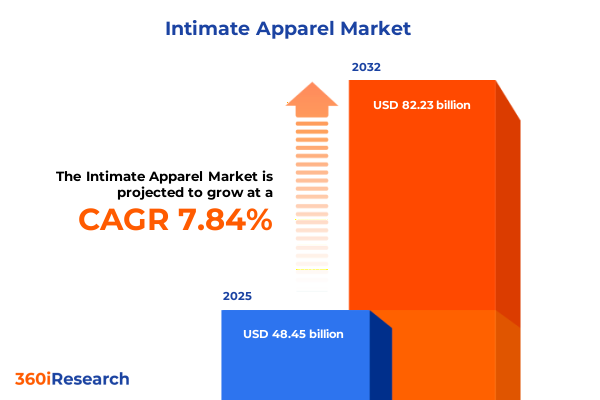

The Intimate Apparel Market size was estimated at USD 48.45 billion in 2025 and expected to reach USD 51.94 billion in 2026, at a CAGR of 7.84% to reach USD 82.23 billion by 2032.

Unveiling the Fundamental Drivers and Emerging Trends Defining the Future of Intimate Apparel in a Dynamic Global Market Landscape

The intimate apparel industry stands at a pivotal moment characterized by rapid innovation, shifting consumer expectations, and an increasingly complex supply chain environment. As lifestyles continue to evolve, underwear, sleepwear, and loungewear are no longer purely functional garments; they have become statements of personal style, indicators of wellness priorities, and extensions of self-expression. Rising interest in health-driven textiles, digital customization capabilities, and inclusive design principles has propelled manufacturers and brands to rethink product development and marketing strategies. Moreover, advances in production technologies-from 3D knitting to seamless fabrication-are enabling unprecedented levels of comfort, performance, and sustainability. This convergence of consumer desire for better fit, feel, and environmental responsibility demands a nuanced understanding of the market’s core drivers.

Against this backdrop, this executive summary distills the most salient trends, federal policy impacts, segmentation dynamics, regional differentiators, and competitive maneuvers shaping intimate apparel through 2025. By synthesizing primary interviews with industry leaders, in-depth surveys of end consumers, and rigorous analysis of trade flows and corporate disclosures, this analysis reveals how decision-makers can align investments with the forces that will determine winners and challengers in the coming years. Whether you are a brand seeking to refine your assortment mix, a manufacturer optimizing your sourcing network, or an investor assessing growth opportunities, the insights presented here will provide a clear line of sight into the strategies and capabilities required to thrive.

Examining the Major Technological, Sustainable, and Consumer Behavior Shifts Reshaping Intimate Apparel Design and Demand Worldwide

Over the past several years, the intimate apparel landscape has undergone profound change driven by a convergence of technological breakthroughs, heightened consumer consciousness, and novel retail formats. Digital platforms have not only expanded the reach of emerging brands but have also catalyzed direct dialogue with consumers, enabling rapid feedback loops that sharpen design iterations and reduce time to market. Meanwhile, sustainability has shifted from a niche concern to a mainstream expectation, with responsible material sourcing, circular product end-of-life strategies, and transparent supply chain practices serving as key differentiators. Transitional dynamics are evident in how brands are integrating eco-friendly fibers with performance-enhancing finishes, blending recycled and plant-based fabrics to satisfy both comfort and environmental benchmarks.

In conjunction with materials innovation, fit personalization has emerged as a transformative factor. Advances in machine learning algorithms, 3D body scanning, and virtual try-on tools have empowered consumers to select intimate apparel tailored to their unique proportions and preferences. As a result, mass personalization is moving from pilot projects to broader rollouts, reshaping expectations for fit quality and customer engagement. Moreover, the expansion of inclusive sizing, diverse representation in marketing imagery, and sensitivity to cultural norms signals a more equitable approach to product development. Together, these shifts underscore a growing imperative for brands to harmonize technological integration, ethical standards, and consumer intimacy to remain relevant in an increasingly crowded marketplace.

