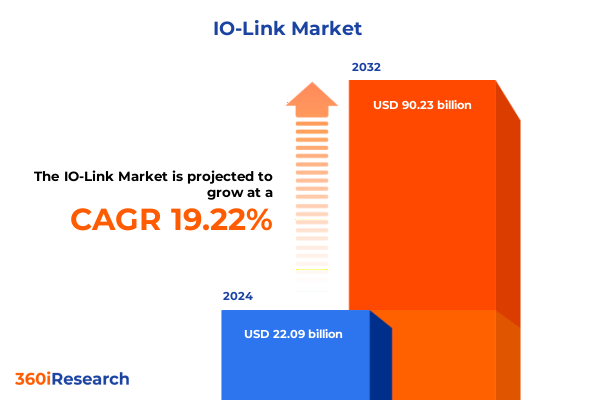

The IO-Link Market size was estimated at USD 26.40 billion in 2025 and expected to reach USD 30.98 billion in 2026, at a CAGR of 19.19% to reach USD 90.23 billion by 2032.

Unleashing Next-Level Industrial Connectivity through IO-Link Protocols for Intelligent Automation and Enhanced Operational Excellence

IO-Link represents a paradigm shift in industrial connectivity, offering standardized communication between smart sensors, actuators, and control systems. This protocol enables seamless device-level interaction, facilitating real-time data collection and bidirectional communication without the complexity of traditional fieldbus networks. As facilities evolve toward Industry 4.0, IO-Link’s plug-and-play architecture and diagnostics capabilities provide a solid foundation for digital transformation, allowing factory engineers to monitor device health, adjust parameters on the fly, and minimize unscheduled downtime.

Moreover, IO-Link supports a wide range of sensor and actuator technologies-from temperature and pressure sensors to valve manifolds-bridging the gap between discrete and process automation. By integrating IO-Link devices into existing infrastructure, manufacturers can accelerate commissioning, reduce wiring complexity, and achieve finer control over production processes. The result is enhanced operational efficiency, shorter time to market for new products, and improved quality assurance. In essence, IO-Link not only streamlines device integration but also lays the groundwork for advanced analytics, predictive maintenance, and adaptive process control, positioning enterprises to thrive in a competitive global environment.

Driving Industrial Evolution with Digital Transformation, Edge Intelligence, and Wireless IO-Link Innovations Reshaping Automation Landscapes

The emergence of IO-Link coincides with a broader transformation in automation, driven by the convergence of edge computing, digital twins, and wireless technologies. Edge processing ensures that critical data analysis occurs close to the source, reducing latency and network congestion. By implementing IO-Link masters with embedded analytics, manufacturers can filter and preprocess raw sensor data before forwarding only relevant insights to higher-level systems. This shift accelerates decision-making on the shop floor and enables real-time adjustments to maintain optimal performance.

Furthermore, the widespread adoption of wireless IO-Link gateways has liberated devices from the constraints of physical cabling, particularly in rotating machinery and mobile platforms. This mobility fosters the deployment of smart sensors in harsh environments or moving equipment, expanding the scope of automation into previously inaccessible areas. Coupled with advancements in cybersecurity, these wireless solutions ensure data integrity and availability, essential for safeguarding production continuity. As a result, businesses gain unparalleled flexibility, scaling their automation strategies without incurring the logistical challenges of rewiring or extensive retrofits.

Finally, the integration of IO-Link with industrial networks-such as Ethernet/IP, PROFINET, and EtherCAT-has created a unified architecture that underpins digital twin initiatives. By synchronizing device-level parameters with virtual models, organizations can simulate process changes, optimize energy consumption, and predict maintenance requirements. This holistic approach not only reduces operational expenses but also accelerates innovation cycles, empowering enterprises to meet evolving market demands with agility and precision.

Navigating the Complex Landscape of 2025 U.S. Tariffs on Electronic Components Shaping IO-Link Supply Chains and Costs

Since 2018, the U.S. Trade Representative has applied Section 301 tariffs on Chinese-origin electronic components, imposing a 25% duty on a broad range of items used across automation systems. Beginning January 1, 2025, these duties were intensified when tariffs on semiconductors categorized under HTS 8541 and 8542 doubled from 25% to 50%, significantly affecting the cost structure for smart sensors and control modules that rely on these components.

In addition to the long-standing Section 301 measures, the administration invoked the International Emergency Economic Powers Act to levy supplementary duties in early 2025. As of March 4, a reciprocal tariff framework imposed a 25% rate on imports from Canada and Mexico and introduced an additional 10% tariff on Chinese shipments, further complicating cross-border procurement for device manufacturers.

Concurrently, a global baseline tariff of 10% was established on electronic components imported from all trading partners to incentivize domestic production and diversify supply chains. This uniform duty applies universally, regardless of country of origin, and has broadened the spectrum of affected items, from integrated circuits to passive components.

For IO-Link device makers, which bundle sensors, actuators, and embedded intelligence into compact modules, the cumulative effect of these tariffs has led to tighter profit margins, longer lead times, and a renewed focus on nearshoring. Many organizations are accelerating qualification of non-U.S. suppliers in tariff-exempt regions and investing in vertical integration to mitigate exposure, underscoring the critical need for agile sourcing strategies in a volatile trade landscape.

