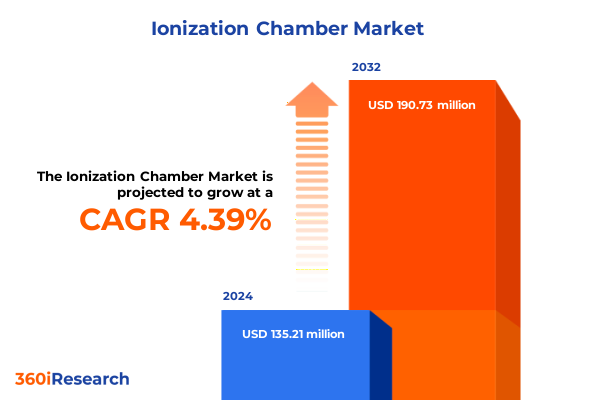

The Ionization Chamber Market size was estimated at USD 139.98 million in 2025 and expected to reach USD 147.34 million in 2026, at a CAGR of 4.51% to reach USD 190.73 million by 2032.

Unveiling the Core Landscape of Ionization Chambers Highlighting Market Fundamentals and Emerging Catalysts Alongside Pivotal Technological and Regulatory Trends

Ionization chambers serve as critical instruments for detecting and measuring ionizing radiation, underpinning applications across healthcare, industrial, environmental, and nuclear sectors. These devices, designed to convert radiation energy into electrical signals through precise ion collection, have evolved from basic analog meters to sophisticated digital systems. As global regulations on radiation safety tighten and advanced imaging technologies proliferate, the fundamental importance of ionization chambers in quality assurance, compliance, and operational reliability has never been greater.

The ionization chamber market is shaped by multifaceted drivers including rising healthcare infrastructure investments, expansion of nuclear power generation, heightened environmental monitoring mandates, and the burgeoning demand for nondestructive testing in industrial processes. Regulatory frameworks such as the International Atomic Energy Agency’s safety standards and national calibration guidelines reinforce the need for precise, traceable measurements, thereby cementing the value of ionization technology. Additionally, digital transformation and the integration of intelligent data analytics are accelerating innovation in chamber design and performance measurement.

Against this backdrop, this executive summary lays the groundwork for a comprehensive exploration of market dynamics, highlighting key catalysts, potential barriers, and pivotal trends. The ensuing analysis will navigate through transformative shifts, trade policies, segmentation intricacies, regional patterns, competitive landscapes, and strategic recommendations, offering an authoritative perspective for decision-makers seeking to capitalize on emerging opportunities.

Navigating the Transformative Shifts Reshaping Ionization Chamber Deployment Across Healthcare Energy Environmental and Industrial Sectors

Over the past few years, the ionization chamber landscape has undergone transformative shifts driven by digitalization, miniaturization, and an increased focus on real-time data integration. Traditional analog chambers, once limited to standalone readings, are now complemented by smart modules capable of wireless connectivity, enabling remote calibration, automated quality checks, and continuous monitoring. This digital migration not only enhances measurement precision but also facilitates integration with broader Internet of Things (IoT) ecosystems, empowering end users to harness predictive analytics for proactive maintenance and safety compliance.

Simultaneously, advancements in materials science have yielded chambers with enhanced sensitivity and durability. Novel alloys and composite plastics have improved chamber lifespan under harsh environmental conditions, while specialized coatings mitigate contamination risks. In diagnostic radiology, these enhancements allow manufacturers to develop chambers capable of capturing low-dose exposures with unprecedented accuracy, aligning with the industry’s push toward dose optimization and patient safety.

Environmental monitoring has also been redefined by portable, battery-operated chambers fitted with advanced microelectronics. Real-time stack and ambient radiation assessments are now possible through compact form factors, enabling industrial sites and regulatory agencies to conduct rapid field inspections without sacrificing data fidelity. Furthermore, the convergence of chamber technology with cloud-based platforms has facilitated centralized data management, streamlining regulatory reporting and trend analysis across multiple sites.

As the nuclear sector advances toward next-generation reactor designs, ionization chambers are being reconfigured for high-temperature, high-flux environments. These specialized units incorporate robust electronics and thermal shielding to withstand extreme conditions, signaling a broader trend of customizing chamber technologies for niche applications. Collectively, these shifts underscore a market in flux, characterized by continuous innovation and the redefinition of performance benchmarks.

Examining the Multifaceted Cumulative Effect of Latest United States Tariff Measures on Ionization Chamber Supply Chains and Cost Structures

In 2025, United States trade policy continues to exert significant influence on the ionization chamber supply chain through targeted tariffs that impact both finished chambers and critical components. While ionization chambers generally benefit from duty-free status under most Harmonized Tariff Schedule (HTS) provisions, key electronic elements such as semiconductors face substantial additional duties. Under the Section 301 measures enacted against certain imports from China, tariffs on a range of semiconductor products soared to 50% effective January 1, 2025, up from an initial 25% rate. This escalation has created an effective cost burden on chamber manufacturers who rely on specialized detector chips, integrated circuits, and sensor modules for enhanced performance and digital connectivity.