Assessing How Recent U.S. Import Tariffs Have Reshaped Sourcing Strategies Production Costs and Competitive Dynamics in Intimate Apparel

In 2025, the cumulative impact of U.S. import tariffs has become a defining factor in the cost structure and strategic orientation of intimate apparel supply chains. Beginning in 2018, tariffs on textile and apparel products originating from key sourcing markets have gradually increased, prompting manufacturers and brands to reassess established relationships and seek alternative production hubs. By imposing additional duties on items such as lingerie, thermal wear, and loungewear, these measures have effectively elevated landed costs, squeezing margins for those reliant on traditional low-cost suppliers in East Asia.

In response, many industry participants have accelerated diversification of their sourcing footprints. Southeast Asia, Latin America, and select African nations have gained prominence as lower-duty alternatives, while nearshoring initiatives within the Americas have been propelled by the desire to mitigate both tariff exposure and logistical disruptions. These strategic shifts, however, carry their own complexities: emerging suppliers often require capacity building, quality assurance investments, and longer lead times. As such, brands must balance cost savings with up-front development expenditures and the risk of dilution in quality consistency.

Furthermore, the interplay between tariff escalation and broader trade policy uncertainty has induced greater hedging behavior, with companies building in buffer inventory or negotiating longer-term contracts to lock in favorable rates. This recalibration of procurement strategies not only influences cost forecasting but also reshapes relationships with contract manufacturers and consolidators. Ultimately, the tariff landscape of 2025 underscores the critical importance of agile sourcing capabilities and dynamic cost management for sustaining competitive advantage in intimate apparel.

Decoding Consumer Preferences and Buying Patterns Across Product Types Materials Genders and Distribution Channels in Intimate Apparel

Consumer choices in intimate apparel exhibit pronounced variation across the full spectrum of product types, from lower innerwear designed for everyday comfort to sophisticated sleepwear and loungewear that blend style with relaxation functionality. At the same time, thermal wear has seen rising demand in cooler climates and seasons, leveraging advanced insulating fabrics, while upper innerwear has benefited from innovations in fit and support. These product type dynamics demand that manufacturers calibrate design and fabrication workflows to deliver differentiated offerings at scale.

Material considerations further nuance consumer preference patterns. Traditional cotton continues to command trust for its breathability and softness, yet demand is splitting between organic varieties and premium Pima cotton, both prized for environmental credentials or superior fiber strength. In parallel, the aspirational allure of lace endures, primarily in higher-end intimate pieces, while performance-oriented microfiber and luxurious silk segments cater to consumers seeking either enhanced moisture management or indulgent sensory experiences. The interplay among these materials reflects a balancing act between cost, comfort, aesthetics, and sustainability goals.

Gender segmentation remains a cornerstone of market targeting, with women’s intimate apparel driving broader innovation in fit, design diversity, and marketing narratives. Conversely, the men’s segment is witnessing incremental growth through expanded lifestyle positioning that emphasizes wellness, softness, and style beyond traditional functional briefs. Finally, distribution channels dictate purchase journeys, as department stores and specialty boutiques offer tactile discovery, while brand websites and third-party e-commerce platforms facilitate convenient, data-driven personalization. The continuous blurring between offline and online channels underscores a need for omnichannel integration to capture consumer attention wherever they engage.

This comprehensive research report categorizes the Intimate Apparel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Gender

- Distribution Channel

Exploring Regional Variations in Consumer Demand Supply Chain Networks and Competitive Landscapes Across Americas EMEA and Asia Pacific Markets

Regional dynamics in intimate apparel reflect both cultural distinctions and varying stages of industry evolution. In the Americas, the United States leads in premiumization, driven by consumers’ willingness to invest in fit, innovation, and eco-friendly credentials. Brazil’s domestic brands capitalize on vibrant fashion culture and a strong textile manufacturing base, resulting in a competitive mix of international players and agile local labels. The region’s nearshore production initiatives have been motivated by tariff avoidance and logistical resilience, although capacity constraints in certain countries are creating selective bottlenecks.

Across Europe, the Middle East, and Africa, divergence is pronounced between Western European markets-where regulatory standards on chemicals and labor foster transparent supply chains-and emerging economies in Eastern Europe and North Africa that are leveraging lower labor costs to attract foreign direct investment. In the Gulf Cooperation Council countries, luxury positioning in intimate apparel has grown through the proliferation of regional monobrand boutiques and high-end department store concessions. Simultaneously, sub-Saharan African markets are benefiting from digital commerce penetration, with mobile-first sales channels connecting specialty startups to a growing wellness-conscious consumer base.

