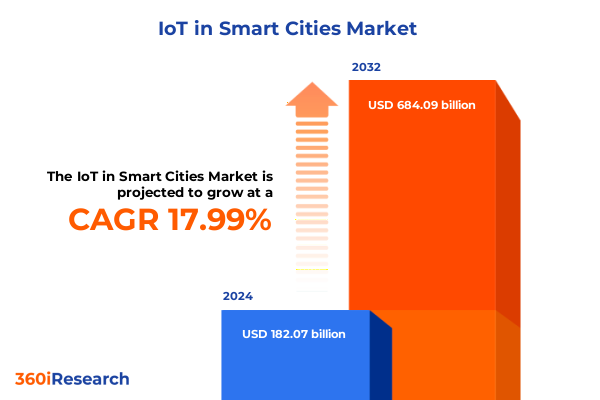

The IoT in Smart Cities Market size was estimated at USD 214.11 billion in 2025 and expected to reach USD 251.80 billion in 2026, at a CAGR of 18.05% to reach USD 684.09 billion by 2032.

Understanding the Role of IoT in Transforming Urban Environments with Connected Intelligence and Data-Driven Governance

The advent of the Internet of Things (IoT) has fundamentally altered the way urban environments operate, ushering in a new era of connected intelligence that underpins efficient public services and infrastructure management. By embedding sensors, gateways and actuators throughout city systems, municipalities can gather real-time data on everything from traffic flows to air quality, enabling more responsive governance and a higher quality of life. This integration is further magnified by advances in network technologies and edge computing, which reduce latency and empower localized decision-making at the device level, ensuring that critical alerts and automated controls occur seamlessly at the point of need.

Exploring Pivotal Technological and Societal Shifts Driving the Next Wave of Smart City IoT Deployments and Connectivity

The contemporary smart city landscape is undergoing a profound transformation fueled by breakthroughs in connectivity, analytics and artificial intelligence. The rollout of 5G-Advanced networks offers unprecedented data rates and ultra-reliable low-latency communications that support immersive applications like autonomous transit and real-time public safety monitoring. Concurrently, the convergence of AI and IoT-often referred to as AIoT-enables predictive maintenance and proactive service optimization, allowing city administrators to anticipate infrastructure failures and allocate resources dynamically. Moreover, edge computing has emerged as a pivotal enabler for decentralized data processing, ensuring that mission-critical functions such as traffic signal adjustments and emergency response analytics are executed without dependence on distant cloud servers.

Analyzing How Recent U.S. Tariff Policies Have Reshaped IoT Device Supply Chains and Cost Structures in Smart City Initiatives

In 2025, the U.S. trade policy environment has exerted a notable cumulative effect on IoT device supply chains, cost structures and deployment timelines within smart city projects. At the start of the year, semiconductor components critical to sensors and controllers faced a tariff rate increase from 25 percent to 50 percent under Section 301 of the Trade Act, impacting products classified under HTS headings 8541 and 8542 and elevating procurement costs for integrated circuits used in connected traffic and environmental monitoring devices. Shortly thereafter, in early April, the administration imposed Reciprocal Tariffs that added to existing Section 301 and IEEPA levies on China-origin goods, resulting in combined duties as high as 170 percent on key hardware imports and compelling many integrators to reassess supplier strategies and localize component sourcing where feasible. Although a diplomatic agreement in mid-May reduced Reciprocal Tariffs on Chinese-origin products to 10 percent by May 14, the retention of core Section 301 and Section 232 measures has sustained elevated barriers for specialized IoT modules and advanced sensor technologies. Collectively, these shifts have prolonged lead times, injected cost volatility and accelerated the diversification of manufacturing footprints beyond traditional hubs.

Uncovering Critical Perspectives Across Component, Communication, Application, End-Use, and Deployment Dimensions of the IoT Market Landscape

The IoT market in smart cities can be dissected through multiple analytical lenses, each revealing unique value drivers and strategic imperatives. From a component perspective, hardware segments such as actuators, gateways and a variety of sensors-environmental, motion and temperature-form the foundation of connectivity and environmental awareness, while services split between managed and professional offerings enable live operation and bespoke system integration. Software capabilities center on platforms and advanced analytics, ranging from descriptive insights to predictive models that forecast maintenance windows and resource demand. When viewed by communication technology, solutions traverse cellular networks (including 5G and LTE), LPWAN protocols like LoRaWAN, NB-IoT and Sigfox, as well as WLAN standards embodied by Bluetooth and Wi-Fi. Application domains extend across energy management, public safety, smart lighting, parking, traffic management and waste systems. Meanwhile, end-use sectors such as government, healthcare, transportation and utilities underscore the diverse stakeholders driving IoT investments. Finally, deployment modes oscillate between cloud and on-premise architectures, reflecting varying priorities around latency, scalability and data sovereignty.

This comprehensive research report categorizes the IoT in Smart Cities market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Communication Technology

- Application

- End Use

- Deployment Mode

Examining Regional Dynamics and Strategic Divergence in Smart City IoT Adoption Across Major Global Markets and Economic Zones

Regional markets exhibit distinct trajectories in the adoption and scaling of smart city IoT solutions, each shaped by regulatory environments, infrastructure maturity and socio-economic objectives. In the Americas, leading municipalities are pioneering integrated platforms that leverage extensive fiber and 5G backbones, prioritizing public safety enhancements and sustainable energy programs. Across Europe, the Middle East & Africa, a mosaic of initiatives-driven by stringent data privacy frameworks and emerging megacities-has catalyzed cross-border consortiums focused on digital twins and resilience planning. In the Asia-Pacific region, rapid urbanization coupled with large-scale national funding commitments has propelled network rollout and AI-enabled traffic ecosystems, creating lucrative opportunities for global vendors and local system integrators alike.