The imposition of these elevated duties has prompted many original equipment manufacturers to reassess their sourcing strategies. Suppliers in Europe, Japan, and South Korea have seen increased orders as companies seek to mitigate exposure to high-tariff imports. However, these alternatives often entail longer lead times and higher baseline prices, challenging manufacturers to balance cost optimization with performance requirements. The combined effect of import duties and component scarcity has placed upward pressure on production costs and extended project timelines for end users in healthcare, nuclear power, and environmental monitoring segments.

Moreover, ancillary tariffs on raw materials and supporting electronics-while not directly targeting ionization chambers-have a cumulative impact on landed costs. Battery components, used in portable chamber designs, saw an additional 25% duty under the same Section 301 framework, further complicating the economics of mobile monitoring solutions. Although selective exclusions and temporary waivers have been granted under narrow circumstances, the overall trajectory remains one of heightened import costs and supply chain realignment.

Looking ahead, industry stakeholders are evaluating nearshoring and vertical integration as potential countermeasures to tariff-driven uncertainties. Investments in domestic semiconductor fabrication and strategic partnerships with alternative suppliers represent key tactics for future resilience. Ultimately, the interplay of policy measures and market adaptation will continue to shape the ionization chamber landscape in 2025 and beyond.

Decoding Key Segmentation Revelations Illustrating Application End Users Types Operation Modes and Materials Influencing Market Trajectories

Insight into the ionization chamber market is illuminated by examining the diverse segments driven by application requirements, end-user profiles, device types, operational modes, and material compositions. Different healthcare modalities demand distinct chamber attributes: diagnostic radiology applications such as computed tomography call for high detection linearity to verify computed dose outputs, while mammography requires ultra-sensitive chambers calibrated for low-energy X-rays. In industrial radiography settings, ruggedized chambers designed for pipeline inspection must endure on-site vibrations and temperature shifts, whereas weld inspection instruments emphasize spatial resolution and portability. Environmental monitoring further diversifies demand, with ambient air surveillance systems needing continuous sampling capabilities, and stack monitoring solutions engineered for integration with process control systems. Nuclear medicine’s positron emission tomography applications hinge on chambers capable of handling high energy emissions, and single photon emission computed tomography practices require precise energy discrimination, all while radiation therapy dosimetry encompasses brachytherapy devices tailored to source proximity and external beam therapy chambers calibrated against high-energy photon fields.

Equally influential is the end-user segmentation, shaping procurement and operational deployment. Calibration laboratories prioritize traceability and certification protocols, investing in advanced chambers that align with national metrology standards. Hospitals and clinics focus on in-house quality assurance, valuing chambers with seamless integration into imaging suites and user-friendly interfaces. Industrial facilities in manufacturing often seek turnkey monitoring packages, whereas oil and gas operators require chambers certified for hazardous environments. Nuclear power plants, whether boiling water reactors or pressurized water reactors, rely on chambers for critical safety instrumentation, and research institutes spanning academic institutions to government laboratories drive demand for customizable, research-grade units that support ever-evolving experimental protocols.

Type differentiation further refines market choices. Cylindrical chambers, prized for their broad energy range acceptance, serve as general-purpose instruments, while plane parallel chambers have become the standard for surface dose measurements in radiotherapy. Extrapolation chambers find their niche in precise dosimetry research, facilitating energy-dependent response studies, and recombination chambers enable accurate readings in ultra-high dose-rate applications, such as FLASH radiotherapy research. The selection between alternating current and direct current operation modes presents another dimension: AC chambers often exhibit stable performance under variable environmental conditions, while DC chambers deliver simpler power requirements and streamlined circuitry.

Material composition rounds out the segmentation landscape. Air-filled chambers remain ubiquitous for their predictable ion collection characteristics, yet tissue-equivalent designs have gained traction in radiotherapy, providing dose measurements that closely mimic human tissue interactions. This rich tapestry of segmentation criteria underscores a market defined not merely by volume demand, but by nuanced technical specifications and evolving user preferences.

This comprehensive research report categorizes the Ionization Chamber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Operation Mode

- Material

- Application

- End User

Uncovering Essential Regional Dynamics Driving Ionization Chamber Adoption Patterns Across Americas Europe Middle East Africa and Asia Pacific

Regional analysis reveals distinct adoption patterns that underscore both maturity and growth potential across the globe. In the Americas, a well-established healthcare system and a robust nuclear power infrastructure support steady demand for high-precision ionization chambers. The presence of leading calibration laboratories and stringent accreditation requirements further reinforces the region’s emphasis on quality and performance. North America’s environmental regulations have also amplified the need for real-time monitoring devices in industrial emissions and community safety programs.

