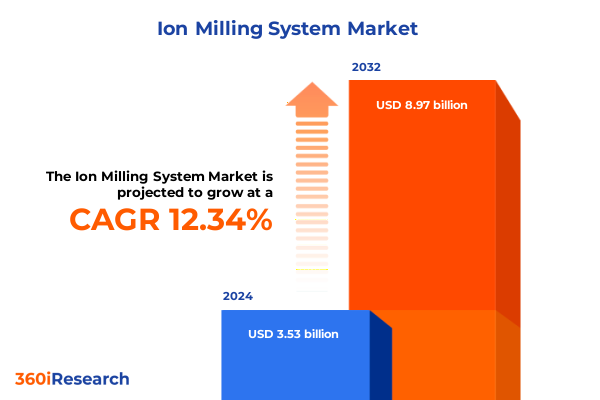

The Ion Milling System Market size was estimated at USD 3.96 billion in 2025 and expected to reach USD 4.45 billion in 2026, at a CAGR of 12.36% to reach USD 8.97 billion by 2032.

Unveiling the Core Foundations and Strategic Significance of Ion Milling Systems in Enabling Superior Surface Preparation and Analytical Precision

Ion milling systems have become foundational tools in advanced material science and analytical laboratories, enabling unparalleled precision in surface preparation, cleaning, and cross‐section polishing. These instruments harness ion beam technology to delicately remove material at the nanoscale, making them indispensable for industries that demand meticulous characterization and quality control, from semiconductor wafer thinning to composite material failure analysis. The core functionality centers on directing a focused or broad ion beam onto a target, sputtering away surface layers with controlled energy and incidence angles. Over time, enhancements in beam stability, vacuum integrity, and automation have elevated these systems from niche research tools to mission‐critical equipment in high‐throughput manufacturing and complex failure diagnostics.

Beyond microfabrication and microscopy, ion milling plays an essential role in enabling detailed transmission electron microscopy sample preparation, where both cross‐section and plan‐view imaging require precisely thinned specimens to reveal atomic‐scale structures. Simultaneously, the versatility of cold ion beam and gas cluster ion beam technologies has opened new frontiers in gentle surface cleaning and modification, preserving sensitive polymer and semiconductor surfaces while delivering high‐resolution results. As advanced materials continue to evolve in complexity-encompassing novel ceramics, composites, and multi‐layered semiconductor stacks-the strategic significance of ion milling systems intensifies, positioning them at the heart of next‐generation research and production workflows.

Navigating the Unprecedented Technological and Market Shifts Revolutionizing Ion Milling Systems for Next-Generation Materials and Semiconductor Fabrication

The landscape of ion milling systems is experiencing transformative shifts driven by technological innovation, integration of artificial intelligence, and the evolving demands of emerging end markets. Advances in focused ion beam (FIB) platforms, particularly dual beam configurations that integrate electron and ion sources, provide simultaneous milling and high‐resolution imaging capabilities, enabling researchers and manufacturers to diagnose defects and engineer structures with unprecedented efficiency. Concurrently, the adoption of gas cluster ion beams-composed of thousands of low‐energy atoms-addresses the need for minimally invasive surface modification, unlocking applications in sensitive semiconductor layers and delicate polymeric materials without compromising structural integrity.

Automation and process control have become pivotal differentiators as system vendors embed machine learning algorithms to optimize beam parameters, reduce cycle times, and predict maintenance intervals. The convergence of real‐time analytics with closed‐loop feedback ensures consistent results across diverse materials, facilitating higher throughput in semiconductor fabrication lines and repeatable sample preparation in academic and industrial laboratories. Moreover, the integration of modular vacuum and filtration systems affords flexible configurations that accommodate a broad range of research institutes, semiconductor fabs, and aerospace component manufacturers. As end users demand streamlined workflows and reduced operator dependency, these technological advances position contemporary ion milling systems as agile, intelligent platforms capable of adapting to increasingly stringent quality standards and emerging material challenges.

Assessing the Ripple Effects of 2025 United States Tariffs on Ion Milling System Supply Chains and Import Dynamics across Critical Market Verticals

The introduction of United States tariffs on select imported lithography and etching equipment in early 2025 has reverberated throughout the ion milling system supply chain, driving equipment manufacturers and end‐users to reassess sourcing strategies and cost structures. While these tariffs aimed to bolster domestic production capabilities, the immediate effect was a sharp increase in landed costs for systems and critical components sourced from overseas suppliers. Firms reliant on specialized ion source assemblies, vacuum pumps, and precision power supplies began exploring alternate supply channels, intensifying partnerships with regional manufacturers to mitigate exposure to duty‐induced price volatility.

