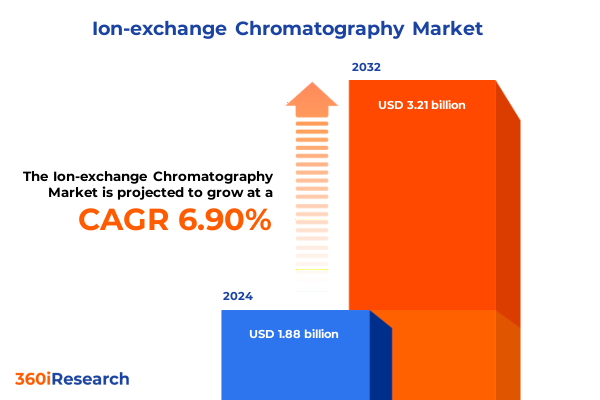

The Ion-exchange Chromatography Market size was estimated at USD 2.01 billion in 2025 and expected to reach USD 2.14 billion in 2026, at a CAGR of 6.95% to reach USD 3.21 billion by 2032.

Revealing the Power and Precision of Ion-Exchange Chromatography in Modern Analytical and Preparative Applications for Advanced Separation Solutions

Ion-exchange chromatography stands as a cornerstone technique in modern separation science, offering unparalleled specificity and adaptability across a broad array of analytical and preparative applications. By leveraging the reversible adsorption of charged analytes onto oppositely charged resins, this method achieves high-resolution separations of proteins, nucleic acids, small molecules, and ions. The fundamental principles of ion-exchange rely on electrostatic interactions, enabling practitioners to fine-tune operational parameters-such as pH, ionic strength, and eluent composition-to target specific molecular species with remarkable precision.

Over the past decade, ion-exchange chromatography has evolved from a niche laboratory procedure into an essential tool for biotechnology, environmental testing, pharmaceutical development, and water treatment. Advancements in resin chemistry, high-performance instrumentation, and automation have expanded its capabilities, making it indispensable for quality control, process optimization, and research applications. This executive summary introduces the key drivers, segmentation insights, regional dynamics, and strategic recommendations that will shape the future of ion-exchange chromatography, providing industry leaders with a clear roadmap for innovation and growth.

Emerging Technological Advances and Evolving Application Demands Driving Paradigm Shifts in Ion-Exchange Chromatography

The landscape of ion-exchange chromatography is undergoing transformative shifts driven by breakthroughs in materials science, automation, and sustainability. Innovations in synthetic resins, including advanced acrylic and polystyrene chemistries, are enhancing binding capacities and operational stability. Concurrently, the advent of macroporous and gel-type porous resins has opened new frontiers in high-throughput protein purification, enabling researchers to isolate monoclonal antibodies and recombinant proteins with unprecedented efficiency.

Beyond resin development, the integration of ion-exchange platforms with mass spectrometry and multi-dimensional chromatography systems is redefining analytical workflows. These hybrid approaches deliver deeper molecular insights while reducing analysis times, propelling applications in drug development and clinical diagnostics. At the same time, the push toward greener practices has spurred the adoption of salt-sparing elution methods and recyclable membrane formats to minimize solvent consumption and waste generation. Together, these technological and environmental imperatives are reshaping how laboratories and production facilities deploy ion-exchange chromatography, setting the stage for a new era of performance and sustainability.

Analyzing the Cumulative Effects of United States 2025 Tariff Adjustments on the Ion-Exchange Chromatography Supply Chain Ecosystem

In 2025, the cumulative impact of recent United States tariff adjustments has reverberated through the ion-exchange chromatography supply chain, affecting both raw materials and finished goods. Tariffs on imported synthetic resins and specialized chromatographic columns have contributed to increased input costs, prompting organizations to reevaluate supplier relationships and inventory strategies. These changes have sharpened cost pressures in research and manufacturing environments, where consistent access to high-quality materials is paramount.

In response, many stakeholders are accelerating efforts to diversify sourcing, with domestic resin production gaining renewed investment and alternative suppliers emerging to fill gaps. Nearshoring initiatives and expanded local manufacturing capabilities aim to reduce lead times and mitigate exposure to unpredictable tariff fluctuations. Simultaneously, the development of more robust process controls and just-in-time procurement models helps laboratories maintain operational continuity despite trade uncertainties. These adaptive measures will play a crucial role in sustaining the momentum of ion-exchange chromatography innovation amid an evolving geopolitical landscape.

