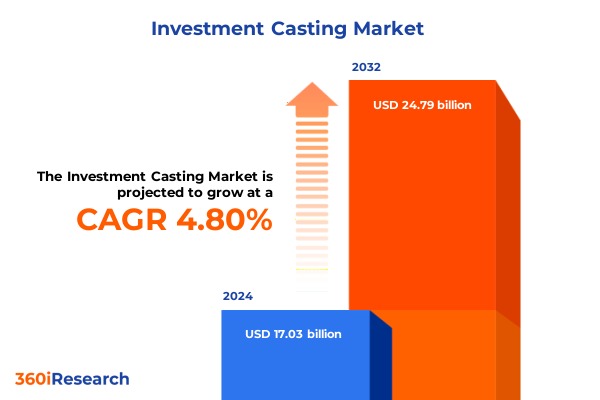

The Investment Casting Market size was estimated at USD 17.82 billion in 2025 and expected to reach USD 18.64 billion in 2026, at a CAGR of 4.83% to reach USD 24.79 billion by 2032.

Embracing the Lost-Wax Heritage and Unveiling How Investment Casting Continues to Revolutionize Precision Manufacturing Across High-Performance Industrial Sectors

Investment casting is an industrial process rooted in the ancient lost-wax technique, dating back more than five millennia. Over centuries, it evolved from artisans crafting intricate jewelry and ritual objects to becoming the foundation of high-precision components used in modern aerospace, medical, and energy sectors. Its name derives from the practice of “investing,” or encasing, a wax pattern in refractory material to form a ceramic shell into which molten metal is poured, yielding parts that precisely replicate every detail of the original design.

In contemporary settings, the process primarily employs two methods: the water glass or sodium silicate process and the silica sol or tetraethyl orthosilicate approach. These techniques differ in surface finish and cost, with the silica sol method delivering superior surface quality at a premium, while the water glass method offers a cost-effective solution for less demanding applications. Advancements in pattern materials, from beeswax to high-performance polymer resins, further underscore the process’s adaptability and capacity to meet stringent dimensional tolerances and surface quality requirements.

Today’s investment casting facilities leverage refined refractory materials, including fused silica, zircon, and alumino-silicates, to create molds capable of withstanding extreme operational environments. The ability to cast complex geometries, thin-wall structures, and superalloys such as nickel-based alloys and titanium has cemented its role in manufacturing critical engine components, medical implants, and specialized industrial machinery parts. This unique combination of precision, versatility, and material diversity continues to drive the technology’s relevance across industries demanding uncompromising quality and performance.

Exploring the Digital, Material, and Sustainability Revolutions That Are Transforming Investment Casting Processes and Supply Chains in 2025

The investment casting landscape is experiencing sweeping technological transformations driven by digitalization and advanced simulation tools. Real-time monitoring systems powered by the Internet of Things (IoT) capture critical parameters such as temperature, pressure, and humidity throughout the casting cycle. These data streams feed into artificial intelligence and machine learning platforms, enabling predictive analytics that identify process deviations before defects occur. As a result, yield rates improve and scrap is minimized, establishing new benchmarks for consistent quality control and reducing total cost of ownership for foundries worldwide.

Additive manufacturing integration represents another paradigm shift, as 3D printing technologies enable rapid fabrication of complex wax patterns and molds directly from CAD files. Binder jetting and stereolithography approaches deliver fine-featured patterns that bypass traditional tooling constraints, accelerating prototyping cycles and opening new avenues for design optimization. This hybrid model merges the strengths of additive and investment casting, facilitating small-batch production of bespoke components for aerospace, medical, and defense applications while maintaining the high dimensional accuracy inherent to lost-wax processes.

Sustainability has become a focal point, prompting foundries to adopt circular economy principles and closed-loop recycling of ceramic shells and wax feedstock. Ceramic slurry reclamation systems now reclaim up to 98 percent of refractory materials, and bio-based wax formulations are gaining traction for their reduced environmental footprint. Combined with energy-efficient furnaces and process optimization tools, these eco-conscious practices underscore a commitment to reducing carbon emissions and complying with evolving regulatory standards, while also delivering cost savings and resource security in a volatile supply chain environment.