In response, leading vendors have shifted certain production lines back to U.S.-based facilities, ramping up local fabrication of vacuum chambers and control system modules to avoid the most onerous tariff classifications. This onshoring trend, while reducing exposure to import duties, has also introduced new challenges related to labor costs and capacity constraints, prompting companies to invest in advanced automation to preserve margins. Additionally, importers have increased focus on tariff engineering-redesigning product kits and leveraging duty‐drawback mechanisms-to minimize classification within high‐tariff brackets. These strategic adjustments underscore the resilience and adaptability of the ion milling system market, even as policy shifts redefine competitive dynamics and supply‐chain frameworks.

Deciphering the Multifaceted Segmentation Landscape Illuminating Diverse End User Needs and Technology Preferences Shaping Ion Milling System Adoption

A nuanced understanding of the ion milling system market emerges when dissecting the diverse requirements of end users, the evolution of ion beam technologies, application-specific demands, material complexities, component ecosystems, and mobility preferences. End users span aerospace manufacturers seeking flawless composite edge finishes, automotive developers analyzing microstructural fatigue in metal alloys, electronics firms validating PCB coatings, research institutes conducting fundamental studies, and the semiconductor sector undertaking IC manufacturing, MEMS fabrication, and wafer processing. This diversity compels solution providers to tailor beam configurations, vacuum architecture, and sample handling modules to match distinct operational environments.

On the technology front, broad beam platforms deliver high removal rates for general surface preparation, while cold ion beam systems excel at delicate cleaning tasks, preserving polymer and ultra-thin semiconductor layers. Focused ion beam variants, offered in single column and dual beam models, facilitate simultaneous imaging and milling-critical for defect analysis-whereas gas cluster ion beam setups enable gentle sputtering with molecular-level precision. Application-wise, instruments dedicated to cross‐section polishing and failure analysis possess enhanced beam alignment features, while those optimized for sputter deposition, surface cleaning, and TEM sample preparation (including both cross‐section and plan‐view configurations) integrate software modules that automate wafer mapping and tilt compensation.

Material-specific insights emphasize the need for adaptable beam energies and gas chemistries to accommodate ceramics, composites, metals, polymers, and semiconductors, ensuring surface integrity and minimal subsurface damage. The component landscape-including control systems, filtration modules, ion sources, power supplies, and vacuum assemblies-frequently dictates maintenance cycles and uptime, influencing total cost of ownership considerations. Finally, mobility options range from compact benchtop units favored by academic labs to fixed installations in high‐volume fabs and portable instruments designed for on‐site failure diagnostics. This segmentation mosaic underscores the importance of integrated, configurable platforms to meet the evolving needs of a heterogeneous customer base.

This comprehensive research report categorizes the Ion Milling System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- Components

- Mobility

- End Users

- Application

Exploring Regional Variances and Growth Drivers across Americas Europe Middle East & Africa and Asia Pacific in the Ion Milling System Ecosystem

Geographic dynamics play a pivotal role in shaping the competitive landscape and growth trajectories of ion milling system providers. In the Americas, robust investments in semiconductor R&D, advanced materials science programs, and a mature aerospace sector drive strong demand for systems capable of high‐throughput and precise surface modification. U.S.-based research universities and national laboratories further bolster this region’s appetite for versatile benchtop and fixed systems, while Canadian and Mexican manufacturing clusters contribute to a steady volume of service and maintenance contracts.

Across Europe, the Middle East, and Africa, a diverse mix of developed and emerging markets influences adoption patterns. Western Europe’s automotive and electronics sectors prioritize integrated dual beam solutions for failure analysis and component validation, while research institutions in the Nordics champion gas cluster ion beam applications for polymer and semiconductor research. In the Middle East, government-funded technology parks and defense research initiatives are expanding demand for portable and fixed ion milling systems. Meanwhile, South Africa’s emerging manufacturing base is adopting mid-range platforms for composite material testing and advanced metallurgy studies.

The Asia-Pacific region stands out as a dynamic powerhouse, led by China, South Korea, Japan, and Taiwan, where aggressive semiconductor fab expansion and consumer electronics production propel market growth. Local manufacturers are increasingly developing indigenous ion source technologies, challenging established global players, while government incentives for domestic equipment innovation intensify regional competition. Additionally, Australia’s academic sector drives demand for compact benchtop units, and Southeast Asia’s emerging R&D hubs are gradually adopting higher-end dual beam and gas cluster platforms to support next‐generation device research.

