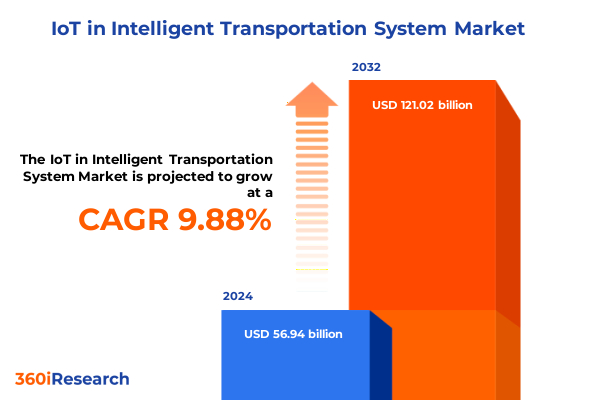

The IoT in Intelligent Transportation System Market size was estimated at USD 62.32 billion in 2025 and expected to reach USD 68.22 billion in 2026, at a CAGR of 9.94% to reach USD 121.02 billion by 2032.

Unveiling the Transformative Promise of IoT Integration within Intelligent Transportation Networks to Revolutionize Mobility Experiences

The fusion of Internet of Things technologies with modern transportation networks is paving the way for a new era of connectivity, safety, and operational efficiency. By embedding sensors, communication modules, and intelligent software into vehicles, road assets, and traffic control systems, decision-makers can collect real-time data on vehicle performance, passenger flows, and environmental conditions. This interconnected ecosystem not only enhances situational awareness across urban corridors and highways but also lays the foundation for predictive maintenance, dynamic routing, and personalized travel experiences.

As public agencies and private operators grapple with rising congestion, emissions targets, and evolving consumer expectations, the integration of IoT into transportation infrastructure becomes an imperative rather than an option. Smart traffic lights synchronize with vehicle telemetry to reduce idle time, while connected fleets leverage telematics to optimize routes, minimize downtime, and safeguard asset health. Transitioning from isolated point solutions to an orchestrated network of devices, platforms, and analytics tools, the intelligent transportation system promises to transform mobility into a seamless, adaptive, and sustainable service.

Navigating Critical Upheavals as Emerging Connectivity Technologies and Policy Shifts Redefine Intelligent Transportation Dynamics

Emerging connectivity technologies, including fifth-generation cellular networks, low-power wide-area protocols, and satellite links, are collectively reshaping how data is captured, transmitted, and analyzed across transportation corridors. The rollout of 5G enables sub-second latency and high bandwidth, which is critical for vehicle-to-infrastructure communication and autonomous vehicle coordination. Meanwhile, networks like LoRaWAN and NB-IoT extend coverage to peripheral road assets and rural environments, ensuring that even remote traffic signals and pavement sensors remain connected.

In parallel, regulatory bodies are refining policies that encourage data sharing and standardization, fostering a competitive ecosystem of vendors and integrators. Mandates for open data portals, safety certifications, and cybersecurity frameworks are driving solution providers to adopt interoperable architectures and robust encryption techniques. This dual impetus of technological advancement and policy evolution is accelerating the adoption curve, enabling municipalities and transport operators to pilot smart corridors, digital tolling, and predictive maintenance initiatives at scale.

Assessing the Far-reaching Effects of Recent United States Tariff Policies on the IoT-enabled Transportation Infrastructure Landscape

At the dawn of 2025, the United States enacted a series of tariffs targeting imported electronics components integral to IoT deployments. Levies on semiconductors, connectivity modules, and precision sensors have introduced upward pressure on hardware costs, challenging integrators to absorb or pass through additional expenses. Procurement teams have been compelled to reassess vendor agreements, pivoting toward domestically produced chipsets and modules where feasible to mitigate import duties and logistics delays.

These trade measures have also prompted strategic realignments in supply chain design. Manufacturers of memory units and processors are accelerating investments in local assembly lines, while service providers are recalibrating their operational models to pool hardware across multiple project sites. The ripple effects extend to software licensing agreements as clients demand more inclusive service contracts to offset higher upfront capital expenditures. Although the tariff landscape continues to evolve, its immediate impact has underscored the importance of flexible sourcing strategies and long-term supplier partnerships to sustain growth in the intelligent transportation sector.