Assessing the Comprehensive Effects of 2025 United States Section 232 Tariffs on Steel, Aluminum, and Derivative Articles Impacting Investment Casting

In March 2025, the United States implemented a blanket 25 percent tariff under Section 232 of the Trade Expansion Act of 1962 on steel and aluminum imports, extending coverage to derivative articles based on the value of their steel or aluminum content. The new measures, effective as of March 12, required importers to report primary and secondary smelt locations along with the country of cast, introducing additional administrative complexity and compliance costs for investment casting producers relying on global supply networks for feedstock metals.

To reinforce domestic industry resilience, the administration raised these duties to 50 percent on June 4, 2025, applying the higher ad valorem rate to all steel and aluminum articles and their derivatives. This escalation included tailored provisions for imports from the United Kingdom under the U.S.-UK Economic Prosperity Deal, reflecting strategic trade partnerships while underscoring national security objectives. The substantial tariff hike exerted upward pressure on raw material costs, compelling foundries to reassess sourcing strategies and evaluate the economic viability of nearshoring or vertical integration of key supply chain elements.

The cumulative tariff landscape has prompted industry participants to explore alternative materials and alloys to mitigate cost impacts, while also accelerating investments in domestic melting and casting capacity. Companies have engaged with policymakers to refine tariff definitions for derivative articles, seeking clarity on HTS classifications to avoid inadvertent exposure. This complex regulatory environment underscores the importance of agile procurement practices and proactive trade compliance capabilities to sustain competitiveness in the evolving 2025 investment casting market.

Unlocking Market Intelligence by Examining Process, Material, Application, and End-User Segmentation to Illuminate Investment Casting Dynamics

The investment casting market can be deconstructed along multiple dimensions, each revealing unique growth and innovation opportunities. Process type analysis distinguishes between the sodium silicate method, which offers cost-effective mold creation for high-volume runs, and the tetraethyl orthosilicate (silica sol) approach prized for its superior surface finish and precision in critical aerospace and medical components. Understanding how these processes influence cycle time, material usage, and surface quality enables manufacturers to align production with end-use requirements.

Material type segmentation uncovers strategic choices between ferrous and non-ferrous alloys. Ferrous metals, including cast iron for robust structural parts and steel for moderate-to-high-temperature applications, serve industrial machinery and energy sectors. Non-ferrous options encompass aluminum for lightweight designs, cobalt alloys for wear-resistant components, copper alloys for conductive parts, nickel alloys for corrosion resistance and high-temperature stability, and titanium for extreme strength-to-weight requirements in aerospace and defense.

Application-based insights spotlight the diverse roles investment castings play, from aerospace control systems, engine components, and structural assemblies to agriculture machinery components, irrigation equipment, and livestock implements. In the automotive arena, engine castings, body and interior fittings, chassis and suspension elements, and transmission components benefit from the method’s dimensional accuracy. Medical implants, surgical instruments, and diagnostic equipment leverage tight tolerances, while military and defense platforms depend on investment-cast equipment, vehicles, and weapon systems. The oil and gas sector uses specialized castings for drilling machinery, offshore structures, pipelines and fittings, and refinery equipment that must endure harsh environments.

Finally, end-user segmentation differentiates between aftermarket suppliers-who prioritize quick-turn, low-volume production for maintenance and repair-and original equipment manufacturers (OEMs), which demand high-certification standards, consistent batch quality, and integrated supply chain management. By mapping capabilities against these segmented requirements, stakeholders can refine product portfolios and tailor value propositions to the most lucrative niches.

This comprehensive research report categorizes the Investment Casting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process Type

- Material Type

- Application

- End-User

Understanding Regional Divergence and Growth Trajectories in the Americas, Europe Middle East & Africa, and Asia-Pacific Investment Casting Markets

Regional dynamics in the investment casting landscape diverge significantly across the Americas, Europe Middle East & Africa (EMEA), and Asia-Pacific, each shaped by distinct economic drivers and policy frameworks. In the Americas, nearshoring trends and reshoring initiatives have gained momentum, supported by incentives and rising labor costs abroad. This environment has catalyzed investments in domestic foundry upgrades and digital capabilities, particularly to service the robust aerospace, automotive, and oil and gas sectors that underpin North American demand.

