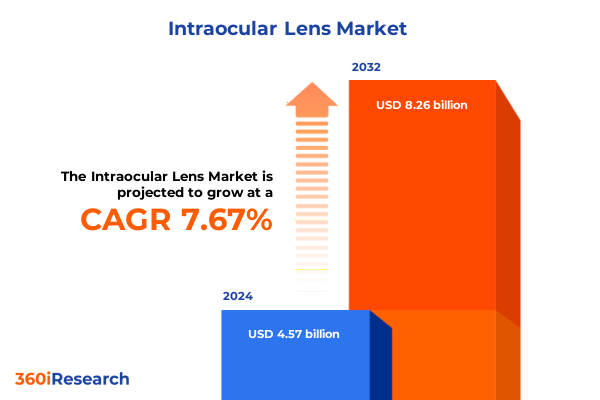

The Intraocular Lens Market size was estimated at USD 4.91 billion in 2025 and expected to reach USD 5.27 billion in 2026, at a CAGR of 7.72% to reach USD 8.26 billion by 2032.

A comprehensive overview of technological advances and demographic drivers transforming the intraocular lens market landscape

The intraocular lens (IOL) market stands at the intersection of medical innovation and demographic demand as aging populations worldwide drive the need for safe, effective cataract surgery solutions. As advancements in lens design, material science, and surgical instrumentation continue, healthcare providers and device manufacturers are presented with both opportunities and challenges in meeting patient expectations for visual acuity and postoperative quality of life. Emerging premium IOL technologies promise enhanced outcomes such as extended depth of focus and reduced dependence on corrective eyewear, yet they also introduce complexity in patient selection, reimbursement landscapes, and regulatory pathways. Moreover, global shifts in healthcare delivery models-ranging from ambulatory surgery centers to hospital outpatient departments-are redefining how and where these procedures are performed. Against this backdrop, industry stakeholders must navigate a dynamic ecosystem where technological breakthroughs and evolving policy frameworks converge, shaping a new era for vision restoration therapies.

Transitioning beyond traditional monofocal lenses, the marketplace has begun to embrace multifocal and accommodative platforms that cater to lifestyle-driven segments. Meanwhile, surgical fees, bundled payment structures, and macroeconomic trends influence provider adoption rates, compelling device makers to refine value-based arguments. Through this executive summary, readers will uncover the forces driving market evolution, the implications of recent United States tariff adjustments, and the strategies that leading manufacturers are deploying to maintain a sustained competitive edge. In doing so, we set the stage for a deeper exploration of segmentation nuances, regional dynamics, and actionable recommendations critical for informed decision-making.

How digital diagnostics and novel lens designs are reshaping the future of cataract surgery and patient outcomes

In recent years, the intraocular lens sector has witnessed transformative shifts propelled by the convergence of digital diagnostics, customizable lens optics, and patient-centric care models. The integration of femtosecond laser platforms and artificial intelligence–driven biometry has refined surgical planning, leading to more predictable refractive outcomes. At the same time, the rise of extended depth-of-focus and enhanced multifocal designs has redefined postoperative visual expectations, challenging the dominance of traditional monofocal implants. As a result, clinicians are increasingly prioritizing personalized lens selection workflows, leveraging data analytics to match optical profiles with patient lifestyles and tolerance thresholds.

Concurrently, material innovations-such as advanced hydrophobic acrylic polymers with optimized square-edge geometries-are addressing posterior capsular opacification and long-term biocompatibility. Meanwhile, next-generation injectable and foldable designs are facilitating microincision cataract surgery, reducing surgical trauma and improving refractive stability. These technological leaps are also reshaping supply chain dynamics, as manufacturers invest in scalable cleanroom production and tighter quality control to meet rising global demand. The combined effect of these advancements underpins a competitive environment in which device differentiation and service excellence have become paramount.

Examining the layered effects of United States trade duties on intraocular lens supply chains and pricing dynamics in 2025

In early 2025, the United States implemented revised tariff schedules on select imported medical device components, including intraocular lens assemblies, as part of broader trade realignments. These tariff changes have introduced incremental cost pressures on manufacturers reliant on overseas production of premium acrylic polymers and precision optical tooling. Although the duties apply variably-from low single-digit percentages on hydrophobic acrylic blanks to higher rates on specialized folding injectors-the cumulative effect has begun to ripple through pricing negotiations and contract reviews with group purchasing organizations and private equity–backed ambulatory surgery providers.

Manufacturers have responded by reassessing their supply chain footprints, exploring nearshoring options in Mexico and the Caribbean Basin to leverage existing free trade agreements. At the same time, R&D teams are evaluating alternative materials and component sourcing strategies to mitigate volatility. While the impact on end-user pricing remains modest at present, stakeholders are closely monitoring reimbursement adjustments from Medicare and commercial payers, as these will ultimately determine uptake of high-margin premium IOL offerings. In parallel, alliances between device producers and contract manufacturers have intensified, aimed at securing stable raw material pipelines and attenuating tariff-driven cost escalations.