Deriving Actionable Perspectives from Comprehensive Component, Application, Connectivity, and End User Segmentation Patterns

An in-depth analysis of market segmentation reveals that hardware remains the foundational pillar of intelligent transportation solutions, comprising connectivity modules, memory systems, processors, and a diverse array of sensors designed to capture vehicle telemetry, environmental readings, and structural health metrics. Complementing this, services encompass both managed offerings-such as remote monitoring, cloud hosting, and ongoing maintenance-and professional services, including system integration, consulting, and training. On the software front, application suites deliver end-user interfaces for fleet managers, urban planners, and commuters; middleware facilitates data orchestration and device management; and operating systems ensure secure, real-time performance controls at the network edge.

Use cases span electronic toll collection systems that automate fee assessment and reduce queue times, fleet management platforms that optimize dispatch and fuel efficiency, passenger information systems that provide dynamic updates via mobile apps and station displays, smart parking solutions that guide vehicles to available spaces, and traffic management applications that harness AI-driven analytics to proactively adjust signal timings and incident responses. Connectivity options cater to diverse environments, with cellular networks-spanning both 4G and 5G-in metropolitan corridors, LPWAN protocols such as LoRaWAN and NB-IoT reaching across extended urban and rural areas, satellite links ensuring redundancy for critical arterial roads, and short-range technologies like Bluetooth and Wi-Fi enabling precise proximity services. Adoption patterns vary across government transportation agencies, logistics providers, private fleet operators, and public transit authorities, each drawing on different combinations of components, applications, and connectivity modalities to meet their unique operational requirements.

This comprehensive research report categorizes the IoT in Intelligent Transportation System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Connectivity Type

- Application

- End User

Illuminating Regional Variances and Growth Drivers across the Americas, Europe, Middle East, Africa, and Asia-Pacific IoT Transportation Domains

Across the Americas, municipal and state governments are channeling infrastructure investments into smart highways and urban mobility corridors. In North America, federal grants are driving deployments of connected traffic signals and vehicle-to-infrastructure pilots, while Latin American cities prioritize cost-effective LPWAN networks to enhance public transport efficiency under tight budget constraints. The alignment of public-private partnerships has been instrumental in bridging funding gaps and accelerating project timelines.

In Europe, the Middle East, and Africa, regulatory frameworks such as the European Commission’s Intelligent Transport Systems Directive and various GCC smart city programs are fostering interoperability and cross-border data cooperation. Europe’s dense urban centers are home to advanced traffic control centers that integrate multimodal datasets, whereas Gulf nations leverage substantial sovereign funds to deploy large-scale sensor networks across new urban developments. Africa’s early adopters are focusing on smart tolling and road safety systems to address rapid urbanization and logistical bottlenecks.

Asia-Pacific continues to lead in both infrastructure scale and innovation velocity. China’s national smart city initiative has catalyzed the construction of intelligent traffic management platforms in hundreds of municipalities, while India’s emphasis on digital highways is driving demand for mid-band cellular coverage and edge analytics. In Australia and Southeast Asia, interoperability with legacy systems and the integration of renewable energy sources into roadside assets are emerging as key differentiators.

This comprehensive research report examines key regions that drive the evolution of the IoT in Intelligent Transportation System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Leading Innovators Shaping the Future of Connected Transportation through Strategic Partnerships and Cutting-edge Solutions

Leading technology providers and system integrators are forging strategic collaborations to deliver end-to-end IoT transportation offerings. Network equipment manufacturers have partnered with chipset designers to produce pre-validated connectivity modules that streamline the deployment lifecycle and reduce certification overhead. Simultaneously, industrial automation companies are embedding their control platforms with specialized middleware to support real-time analytics and predictive maintenance for traffic control centers.

In parallel, software firms are integrating advanced AI and machine learning models into their passenger information and fleet telematics solutions, enabling anomaly detection, demand forecasting, and automated incident management. Logistics specialists have joined forces with telecom operators to offer managed mobility services that incorporate vehicle tracking, route optimization, and carbon footprint reporting as a unified package. Cybersecurity vendors, recognizing the heightened risk profile of connected transportation assets, are bundling threat detection and response capabilities directly into edge computing gateways and central command platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the IoT in Intelligent Transportation System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Broadcom Inc.

- Cisco Systems, Inc.

- Continental AG

- Cubic Corporation

- DENSO CORPORATION

- Garmin Ltd.

- Hitachi, Ltd.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Indra Sistemas, S.A.

- International Business Machines Corporation

- Kapsch TrafficCom AG

- Robert Bosch GmbH

- Samsara Inc.

