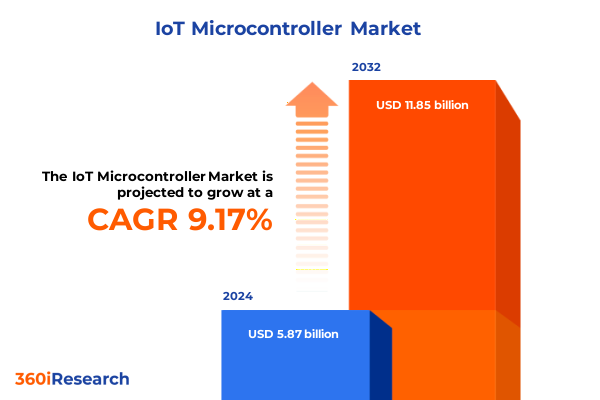

The IoT Microcontroller Market size was estimated at USD 6.40 billion in 2025 and expected to reach USD 7.01 billion in 2026, at a CAGR of 9.19% to reach USD 11.85 billion by 2032.

Discover the Critical Role of IoT Microcontrollers in Driving Next-Generation Connectivity and Intelligent Edge Computing Innovations

The rapid evolution of the Internet of Things has ushered in an era where compact, efficient, and secure microcontrollers are no longer peripheral components but central enablers of a connected world. As devices ranging from wearable health monitors to industrial automation systems increasingly rely on embedded processing, the IoT microcontroller has emerged at the heart of digital transformation strategies. This surge in demand is underpinned by the dual thrust of expanding connectivity protocols and the relentless pursuit of power efficiency, driving suppliers to innovate across hardware architectures and integrated feature sets.

Against this backdrop, the IoT microcontroller market has become a focal point for organizations seeking to deliver intelligent edge computing capabilities. Manufacturers are rethinking traditional design paradigms to embed real-time analytics, built-in security engines, and ultra-low-power modes into ever-smaller form factors. As a result, device architects gain unprecedented flexibility to develop smarter endpoints that respond dynamically to environmental stimuli, process data locally to reduce latency, and maintain robust protection against sophisticated cyber threats. This introductory overview sets the stage for a detailed examination of the forces, shifts, and strategic imperatives shaping the next wave of IoT microcontroller innovations.

Unveiling the Pivotal Technological Shifts Reshaping the IoT Microcontroller Market Landscape with Enhanced Security and Low-Power Designs

Over the past few years, the IoT microcontroller landscape has witnessed transformative shifts that are redefining performance benchmarks and creating new competitive dimensions. One of the most significant trends is the migration of artificial intelligence workloads from centralized cloud environments to the network edge. By integrating machine learning accelerators directly within microcontrollers, developers can achieve real-time decision-making without incurring the latency and privacy risks associated with continuous cloud connectivity. Consequently, applications in areas such as predictive maintenance, anomaly detection, and gesture recognition are now feasible on highly resource-constrained devices.

In parallel, the imperative for enhanced security has accelerated the adoption of hardware-rooted trust models. Secure boot sequences, on-chip cryptographic modules, and isolated execution environments have become standard design elements, reflecting the heightened threat landscape across consumer, industrial, and critical-infrastructure domains. Furthermore, the proliferation of open-source instruction set architectures has democratized innovation, enabling emerging players to tailor microcontroller cores for specialized use cases and fostering a more diverse ecosystem of IP providers and silicon foundries. These combined shifts are driving a new generation of microcontrollers that balance power efficiency, connectivity versatility, and security robustness to meet the rigorous demands of tomorrow’s IoT deployments.

Assessing the Aggregate Effects of 2025 US Tariff Measures on Supply Chains Cost Structures and Strategic Sourcing in the IoT Microcontroller Sector

The imposition of additional tariff measures by the United States in 2025 has introduced a complex set of cost and operational challenges across the global IoT microcontroller supply chain. Hardware suppliers dependent on imported silicon wafers and specialized semiconductor components have encountered elevated input costs, compelling procurement teams to reevaluate vendor agreements and explore alternative sourcing strategies. As a direct result, many original equipment manufacturers have adjusted inventory policies, adopting just-in-case buffers alongside just-in-time practices to mitigate the risk of shipment delays and to stabilize production schedules.