In the Asia-Pacific region, China maintains a commanding position as both a production powerhouse and a rapidly maturing domestic consumer market. However, rising wages and geopolitical considerations are prompting multinational brands to accelerate expansion in India, Southeast Asia, and select Pacific island economies. These jurisdictions offer not only lower production costs but also burgeoning middle-class populations with increasing disposable income. Combined with government incentives for value-added textile manufacturing, the Asia-Pacific landscape is becoming more multifaceted-challenging traditional sourcing norms and creating opportunities for diversified supply chain architectures.

This comprehensive research report examines key regions that drive the evolution of the Intimate Apparel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives Collaborations and Innovations Driving Competitive Advantage Among Leading Intimate Apparel Manufacturers and Brands

Leading companies in the intimate apparel space are deploying a range of strategic initiatives to sustain growth amid intensifying competitive pressures. A number of established heritage brands have reinforced their direct-to-consumer channels, investing in proprietary digital platforms to enhance shopper engagement and gather first-party data. In doing so, they have gained clearer insights into purchase behaviors, enabling more targeted product drops and personalized retention marketing.

At the same time, digitally native disruptors are carving market share by emphasizing body-positive branding, inclusive size ranges, and socially conscious campaigns. Their agility in test-and-learn product introductions allows for rapid adaptation to emerging micro-trends, while partnerships with athleisure and wellness influencers extend brand reach into adjacent markets. Concurrently, contract manufacturers and vertically integrated producers are pursuing strategic alliances with technology providers to embed smart textiles, sensor integration, and advanced manufacturing techniques into their offerings, thereby attracting both established brands and new entrants seeking next-generation differentiation.

Moreover, collaborative ventures between material innovators and leading apparel labels are accelerating the commercialization of circular fabric systems, enzyme-infused breakdown processes, and recyclable garment design. These cross-industry partnerships highlight a shift from isolated sustainability projects toward systemic changes that align ecological imperatives with cost rationalization. Collectively, these corporate maneuvers illustrate a competitive environment where scale and heritage are being challenged by nimble, data-driven players and purpose-driven collaborations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intimate Apparel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Affix Apparel

- American Eagle Outfitters, Inc.

- Ann Summers Ltd

- Ariela & Associates International

- BareWeb, Inc. by Delta Galil Industries Ltd

- Blum's Swimwear & Intimate Apparel

- Fruit of the Loom Inc. by Berkshire Hathaway, Inc.

- FullBeauty Brands Operations, LLC

- Gianni Versace S.r.l.

- Giorgio Armani S.p.A.

- Hanesbrands Inc.

- Hanky Panky, Ltd.

- Hugo Boss AG

- Industria de Diseño Textil, S.A.

- Jockey International, Inc.

- Marks and Spencer PLC

- MAS Holdings

- Nike Inc.

- Puma SE

- Savage X

- SKIMS

- ThirdLove, Inc.

- Trent Limited by Tata Group

- Triumph International Ltd.

- Ubras

- Victoria's Secret

- Wacoal Holdings

- Zivame

Strategic Guidance for Industry Leaders to Innovate Streamline Operations and Engage Consumers Effectively in a Rapidly Evolving Intimate Apparel Market

To capitalize on the evolving intimate apparel landscape, industry leaders should prioritize investments in sustainable and adaptive materials that resonate with environmentally conscious consumers. Aligning fiber innovation roadmaps with transparent sourcing certifications and circular economy principles will not only mitigate regulatory risk but also cultivate brand loyalty among discerning demographics. Concurrently, developing proprietary digital tools for fit customization and virtual try-on experiences can elevate the shopping journey, reduce return rates, and differentiate brands in a crowded digital marketplace.

Operational resilience must also be reinforced through diversified sourcing strategies that balance low-cost geographies with nearshore partners capable of rapid replenishment. Establishing collaborative relationships with emerging suppliers while retaining contingency capacity in core markets can insulate organizations from tariff volatility and geopolitical disruptions. Furthermore, integrating advanced analytics across procurement, inventory management, and consumer insights will enable real-time decision making, optimizing both cost structures and product assortments in response to shifting demand signals.