This comprehensive research report examines key regions that drive the evolution of the IoT in Smart Cities market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Innovating Across Hardware, Software, Services, and Connectivity to Accelerate Smart City IoT Solutions

Leading companies in the smart city IoT arena distinguish themselves through end-to-end solution portfolios that span hardware manufacturing, software development and service delivery. Established networking and telecommunications providers have fortified their offerings with edge compute platforms and robust security frameworks, while industrial conglomerates have scaled sensors and gateway production to align with resilient supply chains. Specialty software firms continue to innovate analytics stacks that transform raw IoT data into actionable insights, and pure-play service integrators offer managed services that ensure optimal system performance. Cross-sector partnerships and acquisitions further characterize the competitive landscape, enabling the rapid deployment of turnkey solutions that address unique urban challenges, from smart street lighting to predictive maintenance of municipal assets.

This comprehensive research report delivers an in-depth overview of the principal market players in the IoT in Smart Cities market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Actility

- Cisco Systems, Inc.

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Microsoft Corporation

- Qualcomm Incorporated

- SAP SE

- Schneider Electric SE

- TEKTELIC Communications Inc.

- Trigyn Technologies Limited

Strategic Imperatives for Industry Leaders to Navigate Complex IoT Ecosystem Challenges and Capitalize on Emerging Urban Technology Opportunities

To thrive in the evolving smart city ecosystem, industry leaders should consider a multidimensional strategy that balances technology innovation with agile operational models. Prioritizing end-to-end supply chain resilience through diversified manufacturing locations and strategic partnerships can mitigate the impact of ongoing trade policy uncertainties. Investing in modular, interoperable platforms will facilitate seamless integration across existing infrastructure and future upgrades, while edge analytics capabilities will minimize latency for mission-critical functions. Collaborating proactively with municipal agencies to establish clear governance frameworks for data privacy and cybersecurity will not only build public trust but also unlock new revenue streams through value-added services. Finally, fostering cross-industry consortia to co-develop open standards and pilot programs can accelerate time-to-market and lower adoption barriers for connected urban solutions.

Overview of Robust Research Framework Combining Primary Interviews, Secondary Data Analysis, and Quantitative Modeling in IoT Market Study

This study leverages a mixed-method research framework that merges primary interviews, expert workshops and stakeholder surveys with comprehensive secondary data analysis. Primary insights were gathered through in-depth discussions with city planners, technology executives and system integrators to validate emerging trends and uncover practical deployment barriers. Secondary sources-including government policy documents, industry white papers and leading academic publications-served to triangulate findings and refine the segmentation model. Quantitative elements such as tariff rate schedules, technology adoption curves and infrastructure investment patterns were integrated to contextualize the qualitative narratives. Rigorous data cleansing, cross-validation against multiple sources and iterative hypothesis testing ensured the robustness and reliability of all conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IoT in Smart Cities market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IoT in Smart Cities Market, by Component

- IoT in Smart Cities Market, by Communication Technology

- IoT in Smart Cities Market, by Application

- IoT in Smart Cities Market, by End Use

- IoT in Smart Cities Market, by Deployment Mode

- IoT in Smart Cities Market, by Region

- IoT in Smart Cities Market, by Group

- IoT in Smart Cities Market, by Country

- United States IoT in Smart Cities Market

- China IoT in Smart Cities Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesizing Critical Findings and Strategic Takeaways to Guide Decision-Makers in the Evolving Smart City IoT Ecosystem

The convergence of advanced connectivity, intelligent analytics and evolving trade dynamics is revolutionizing the smart city IoT arena, yielding new efficiencies in urban operations and service delivery. As municipalities worldwide confront rising demands for sustainability, safety and citizen engagement, the integration of modular hardware, scalable software platforms and resilient supply chains emerges as a critical success factor. While tariff fluctuations have introduced near-term cost and lead-time volatility, they have also catalyzed a shift toward localized manufacturing and strategic partnerships that promise greater long-term stability. By embracing a holistic segmentation approach and aligning technology investments with regional priorities, decision-makers can unlock the transformative potential of IoT to build safer, greener and more connected cities.

Connect with Ketan Rohom to Access Comprehensive Market Intelligence and Drive Your Smart City IoT Strategy Forward Today

If you’re seeking to navigate the complexities of the smart city IoT ecosystem and make informed strategic decisions, our comprehensive report delivers the insights you need. Ketan Rohom, Associate Director of Sales & Marketing, is ready to discuss how this research can address your unique challenges, whether it’s optimizing technology investments, mitigating supply chain risks or uncovering growth opportunities in emerging cities. Reach out to Ketan today to schedule a personalized briefing and explore flexible licensing options that align with your organizational goals. Drive your smart city initiatives forward with data-driven intelligence and expert guidance.

- How big is the IoT in Smart Cities Market?

- What is the IoT in Smart Cities Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?