Moreover, these tariff pressures have catalyzed a broader trend toward supply chain resilience and regional diversification. Firms are increasingly investing in localized manufacturing and assembly operations to reduce exposure to cross-border fee fluctuations, while strategic collaborations with domestic foundries are gaining traction. In parallel, the need to absorb or pass through added duties has spurred innovation in component standardization, enabling designers to leverage pin-compatible alternatives to minimize redesign cycles. Ultimately, the cumulative impact of the 2025 tariff landscape has reinforced the importance of agile procurement frameworks, cost-containment measures, and proactive scenario planning for companies competing in the fast-moving IoT microcontroller arena.

Decoding the Diverse Market Segmentation of IoT Microcontrollers from Core Architectures to Distribution Channels and Deployment Models

A nuanced understanding of the IoT microcontroller market requires a detailed exploration of how product characteristics and distribution mechanisms align with end-use requirements. When examining microcontroller cores, the range spans from resource-lean 8-bit solutions up through mid-range 16-bit offerings, and on to high-performance 32-bit architectures that support advanced data processing and complex peripheral integrations. Each architectural class addresses a distinct set of application demands, from minimalist control loops to rich multimedia and network protocols.

Application segmentation further illuminates the market’s breadth, encompassing critical industries such as automotive and consumer electronics alongside sectors like healthcare, industrial automation, smart home ecosystems, and personal wearables. Within automotive systems, the roles of microcontrollers extend from infotainment interfaces and powertrain management modules to safety enforcement and telematics communication units. Meanwhile, consumer electronics segments break down into home appliances that leverage smart sensors, next-generation televisions with embedded connectivity, and feature-rich smartphones that demand real-time responsiveness.

On the intellectual property front, Arm-based cores continue to command broad adoption thanks to a mature toolchain and extensive partner network, while proprietary designs cater to highly specialized performance and integration requirements. Rising alongside these is the RISC-V ecosystem, which offers an open framework for custom extensions and accelerated innovation cycles. As for distribution channels, manufacturers reach end customers through a combination of aftermarket resellers, direct sales teams, OEM partnerships, and growing online platforms that facilitate rapid prototyping and small-volume orders.

Packaging preferences also delineate customer choices between minimal chip-level solutions optimized for cost and module-level designs that integrate essential peripherals and wireless radios. Finally, deployment types split into embedded configurations, which remain deeply integrated within larger systems, and standalone modules destined for plug-and-play deployments in edge gateways or retrofit applications. By weaving together these segmentation dimensions, market participants gain a holistic view of where and how to align their product roadmaps for maximum market relevance.

This comprehensive research report categorizes the IoT Microcontroller market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Architecture

- IP Core

- Packaging

- Deployment Type

- Application

- Distribution Channel

Analyzing Regional Dynamics Influencing IoT Microcontroller Adoption across Americas Europe Middle East & Africa and Asia-Pacific Markets

Geographic dynamics exert a profound influence on the adoption and innovation trajectories of IoT microcontrollers, reflecting regional technology priorities and regulatory regimes. In the Americas, North American automotive OEMs and industrial automation integrators have spearheaded the integration of advanced microcontroller platforms in both consumer and enterprise contexts. This region’s strong emphasis on data security compliance and robust infrastructure has accelerated the deployment of microcontrollers with built-in trust architectures and flexible connectivity options.

In contrast, the Europe Middle East & Africa bloc demonstrates a dual focus on regulatory-driven safety standards and emerging smart city investments. European automotive suppliers continue to elevate functional safety benchmarks, driving adoption of microcontrollers that support ISO 26262 certification and advanced diagnostics. Simultaneously, nascent smart grid and smart transportation initiatives across the Middle East and Africa are igniting new demand for energy-efficient control units capable of operating in challenging environmental conditions.

