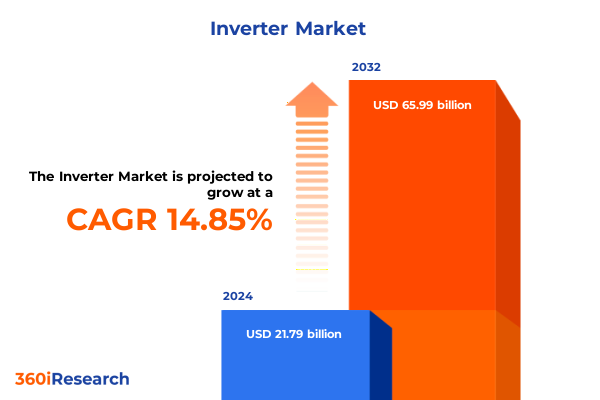

The Inverter Market size was estimated at USD 24.53 billion in 2025 and expected to reach USD 27.63 billion in 2026, at a CAGR of 15.18% to reach USD 65.99 billion by 2032.

Inverter Market Dynamics Unveiled: Advancements, Challenges, and Strategic Opportunities Shaping the Global Power Conversion Landscape

In recent years, the inverter sector has emerged as a critical enabler of global energy transformation, seamlessly converting direct current into alternating current to power a vast array of applications. As decarbonization objectives intensify and renewable energy penetration rises, advanced inverters are becoming pivotal in optimizing grid stability, enhancing energy efficiency, and facilitating smart grid functionality. Beyond their traditional role, modern inverters now integrate digital monitoring, predictive maintenance, and artificial intelligence–driven performance optimization to deliver enhanced reliability and operational visibility. This convergence of power electronics and software intelligence marks a new era, where inverters are not merely passive converters but active participants in energy ecosystems.

Amid these innovations, industry stakeholders must navigate a landscape shaped by shifting regulatory frameworks, evolving consumer expectations, and competitive pressures. Manufacturers are under increasing demand to deliver modular, scalable, and resilient solutions aligned with diverse application requirements, spanning from large-scale utility projects to residential solar installations. Moreover, the growing emphasis on electrification of transportation and the burgeoning market for energy storage systems further underscores the need for versatile inverter solutions capable of bi-directional power flow and seamless integration with battery technologies. As the market matures, strategic differentiation will hinge on the ability to blend technical excellence with comprehensive service offerings, forging stronger relationships with installers, project developers, and end-users.

Emerging Technological and Regulatory Transformations Redefining Inverter Applications Across Commercial, Residential, and Utility Segments

Technological breakthroughs are rapidly redefining the inverter landscape, ushering in a wave of capabilities that extend far beyond mere power conversion. The advent of digital twin modeling and real-time data analytics has enabled manufacturers to fine-tune performance parameters, predict component wear, and preempt failures. Moreover, the integration of edge computing and Internet of Things connectivity is empowering system operators to orchestrate distributed energy resources with unprecedented granular control. As a result, installers and utilities alike are gaining actionable insights that reduce downtime, optimize maintenance schedules, and improve overall asset yield.

In parallel, regulatory transformations are reshaping the contours of inverter deployment across key markets. Stricter grid interconnection standards now mandate advanced functionalities such as low-voltage ride-through, dynamic reactive power support, and anti-islanding protection. Net metering reforms and time-of-use tariff structures are further incentivizing the adoption of smart inverters capable of managing bi-directional energy flows and participating in demand response programs. Additionally, emerging mandates for vehicle-to-grid interoperability are accelerating development of bidirectional inverters, enabling electric vehicles to serve as mobile storage assets. Collectively, these technological and regulatory shifts are driving an evolution from basic conversion devices toward fully orchestrated energy management platforms.

Assessing the Ripple Effects of 2025 United States Tariffs on Inverter Supply Chains, Manufacturing Costs, and Competitive Positioning Worldwide

In 2025, the imposition of revised import duties on critical inverter components in the United States is exerting significant pressure on global supply chains and cost structures. Tariff escalations have prompted original equipment manufacturers to reassess sourcing strategies, with many accelerating the relocation of production facilities to countries with preferential trade agreements. Concurrently, domestic producers are expanding capacity investments to capitalize on protectionist measures, seeking to capture share in the wake of reduced foreign competition.

These shifts are reverberating downstream, as installers and project developers confront higher procurement costs and longer lead times. In response, players across the value chain are exploring collaborative procurement pools, localized warehousing solutions, and design-for-manufacture principles to mitigate cost inflation and delivery risk. Furthermore, tariff-induced price differentials have sparked innovation in modular inverter architectures that facilitate rapid reconfiguration and component substitution, helping to buffer against supply shocks. As a result, the 2025 tariff landscape is not merely a cost headwind but a catalyst for strategic realignment and resilience across the inverter market.

