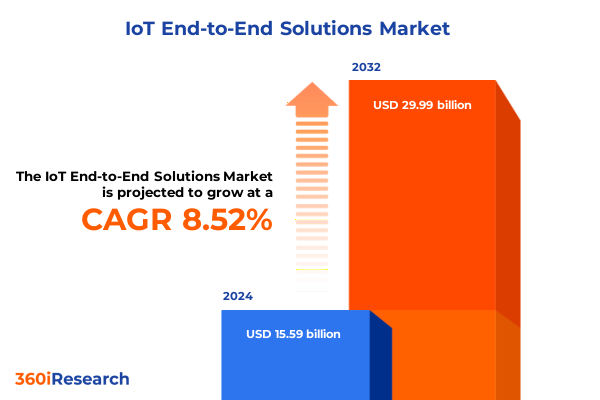

The IoT End-to-End Solutions Market size was estimated at USD 16.87 billion in 2025 and expected to reach USD 18.35 billion in 2026, at a CAGR of 8.56% to reach USD 29.99 billion by 2032.

Setting the Stage for Seamless End-to-End IoT Integration Across Hardware, Gateways, Software Platforms, and Services in Modern Enterprises

End-to-end IoT solutions encompass the entire technology chain, moving data seamlessly from physical devices through gateways, processing layers, and into analytics platforms in the cloud. By treating hardware, connectivity, software, and services as an integrated ecosystem rather than isolated components, organizations can achieve consistent performance, enhanced security, and simplified management across deployments. When each layer is designed to operate harmoniously under a unified architecture, businesses benefit from reduced latency, minimized integration challenges, and streamlined scalability across global assets.

Beyond integration, a cohesive end-to-end approach embeds security and reliability into the system’s DNA. By enforcing uniform communication protocols at sensors, gateways, and cloud endpoints, companies can enforce encryption standards, manage identity consistently, and deliver real-time threat monitoring that spans the full IoT lifecycle. This comprehensive perspective reduces operational risk and accelerates time-to-value, empowering organizations to harness connected data for innovation with confidence.

Navigating Critical Technological, Connectivity, and Security Transformations Reshaping the End-to-End IoT Solutions Landscape in 2025

Artificial intelligence and edge intelligence have converged to redefine the capabilities of end-to-end IoT solutions. By deploying AI-driven analytics at the network edge, organizations can process sensor data in real time for predictive maintenance, quality control, and autonomous decision-making. Edge AI reduces reliance on centralized clouds, cutting down on bandwidth requirements and ensuring low-latency responses critical for industrial automation and autonomous systems. Advancements in chiplet packaging and non-volatile memory further enable these edge devices to handle complex workloads locally, improving energy efficiency while meeting demanding performance criteria.

The expansion of 5G networks and the rise of private connectivity infrastructures are unlocking new possibilities for IoT deployments. Ultra-low latency and high throughput provided by 5G allow massive volumes of machine-to-machine traffic to flow uninterrupted, driving large-scale industrial IoT rollouts and next-generation smart city initiatives. Hybrid connectivity strategies that combine 5G, LPWAN, and satellite networks also ensure continuous coverage in both urban and remote environments, granting businesses the flexibility to tailor network architectures to specific use cases and geographic requirements. This multi-modal approach balances cost, coverage, and performance to meet diverse operational demands.

As IoT ecosystems scale, security and regulatory considerations have moved to the forefront. Zero Trust architectures and secure-by-design principles are now essential to protect expansive device fleets from evolving cyber threats. Industry regulations such as the EU’s NIS2 directive, the U.S. Cyber Supply Chain Act, and data sovereignty mandates are reshaping compliance frameworks, compelling organizations to adopt end-to-end encryption, real-time anomaly detection, and robust identity management across devices and platforms. Additionally, geopolitical tensions and trade policy shifts are introducing new complexities in vendor selection and supply chain resilience, forcing enterprises to diversify sourcing strategies and align their IoT roadmaps with evolving international standards.

Evaluating the Comprehensive Effects of the 2025 United States Tariffs on IoT Devices, Components, Supply Chains, and Business Models

The United States’ 2025 trade policy introduced sweeping tariff revisions aimed at enforcing stricter rules of origin and curbing evasion through transshipment. By April 2025, tariffs on key Chinese imports had climbed to as high as 145 percent, prompting the administration to establish firm deadlines for enforcement without extension. This two-tier tariff scheme, coupled with pressure on allied nations to impose parallel duties, sets a new precedent for import controls, particularly on electronic components fundamental to IoT devices.

IoT hardware components-including gateways, rugged devices, and sensors-have experienced significant cost inflation as duties apply directly to physical goods. Sensors and connectivity modules sourced from tariff-affected regions have seen price tags rise by 10 to 20 percent, challenging device OEMs to absorb costs or pass them to end-users. In response, many providers are exploring alternative supply bases in Southeast Asia and Mexico, while subscription-based service models are emerging to distribute higher equipment expenses over multi-year contracts.