This comprehensive research report examines key regions that drive the evolution of the Ion Milling System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Enterprises Driving Innovation in Ion Milling Systems through Strategic Collaborations and Cutting Edge Technological Developments

The ion milling system market is characterized by a constellation of established equipment manufacturers and emerging innovators, each vying to deliver differentiated value through technological prowess, service excellence, and strategic collaborations. Leading global firms have reinforced their portfolios by integrating advanced process control software and expanding modular vacuum and filtration offerings, enabling streamlined upgrades and localized customization. Partnerships with semiconductor foundries and academic consortia underscore the emphasis on co-development of next-generation beam sources and in situ analytical attachments, reinforcing vendor credibility and accelerating time-to-market for novel applications.

Simultaneously, specialized companies focusing on focused ion beam and gas cluster ion beam technologies have carved out niche positions through targeted product roadmaps and after-sales support networks, catering to laboratories that demand ultra-high precision and repeatable performance. Several vendors have embraced service-centric business models, offering remote diagnostics, preventative maintenance programs, and operator training modules to maximize uptime and knowledge transfer. Collaborative ventures between power supply and vacuum system specialists have yielded plug-and-play component packages that reduce installation complexity and accelerate deployment schedules.

Notably, cross-industry alliances-spanning materials suppliers, instrumentation integrators, and software analytics providers-are reshaping competitive dynamics. By combining domain expertise in ceramics, semiconductors, and polymers with bespoke milling capabilities, these coalitions address complex sample preparation challenges that extend far beyond traditional applications. This convergence of capabilities and alliances underpins the marketplace’s adaptive strategies, ensuring providers remain at the forefront of innovation while meeting the stringent quality demands of high-value end users.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ion Milling System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4Wave Inc.

- Carl Zeiss AG

- Fischione Instruments, Inc.

- Gatan, Inc.

- Hitachi High-Technologies Corporation

- JEOL Ltd.

- Leica Microsystems GmbH

- Oxford Instruments plc

- Plasma-Therm LLC

- SPTS Technologies, Ltd.

- Ted Pella, Inc.

- Thermo Fisher Scientific Inc.

- Torrey Pines Scientific, Inc.

- Vacuum Generators Ltd.

Implementing Actionable Strategies and Operational Best Practices to Capitalize on Emerging Opportunities in the Ion Milling System Industry

To effectively capitalize on the evolving opportunities within the ion milling system landscape, industry leaders should prioritize the integration of intelligent automation frameworks that leverage machine learning for real-time beam parameter optimization and predictive maintenance scheduling. By embedding adaptive process control and remote monitoring capabilities, organizations can minimize unplanned downtime, elevate throughput consistency, and reduce reliance on specialized technician interventions for routine adjustments. Concurrently, diversifying supply chains through a balanced mix of domestic and regional component sourcing can mitigate the impact of tariffs and geopolitical uncertainties, ensuring resilient access to critical vacuum pumps, ion sources, and precision power supplies.

Moreover, adopting a modular product architecture enables scalable upgrades and tailored configurations, empowering end-users to enhance system capabilities incrementally as application demands evolve. Strategic alliances with material suppliers and analytical software vendors can foster co-innovation, resulting in bundled offerings that address the full gamut of sample preparation workflows-from surface cleaning to TEM plan‐view and cross‐section imaging. A strong after-sales ecosystem, underpinned by structured training programs, operator certifications, and virtual support platforms, further differentiates vendors by maximizing equipment utilization and facilitating rapid technology diffusion across research and production facilities.

Finally, proactive engagement with regulatory bodies and industry consortia is essential to anticipate policy shifts-such as potential changes to import duties or environmental standards governing ion beam emissions-and lobby for standards that support both innovation and environmental stewardship. Executives who embrace these actionable strategies will position their organizations to navigate shifting market dynamics, drive customer satisfaction, and secure leadership in the high-precision materials processing market.

Detailing the Comprehensive Multi-Source Research Methodology Ensuring Robust Data Integrity and High Confidence in Ion Milling System Market Insights

The insights presented in this report stem from a robust, multi-layered research methodology designed to ensure data integrity, contextual accuracy, and comprehensive market visibility. Primary data was collected through structured interviews with equipment manufacturers, end-user technical leads, and independent laboratory directors, providing firsthand perspectives on technological preferences, procurement challenges, and evolving application needs. These qualitative inputs were supplemented by a detailed review of patent filings, regulatory submissions, and product manuals, enabling a granular understanding of beam source innovations, component specifications, and system performance benchmarks.