Across Europe, Middle East, and Africa, regulatory harmonization under frameworks such as Euratom and evolving safety mandates in oil-rich Gulf countries have generated sustained opportunities for ionization chamber suppliers. European markets prioritize advanced digital integration and interoperability with centralized data systems, while certain Middle Eastern nations are investing heavily in new nuclear power projects, necessitating specialized monitoring hardware. African nations, while at an earlier stage of market development, are increasingly adopting portable chamber systems to address environmental monitoring and healthcare quality gaps.

In the Asia-Pacific region, rapid healthcare modernization in China, India, and Southeast Asia has been the primary growth driver. Large-scale investments in hospital expansion and diagnostic imaging equipment have translated into heightened chamber installations. Concurrently, China’s ongoing expansion of nuclear energy capacity, alongside Japan’s post-Fukushima safety upgrades, has created a fertile environment for advanced dosimetry solutions. Environmental imperatives in rapidly industrializing economies have also fueled demand for chamber-based monitoring systems, positioning Asia-Pacific as the fastest-growing market segment.

This regional mosaic illustrates that while developed markets maintain demand through replacement cycles and regulatory compliance, emerging economies are defining new demand curves through infrastructure growth and heightened safety benchmarks. Market entrants and established suppliers alike must tailor offerings to meet region-specific technical requirements, service expectations, and procurement frameworks.

This comprehensive research report examines key regions that drive the evolution of the Ionization Chamber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Prominent Industry Players and Their Strategic Initiatives That Are Steering Innovation and Competitive Positioning Globally

The global ionization chamber market is characterized by a competitive landscape where product innovation, strategic alliances, and service excellence dictate leadership. Mirion Technologies has distinguished itself through targeted acquisitions that broaden its sensor portfolio and strengthen its global distribution network. By integrating complementary technologies, the company has enhanced its capacity to deliver end-to-end solutions spanning dosimetry, environmental monitoring, and nondestructive testing.

PTW Freiburg’s reputation rests on its precision engineering and advanced calibration services. The firm’s continuous investment in R&D has yielded a series of digital chamber platforms that offer high-resolution readings and streamlined software interfaces. Strategic collaborations with research institutions have further cemented PTW’s standing as a pioneer in dosimetry accuracy and reliability.

Fluke Biomedical has leveraged its brand equity in electrical test instrumentation to enter the ionization chamber space, emphasizing service contracts and on-site calibration offerings. This service-oriented approach has resonated with hospitals and clinics seeking to outsource quality assurance protocols, thereby mitigating in-house resource constraints.

IBA Dosimetry has focused on end-to-end radiation quality solutions, coupling chamber hardware with comprehensive data management software. The company’s emphasis on modularity and upgrade paths has facilitated longitudinal monitoring programs in major treatment centers worldwide.

Victoreen, now under the AMETEK umbrella, continues to innovate with rechargeable chamber systems that address sustainability concerns and reduce long-term operational costs. Radcal’s cost-competitive offerings have made precision chambers accessible to smaller research labs and educational institutions, driving broader market penetration.

Across these key players, common strategic themes emerge: expansion of service portfolios, digital technology integration, geographic diversification, and partnerships with regulatory and accreditation bodies. These dynamics frame the competitive environment, compelling stakeholders to differentiate through both technology leadership and customer-centric services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ionization Chamber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aralab

- Berthold Technologies GmbH & Co.KG

- Canon Electron Tubes & Devices Co., Ltd.

- Centronic Limited

- CM Envirosystems

- DT Imaging Technology (Shanghai) Co., Ltd.

- Fluke Biomedical

- IBA Dosimetry GmbH

- LND Inc

- Ludlum Measurements, Inc.

- Mirion Technologies

- ORDELA Inc.

- PTW Freiburg GmbH

- Radcal

- Siemens Healthineers AG

- Standard Imaging

- Sun Nuclear Corporation

- Thermo Fisher Scientific

- Unfors RaySafe AB

- VacuTec Meßtechnik GmbH

Providing Actionable Roadmap Recommendations for Industry Leaders to Capitalize on Emerging Trends Mitigate Risks and Strengthen Market Standing

To capitalize on emerging opportunities and mitigate risks within the ionization chamber market, industry leaders should adopt a multifaceted strategic roadmap. First, investing in digital integration and IoT connectivity for chamber platforms will meet rising demand for remote calibration, automated data analytics, and predictive maintenance. Such capabilities not only enhance user experience but also create recurring service revenue streams through software subscriptions and calibration contracts.

Second, diversifying supply chains for critical components-particularly semiconductors and sensor materials-can reduce exposure to tariff fluctuations and geopolitical uncertainties. Collaborative partnerships with domestic fabrication facilities and multi-sourcing agreements will bolster resilience and enable more consistent delivery timelines.