Decoding Product, Application, Installation, Phase, and Power Rating Segmentation to Illuminate the Diverse Inverter Market Landscape and Opportunities

A nuanced appreciation of market segmentation reveals distinct growth trajectories and opportunity nodes for inverter providers. By product type, central inverters continue to dominate utility-scale installations due to their high power capacities and cost-effectiveness, while microinverters are gaining traction in residential settings thanks to their panel-level performance optimization and enhanced safety features. String inverters, with their balance of scalability and efficiency, bridge the gap between small commercial deployments and larger distributed arrays. Hybrid inverters, which combine solar conversion and battery inverter functions, are experiencing rapid uptake amidst rising demand for behind-the-meter energy storage integration.

When viewed through application lenses, heterogeneous needs emerge more clearly. Commercial end users, segmented into large and small business categories, are prioritizing energy cost savings and sustainability targets, driving interest in solar-plus-storage solutions. Industrial facilities, spanning heavy and light sectors, demand robust inverter designs capable of coping with harsh environmental conditions and variable load profiles. Residential consumers, whether in single-family homes or multifamily communities, are gravitating toward turnkey systems with integrated monitoring platforms. Utility-scale projects, both ground-mounted and floating, rely on high-efficiency, grid-compliant inverters that can seamlessly integrate into complex power networks.

Installation typologies further underscore differentiation: hybrid systems that marry solar arrays with battery storage or diesel generators present unique technical requirements, while off-grid setups-either standalone solar or hybrid solar-wind configurations-necessitate inverters designed for complete grid independence. On-grid installations, by contrast, emphasize anti-islanding protocols and reactive power capabilities to satisfy grid operator criteria. Phase distinctions, between single-phase units for smaller loads and three-phase inverters for heavy-duty applications, influence product design and certification pathways. Power rating tiers-from low-power residential units under 5 kilowatts, through medium-power offerings between 5 and 50 kilowatts, to high-power central inverters exceeding 50 kilowatts-shape not only technical specifications but also sales channels and service models.

This comprehensive research report categorizes the Inverter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Installation Type

- Phase

- Power Rating

Uncovering Regional Growth Drivers and Adoption Patterns in Americas, Europe Middle East & Africa, and Asia-Pacific Inverter Markets for Strategic Planning

Regional dynamics play a pivotal role in shaping market prospects and strategic priorities. In the Americas, supportive policy mechanisms such as investment tax credits, renewable portfolio standards, and net metering regimes continue to underpin robust solar adoption across the United States, Canada, and select Latin American nations. Utility-scale solar deployments in Brazil and Chile are complemented by burgeoning residential markets in Mexico, propelled by declining system costs and rising consumer awareness.

Over in Europe, the Middle East, and Africa, decarbonization roadmaps and green hydrogen initiatives are fueling demand for large-scale inverter installations, particularly in countries targeting carbon neutrality by mid-century. Landmark projects in the Gulf region are deploying floating solar farms equipped with advanced grid-support functionalities, while North African nations explore off-grid solutions to enhance rural electrification. Regulatory priorities around grid modernization and energy security underscore the importance of resilient inverter technologies capable of operating in diverse climatic and infrastructural contexts.

Asia-Pacific remains the world’s largest inverter market, driven by continued expansion in China, India, Japan, and Southeast Asia. China’s vertically integrated supply chain advantages and domestic content policies sustain high-volume production, while India’s target for 500 gigawatts of renewable capacity by 2030 catalyzes opportunities across applications. In Southeast Asia, emerging economies such as Vietnam and the Philippines are witnessing rapid solar adoption, often in hybrid microgrid models that support remote communities and industrial parks. Across the region, electrification of transport and industry continues to spur investment in smart inverters aligned with evolving grid codes and demand response frameworks.

This comprehensive research report examines key regions that drive the evolution of the Inverter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Inverter Manufacturers and Technology Providers to Highlight Competitive Strategies, Innovation Roadmaps, and Market Positioning

Leading technology providers are differentiating through a combination of product innovation, service excellence, and strategic partnerships. Manufacturers that leverage cross-domain expertise in power electronics, software analytics, and energy storage have managed to deliver portfolio breadth tailored to diverse customer segments. Collaborative alliances between inverter OEMs and battery system integrators are emerging as a key trend, enabling seamless plug-and-play solutions that reduce integration complexity and accelerate deployment timelines.

In addition, tier-one players are investing heavily in digital service platforms that offer remote monitoring, predictive maintenance, and firmware over-the-air updates. These capabilities not only enhance system uptime but also unlock new revenue streams through value-added services and performance-based contracts. Strategic acquisitions of start-ups specializing in advanced semiconductors and AI-driven control algorithms signal an industry-wide push to embed smarter features and improve conversion efficiencies.

Regional champions in established markets continue to fortify their competitive moats via localized manufacturing, robust distribution networks, and comprehensive training programs for installers. At the same time, challenger brands are gaining share by catering to niche applications with highly customized solutions, demonstrating that agility and customer intimacy can rival scale and heritage when it comes to winning new projects.

This comprehensive research report delivers an in-depth overview of the principal market players in the Inverter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- AIMS Power Inc.

- Delta Electronics, Inc.

- Eaton Corporation plc

- Fronius International GmbH

- General Electric Company

- GoodWe Power Supply Technology Co., Ltd.

- Growatt New Energy Co., Ltd.

- Hoymiles Power Electronics Inc.

- Huawei Digital Power Technologies Co., Ltd.