Deep Dive into IO-Link Market Segmentation Highlighting Product Types, Installation Approaches, Components, Communications, Applications, and Industry Verticals

To understand the nuances of the IO-Link market, it is essential to examine various segments that shape demand and adoption. From a product perspective, the ecosystem spans actuators, analog devices, RfId devices, sensors, and valve manifolds. Sensor technologies further branch into flow, level, photoelectric, pressure, proximity, and temperature variants, each serving discrete monitoring and control functions across automated lines.

Installation scenarios influence decision-making frameworks, with enterprises choosing between new installations for greenfield projects and retrofit upgrades to modernize legacy systems. Component classification divides the market into IO-Link devices-covering both sensors and actuators-IO-Link masters, and specialist IO-Link software platforms that facilitate configuration and diagnostics.

Communication modalities play a pivotal role, distinguishing wired implementations from emerging wireless solutions that reduce cabling complexity and enable mobility in dynamic environments. Application domains extend into discrete automation, factory-wide process control, material handling logistics, packaging lines, and continuous process sectors. Finally, end users span a diverse range of industries, including automotive assembly lines and body shop processes, chemicals production, food and beverage bottling and filling operations, metals and mining, oil and gas across downstream to upstream sectors, pharmaceuticals filling and packaging facilities, pulp and paper mills, and water and wastewater treatment plants. This multi-dimensional segmentation framework reveals the varied ways IO-Link technology is leveraged to achieve operational excellence and strategic differentiation.

This comprehensive research report categorizes the IO-Link market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation Type

- Component Type

- Communication Type

- Application

- End User Industry

Analyzing Global IO-Link Adoption Trends across Americas, Europe-Middle East-Africa, and Asia-Pacific to Uncover Regional Dynamics

Regional dynamics play a critical role in shaping the adoption curve for IO-Link technology. In the Americas, North American manufacturers have embraced IO-Link primarily through retrofit programs in automotive assembly, where wireless masters reduce cabinet footprints and speed commissioning. Meanwhile, Canada’s resource extraction sectors leverage ruggedized IO-Link hubs for mine automation, and Mexico’s expanding electronics plants integrate IO-Link sensors for real-time quality control.

Across Europe, the Middle East, and Africa, high levels of industrial digitization have driven strong uptake in leading manufacturing economies. Germany and the Nordics, pioneers in Industry 4.0, utilize standardized IO-Link implementations to achieve predictive maintenance and energy optimization in machinery-heavy operations. In parallel, energy and infrastructure initiatives in the GCC and South African utilities are adopting IO-Link for condition-based monitoring, reflecting growing government incentives for smart city and industrial digitization projects.

Asia-Pacific remains the fastest-growing frontier, with China, Japan, and South Korea incorporating IO-Link into automotive, semiconductor, and electronics assembly lines to counter rising labor costs through automation. Southeast Asian and Indian facilities, buoyed by multinational investments, are also deploying IO-Link systems despite local skill gaps, thanks to bundled training and technology transfer programs. This geographic diversity underscores how regional priorities-from manufacturing resilience in the Americas to digital transformation in EMEA and rapid industrialization in APAC-drive tailored IO-Link strategies.

This comprehensive research report examines key regions that drive the evolution of the IO-Link market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Moves of Leading IO-Link Industry Players Driving Innovation, Partnerships, Technological Advances, and Competitive Differentiation

Several industry-leading organizations are shaping the IO-Link landscape through targeted investments and strategic collaborations. Focusing on end-to-end solutions, one major automation supplier has expanded its IO-Link master portfolio to include wireless gateways and integrated edge analytics, enabling customers to extract actionable insights directly at the field level. Another prominent device manufacturer has forged partnerships with software vendors to embed advanced diagnostic tools in IO-Link software suites, streamlining device configuration and lifecycle management.

In addition, select sensor producers have launched next-generation IO-Link modules featuring higher data rates and support for long-distance signal transmission, catering to applications in harsh or distributed environments. These developments have been complemented by consortium efforts aimed at enhancing interoperability standards and defining best practices for secure wireless IO-Link implementations. Collaboration between OEMs and systems integrators has also intensified, resulting in pre-validated solution packages that reduce integration risk and accelerate time to deployment.

Moreover, venture-backed startups specializing in IO-Link ecosystem services have emerged, delivering cloud-native platforms that integrate with enterprise resource planning and manufacturing execution systems. Their focus on open APIs and modular architectures is reshaping competitive dynamics, as traditional hardware-centric suppliers adapt to the growing demand for software-enabled industrial IoT offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the IO-Link market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Balluff GmbH

- Banner Engineering Corp

- Baumer Holding AG

- Beckhoff Automation GmbH

- Carlo Gavazzi Holding AG

- Datalogic S.p.A.