Unveiling the layered segmentation architecture that illuminates distinct growth trajectories and adoption patterns across patient and provider cohorts

The intraocular lens market can be best understood by evaluating its multi-dimensional segmentation framework, which reveals where growth and innovation converge across patient and provider preferences. Type segmentation delineates between monofocal lenses, which continue to dominate volume-driven procedures due to their proven refractive accuracy, and multifocal variants that have bifocal and trifocal subdivisions for patients desiring spectacle freedom at multiple focal points. Material segmentation distinguishes between hydrophilic acrylic, prized for its ease of injectability and lower incidence of calcification, and hydrophobic acrylic, which leads the market in terms of long-term clarity, alongside silicone-based designs for niche applications requiring enhanced foldability.

Design segmentation unpacks the dichotomy between single-piece lenses, favored for streamlined implantation with integrated haptic-enclosure systems, and three-piece platforms that offer modular stability in complex capsular bag scenarios. Price range segmentation contrasts premium implants-with their advanced optics and proprietary coatings-against standard models that maintain affordability for publicly funded healthcare programs. End-user segmentation underscores the rising role of ambulatory surgery centers in outpatient settings, while eye clinics capitalize on specialized refractive lens exchanges and hospitals secure emergency and complex case volumes. Finally, distribution channel segmentation maps the evolution from hospital pharmacies as primary dispensing outlets to the growth of online platforms and retail pharmacies catering to self-preparing surgical centers.

This layered view of the market’s architecture enables stakeholders to pinpoint areas of unmet need, align product development roadmaps with clinical adoption curves, and tailor commercial strategies for each segment’s unique value proposition.

This comprehensive research report categorizes the Intraocular Lens market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Design

- End User

- Distribution Channel

Dissecting regional market drivers and healthcare architectures that define intraocular lens adoption across the Americas, Europe, Middle East & Africa, and Asia-Pacific

Regional dynamics in the intraocular lens sector reveal distinct trends shaped by healthcare infrastructure, regulatory climates, and demographic trajectories. In the Americas, robust reimbursement frameworks and high cataract surgery volumes continue to support both monofocal and premium lens adoption, with ambulatory surgery centers acting as innovation hubs for microincision techniques. Meanwhile, Latin American markets are gradually integrating multifocal and toric IOLs as private pay models gain traction in urban centers.

In Europe, Middle East & Africa, regulatory harmonization under CE marking accelerates cross-border product launches, yet healthcare budget constraints in certain markets temper the uptake of premium IOLs, favoring cost-effective monofocal systems. The Middle East has emerged as a testing ground for next-generation injectable lens platforms due to growing investment in medical tourism and state-of-the-art ophthalmic clinics. Across Africa, access initiatives driven by non-governmental organizations are essential to expanding cataract coverage, albeit with a continued focus on standard implants for volume outreach.

Asia-Pacific exhibits one of the fastest growth rates, driven by aging populations in Japan, South Korea, and China, coupled with rising middle-class demand for premium vision solutions. China’s domestic lens manufacturers are scaling advanced hydrophobic acrylic production to compete with global incumbents, while India’s tier-2 and tier-3 cities are unlocking latent demand for cataract surgery through improved surgical training and ambulatory infrastructure. These regional nuances underscore the importance of adaptable strategies and localized partnerships for optimal market penetration.

This comprehensive research report examines key regions that drive the evolution of the Intraocular Lens market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing how dominant manufacturers and agile challengers are reshaping portfolios and supply strategies to secure competitive differentiation

Leading players in the intraocular lens arena are intensifying their focus on full-spectrum portfolios, encompassing monofocal, multifocal, toric, and extended depth-of-focus products. Legacy innovators have fortified their pipelines through acquisitions of specialized optics firms and strategic collaborations with contract manufacturers to accelerate time to market. Concurrently, emerging challengers are differentiating through niche materials expertise, such as next-generation hydrophobic copolymers that resist glistening formation and proprietary surface treatments designed to minimize dysphotopsia risks.

In response to tariff-induced cost pressures, some top-tier companies have deployed dual-sourcing strategies, maintaining core production in established European cleanrooms while scaling secondary capacity in North America. Others are leveraging digital platforms for direct-to-clinic engagement, providing turnkey surgical planning tools and remote patient monitoring capabilities. In parallel, a subset of innovators is exploring the integration of drug-eluting IOLs that release anti-inflammatory or anti-proliferative agents, aiming to address postoperative complications and differentiate on clinical outcomes. Collectively, these corporate maneuvers underscore an industry-wide pivot toward holistic ophthalmic solutions, blending product, service, and data-driven care pathways.

This comprehensive research report delivers an in-depth overview of the principal market players in the Intraocular Lens market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Vision LLC

- Aurolab

- Bausch + Lomb Corporation

- Care Group Inc.

- Carl Zeiss AG

- Essilor International SAS

- EyeKon Medical, Inc.

- Hoya Corporation

- HumanOptics AG

- Johnson and Johnson Services, Inc.

