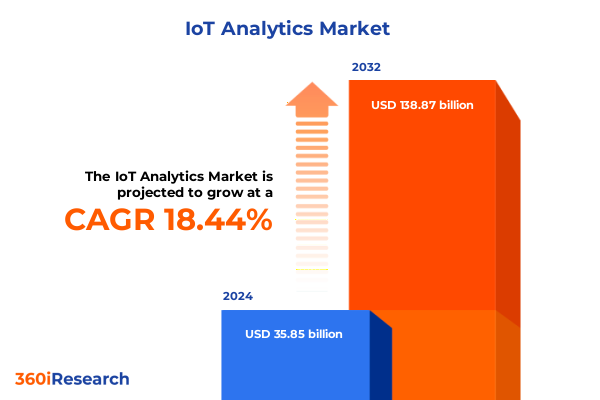

The IoT Analytics Market size was estimated at USD 42.35 billion in 2025 and expected to reach USD 50.33 billion in 2026, at a CAGR of 18.48% to reach USD 138.87 billion by 2032.

Exploring the Strategic Fusion of Connectivity Intelligence and Edge Insights Shaping the Future Trajectory of Global IoT Analytics Solutions

The proliferation of connected devices has surged past forty-one point six billion worldwide, producing zettabytes of real-time telemetry that demand sophisticated analytics to extract actionable insights. As data volumes escalate, enterprises are leveraging edge computing architectures to process and filter data closer to the source, reducing latency and bandwidth usage while enabling real-time decision-making. Moreover, AI-driven analytics at the edge are transforming raw sensor outputs into predictive intelligence, enabling organizations to preempt failures and optimize operations with minimal cloud dependency.

The convergence of connectivity, compute, storage, and machine learning within unified IoT analytics platforms has become a strategic imperative for businesses. By embracing a comprehensive stack that spans short-range protocols such as Bluetooth and Zigbee to wide-area connectivity powered by 5G RedCap and NB-IoT, organizations can integrate diverse data streams into a singular analytics pipeline. This integrated approach ensures that even the most bandwidth-constrained environments benefit from advanced data transformations and machine learning models, fostering agility and resilience in rapidly evolving digital landscapes.

Unveiling Transformative Inflection Points in IoT Infrastructure Adoption Driven by AIoT Advances and Next-Generation Connectivity Innovations

Artificial intelligence is increasingly embedded within IoT ecosystems, giving rise to AIoT architectures that enable devices to learn from and act upon data in real time. Generative AI and machine learning models are now employed to automate anomaly detection, forecast maintenance requirements, and personalize user experiences across consumer and industrial applications. This evolution is prompting a shift from traditional cloud-centric analytics to distributed intelligence, where inference occurs at the edge and only distilled insights traverse networks for further analysis.

Simultaneously, next-generation connectivity technologies are transforming how devices communicate and how enterprises architect their networks. Five-G’s ultra-low latency and high throughput capabilities are crucial for mission-critical applications, while private LPWAN deployments and satellite IoT solutions extend coverage to remote and harsh environments. As these technologies converge, organizations are redesigning their IoT infrastructures to support massive device densities, stringent quality-of-service requirements, and evolving security standards.

Alongside connectivity and AI enhancements, cybersecurity has become a pivotal focus for IoT analytics deployments. The rise of AI-driven threats and the average cost of a data breach approaching five million dollars have spurred enterprises to adopt layered security strategies, embedding identity and endpoint protections directly into analytics frameworks. This paradigm ensures real-time threat detection and rapid incident response within highly distributed, interconnected environments.

Assessing the Comprehensive Ripple Effects of New American Trade Tariffs on Hardware Costs Supply Chains and Device Deployment Dynamics in 2025

In 2025, sweeping U.S. import tariffs-rising to an average of fifteen percent from just above two percent-have reshaped the global cost structure for IoT hardware and components, marking the highest rate since the 1940s. This policy surge has impacted semiconductors and raw materials, driving up prices for microchips, RF modules, and sensors, and prompting leading chipmakers to caution about reduced demand and irregular ordering patterns. Notably, major corporations such as Texas Instruments and ASM International have publicly cited tariff-related disruptions, underscoring the widespread influence on technology supply chains.

The tariffs have also catalyzed pronounced supply chain realignment within the IoT sensors segment. To mitigate heightened costs and logistical bottlenecks, manufacturers are diversifying their sourcing strategies by engaging alternative producers in Southeast Asia, Latin America, and select domestic facilities. Simultaneously, many organizations have accelerated reshoring initiatives, bringing assembly and integration operations closer to end markets to reduce exposure to volatile international trade policies and preserve delivery timelines.

Amid these adjustments, legal uncertainty persists following a U.S. Court of International Trade ruling that vacated key tariff orders as exceeding executive authority. Although the government has appealed and signaled intent to pursue similar measures, technology manufacturers continue to grapple with planning complexities, balancing the promise of relief from judicial outcomes against the prospect of renewed or alternative tariff implementations in future trade actions.