In the EMEA region, legacy aerospace hubs in Western Europe continue to invest in advanced ceramics, non-destructive testing methodologies, and digital transformation efforts to maintain technological leadership. Meanwhile, the Middle East’s focus on energy infrastructure projects and strategic defense modernization programs drives demand for high-performance castings. Africa represents an emerging frontier, where infrastructure development and mining activities are slowly creating new markets, though supply chain challenges and capital constraints temper near-term growth prospects.

The Asia-Pacific region registers the fastest expansion, fueled by rapidly industrializing economies and government-backed manufacturing incentives. China’s strategic emphasis on advanced materials and precision manufacturing, along with India’s growing energy and transportation infrastructure programs, has led to capacity additions and technology collaborations. Southeast Asian countries, benefiting from competitive labor costs and free trade agreements, are evolving into regional sourcing bases for medium-complexity castings, while Japan and South Korea sustain leadership in superalloy and medical-grade components.

This comprehensive research report examines key regions that drive the evolution of the Investment Casting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Shaping Investment Casting with Groundbreaking Technologies and Strategic Collaborations

The competitive landscape of investment casting is anchored by a handful of global leaders and innovative challengers. Precision Castparts Corp.’s structural and airfoil divisions excel in superalloy, aluminum, and titanium castings, supplying major aero-engine manufacturers and industrial turbine producers with components up to 100 inches in diameter. Arconic, established as a specialist in high-performance alloys, delivers complex investment castings for aerospace, defense, and industrial gas turbines through a global network of foundries and machining centers.

Hitchiner Manufacturing distinguishes itself through proprietary countergravity casting technologies that optimize yield and surface quality, catering to automotive, fluid power, and defense segments. Georg Fischer leverages robust R&D capabilities to drive lightweight alloy adoption and digital foundry systems, aligning product development with evolving customer requirements. Howmet Aerospace, following its strategic realignment from Arconic, emphasizes end-to-end capabilities in castings, machining, and additive manufacturing for next-generation engine components.

Emerging specialists such as Bescast harness fully automated production control systems and precision investment workflows to serve power generation and aerospace customers, while RPM Engineering focuses on low-volume, high-mix production for aftermarket and custom applications. Collectively, these companies illustrate the balance between scale-driven cost leadership and nimble innovation that defines the investment casting market’s competitive dynamics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Investment Casting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- American Casting Company

- CFS Machinery Co., Ltd.

- Consolidated Precision Products

- Dawang Metals Pte. Ltd.

- Doncasters Group

- Dongguan Cast Dream Steel Precision Casting Co.,Ltd

- Eagle Group Manufacturing

- Engineered Precision Casting Co., Inc.

- Ferralloy Inc.

- Form Technologies

- Georg Fischer Ltd.

- Hitachi, Ltd.

- HITCHINER Manufacturing Co., Inc.

- Howmet Aerospace Inc. (Formarly Arconic Inc.)

- Impro Precision Industries Limited

- INDO-MIM LIMITED

- Invest Cast Inc.

- Laszeray Technology, LLC

- MetalTek International, Inc.

- Milwaukee Precision Casting, Inc.

- Ningbo Yinzhou Leisheng Machinery Co.,Ltd

- Post Precision Castings, Inc.

- Precision Castparts Corp.

- QINGDAO HUIYUHAOYE INDUSTRY&TRADING CO., LTD.

- Redstone

- Reliance Foundry Co. Ltd.

- RLM Investment Casting

- Sumangal Castings Pvt. Ltd.

- Tamboli Castings Limited

- Texmo Blank

- TICCO Inc.

- U.S. Titanium Industry Inc.

- Wisconsin Precision Casting Corporation

- ZOLLERN GmbH & Co. KG

Driving Strategic Excellence Through Actionable Recommendations on Digitalization, Supply Chain Resilience, and Sustainability for Investment Casting Executives

To maintain a competitive edge, industry leaders should accelerate the deployment of digital twins and AI-driven quality control systems, leveraging real-time analytics to reduce defects and optimize resource utilization. Prioritizing end-to-end traceability, from feedstock origin to finished component, will enhance compliance with evolving tariffs and regulatory requirements while mitigating supply chain disruptions.