Supply chain realignment has become a strategic imperative, with distributors and OEMs accelerating diversification efforts to mitigate tariff exposure. Some non-U.S. original equipment manufacturers have announced plans to relocate assembly operations domestically, branding their devices as “Made in the USA” to bypass duties. Simultaneously, software and service segments remain relatively insulated from direct tariff impacts; however, reduced device deployment can indirectly slow the uptake of device management, analytics, and security platforms. The ripple effect underscores the need for holistic end-to-end strategies that adapt hardware sourcing, service offerings, and pricing models in tandem.

Revealing Deep Insights into Component, Application, Connectivity, Deployment, and End-User Segmentation Driving IoT Market Dynamics

Understanding the end-to-end IoT market requires a lens on five key segmentation dimensions. Component segmentation reveals that hardware devices, including gateways and ruggedized sensors, form the physical backbone of solutions, while software capabilities like analytics and security deliver intelligence and protection. Services such as integration and managed support bridge the gap between technology and operational excellence, ensuring deployments remain adaptive.

Application segmentation underscores the diversity of IoT use cases, from precision farming in agriculture to telehealth in healthcare and telematics in transportation. Each vertical application leverages specific device configurations and connectivity types-whether cellular for remote asset monitoring or Bluetooth for wearable devices-to optimize performance and return on investment. Connectivity segmentation highlights the multi-protocol reality of IoT, where LPWAN, Wi-Fi, and emerging 5G standards coexist to meet varying range, throughput, and power requirements.

Deployment mode segmentation further differentiates solutions into cloud-native, on-premises, and hybrid architectures, allowing organizations to balance control, scalability, and compliance. Finally, end-user segmentation distinguishes consumer applications in smart homes and wearables from enterprise deployments in large corporations and SMEs, reflecting distinct expectations around reliability, security, and total cost of ownership.

This comprehensive research report categorizes the IoT End-to-End Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity

- Deployment Mode

- Application

- End-User

Highlighting Diverse Regional Trends and Challenges Across Americas, Europe Middle East & Africa, and Asia-Pacific in the IoT Ecosystem

Regional dynamics play a decisive role in the adoption and evolution of end-to-end IoT solutions. In the Americas, widespread industrial automation and advancements in smart manufacturing are driving demand for integrated device-to-cloud architectures. Regulatory incentives and government support for critical infrastructure projects bolster IoT deployments in sectors such as energy and utilities, while private sector investment in smart logistics continues to expand use cases.

Europe, Middle East & Africa (EMEA) illustrate a blend of innovation hubs and regulatory complexity. The European Union’s stringent data protection and network security regulations, including NIS2, compel solution providers to embed compliance by design. Meanwhile, the Middle East invests heavily in smart city initiatives and digital transformation in oil & gas, enabling pilot projects that showcase edge computing and AIoT in harsh environments. Africa, with its emerging connectivity infrastructure and leapfrog potential, is optimizing LPWAN and satellite IoT for remote asset management in agriculture and mining.

Asia-Pacific stands at the forefront of connectivity innovations and large-scale public deployments. Countries such as South Korea and Japan are implementing nationwide 5G private networks for industrial and campus applications, while China’s vast manufacturing ecosystem advances integration of robotics and AI-driven analytics on the factory floor. Southeast Asian economies are rapidly adopting smart agriculture and logistics applications, fueled by government programs targeting food security and trade facilitation.

This comprehensive research report examines key regions that drive the evolution of the IoT End-to-End Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Innovation Profiles of Leading Vendors Powering Comprehensive IoT End-to-End Solutions Worldwide

Cisco continues to lead with its robust industrial networking portfolio, earning accolades as the Industrial IoT Company of the Year. By integrating high-bandwidth, low-latency network fabrics with built-in security and validated design guides, Cisco empowers enterprise and OT teams to collaborate seamlessly. Its industrial switches, routers, and wireless solutions now include AI readiness, enabling real-time asset profiling and threat intelligence at scale.

Microsoft’s Azure Sphere and Azure IoT Hub showcase how cloud providers are embedding security and management into the edge-to-cloud continuum. Azure Sphere’s secure OS on microcontrollers and Azure IoT Hub’s device provisioning, identity management, and data streaming capabilities form a unified platform that simplifies development and accelerates secure deployments across industries. Deep alignment with established communication protocols and encryption frameworks ensures consistent protection from device boot to cloud ingestion.

Amazon Web Services has expanded its IoT suite to include AWS IoT Core, Device Management, and Analytics, providing scalable pipelines for data ingestion, processing, and actionable insights. AWS IoT Fleet Provisioning automates large-scale device onboarding, while integrated analytics services enable real-time anomaly detection and optimization of operational workflows. Through serverless architectures and event-driven computing, AWS facilitates agile development cycles and cost-efficient scaling for enterprise-grade IoT solutions.

IBM’s Watson IoT Platform and the Maximo Application Suite exemplify the convergence of asset management and cognitive analytics in industrial settings. Maximo leverages AI-driven predictive maintenance and digital twins to extend asset lifecycles and minimize downtime in utilities and manufacturing. Meanwhile, IBM Watson IoT delivers device orchestration, real-time telemetry, and blockchain-based traceability for complex supply chains, empowering organizations to translate raw data into strategic insights across the enterprise.