- KSTAR Science and Technology Co., Ltd.

- Omron Corporation

- Schneider Electric SE

- Siemens AG

- SMA Solar Technology AG

- SolarEdge Technologies, Inc.

- SolaX Power Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- TBEA Co., Ltd.

- Toshiba Mitsubishi-Electric Industrial Systems Corporation

- Yaskawa Electric Corporation

Strategic Imperatives for Industry Stakeholders to Navigate Market Volatility, Leverage Technological Advancements, and Strengthen Competitive Advantage

To thrive amidst intensifying competition and evolving market conditions, industry leaders should prioritize the development of modular architectures that facilitate rapid configuration and simplify field service interventions. Investing in research and development for next-generation wide-bandgap semiconductors and decentralized control schemes will yield efficiency gains and cost advantages over legacy systems. Moreover, forming strategic alliances with renewable project developers, energy storage firms, and grid operators can unlock new channel opportunities and reinforce end-to-end solution capabilities.

Supply chain resilience must become a board-level concern; diversified sourcing, regional assembly hubs, and real-time logistics analytics will help mitigate tariff fluctuations and shipping disruptions. Leaders should also cultivate comprehensive training ecosystems for installers and maintenance technicians, ensuring consistent quality of deployment and fostering brand loyalty. In parallel, embracing data monetization models-for example, selling aggregated performance insights or offering subscription-based analytics-can create recurring revenue streams and deepen customer engagement.

Finally, aligning product roadmaps with evolving regulatory requirements and utility procurement frameworks will guarantee market access and competitive differentiation. By proactively engaging with standards bodies and participating in pilot programs for smart grid integration, companies can secure performance certifications early and position themselves as trusted partners in the energy transition.

Comprehensive Research Approach Integrating Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Robust Inverter Market Insights

This research employs a rigorous mixed-method approach to ensure comprehensive coverage and data reliability. Primary research involved structured interviews with over 50 stakeholders, including inverter OEM executives, system integrators, project developers, and regulatory experts. These engagements provided firsthand insights into strategic priorities, technology adoption barriers, and regional market nuances.

Secondary research encompassed an extensive review of industry publications, technical whitepapers, regulatory filings, and corporate disclosures to capture historical trends and emerging best practices. Quantitative data was triangulated across multiple public and proprietary sources to validate market dynamics and segmentation breakdowns. Specialized databases were leveraged to extract shipment volumes, product specifications, and competitive landscapes, ensuring that all findings rest on a solid empirical foundation.

In addition, an expert advisory panel comprising grid engineers, renewable energy consultants, and financial analysts was convened to review preliminary conclusions and challenge assumptions. This collaborative vetting process enhanced the accuracy of our insights and reinforced the credibility of key takeaways. Together, these methodologies underpin a robust framework designed to guide strategic decision-making in the inverter domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Inverter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Inverter Market, by Product Type

- Inverter Market, by Application

- Inverter Market, by Installation Type

- Inverter Market, by Phase

- Inverter Market, by Power Rating

- Inverter Market, by Region

- Inverter Market, by Group

- Inverter Market, by Country

- United States Inverter Market

- China Inverter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Synthesizing Critical Inverter Market Findings to Guide Decision Makers Toward Growth Opportunities, Risk Mitigation Strategies, and Future Research Directions

The inverter sector is poised at the crossroads of rapid technological evolution and shifting regulatory landscapes, presenting both substantial challenges and transformative opportunities. Emerging digital capabilities are redefining performance paradigms, while tariff adjustments and supply chain realignments necessitate nimble operational strategies. Segmentation analysis underscores the importance of product customization, application-specific solutions, and phase-based configurations, whereas regional insights highlight the diversity of demand drivers across the Americas, EMEA, and Asia-Pacific.

Competition is intensifying as established manufacturers strengthen their portfolios and agile newcomers carve out niche positions. Yet, companies that combine technical prowess with service innovation and strategic partnerships will stand out, capturing value through enhanced customer experiences and recurring revenue models. Moving forward, industry leaders must balance investment in cutting-edge R&D with disciplined execution in supply chain, channel development, and regulatory compliance.

In conclusion, success in the inverter market will depend on an organization’s ability to anticipate shifts, adapt offerings to local market conditions, and deliver differentiated value across the entire energy conversion lifecycle. Those who embrace a holistic, data-driven approach and maintain close collaboration with stakeholders stand to lead the next wave of growth in this critical technology domain.

Connect with Ketan Rohom to Secure In-Depth Inverter Market Intelligence and Unlock Actionable Insights for Revenue Growth and Competitive Differentiation

To gain comprehensive visibility into the evolving inverter landscape and translate market intelligence into actionable strategies, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. By engaging with Ketan Rohom, you will secure an exclusive package that includes in-depth analysis, customized data tables, and expert support tailored to your organizational objectives. Empower your team with precise, data-driven insights to optimize investment decisions, enhance competitive positioning, and accelerate growth in the dynamic inverter sector; contact Ketan Rohom today to purchase the full market research report and unlock unparalleled industry intelligence

- How big is the Inverter Market?

- What is the Inverter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?