Secondary research encompassed an extensive analysis of industry white papers, financial disclosures from key public companies, and vendor collateral, ensuring alignment between self-reported capabilities and real-world application outcomes. Quantitative data aggregation was conducted across regional procurement statistics, equipment shipment records, and aftermarket service logs, with cross-verification processes employed to reconcile discrepancies and validate emerging trends. Analytical frameworks such as SWOT analysis and Porter’s Five Forces were applied to characterize competitive positioning and market dynamics, while scenario planning exercises assessed the potential impacts of policy changes, supply chain disruptions, and technological breakthroughs.

Throughout the research process, rigorous data governance protocols-encompassing version control, source auditing, and peer review by subject matter experts-were enforced to maintain methodological transparency and reproducibility. This disciplined approach ensures stakeholders can place high confidence in the report’s conclusions and leverage its findings to inform strategic decisions in the fast-evolving ion milling system arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ion Milling System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ion Milling System Market, by Technology

- Ion Milling System Market, by Material

- Ion Milling System Market, by Components

- Ion Milling System Market, by Mobility

- Ion Milling System Market, by End Users

- Ion Milling System Market, by Application

- Ion Milling System Market, by Region

- Ion Milling System Market, by Group

- Ion Milling System Market, by Country

- United States Ion Milling System Market

- China Ion Milling System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Core Findings and Strategic Insights to Provide a Cohesive Perspective on the Future Trajectory of the Ion Milling System Landscape

Bringing together the core analyses underscores a market at the nexus of technological innovation, shifting policy landscapes, and diversified end-user requirements. The advent of advanced focused ion beam configurations, intelligent automation, and gas cluster ion beam modalities is redefining surface preparation and analytical workflows, while 2025 tariffs have catalyzed supply chain realignments, driving onshoring initiatives and tariff mitigation strategies. Segmentation analysis reveals a highly fragmented demand structure, with aerospace, automotive, electronics, research institutes, and semiconductor sectors each dictating unique system specifications, further complicated by the wide spectrum of materials, component dependencies, and mobility preferences.

Regionally, established markets in the Americas and EMEA benefit from sophisticated R&D infrastructures and mature manufacturing bases, whereas the Asia-Pacific sphere is characterized by rapid semiconductor fab expansion, government incentives, and the rise of domestic equipment producers challenging traditional incumbents. Competitive profiling highlights ongoing collaborations between instrumentation providers, materials specialists, and software developers, underscoring an ecosystem increasingly defined by strategic alliances and integrated solutions. Actionable recommendations emphasize the need for modular design, supply chain agility, advanced automation, and strong after-sales networks to mitigate risk and capitalize on emerging growth vectors.

As organizations navigate this complex terrain, the importance of data-driven decision-making, cross-functional collaboration, and regulatory foresight cannot be overstated. The confluence of these factors will shape the next chapter of ion milling systems, determining which players emerge as market leaders and how innovations translate into operational excellence and scientific breakthroughs.

Initiating Strategic Dialogue to Unlock In-Depth Ion Milling System Intelligence and Propel Informed Strategic Decision Making

To explore how these comprehensive ion milling system insights can elevate your strategic initiatives and operational capabilities, schedule a detailed consultation with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan Rohom will guide you through the report’s in-depth analyses, clarifying how the identified trends and recommendations align with your organization’s objectives. By engaging directly with Ketan, you can tailor the data to your unique use cases, understand the implications for your supply chain, technology roadmap, or service models, and secure competitive advantages in high‐value market segments.

Taking this next step provides immediate access to customized scenario planning, detailed supplier profiles, and advanced methodological disclosures that underpin the report’s findings. Ketan Rohom is prepared to discuss how leading companies are leveraging new ion source technologies, addressing tariff-driven cost challenges, and optimizing segmentation strategies across end users, applications, and geographies. Don’t miss the opportunity to transform these insights into actionable plans that drive innovation, operational excellence, and sustainable growth. Reach out today to initiate your tailored briefing and ensure your leadership team is equipped with the actionable intelligence required for confident decision‐making in the evolving ion milling system landscape

- How big is the Ion Milling System Market?

- What is the Ion Milling System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?