Diversifying material sourcing through strategic partnerships and regional production hubs can offset escalating tariff exposures. By establishing localized melting and casting operations in key markets, foundries can reduce lead times, achieve cost parity, and qualify for government-led incentive programs. Simultaneously, investing in alternative alloy formulations that rely less on tariff-sensitive materials may uncover new performance advantages and open avenues in sectors such as renewable energy and electric mobility.

Embedding sustainability within core operations-through closed-loop recycling, energy-efficient furnaces, and bio-based waxes-will align companies with global decarbonization goals and customer ESG commitments. Additionally, cultivating talent pipelines via partnerships with technical universities and apprenticeship programs ensures a future-ready workforce equipped to master emerging digital and additive manufacturing technologies.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Advanced Qualitative and Quantitative Techniques

This analysis draws on a multi-faceted research methodology combining primary and secondary data sources to ensure comprehensive market understanding. Secondary research entailed a review of trade publications, regulatory filings, and academic journals to capture historical context and technology evolution. Publicly available tariff notifications and government proclamations provided real-time insights into policy impacts.

Primary research included in-depth interviews with senior executives at leading foundries, materials suppliers, and trade association representatives. These conversations illuminated operational challenges, strategic priorities, and technology adoption roadmaps. Data triangulation techniques were employed to reconcile findings from diverse sources, strengthening the validity of key insights.

Quantitative analysis utilized segmentation frameworks across process types, material categories, applications, and regions to map growth vectors and competitive intensity. Qualitative assessments evaluated innovation maturity, regulatory pressures, and sustainability practices, enabling a balanced perspective on market dynamics. Limitations include ongoing policy shifts and the proprietary nature of certain performance metrics, which may affect near-term forecasts and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Investment Casting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Investment Casting Market, by Process Type

- Investment Casting Market, by Material Type

- Investment Casting Market, by Application

- Investment Casting Market, by End-User

- Investment Casting Market, by Region

- Investment Casting Market, by Group

- Investment Casting Market, by Country

- United States Investment Casting Market

- China Investment Casting Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Summarizing Key Findings to Highlight the Strategic Imperatives and Future Directions of Investment Casting in a Rapidly Evolving Landscape

Through a thorough examination of process innovations, material advancements, policy environments, segmentation dynamics, regional trends, and competitive positioning, this executive summary elucidates the transformative forces shaping the 2025 investment casting market. Digitalization and additive manufacturing integration emerge as cornerstones of next-generation production models, while sustainability imperatives drive circular economy practices and energy efficiency.

The imposition and escalation of Section 232 tariffs underscore the importance of agile supply chain strategies and proactive compliance efforts to manage input cost volatility. Segmentation analyses reveal nuanced opportunities across process types, alloy selections, and end-use applications, enabling targeted growth strategies. Regional insights highlight the Americas’ reshoring momentum, EMEA’s technological leadership, and Asia-Pacific’s robust capacity expansion.

By leveraging the strategic recommendations outlined here, industry leaders can fortify their operations against market uncertainties, capitalize on emerging innovation trends, and deliver enhanced value to their customers. The convergence of technology, policy, and sustainability will define competitive advantage in the evolving investment casting landscape.

Partner with Ketan Rohom to Secure Tailored Investment Casting Market Research Insights and Drive Strategic Growth

Engaging with a seasoned sales leader can accelerate your access to proprietary insights and ensure you extract maximum value from specialized market research tailored to investment casting. Ketan Rohom, serving as Associate Director of Sales & Marketing, brings extensive expertise in guiding executives through the nuanced landscape of precision manufacturing data. By connecting with him directly, you will gain personalized support in selecting the right research modules, clarifying complex methodologies, and aligning findings with your strategic goals. Reach out to secure your comprehensive investment casting market research report and initiate a collaboration that transforms data into actionable growth and competitive advantage.

- How big is the Investment Casting Market?

- What is the Investment Casting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?