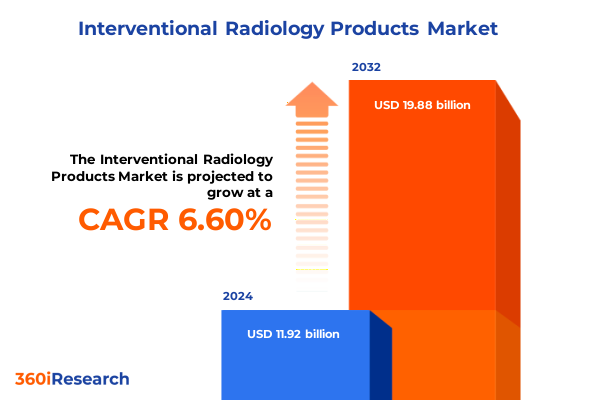

The Interventional Radiology Products Market size was estimated at USD 12.70 billion in 2025 and expected to reach USD 13.53 billion in 2026, at a CAGR of 6.61% to reach USD 19.88 billion by 2032.

Unveiling The Essential Role Of Interventional Radiology Products In Advancing Minimally Invasive Patient Care And Operational Efficiencies

Interventional radiology has emerged as a transformative force in modern healthcare, blending minimally invasive techniques with precision imaging to deliver superior patient outcomes and cost efficiencies. Clinicians worldwide are increasingly adopting catheter-based therapies such as ablation, embolization, and stenting to address oncological, neurological, vascular, and pain-related conditions. These procedures not only reduce hospital stays but also minimize post-operative complications, positioning interventional radiology products at the forefront of therapeutic innovation and health system priorities.

Within this context of rapid clinical adoption, stakeholders across the value chain-including device manufacturers, healthcare providers, and policymakers-are seeking clarity on the evolving market dynamics and strategic imperatives. This executive summary distills the most impactful trends, regulatory shifts, and supply chain considerations shaping the interventional radiology products space. By examining technological breakthroughs, tariff-driven cost pressures, and nuanced segmentation patterns, this report provides decision-makers with the insights required to develop resilient strategies and capitalize on emerging revenue streams.

How Digital Imaging, Artificial Intelligence, And Robotic-Assisted Navigation Are Redefining Interventional Radiology Workflows With Unprecedented Precision

Recent years have witnessed a paradigm shift in interventional radiology, driven by the integration of digital imaging, artificial intelligence, and robotics into procedural workflows. High-definition 3D imaging platforms now enable clinicians to visualize complex vascular anatomies in real time, enhancing the precision of stent deployment and embolic agent delivery. Concurrently, AI-powered software has begun to automate lesion segmentation and treatment planning, reducing procedure times and elevating consistency across institutions.

Beyond imaging, the adoption of robotic-assisted catheter navigation systems is streamlining complex interventions by providing enhanced stability and tactile feedback. This fusion of robotics and AI not only reduces the procedural learning curve for new physicians but also opens the door to remote interventions, extending advanced care to underserved regions. Moreover, the relentless miniaturization of guidewires and catheters has expanded the reach of interventional therapies, enabling access to smaller peripheral vessels and promoting the treatment of previously inoperable conditions.

Analyzing The Ripple Effects Of 2025 Tariff Policies On Costs, Supply Chains, And Domestic Manufacturing Strategies In The U.S.

The United States’ tariff measures implemented in early 2025 have introduced significant cost pressures across the interventional radiology supply chain, particularly for import-reliant devices. Duties on several categories of ablation systems, embolization coils, and specialized catheters have increased landed costs, compelling manufacturers to reassess their sourcing strategies. Importers have responded by negotiating volume-based discounts, exploring tariff exemptions, and, in some cases, redesigning products to qualify for lower duty classifications.

These policy-driven shifts have also spurred a surge in domestic manufacturing initiatives. Several leading device companies have accelerated capital investments in U.S.-based production facilities and formed partnerships with local contract manufacturers to mitigate future tariff risks. At the same time, distributors are diversifying their supplier portfolios to include non-Chinese sources, ensuring continuity of supply for high-demand products like vascular stents and embolic agents. Although these adjustments have initially compressed margins, the long-term outcome is expected to be a more resilient and geographically balanced supply network.