Unveiling Critical Market Segmentation Insights Based on Material Technique Resin Type Eluent Type Product Form Production Scale Analysis Type End-User Industry and Application Dynamics

A nuanced understanding of market segmentation reveals the diverse drivers shaping ion-exchange chromatography applications today. Material preferences range from traditional inorganic ion exchangers-such as activated alumina, zeolites, and metal oxides-to biocompatible natural polymers and advanced synthetic resins. Inorganic variants deliver exceptional thermal and chemical stability, while natural polymers appeal for their renewable origins. Meanwhile, synthetic resins offer customizability in pore structure and functional group density, supporting a spectrum of analytical and preparative needs.

Technique distinctions underscore the critical role of anion and cation exchange formats in targeting oppositely charged species, with protocol selection hinging on analyte properties and desired purity levels. Resin types span acrylic, polystyrene, and porous matrices, the latter encompassing both gel and macroporous subtypes tailored for rapid flow rates and high binding capacity. Elution strategies further differentiate performance profiles, where gradient, pH, and salt methods enable selective desorption under controlled conditions.

Diverse product forms-ranging from traditional bead-based columns to membrane devices and gel cartridges-cater to varied throughput requirements, from pilot-scale process development to full industrial manufacturing. Production scales extend from bench-top systems in research laboratories to large-scale industrial operations, with dedicated platforms designed to ensure reproducibility and regulatory compliance. Analytical workflows balance qualitative assessments for initial screening with quantitative approaches that deliver precise concentration and purity metrics. Finally, industry end users include biotechnology innovators, chemical manufacturers, environmental testing services, food and beverage laboratories, pharmaceutical developers, and water treatment facilities. Applications traverse clinical diagnostics, drug development, nucleic acid purification, protein purification-including monoclonal antibodies, recombinant proteins, and vaccine intermediates-and water analysis, highlighting the versatility and ubiquity of ion-exchange chromatography across mission-critical processes.

This comprehensive research report categorizes the Ion-exchange Chromatography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Technique Type

- Production Scale

- Analysis Type

- Structure Type

- End-User

Comparative Regional Dynamics Shaping Ion-Exchange Chromatography Growth in the Americas Europe Middle East & Africa and Asia-Pacific Markets

Regional dynamics in ion-exchange chromatography reflect distinct priorities and growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, robust pharmaceutical and biotechnology sectors drive demand for high-throughput purification platforms and advanced analytical tools. A well-established network of research institutions and contract manufacturing organizations fuels continuous product development, while regulatory frameworks emphasize quality assurance and environmental sustainability. This combination of factors underpins steady investments in chromatography infrastructure and service offerings.

Across the Europe, Middle East & Africa region, stringent regulatory regimes and a focus on green chemistry accelerate the adoption of low-waste elution techniques and recyclable media. Collaborative research initiatives between academic centers and industrial partners foster innovation in resin design and process intensification. Meanwhile, growing demand for water treatment and environmental monitoring applications in emerging economies is stimulating market expansion, as governments and utilities seek reliable methods to ensure water quality and compliance.

Asia-Pacific stands out for its rapid expansion in pharmaceutical manufacturing, environmental testing, and food safety analysis. Domestic resin producers are scaling up capacities to serve local demand, while international suppliers establish regional hubs to reduce lead times. Investments in automation and modular chromatography systems cater to manufacturers aiming for cost-effective, high-performance separations. These complementary trends highlight the significance of tailoring strategies to regional market drivers and regulatory landscapes to achieve sustained growth and operational efficiency.

This comprehensive research report examines key regions that drive the evolution of the Ion-exchange Chromatography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives That Are Redefining the Ion-Exchange Chromatography Landscape

The ion-exchange chromatography arena is characterized by a diverse roster of influential players, each leveraging unique strengths to capture market opportunities. Leading multinational corporations bolster their portfolios through continuous product innovation, unveiling next-generation resins with enhanced selectivity and stability. Many of these firms emphasize sustainability, integrating recyclable membrane technologies and solvent-reduction strategies into their pipeline to meet evolving environmental standards.

Mid-sized companies and specialized firms carve out niche positions by focusing on high-value applications such as monoclonal antibody purification and nucleic acid separation. Strategic partnerships with academic institutions and contract research organizations enable rapid adoption of novel chemistries and automation platforms, fostering agility in responding to customer needs. Concurrently, regional players in Asia-Pacific and the Americas enhance local service offerings by establishing application labs and training centers, supporting end users with method development and troubleshooting expertise.

Together, these companies are shaping competitive dynamics through targeted mergers and acquisitions, technology licensing deals, and co-development agreements. The resulting landscape incentivizes continuous performance improvements and cost efficiencies, ensuring that the ion-exchange chromatography sector remains responsive to the stringent demands of biopharmaceutical, environmental, and industrial end markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ion-exchange Chromatography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Avantor, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- GE Healthcare

- MembraPure GmbH

- Merck KGaA

- Metrohm AG

- Mitsubishi Chemical Corporation

- Perkin Elmer Inc.

