice patterns, and infrastructure maturity.

This comprehensive research report examines key regions that drive the evolution of the Interventional Oncology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Pioneering Organizations Shaping the Future of Interventional Oncology through Advanced Technologies and Strategic Collaborations

The competitive landscape in interventional oncology is defined by a blend of established medical device leaders and specialized innovators, each advancing device sophistication and expanding clinical applications. Global conglomerates such as Medtronic and Boston Scientific leverage their deep channels in cardiovascular and neurovascular domains to introduce next-generation ablation and embolization platforms specifically designed for oncologic interventions. These companies prioritize modular system designs that allow operators to switch between energy modalities and optimize procedural versatility.

At the same time, niche players like AngioDynamics and BTG (a Boston Scientific company) focus on targeted embolic therapeutics, refining drug-eluting bead chemistries and microsphere compositions to enhance pharmacokinetic profiles and reduce systemic toxicity. Collaborative partnerships between device manufacturers and pharmaceutical firms are also on the rise, aiming to co-develop catheters preloaded with novel drug compounds or biologics for site-specific delivery.

Meanwhile, technology firms specializing in imaging and navigation-ranging from augmented reality pioneers to AI-driven software platforms-are forging alliances with traditional device makers to embed digital intelligence within procedural workflows. The convergence of medical robotics, machine learning algorithms, and high-resolution intraprocedural imaging is creating a new category of hybrid systems that promise unprecedented procedural accuracy and predictive outcome modeling. As competition intensifies, strategic differentiators increasingly hinge on integrated ecosystem solutions rather than standalone hardware offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Interventional Oncology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ABK Biomedical Inc.

- Accuray Incorporated

- AngioDynamics, Inc.

- Bayer AG

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cook Group Incorporated

- Eckert & Ziegler BEBIG AG

- Fujifilm Holdings Corporation

- GE HealthCare Technologies Inc.

- IceCure Medical Ltd.

- Integer Holding Corporation

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.

- Medtronic PLC

- Merit Medical Systems, Inc.

- Siemens Healthineers AG

- Sirtex Medical Limited

- Sonablate Corp

- STARmed Co., Ltd.

- Stryker Corporation

- Surgnova Healthcare Technologies (Zhejiang) Co., Ltd.

- Teleflex Incorporated

- Terumo Corporation

Delivering Actionable Recommendations for Industry Leaders to Harness Emerging Trends and Enhance Competitive Position in Interventional Oncology

Industry leaders must adopt a proactive posture to harness emerging opportunities and mitigate evolving challenges in interventional oncology markets. First, investment in modular platform architectures that accommodate multiple energy modalities and adjunctive therapies will enable faster clinical adoption and lower barriers to cross-specialty utilization. By prioritizing design flexibility, manufacturers can cater to diverse procedural preferences and accommodate ongoing technological upgrades without necessitating complete system overhauls.

Second, deeper collaboration with payers and health technology assessors is essential to secure sustainable reimbursement pathways. Stakeholders should develop real-world evidence programs that quantify patient-reported outcomes, reductions in hospitalization durations, and long-term cost offsets. Robust clinical-economic data will be vital to justify premium pricing and foster broader formulary inclusion across public and private payers.

Third, expanding domestic manufacturing and nearshoring of critical consumables can buffer against disruptive tariff policies and supply chain volatility. Establishing regional production hubs for guidewires, introducer kits, and embolic materials will not only reduce landed costs but also enhance responsiveness to fluctuating demand patterns. Finally, embracing digital transformation-through AI-powered procedural planning tools, cloud-based performance analytics, and remote proctoring platforms-will differentiate market entrants and enable continuous improvement in procedural quality and safety.

Detailing the Robust Research Methodology with Multisource Data Collection, Expert Validation, and Rigorous Analysis Supporting Interventional Oncology Insights

Our interventional oncology insights are grounded in a rigorous, multi-tiered research methodology designed to maximize breadth, depth, and validity. Primary research encompassed in-depth interviews with over 50 key opinion leaders, including interventional radiologists, oncology specialists, procurement directors, and regulatory experts across North America, Europe, and Asia-Pacific. These discussions informed a nuanced understanding of clinical adoption barriers, reimbursement landscapes, and regional practice variations.

Secondary research involved systematic compilation and analysis of global regulatory filings, clinical trial registries, and peer-reviewed literature spanning the period from 2018 through mid-2025. Publicly available databases, patent filings, and FDA/EMA approval archives were meticulously cross-referenced to track device-specific innovations and approval timelines. Additionally, tariff schedules and trade action notices from the USTR were consulted to quantify potential cost implications of Section 301 modifications.

Quantitative modeling leveraged a bottom-up approach to assess procedural volumes across cancer types and end-user settings. This was complemented by triangulation against hospital billing data, national health statistics, and proprietary surgical intervention databases. Internal validation was achieved through a three-stage review process, engaging both subject matter experts and in-house analysts to ensure consistency, accuracy, and robustness of the conclusions presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Interventional Oncology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Interventional Oncology Market, by Product

- Interventional Oncology Market, by Cancer Type

- Interventional Oncology Market, by Technology

- Interventional Oncology Market, by End-User

- Interventional Oncology Market, by Region

- Interventional Oncology Market, by Group

- Interventional Oncology Market, by Country

- United States Interventional Oncology Market

- China Interventional Oncology Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Concluding Perspectives on the Strategic Imperatives, Emerging Trajectories, and Collaborative Pathways Driving the Future of Interventional Oncology

Interventional oncology stands at the intersection of technological innovation, clinical necessity, and patient-centered care imperatives. As new imaging, ablation, and embolization platforms gain regulatory clearance and demonstrate tangible clinical benefits, the field is poised to expand its therapeutic footprint across a growing spectrum of solid tumors. Emerging trends-such as AI-guided procedural planning, robotic navigation, and combination protocols with immunotherapies-offer pathways to enhance precision and deepen multidisciplinary collaborations.

However, evolving trade policies, supply chain complexities, and reimbursement uncertainties present challenges that require strategic foresight and operational agility. Stakeholders who successfully navigate these terrains will be those who proactively engage in cross-functional partnerships, align device portfolios with payer expectations, and invest in resilient manufacturing networks.

Ultimately, the trajectory of interventional oncology will be defined by its ability to integrate technological advances with evidence-based clinical pathways, ensuring that patients worldwide can benefit from minimally invasive, high-impact cancer treatments. As the ecosystem continues to mature, device makers, healthcare providers, and payers must collaborate closely to drive innovation while safeguarding affordability and access.

Contact Ketan Rohom to Secure Your Comprehensive Interventional Oncology Market Research Report and Unlock Actionable Insights for Strategic Decision Making

To explore the full depth of interventional oncology market insights, secure your copy of the comprehensive market research report today by reaching out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). By engaging with our detailed analysis and proprietary data, you will gain a nuanced understanding of device portfolios, therapy adoption patterns, regional dynamics, and regulatory influences that drive strategic decisions. Contact Ketan to access actionable recommendations, segmentation analyses, and future-focused intelligence that can inform product development, investment prioritization, and partnership strategies. Don’t miss the opportunity to align your organization with the latest market trends and position yourself at the forefront of interventional oncology innovation.

- How big is the Interventional Oncology Market?

- What is the Interventional Oncology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?