Uncovering Key Segmentation Drivers Across Product Types, Clinical Applications, End Users, And Distribution Modalities

Examining the market through the lens of product type segmentation reveals that ablation devices, subdivided into microwave and radiofrequency systems, are garnering accelerated R&D investments aimed at improving energy delivery efficiency and tissue specificity. Concurrently, catheter-based solution segments-from angioplasty balloons to advanced guidewires-continue to evolve through enhanced polymer coatings and hydrophilic designs that facilitate vessel navigation and reduce the risk of thrombus formation.

Application-based insights indicate that oncology and neuro interventions are witnessing divergent growth trajectories. Transarterial chemoembolization and tumor ablation techniques, which include cryoablation alongside both microwave and radiofrequency modalities, are becoming mainstays in liver and kidney cancer protocols. In parallel, aneurysm embolization and stroke thrombectomy continue to leverage liquid and particulate embolic agents tailored for precise occlusion and minimal off-target effects. Pain management interventions are also expanding, with novel neurolytic agents and spinal angioplasty offering new avenues for chronic pain relief.

From an end-user perspective, hospitals remain the predominant purchaser of high-complexity devices due to their extensive clinical infrastructure, yet ambulatory surgical centers are increasingly capturing less-invasive case volumes by leveraging streamlined procurement and faster reimbursement cycles. Clinics focusing on outpatient endovascular therapies are similarly boosting their market share, driven by lower capital barriers and growing patient preference for same-day procedures. Within distribution channels, a direct-sales approach is favored by manufacturers seeking deeper clinical engagement, whereas distributor networks continue to serve smaller accounts and emerging markets with cost-effective logistics solutions.

This comprehensive research report categorizes the Interventional Radiology Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Distribution Channel

Dissecting Regional Adoption Patterns And Investment Trends Across The Americas, Europe, Middle East & Africa, And Asia-Pacific Markets

In the Americas, the United States leads global adoption of interventional radiology products, buoyed by favorable reimbursement policies, robust clinical trial infrastructures, and the presence of major market incumbents. Canada and Latin America are following suit, with healthcare systems increasingly investing in catheterization labs and training programs for interventional specialists. The Americas region also serves as a testbed for novel device launches, with rapid regulatory pathways and expansive patient registries aiding post-market surveillance.

The Europe, Middle East & Africa bloc presents a more heterogeneous landscape. Western European nations maintain strict regulatory frameworks under the EU’s MDR, driving higher safety and performance benchmarks. Meanwhile, Middle Eastern healthcare hubs are channeling sovereign wealth into state-of-the-art hospitals, often partnering with global OEMs to establish centers of excellence. African markets, though nascent, are showing growing interest in cost-effective embolic solutions and compact imaging units to address rising incidences of vascular diseases.

Asia-Pacific is characterized by its dual-speed growth dynamic. Mature markets like Japan and Australia focus on premium, AI-enabled imaging systems and next-generation stents, whereas high-growth economies such as China and India are balancing cost optimization with domestic innovation mandates. Government-led initiatives to expand interventional radiology training programs and fast-track device approvals are expected to accelerate adoption curves in key APAC territories.

This comprehensive research report examines key regions that drive the evolution of the Interventional Radiology Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players, Recent Strategic Alliances, And Disruptive Entrants Reshaping The Interventional Radiology Arena

Global interventional radiology leaders are doubling down on portfolio diversification and strategic partnerships. Company A has recently acquired an advanced molecular imaging startup to complement its existing embolic offerings, thereby enabling integrated diagnostic-therapeutic workflows. Company B’s launch of a next-generation, AI-enhanced catheter guidance platform is set to challenge established players by offering real-time lesion mapping and adaptive control algorithms.

Meanwhile, legacy OEMs are strengthening their market positions through bolt-on acquisitions of specialized device firms and cross-industry collaborations with robotics innovators. Notable joint ventures are emerging between imaging giants and software developers to co-create end-to-end procedural suites, marrying high-resolution fluoroscopy with cloud-based analytics. Smaller, nimble competitors are also capitalizing on niche segments by focusing on disposable component innovations and patient-specific implant designs, thus carving out defensible market niches in a landscape dominated by larger conglomerates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Interventional Radiology Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- B. Braun SE

- Becton, Dickinson and Company

- BIOTRONIK SE & Co. KG

- Boston Scientific Corporation

- Cardinal Health, Inc.