- Regis Technologies Inc.

- Sartorius AG

- Shimadzu Corporation

- Sykam GmbH

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- Waters Corporation

Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Mitigate Challenges in Ion-Exchange Chromatography

To navigate the complexities of today’s ion-exchange chromatography environment, industry leaders should prioritize strategic investments in advanced resin chemistries and automation technologies that boost throughput and consistency. Establishing collaborations with local resin manufacturers and equipment providers can mitigate tariff-related disruptions and foster supply chain resilience. In addition, integrating digital monitoring tools into chromatography platforms enhances process visibility, enabling proactive adjustments for optimal performance and regulatory adherence.

Companies should also embrace sustainable practices by adopting salt-minimizing elution methods and exploring recyclable media formats, aligning operations with global environmental goals. Cultivating talent through specialized training programs ensures that laboratory personnel remain adept at the latest separation techniques and quality management systems. Finally, continuous engagement with regulatory bodies and participation in industry consortia will help organizations anticipate compliance changes and shape standards, reinforcing their market leadership and credibility.

Detailed Overview of Research Methodology Integrating Primary Interviews Secondary Source Analysis and Rigorous Data Validation Processes

This comprehensive market analysis was developed through a multi-tiered research methodology designed to ensure both depth and reliability. Primary research involved in-depth interviews with chromatography experts, process engineers, procurement managers, and end-user representatives across key regions, capturing real-time perspectives on market drivers and challenges. Secondary research encompassed rigorous reviews of peer-reviewed journals, patent databases, corporate filings, and industry-agnostic publications to validate emerging trends and technological breakthroughs.

Data triangulation and cross-verification procedures were applied throughout the study, aligning quantitative insights with qualitative feedback to eliminate inconsistencies. Critical information on tariff regimes and regulatory frameworks was corroborated through official government sources and trade association reports. The final deliverable underwent multiple rounds of internal quality assurance, including peer review by subject-matter experts and editorial scrutiny, ensuring that the findings are accurate, balanced, and actionable for stakeholders seeking to make informed decisions in the ion-exchange chromatography domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ion-exchange Chromatography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ion-exchange Chromatography Market, by Material Type

- Ion-exchange Chromatography Market, by Technique Type

- Ion-exchange Chromatography Market, by Production Scale

- Ion-exchange Chromatography Market, by Analysis Type

- Ion-exchange Chromatography Market, by Structure Type

- Ion-exchange Chromatography Market, by End-User

- Ion-exchange Chromatography Market, by Region

- Ion-exchange Chromatography Market, by Group

- Ion-exchange Chromatography Market, by Country

- United States Ion-exchange Chromatography Market

- China Ion-exchange Chromatography Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Future Trajectory of Ion-Exchange Chromatography and Its Strategic Impact on Diverse End Markets

As ion-exchange chromatography continues to evolve, its significance across biotechnology, pharmaceuticals, environmental testing, and industrial processes remains indisputable. The convergence of advanced resin materials, automation, and sustainability initiatives will drive new application frontiers, from high-purity therapeutic manufacturing to real-time environmental monitoring. Regional market variations underscore the importance of localized strategies, whether in optimizing supply chains in the Americas, advancing green protocols in EMEA, or scaling capacity in Asia-Pacific.

Moving forward, stakeholders who embrace innovation, diversify their supplier base, and invest in robust process controls will secure competitive advantages and resilience against geopolitical uncertainties. By leveraging the insights and recommendations outlined herein, industry participants can chart a clear course toward operational excellence and sustainable growth in the dynamic field of ion-exchange chromatography.

Engage with Ketan Rohom to Unlock Comprehensive Ion-Exchange Chromatography Insights and Drive Informed Strategic Decisions Today

If you are seeking to harness the full potential of ion-exchange chromatography insights and translate them into actionable business strategies, Ketan Rohom, Associate Director of Sales & Marketing, can guide you toward the most impactful decisions. Engaging with Ketan will provide a direct line to in-depth expertise on emerging trends, segmentation dynamics, and regional nuances that define this market. His seasoned perspective ensures you receive tailored recommendations that align with your organization’s objectives and operational realities.

By partnering with Ketan Rohom, you gain access to a comprehensive market research report that goes beyond surface-level analysis to deliver strategic foresight. Whether your focus is optimizing supply chain resilience, identifying high-growth applications, or integrating cutting-edge techniques, this report offers the clarity and direction needed to stay ahead of the curve. Connect with Ketan today to secure your copy and elevate your decision-making process with confidence and precision

- How big is the Ion-exchange Chromatography Market?

- What is the Ion-exchange Chromatography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?