Over in Asia-Pacific, a concentration of electronics manufacturing hubs and a burgeoning consumer market combine to create a high-velocity ecosystem for microcontroller innovation. Major economies such as China, Japan, and India are home to large-scale production capacities as well as an expanding roster of start-ups exploring wearable health devices and smart home appliances. The prevalence of high-volume smartphone assembly lines furthermore intensifies competition among suppliers to deliver microcontrollers that balance cost effectiveness with rich feature sets, fueling rapid iteration cycles and diverse product offerings tailored to both domestic and export markets.

This comprehensive research report examines key regions that drive the evolution of the IoT Microcontroller market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators Driving Competitive Dynamics and Strategic Partnerships in the Global IoT Microcontroller Industry

A competitive survey of the IoT microcontroller landscape highlights a core group of industry leaders that are defining performance, security, and integration standards. A well-established semiconductor powerhouse has leveraged decades of embedded systems expertise to expand its portfolio with ultra-low-power microcontrollers featuring advanced analog peripherals. Another global fabless innovator continues to push the envelope on mixed-signal integration and wireless connectivity, enabling seamless interfacing with next-generation communication stacks and cloud-native architectures.

Emerging challengers are making inroads through open-source instruction sets, offering customizable cores that resonate with design houses seeking differentiation and cost reduction. These organizations have cultivated vibrant software ecosystems that accelerate time to market for specialized applications such as sensor fusion and real-time control. Additionally, mid-tier companies are carving out niches in ultra-secure elements, providing dedicated cryptographic modules and hardware-crossing isolation domains to meet the stringent requirements of financial transactions, medical instrumentation, and government deployments.

Collaborative initiatives between microcontroller vendors and partner networks are further reshaping the competitive dynamics. Strategic alliances with toolchain providers, systems integrators, and cloud service operators are enabling end-to-end solutions that abstract much of the underlying complexity, allowing customers to focus on differentiated feature development. This blend of established incumbents, agile newcomers, and integrated ecosystems forms the backbone of innovation and investment in the global IoT microcontroller industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the IoT Microcontroller market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Analog Devices, Inc.

- Epson Electronics America Inc.

- Espressif Systems (Shanghai) Co., Ltd.

- Holtek Semiconductor Inc.

- Infineon Technologies AG

- Infineon Technologies AG

- Maxim Integrated Products, Inc.

- Microchip Technology Inc.

- Nordic Semiconductor ASA

- Nuvoton Technology Corporation

- NXP Semiconductors N.V.

- Renesas Electronics Corporation

- Rohm Co., Ltd.

- Silicon Laboratories Inc.

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Toshiba Electronic Devices & Storage Corporation

Implementing Strategic Recommendations to Enhance Innovation Resilience and Market Penetration for IoT Microcontroller Industry Leaders

To thrive in a market defined by rapid innovation cycles and evolving regulatory landscapes, industry leaders should adopt a multi-pronged strategic approach that balances technological investment with supply chain agility. Initiatives should include the integration of extensible security frameworks directly into microcontroller hardware, ensuring that cryptographic and authentication capabilities evolve in lockstep with emerging threat vectors. Concurrently, establishing flexible sourcing arrangements with geographically diverse manufacturing partners will mitigate tariff exposure and inventory disruptions.

Innovation roadmaps must prioritize extensibility through modular architectures and support for open instruction sets, granting design teams the freedom to tailor performance profiles and custom peripheral interfaces. By investing in collaborative platforms that unify hardware, software, and cloud services, organizations can shorten development timelines and reduce integration costs. Moreover, fostering partnerships with academic institutions and industry consortia will accelerate the validation and standardization of critical protocols, especially in domains such as functional safety and industrial interoperability.

Finally, senior executives should focus on cultivating an organizational culture that values cross-disciplinary expertise and rapid prototyping. By championing a test-and-learn mindset, companies can more swiftly validate novel use cases-ranging from advanced sensor fusion in wearables to predictive analytics in industrial systems-ensuring that product roadmaps remain aligned with real-world customer needs. This proactive posture will fortify competitive positioning and drive long-term growth in the dynamic IoT microcontroller arena.