Unearthing Multidimensional Insights Across Component Software Services Deployment Models Connectivity Technologies and End-Use Scenarios for IoT Analytics

IoT analytics deployments can be understood through a spectrum of technology layers, each contributing to an integrated end-to-end solution. At the foundational component level, hardware technologies such as devices, gateways, RF modules, and sensors capture and transmit data, while embedded services-spanning managed and professional offerings-ensure system integration, maintenance, and optimization. Overlaying these physical elements, software components provide application-level intelligence and platform-based orchestration, enabling analytics workflows to ingest, cleanse, enrich, and store time-series data.

Across industries, analytics use cases manifest in agriculture, energy and utilities, healthcare, manufacturing, oil and gas, retail, and transportation and logistics. Within manufacturing operations-from aerospace and defense to automotive and electronics-analytics fuel predictive maintenance and yield optimization. In logistics environments, rail and roadway solutions utilize location and telemetry insights to enhance fleet utilization and delivery accuracy. Energy and utilities providers leverage sensor networks for grid monitoring and demand forecasting, whereas retail and healthcare sectors tap into consumer and patient data streams for personalized engagement and operational efficiency.

Connectivity technologies empower these deployments by offering cellular networks spanning 2G through 5G, LPWAN solutions like LoRaWAN, NB-IoT, and Sigfox, and short-range options such as Bluetooth, Wi-Fi, and Zigbee. Organizations select hybrid architectures that balance bandwidth, power consumption, and latency requirements to best serve application needs. Choices between cloud and on-premises deployment models further influence performance, security, and compliance postures. Finally, specific end-use scenarios-ranging from connected cars and smart grids to smart homes and wearables-drive differentiated analytics requirements, underscoring the need for platforms capable of multi-modal data ingestion and adaptive processing.

This comprehensive research report categorizes the IoT Analytics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity Technology

- Deployment Model

- Industry Vertical

- End Use

Deciphering Regional Market Nuances in the Americas Europe Middle East Africa and Asia-Pacific to Inform Strategic IoT Analytics Expansion Approaches

The Americas region continues to lead global IoT analytics investment, driven by large-scale deployments in North America and dynamic digital transformation initiatives in Latin America. Enterprises in the United States benefit from matured hyperscaler ecosystems, robust edge computing infrastructures, and supportive policy frameworks that facilitate rapid adoption of advanced analytics capabilities. Meanwhile, Brazil, Mexico, and Argentina are investing in smart city and agriculture applications, leveraging regional partnerships to enhance food security and urban services.

In Europe, the Middle East, and Africa, regulatory environments shape analytics strategies through data privacy standards and cross-border data flow requirements. European Union directives such as GDPR have accelerated the development of privacy-centric analytics architectures, while Middle Eastern nations’ significant investments in smart infrastructure are fueling projects from intelligent transportation systems to energy-efficiency platforms. Across Africa, connectivity initiatives are expanding network coverage in underserved areas, enabling new use cases in healthcare delivery and resource management.

Asia-Pacific remains a hotbed of IoT analytics innovation, anchored by manufacturing powerhouses such as China and rising technology hubs in India, Southeast Asia, and Oceania. China’s extensive IoT ecosystem continues to scale through government-backed smart city programs and industrial digitization drives. At the same time, nations such as India and Vietnam are attracting analytics service providers to support burgeoning IIoT implementations in electronics fabrication and automotive assembly, further cementing the region’s role as a strategic center for global IoT development.

This comprehensive research report examines key regions that drive the evolution of the IoT Analytics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Innovation Focus of Leading Global Corporations Driving the Evolution of IoT Analytics Platforms and Ecosystems

Among hyperscale cloud providers, one industry leader has redefined its IoT analytics roadmap by announcing the end of support for its dedicated analytics service as of December 15, 2025. Existing customers must migrate to alternative data platforms for long-term time-series ingestion and advanced querying. This shift underscores a broader trend of consolidating analytics workloads onto streaming-optimized services that can dynamically scale with IoT data volumes.

Simultaneously, the same provider has enhanced its edge analytics capabilities by introducing MQTTv5-enabled SiteWise Edge gateways. These gateways centralize connectivity between industrial equipment and cloud services, allowing organizations to enrich telemetry with contextual data on premises before secure transmission and storage in the cloud. This innovation reflects a strategic emphasis on real-time insights and robust store-and-forward resilience for mission-critical applications.

In parallel, another global cloud provider has released its Azure IoT Operations suite, incorporating generative AI assistants and no-code analytics workflows to streamline deployment and accelerate time to insight. Partnerships such as the integration of Siemens Insights Hub within one major provider’s Industrial Data Fabric illustrate how ecosystem alliances are driving value through seamless OT-IT convergence and data contextualization. Beyond the hyperscalers, platform vendors like PTC and Siemens are investing heavily in AI-driven digital twins, while emerging specialized analytics firms are differentiating themselves through vertical-focused machine learning models that address unique operational challenges in sectors such as energy management and autonomous transportation.

This comprehensive research report delivers an in-depth overview of the principal market players in the IoT Analytics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- AVEVA Group plc

- BOSCH.IO GmbH

- Cisco Systems, Inc.