- Festo SE & Co KG

- Hans Turck GmbH & Co KG

- ifm electronic GmbH

- Leuze electronic GmbH

- Murrelektronik GmbH

- Pepperl+Fuchs GmbH

- Phoenix Contact GmbH & Co KG

- Rockwell Automation Inc

- SICK AG

- Siemens AG

- Turck GmbH & Co KG

- Weidmüller Interface GmbH & Co KG

- Wenglor Sensoric GmbH

Actionable Strategies for Industry Leaders to Strengthen IO-Link Adoption, Mitigate Tariff Impacts, and Future-Proof Automation Ecosystems

To thrive in the evolving IO-Link arena, industry leaders should prioritize diversification of supply chains by qualifying additional manufacturing partners in low-tariff regions and expanding in-house assembly capabilities. By leveraging dual-source strategies for critical semiconductor components, organizations can reduce risk exposure and gain greater negotiating power with suppliers.

Investment in workforce development is equally crucial. Establishing training programs for technicians and engineers on IO-Link configuration, wireless integration, and edge computing will accelerate adoption and maximize return on automation investments. Additionally, pilot projects that showcase real-time diagnostics and predictive maintenance use cases can build internal advocacy and validate technology choices before scale-up.

From a technology standpoint, embracing modular software platforms with open APIs will enable rapid integration with existing control systems and cloud infrastructure. Coupled with cybersecurity frameworks tailored to wireless IO-Link, these measures ensure data integrity and regulatory compliance. Finally, fostering collaboration across industry consortia and standards bodies will help shape future protocol enhancements, securing a leadership position in the next wave of smart manufacturing.

Comprehensive Research Methodology Combining Primary Interviews, Secondary Data Validation, and Rigorous Analytical Frameworks for IO-Link Insight Generation

This research draws on a comprehensive blend of primary and secondary data sources to provide a robust foundation for insights. Primary inputs were obtained through structured interviews with key stakeholders, including device manufacturers, systems integrators, and end users across automotive, pharmaceuticals, and process industries. These conversations yielded qualitative perspectives on adoption barriers, technology preferences, and supply chain strategies.

Secondary research involved rigorous analysis of industry publications, tariff schedules, and vendor documentation. Tariff data was validated against official government notices and distributor updates to ensure accuracy. Information related to IO-Link standards and product roadmaps was corroborated through whitepapers and technical briefs from the IO-Link Consortium and major automation organizations.

Quantitative data was synthesized using a bottom-up approach, mapping installed base figures against established segmentation frameworks without projecting future market sizes. Peer benchmarking was conducted to assess competitive positioning of leading suppliers, while scenario analyses explored the sensitivity of adoption rates to tariff fluctuations and technological advancements. Together, these methodologies underpin a fact-based narrative that informs strategic decision-making in IO-Link deployment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IO-Link market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IO-Link Market, by Product Type

- IO-Link Market, by Installation Type

- IO-Link Market, by Component Type

- IO-Link Market, by Communication Type

- IO-Link Market, by Application

- IO-Link Market, by End User Industry

- IO-Link Market, by Region

- IO-Link Market, by Group

- IO-Link Market, by Country

- United States IO-Link Market

- China IO-Link Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Insights on IO-Link’s Role in Accelerating Smart Manufacturing, Overcoming Challenges, and Seizing Opportunities in Automation

IO-Link has firmly established itself as the standardized backbone for smart sensor and actuator communication in modern automation. Its ability to integrate diverse device types, deliver real-time diagnostics, and support both wired and wireless topologies has accelerated digital transformation initiatives worldwide. Despite headwinds from elevated tariffs and geopolitical uncertainty, the protocol’s inherent flexibility and compatibility with broader industrial networks underscore its resilience.

As organizations navigate supply chain disruptions and tariff-induced cost pressures, IO-Link’s modular architecture will facilitate strategic sourcing shifts, equipment retrofits, and the deployment of edge analytics. Regional adoption patterns reflect unique priorities-from productivity gains in North America to predictive maintenance and energy optimization in Europe, and rapid capacity expansion in Asia-Pacific-demonstrating IO-Link’s versatility across industries and geographies.

Moving forward, collaboration among ecosystem participants, enhanced interoperability standards, and continuous innovation in wireless and software-enabled solutions will be pivotal. Enterprises that embrace these advances, coupled with targeted workforce development and proactive trade strategy adjustments, stand poised to unlock the full potential of IO-Link. In doing so, they will secure operational agility, reduce downtime, and harness data-driven insights to drive sustainable growth.

Secure Your Competitive Advantage in IO-Link Automation – Partner with Ketan Rohom to Access Cutting-Edge Market Research and Expert Guidance

Ready to transform your automation strategy with in-depth insights into IO-Link market dynamics, tariff impacts, and segmentation intelligence? Reach out to Ketan Rohom, Associate Director, Sales & Marketing, for a customized discussion on how this comprehensive research report can drive your business forward. Ketan’s expertise in industrial automation sales and marketing ensures you secure the latest data-driven strategies tailored to your organizational objectives. Connect now to schedule a briefing, explore sample findings, and unlock actionable recommendations that will empower your team to stay ahead in the competitive IO-Link landscape.

- How big is the IO-Link Market?

- What is the IO-Link Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?