Elucidating the Comprehensive Research Methodology Employed to Ensure Data Integrity and Analytical Rigor for IoT Microcontroller Market Insights

The foundation of this market analysis rests on a rigorous, multi-layered research methodology designed to deliver reliable and actionable insights. The process began with an exhaustive review of publicly available technical specifications, regulatory filings, and patent disclosures to establish an objective baseline of product capabilities and developmental trajectories. This secondary research was complemented by in-depth interviews with system architects, procurement officers, and application engineers to validate trends and uncover emerging use-case requirements.

To enrich the qualitative findings, a series of structured surveys was administered to a representative sample of OEMs, aftermarket distributors, and technology integrators, capturing granular perspectives on performance trade-offs, security preferences, and deployment challenges. Data triangulation techniques were then applied to reconcile divergent viewpoints and quantify the relative significance of key drivers. Finally, results were subjected to an internal peer review process, involving cross-functional experts in semiconductor manufacturing, supply chain management, and cybersecurity, to ensure interpretative consistency and to identify potential blind spots.

This comprehensive approach, combining primary insights with methodical secondary analysis and robust validation protocols, guarantees that the strategic narratives and recommendations presented in this report are both empirically grounded and forward-looking, empowering stakeholders to navigate the complex ecosystem of IoT microcontroller technologies with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IoT Microcontroller market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IoT Microcontroller Market, by Architecture

- IoT Microcontroller Market, by IP Core

- IoT Microcontroller Market, by Packaging

- IoT Microcontroller Market, by Deployment Type

- IoT Microcontroller Market, by Application

- IoT Microcontroller Market, by Distribution Channel

- IoT Microcontroller Market, by Region

- IoT Microcontroller Market, by Group

- IoT Microcontroller Market, by Country

- United States IoT Microcontroller Market

- China IoT Microcontroller Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Insights on the Transformative Potential and Strategic Imperatives Guiding the Future Trajectory of IoT Microcontrollers

Throughout this analysis, the multifaceted nature of the IoT microcontroller domain has become abundantly clear: technological advances, regulatory pressures, and shifting industry priorities collectively define a landscape of boundless opportunity yet heightened complexity. By appreciating the critical role of edge intelligence, embracing robust security foundations, and aligning product strategies with nuanced segmentation profiles, stakeholders can position themselves to capture emerging value pools across diverse verticals.

Regional nuances-from North America’s focus on data-centric applications to the Asia-Pacific region’s high-volume manufacturing imperatives, and Europe Middle East & Africa’s emphasis on safety and environmental resilience-underscore the importance of adaptable roadmaps that can pivot in response to local market conditions. Simultaneously, the rise of open-source architectures and strategic partnerships highlights the collaborative ethos required to accelerate innovation and to balance cost pressures with differentiation.

Ultimately, success in the IoT microcontroller sector will hinge on proactive scenario planning, disciplined execution of security and performance benchmarks, and the willingness to explore novel business models that leverage integrated hardware and software ecosystems. As companies refine their approaches against the evolving landscape outlined in this report, they will be better equipped to drive lasting impact, differentiate their offerings, and lead the next chapter of the connected revolution.

Take Action Today to Unlock In-Depth IoT Microcontroller Market Intelligence with Ketan Rohom Associate Director of Sales & Marketing

If your organization is poised to harness the detailed insights and strategic advantages offered by this comprehensive market research, now is the moment to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. By collaborating with Ketan, you will gain tailored guidance on how to extract maximum value from the data, contextualize findings for your decision-making processes, and secure early-access privileges to proprietary analyses. Ketan’s expertise in articulating the nuances of IoT microcontroller trends and translating them into actionable intelligence will ensure that you are positioned at the forefront of innovation and investment.

Take the initiative to connect with Ketan through our official inquiry channels, where you can schedule a personal consultation to explore customized reporting options, receive exclusive previews of our latest deep-dive modules, and discuss special portfolio packages designed to fit your organization’s strategic roadmap. Your engagement will open the door to priority support and bespoke deliverables, enabling you to expedite your market entry strategies and foster competitive differentiation.

Seize this opportunity today to secure your organization’s access to the most robust and forward-looking IoT microcontroller market intelligence available. Reach out now and let Ketan Rohom guide your path to informed, confident business decisions that will shape your success in the digital economy.

- How big is the IoT Microcontroller Market?

- What is the IoT Microcontroller Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?