- GE Digital

- Google LLC

- Hitachi, Ltd.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Salesforce, Inc.

- SAP SE

- SAS Institute Inc.

- Siemens AG

- Software AG

- Splunk Inc.

- Zebra Technologies Corporation

Formulating Targeted Strategic Initiatives to Enhance Market Position Leverage Emerging Technologies and Mitigate Supply Chain Risks in IoT Analytics

Industry leaders should prioritize the deployment of distributed AI architectures that balance edge and cloud analytics to ensure low-latency responses and resilient data processing. By implementing flexible connectivity strategies that incorporate cellular, LPWAN, and short-range protocols, organizations can optimize performance across diverse environments while maintaining cost efficiency. Aligning these technological decisions with a robust security-by-design framework will safeguard sensitive telemetry and maintain regulatory compliance.

Additionally, enterprises must diversify supply chains and consider regional manufacturing partnerships to mitigate the risks posed by geopolitical shifts and trade policy fluctuations. Developing strategic alliances with equipment OEMs and hyperscaler partners can accelerate the integration of advanced analytics services and unlock new business models. Investing in interoperability standards and open data schemas will further enable ecosystems to scale seamlessly and foster innovation.

Lastly, decision makers should cultivate cross-functional teams that bridge IT, operations, and line-of-business stakeholders to drive data-driven cultures. By combining quantitative insights with qualitative domain expertise through iterative pilot programs, organizations can refine use cases, adapt to emerging trends, and sustain competitive differentiation in a rapidly evolving IoT landscape.

Detailing a Rigorous Mixed-Methodological Framework Integrating Quantitative Data Sources Qualitative Expert Consultations and Advanced Analytical Techniques

The research underpinning this analysis integrates primary and secondary data sources through a rigorous mixed-method framework. Initially, quantitative data was collected via structured surveys of over five hundred enterprise IT and operations leaders across key industries, capturing detailed insights on technology adoption, deployment models, and use-case prioritization. These findings were complemented by in-depth interviews with senior executives from leading IoT solution providers and end-user organizations to contextualize adoption drivers and strategic objectives.

Secondary research involved a comprehensive review of trade publications, regulatory filings, and technology roadmaps from hyperscalers, platform vendors, and connectivity consortiums. Proprietary data from industry benchmarking studies was analyzed using advanced statistical techniques and scenario modeling to identify performance differentials across segmentation dimensions. Qualitative coding and thematic analysis of interview transcripts enriched quantitative results with real-world examples and best practices.

Finally, techno-economic modeling and sensitivity analyses were performed to evaluate the impact of critical variables such as connectivity costs, edge compute investments, and tariff alterations on deployment economics. This holistic methodology ensures that the insights presented are both empirically grounded and strategically relevant for decision makers seeking to navigate the complex IoT analytics ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IoT Analytics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IoT Analytics Market, by Component

- IoT Analytics Market, by Connectivity Technology

- IoT Analytics Market, by Deployment Model

- IoT Analytics Market, by Industry Vertical

- IoT Analytics Market, by End Use

- IoT Analytics Market, by Region

- IoT Analytics Market, by Group

- IoT Analytics Market, by Country

- United States IoT Analytics Market

- China IoT Analytics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Insights That Synthesize Key Observations Highlight Actionable Opportunities and Chart a Path Forward for Decision Makers in IoT Analytics

This executive summary has highlighted how the intersection of AI, edge computing, and next-generation connectivity is redefining the IoT analytics landscape. It has underscored that the ability to process data locally, secure telemetry at scale, and seamlessly integrate diverse protocols is paramount to sustaining competitive advantage. Regional dynamics, from North America’s hyperscaler-driven deployments to Asia-Pacific’s manufacturing-anchored innovations, emphasize the need for tailored strategies that address local infrastructure and regulatory frameworks.

Moreover, the analysis of recent tariff developments illustrates that supply chain resilience and strategic sourcing are critical to managing cost pressures on hardware and components. By aligning segmentation insights-from component layers to end-use scenarios-with targeted recommendations, organizations can develop robust roadmaps for deploying analytics solutions that deliver measurable business outcomes.

Ultimately, success in this dynamic environment requires a holistic approach that unites technological agility, ecosystem partnerships, and data-driven leadership. By embracing the insights and strategic imperatives detailed herein, industry stakeholders can chart a clear path forward and capitalize on the full potential of IoT analytics to drive innovation and operational excellence.

Engage with Ketan Rohom to Secure Comprehensive IoT Analytics Market Intelligence and Drive Informed Strategic Decisions Backed by Exclusive Research

To explore tailored insights and proprietary data that can empower your strategic roadmap, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in positioning comprehensive IoT analytics research will ensure you receive the most relevant, actionable intelligence for your organization’s unique requirements. Engage with Ketan to secure an executive briefing, customize report add-ons, or arrange a detailed walkthrough of key findings and supplementary datasets. Harness this opportunity to gain a competitive advantage and make informed decisions with precision and confidence

- How big is the IoT Analytics Market?

- What is the IoT Analytics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?