Third, focusing on underserved emerging markets in Asia-Pacific and select EMEA countries presents a path to sustained growth. Tailored product configurations that adhere to local regulatory standards, combined with scalable service models, can facilitate rapid market entry and stakeholder engagement. Establishing regional calibration centers and training programs will strengthen value propositions and foster long-term customer loyalty.

Fourth, establishing strategic alliances with regulatory agencies and accreditation bodies can shape future standards and position firms as thought leaders. Active participation in standards committees fosters early awareness of regulatory changes, enabling proactive product development and certification processes.

Fifth, investing in advanced materials and miniaturization technologies offers a competitive edge for specialized applications such as high-flux reactor environments and compact environmental monitors. Such innovations will unlock new market segments and fortify leadership in cutting-edge research collaborations.

By executing this strategic blueprint-grounded in digital transformation, supply chain resilience, regional focus, regulatory engagement, and material innovation-industry leaders can navigate market complexities, reinforce their market standing, and unlock new avenues for sustainable expansion.

Outlining a Rigorous Research Methodology Integrating Multi Source Data Collection Expert Validation and Quantitative Analytical Techniques

This study employed a rigorous research methodology designed to ensure reliability, validity, and comprehensive coverage of the ionization chamber market. Secondary research formed the foundation, encompassing industry publications, regulatory filings, technical standards, and publicly available company disclosures. Proprietary databases and patent registries were utilized to capture the latest product innovations and strategic developments.

Primary research complemented secondary findings through structured interviews with key stakeholders, including product managers, calibration experts, radiation safety officers, and regulatory officials. These interviews provided nuanced insights into purchasing criteria, performance expectations, and future technology roadmaps. A series of expert panels and the Delphi technique were employed to achieve consensus on critical drivers, challenges, and market outlooks.

Quantitative analysis incorporated data triangulation methods, cross-validating figures sourced from import/export statistics, tariff databases, and calibration service providers. Scenario modelling assessed the impact of varying tariff regimes, supply chain disruptions, and regional policy changes. Qualitative analysis synthesized expert perspectives to contextualize numerical trends and forecast potential market trajectories.

Vendor profiling followed a standardized framework evaluating product portfolios, R&D investments, geographic footprints, and strategic partnerships. Competitive benchmarking against key criteria-such as sensor accuracy, digital capabilities, regulatory compliance, and service offerings-enabled an authoritative ranking of market participants.

Together, these methodological pillars deliver a robust, data-driven narrative that equips stakeholders with actionable insights and a clear understanding of the forces shaping the ionization chamber market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ionization Chamber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ionization Chamber Market, by Type

- Ionization Chamber Market, by Operation Mode

- Ionization Chamber Market, by Material

- Ionization Chamber Market, by Application

- Ionization Chamber Market, by End User

- Ionization Chamber Market, by Region

- Ionization Chamber Market, by Group

- Ionization Chamber Market, by Country

- United States Ionization Chamber Market

- China Ionization Chamber Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Summarizing Conclusive Insights That Synthesize Market Trends Opportunities and Strategic Imperatives for Ionization Chamber Stakeholders

In summary, the ionization chamber market stands at a pivotal juncture, driven by technological advancements, evolving regulatory mandates, and dynamic trade policies. Digitalization and smart connectivity are redefining chamber capabilities, while innovative materials and miniaturized designs unlock new frontiers in healthcare, environmental monitoring, and nuclear applications. Simultaneously, tariff measures on critical components underscore the importance of supply chain diversification and strategic sourcing.

Segmentation analysis reveals that tailored solutions across application areas, end-user categories, device types, operation modes, and materials will become increasingly critical for market success. Regional insights highlight a dual narrative of maturity in established markets and rapid expansion in emerging economies. The competitive landscape favors players that combine product innovation with service excellence and strategic partnerships.

To thrive amidst these complexities, industry stakeholders must embrace digital transformation, fortify supply chains, engage proactively with regulatory bodies, and pursue targeted growth in high-potential regions. Through a combination of agile strategy execution and sustained R&D investment, companies can secure leadership positions and deliver measurable value to end users.

Ultimately, this analysis underscores that the capacity to integrate advanced technologies, navigate policy landscapes, and anticipate user needs will delineate winners and challengers in the evolving ionization chamber market.

Engage with Our Associate Director to Secure the Detailed Ionization Chamber Market Research Report and Unlock Strategic Competitive Advantages

To acquire the comprehensive market research report and leverage in-depth insights tailored for strategic decision making, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). He will guide you through the report’s structure, clarify any questions about methodologies or data sets, and facilitate seamless access to the actionable intelligence you need to stay ahead in the ionization chamber market.

- How big is the Ionization Chamber Market?

- What is the Ionization Chamber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?