- Lenstec Inc.

- Menicon Co., Ltd.

- Novartis AG

- Omni Lens Pvt. Ltd.

- Ophtec B.V.

- PhysIOL S.A.

- Rayner Intraocular Lenses Limited

- SAV IOL SA

- Shanghai Haohai Biological Technology Co. Ltd.

- STAAR Surgical Company

Strategic imperatives for device makers to fortify resilience, enhance patient engagement, and foster value-driven market expansion

To navigate evolving market conditions and capitalize on emerging opportunities, industry leaders should prioritize three strategic imperatives. First, strengthening supply chain resilience through diversified sourcing and nearshoring initiatives will buffer against tariff fluctuations and material shortages. Second, investing in integrated digital services-such as preoperative analytics platforms and postoperative outcome tracking-will enhance customer engagement and reinforce clinical partnerships. Third, expanding collaboration with payers and providers to define value-based reimbursement models for premium IOL offerings will be essential for maximizing adoption and justifying price premiums.

Furthermore, organizations should accelerate R&D efforts focused on next-generation materials and combination therapies, including drug-eluting lenses, to address unmet clinical needs. Establishing regional innovation centers in growth markets, particularly in Asia-Pacific and the Middle East, will facilitate localized product customization and regulatory compliance. Additionally, aligning with ambulatory surgery center networks and specialized eye clinics can yield faster procedural adoption and more immediate feedback loops. By executing this multi-pronged approach, leaders can secure market share, drive margin expansion, and set new benchmarks in patient-centric care delivery.

Detailing our comprehensive research architecture combining secondary analysis, expert interviews, and robust data triangulation for maximal insights

Our research framework is built upon a rigorous blend of secondary intelligence gathering, primary stakeholder dialogues, and multi-faceted data triangulation. In our secondary phase, we conducted an exhaustive review of peer-reviewed journals, regulatory filings, and trade publications to map technological trends and policy evolutions. This was complemented by continuous monitoring of device registries and clinical trial repositories to capture pipeline developments and safety profiles.

The primary research phase involved in-depth interviews with ophthalmologists, surgical center administrators, procurement executives, and materials scientists across North America, Europe, and Asia-Pacific. These expert engagements provided granular insights into adoption drivers, reimbursement negotiations, and emerging procedural workflows. Quantitative analysis was then applied to aggregated data sets, enabling segmentation-specific breakdowns without reliance on proprietary sales figures or speculative market sizing.

Finally, our findings were validated through peer debriefings and scenario stress testing, ensuring robustness against tariff shifts and regulatory reforms. By integrating qualitative and quantitative perspectives, this methodology delivers a comprehensive lens on market dynamics, empowering stakeholders with actionable intelligence and a clear understanding of future trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Intraocular Lens market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Intraocular Lens Market, by Type

- Intraocular Lens Market, by Material

- Intraocular Lens Market, by Design

- Intraocular Lens Market, by End User

- Intraocular Lens Market, by Distribution Channel

- Intraocular Lens Market, by Region

- Intraocular Lens Market, by Group

- Intraocular Lens Market, by Country

- United States Intraocular Lens Market

- China Intraocular Lens Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing pivotal findings and future pathways for innovation, segmentation, and strategic positioning in the intraocular lens market

The intraocular lens sector is poised for sustained transformation as demographic pressures, technological innovation, and policy recalibrations intersect. Premium lens adoption will accelerate, driven by patient demand for independence from corrective eyewear and by the maturation of extended depth-of-focus platforms. Simultaneously, tariff realignments in the United States will continue to influence supply chain strategies, prompting a reevaluation of sourcing footprints and manufacturing alliances.

Segmentation insights highlight the need for tailored approaches across lens type, material, design, price tier, end user setting, and distribution channel. Regional dynamics underscore the criticality of customizing market entry and expansion strategies to local reimbursement environments and infrastructure maturity. Moreover, corporate maneuvering among established incumbents and nimble disruptors will intensify around areas such as drug-eluting technologies and digital service offerings.

Ultimately, success in this evolving landscape will hinge on the ability to integrate product innovation with service excellence and to develop resilient, flexible operations that can adapt to shifting trade policies and clinical paradigms. By harnessing the multidimensional insights presented in this executive summary, stakeholders are equipped to chart a strategic course that balances growth objectives with operational agility.

Finalize your strategic approach with expert guidance by connecting with our Associate Director of Sales and Marketing

To secure your comprehensive guide to the intraocular lens market, contact Ketan Rohom, Associate Director of Sales & Marketing at our firm. Ketan’s team can provide tailored consulting, detailed data sets, and proprietary insights to empower your strategic roadmap. Reach out today to learn how this report will enable you to capitalize on emerging opportunities, mitigate risks from evolving tariffs, and align your product portfolio with regional and segment-specific demands. Unlock the competitive advantage that only our rigorous research can deliver by partnering with Ketan Rohom now

- How big is the Intraocular Lens Market?

- What is the Intraocular Lens Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?