Finally, fostering cross-sector alliances-whether through co-development of smart textile applications with technology firms or joint initiatives with sustainability start-ups-can accelerate the adoption of breakthrough innovations. By embedding multidisciplinary expertise into product roadmaps, organizations can stay ahead of consumer expectations, reinforce their commitment to responsible fashion, and ensure that strategic initiatives are both ambitious and executable.

Detailing the Research Framework Data Sources and Analytical Approaches Employed to Ensure Robust and Actionable Insights for Stakeholders

This analysis draws upon a comprehensive research framework combining primary and secondary methodologies to deliver robust, actionable insights. Primary research involved in-depth interviews with a cross-section of stakeholders, including brand executives, supply chain partners, retail buyers, and consumer focus groups. These conversations provided qualitative context on strategic priorities, material preferences, and technology adoption timelines. Simultaneously, digital ethnography and targeted online surveys offered quantitative validation of key findings, ensuring that anecdotal observations were reinforced by statistically significant consumer response patterns.

Secondary research encompassed a thorough review of trade association reports, government trade data, financial disclosures from public companies, and thought leadership published in industry journals. This foundational dataset was augmented by monitoring of regulatory developments related to chemical safety, labor standards, and trade policy, specifically focusing on tariff measures implemented through 2025. Data triangulation techniques were applied to reconcile discrepancies across sources and enhance confidence in the directional accuracy of emerging trends.

Analytical approaches included segmentation analysis to uncover demand drivers within product types, materials, gender demographics, and distribution channels, as well as regional comparative assessments across the Americas, EMEA, and Asia-Pacific markets. Competitive benchmarking and SWOT evaluations provided clarity on leading players’ strategic postures. The integration of both qualitative insights and quantitative metrics underpins the recommendations and conclusions presented herein, ensuring their relevance and reliability for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intimate Apparel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intimate Apparel Market, by Product Type

- Intimate Apparel Market, by Material

- Intimate Apparel Market, by Gender

- Intimate Apparel Market, by Distribution Channel

- Intimate Apparel Market, by Region

- Intimate Apparel Market, by Group

- Intimate Apparel Market, by Country

- United States Intimate Apparel Market

- China Intimate Apparel Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Critical Insights and Reinforcing the Strategic Imperatives for Navigating Challenges and Capitalizing on Opportunities in Intimate Apparel

In an environment where consumer preferences and trade dynamics are shifting at an unprecedented pace, stakeholders in intimate apparel must adopt a balanced strategy of innovation, operational agility, and consumer intimacy. The interplay of technological advancements in personalization, sustainability imperatives, and import tariff pressures has created both challenges and opportunities for brands, manufacturers, and investors. By understanding the nuanced segmentation of product types, materials, gender preferences, and purchasing channels, companies can tailor their offerings to meet evolving demands.

Regional insights underscore the necessity of adapting strategies to local market characteristics, whether by leveraging nearshore production in the Americas, adhering to stringent regulatory frameworks in Europe and the Middle East, or tapping into rapidly expanding middle-class segments in Asia-Pacific. Simultaneously, the capacity to pivot sourcing in response to tariff escalations will remain a critical determinant of profitability and competitive positioning.

Ultimately, those organizations that can seamlessly integrate data-driven decision making, sustainable material innovation, and nimble supply chain management will be best positioned to thrive. The landscape ahead may be complex, but it is also rich with potential for those prepared to act decisively on the insights and recommendations outlined in this executive summary.

Empower Your Strategic Decisions with Expert Market Intelligence and Connect with Ketan Rohom to Access the Comprehensive Intimate Apparel Industry Report

Empower your strategic approach to intimate apparel with tailored market intelligence and discover how our comprehensive analysis can inform every decision you make. Reach out to Ketan Rohom at the leadership of sales and marketing to secure full access to the in-depth industry report and unlock the data, insights, and forecasts you need to stay ahead. Invest in clarity and confidence as you navigate evolving consumer demands, supply chain complexities, and emerging competitive threats. Contact Ketan Rohom to arrange your personalized briefing, receive privileged expert interpretation of the findings, and ensure your organization capitalizes on the most timely and relevant opportunities in intimate apparel.

- How big is the Intimate Apparel Market?

- What is the Intimate Apparel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?