- SAP SE

- Siemens AG

- Thales S.A.

- TomTom N.V.

Formulating Strategic Roadmaps for Industry Stakeholders to Capitalize on IoT Innovations and Regulatory Evolutions in Transportation

Industry leaders should prioritize the development of a modular architecture that allows seamless integration of emerging connectivity standards and hardware upgrades without overhauling existing infrastructure. By adopting an open-architecture approach, transportation authorities and private operators can accelerate time-to-market for pilot programs and scale successful proofs of concept rapidly. In addition, embedding edge computing capabilities at traffic nodes and in-vehicle devices will be critical for applications requiring ultra-low latency, such as collision avoidance and autonomous shuttles.

To navigate the evolving tariff environment, procurement teams must diversify their supplier base across multiple geographies, securing alternative sources for key components and negotiating long-term supply agreements that include price-adjustment mechanisms. Engaging early with regulatory bodies and standards consortia can help shape policies that balance security, data privacy, and innovation, ensuring that new technology deployments comply with local and international mandates. Finally, fostering cross-sector partnerships with energy providers, smart city initiatives, and mobility aggregators will unlock synergies, enrich data lakes, and create more holistic mobility ecosystems.

Detailing Robust Research Framework Embracing Quantitative and Qualitative Methods to Analyze Complex IoT Transportation Ecosystems

This research leverages a blend of qualitative and quantitative methodologies to ensure comprehensive, reliable insights. Primary data was gathered through structured interviews with senior executives from public agencies, private fleet operators, technology vendors, and telecom carriers, supplemented by targeted surveys capturing deployment timelines, budget allocations, and pain points. Secondary research drew on governmental transportation databases, industry whitepapers, academic journals, and press releases to validate market dynamics, regulatory developments, and emerging technology trends.

A triangulation process reconciled disparate data sources, enabling the identification of consistent patterns and the mitigation of potential biases. Geographic segmentation was informed by regional infrastructure indices and smart city maturity models, while vendor and solution profiles were curated through public disclosures, patent filings, and partnership announcements. All insights underwent peer review by domain experts to ensure analytical rigor and practical relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IoT in Intelligent Transportation System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IoT in Intelligent Transportation System Market, by Component

- IoT in Intelligent Transportation System Market, by Connectivity Type

- IoT in Intelligent Transportation System Market, by Application

- IoT in Intelligent Transportation System Market, by End User

- IoT in Intelligent Transportation System Market, by Region

- IoT in Intelligent Transportation System Market, by Group

- IoT in Intelligent Transportation System Market, by Country

- United States IoT in Intelligent Transportation System Market

- China IoT in Intelligent Transportation System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Critical Findings and Strategic Insights to Chart a Comprehensive Path Forward for Intelligent Transportation Solutions Driven by IoT Technologies

The convergence of high-speed connectivity, distributed analytics, and advanced sensor technologies is driving a paradigm shift in how transportation networks are designed, managed, and optimized. Stakeholders across the spectrum-from government regulators to private logistics firms-are recognizing that IoT-enabled systems can unlock significant gains in safety, efficiency, and user experience. Far from being a set of isolated pilots, these solutions are coalescing into integrated mobility platforms that span tolling, fleet operations, passenger services, parking management, and traffic control.

However, the introduction of trade measures and evolving policy frameworks underscores the need for adaptive business models and resilient supply chains. Organizations that invest in flexible architectures, cultivate strategic alliances, and engage proactively with standards bodies will emerge as leaders in this rapidly maturing market. By synthesizing segmentation insights, regional dynamics, and competitive landscapes, this analysis charts a clear path for stakeholders to harness the transformative potential of IoT in transportation.

Engage Directly with the Expert Associate Director to Secure Exclusive In-depth Intelligence on IoT-driven Transportation Markets and Propel Your Strategic Decisions

To gain a competitive edge and unlock the full potential of IoT-driven intelligent transportation insights, engage personally with Ketan Rohom, Associate Director, Sales & Marketing. His expertise will help you navigate the complexities of the market and secure a tailored research package that aligns with your strategic objectives. Elevate your decision-making with direct guidance and access to proprietary data that can sharpen your investment priorities, accelerate your product roadmaps, and enhance stakeholder confidence.

- How big is the IoT in Intelligent Transportation System Market?

- What is the IoT in Intelligent Transportation System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?