This comprehensive research report delivers an in-depth overview of the principal market players in the IoT End-to-End Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ArcelorMittal S.A.

- BHP Group Limited

- CDE Asia Limited

- Ecoman

- FLSmidth & Co. A/S

- Fortescue Metals Group Ltd.

- HAZEMAG allmineral India Pvt. Ltd.

- Jindal Steel & Power Limited

- KINC Mineral Technologies Pvt. Ltd.

- Metso Outotec Corporation

- Next Track Engineering Private Limited

- NMDC Limited

- Rio Tinto Group

- Rollcon Technofab India Pvt. Ltd.

- Sandvik AB

- Star Trace Private Limited

- ThyssenKrupp Industrial Solutions AG

- Vale S.A.

- Vedanta Limited

- VT Corp Pvt. Ltd.

Actionable Strategies and Best Practices Industry Leaders Must Embrace to Pivot Their IoT End-to-End Solutions Toward Future Resilience and Growth

To thrive in an increasingly complex IoT landscape, industry leaders must prioritize a unified architecture that integrates hardware, connectivity, software, and services from the outset. Embedding security and compliance into the design of every device and platform layer will mitigate risk and simplify audits across global operations. Embracing modular architectures that support hybrid and multi-cloud deployments allows organizations to adapt rapidly to changing workloads and regulatory environments.

Strategic partnerships across the ecosystem-encompassing chipmakers, network operators, and analytics providers-can accelerate innovation while distributing risk. By co-developing solution blueprints and validated designs, companies can reduce implementation time and build confidence among cross-functional stakeholders. In parallel, leaders should invest in workforce upskilling, fostering cross-disciplinary expertise in AI, data analytics, and cybersecurity to sustain ongoing innovation.

Finally, adopting subscription-based and outcome-focused commercial models will help spread upfront costs and align incentives across value chains. By coupling device deployments with managed service agreements and performance-based SLAs, providers can deliver predictable ROI and cultivate long-term customer relationships.

Outlining Rigorous Primary and Secondary Research Methodologies Underpinning Robust IoT End-to-End Solutions Analysis and Insights

This study combines primary interviews with Fortune 500 technology executives, solution architects, and industry analysts to capture real-world perspectives on end-to-end IoT deployments. Complementary secondary research draws on peer-reviewed journals, government trade policy documents, and leading technology consortium reports to validate market dynamics and emerging trends. Data triangulation ensures findings are grounded in both quantitative metrics and qualitative insights, while scenario analysis explores potential future developments in connectivity, security, and regulatory frameworks.

Market sizing and competitive benchmarking rely on detailed vendor disclosures, patent filings, and public financial statements to map the ecosystem’s evolution. Rigorous quality control measures, including peer reviews and expert validations, underpin the report’s conclusions, ensuring that recommendations reflect robust evidence and actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IoT End-to-End Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IoT End-to-End Solutions Market, by Component

- IoT End-to-End Solutions Market, by Connectivity

- IoT End-to-End Solutions Market, by Deployment Mode

- IoT End-to-End Solutions Market, by Application

- IoT End-to-End Solutions Market, by End-User

- IoT End-to-End Solutions Market, by Region

- IoT End-to-End Solutions Market, by Group

- IoT End-to-End Solutions Market, by Country

- United States IoT End-to-End Solutions Market

- China IoT End-to-End Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Consolidating Key Findings and Strategic Imperatives to Guide Decision-Makers Through the Evolving End-to-End IoT Solutions Landscape

The convergence of AI, advanced connectivity, and unified security is driving a new era of end-to-end IoT solutions across industries. As tariffs and trade policies reshape supply chains, organizations must adopt flexible sourcing and subscription models to maintain competitiveness. Segment-specific approaches, regional nuances, and strategic partnerships will define success, while leadership commitment to integrated architectures and workforce expertise remains paramount.

In this dynamic environment, decision-makers who embrace modular, secure, and vertically aligned IoT strategies will unlock transformative efficiencies and sustainable growth. By leveraging the insights and recommendations outlined in this report, stakeholders can navigate complexity with confidence and accelerate their journey toward a fully connected, intelligent enterprise.

Engage with Ketan Rohom to Unlock Tailored Insights and Secure Your Organization’s Investment in the Definitive IoT End-to-End Solutions Market Research Report

To explore the comprehensive IoT end-to-end solutions report and tailor its strategic insights to your organization’s specific challenges, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise in market dynamics and solution-driven research will guide you through the report’s findings and help you identify high-impact opportunities.

Connect with Ketan to schedule a personalized consultation and receive a detailed briefing on how the report can inform your technology investments, go-to-market strategies, and competitive positioning. His proven track record of facilitating enterprise engagements ensures you will receive the support and clarity needed to maximize the value of your research investment.

Don’t miss the opportunity to leverage actionable intelligence that can transform your approach to IoT. Contact Ketan Rohom today to secure your copy of the definitive market research report and begin your journey toward innovation and growth.

- How big is the IoT End-to-End Solutions Market?

- What is the IoT End-to-End Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?