- Cook Medical LLC

- GE HealthCare

- Koninklijke Philips N.V.

- Medtronic plc

- Merit Medical Systems, Inc.

- Siemens Healthineers AG

- Stryker Corporation

- Teleflex Incorporated

- Terumo Corporation

Strategic Imperatives For Industry Leaders To Enhance Resilience, Drive Innovation, And Secure Value-Based Reimbursement Outcomes

To thrive amid intensifying competition and policy uncertainties, industry leaders should prioritize the diversification of their global supply chains by developing dual-sourcing strategies and bolstering domestic production capacities. Investing in artificial intelligence and robotics will be critical to delivering differentiated clinical value, reducing procedure variability, and forging deeper partnerships with key opinion leaders.

In parallel, companies must engage payers proactively by demonstrating robust health-economic outcomes and advocating for value-based reimbursement models that reward procedural efficacy and patient safety. Strengthening post-market surveillance through comprehensive registries and real-world evidence initiatives will further cement stakeholder confidence. Finally, forging collaborative alliances with academic institutions and technology startups can accelerate the co-development of next-generation devices, ensuring that manufacturers remain at the cutting edge of interventional therapeutics.

Overview Of Rigorous Primary And Secondary Research Processes Implemented To Ensure Data Integrity And Comprehensive Market Intelligence

This research employed a multi-tiered methodology combining primary stakeholder engagements with extensive secondary data analysis. Primary inputs were gathered through structured interviews with interventional radiologists, procurement officers, and regulatory experts across North America, EMEA, and APAC, ensuring balanced perspectives on clinical and commercial trends.

Secondary research encompassed a comprehensive review of peer-reviewed journals, regulatory authority databases, and company filings to validate device classifications, regulatory pathways, and technological developments. Quantitative data were triangulated against public registries, healthcare expenditure reports, and patent analytics. Quality control was maintained via iterative peer reviews and an advisory panel of subject-matter experts, yielding rigorous, actionable insights aligned with real-world industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Interventional Radiology Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Interventional Radiology Products Market, by Product Type

- Interventional Radiology Products Market, by Application

- Interventional Radiology Products Market, by End User

- Interventional Radiology Products Market, by Distribution Channel

- Interventional Radiology Products Market, by Region

- Interventional Radiology Products Market, by Group

- Interventional Radiology Products Market, by Country

- United States Interventional Radiology Products Market

- China Interventional Radiology Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Market Dynamics, Segmentation Insights, And Strategic Collaboration Imperatives To Navigate The Future Of Interventional Radiology

The interventional radiology products market stands at an inflection point, propelled by relentless technological innovation, evolving regulatory frameworks, and strategic supply chain realignments. As tariff-driven cost pressures give way to domestic production initiatives, manufacturers and distributors are repositioning themselves to foster greater geographic resilience and operational efficiency.

Emerging segmentation patterns underscore the importance of tailored product portfolios that address the nuanced needs of oncology, neuro, vascular, and pain interventions, while regional variances highlight the necessity for market-specific go-to-market strategies. Looking forward, collaboration between device innovators, healthcare providers, and regulators will be paramount to unlocking the full potential of minimally invasive therapies and delivering enhanced patient outcomes.

Engage With Ketan Rohom Now To Unlock Comprehensive Interventional Radiology Market Insights And Drive Strategic Growth

If you are seeking in-depth insights and strategic guidance to navigate the rapidly evolving interventional radiology landscape, reach out today to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings a deep understanding of market dynamics and a proven track record of aligning research findings with actionable business objectives. By partnering with Ketan, you will gain direct access to the full executive summary, detailed segmentation analyses, regional market breakdowns, and comprehensive competitive landscaping. His expertise will ensure you receive bespoke recommendations tailored to your organization’s unique challenges and growth ambitions.

Contact Ketan to secure your copy of this indispensable market research report and equip your executive team with the intelligence required to drive innovation, streamline supply chains, and capitalize on emergent opportunities. Don’t miss this opportunity to elevate your strategic planning-connect with Ketan today and take the next step toward sustained success in interventional radiology.

- How big is the Interventional Radiology Products Market?

- What is the Interventional Radiology Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?