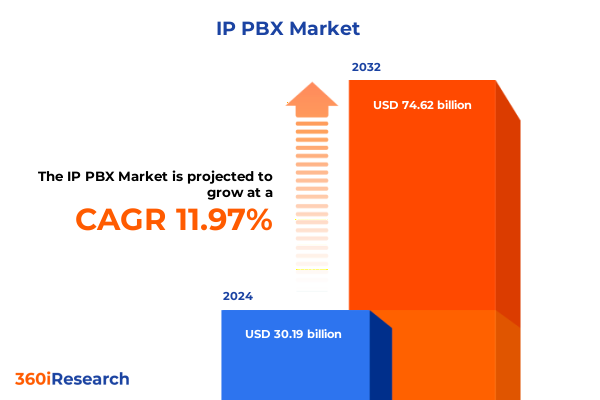

The IP PBX Market size was estimated at USD 33.63 billion in 2025 and expected to reach USD 37.51 billion in 2026, at a CAGR of 12.05% to reach USD 74.62 billion by 2032.

Exploring the Core Principles and Strategic Imperatives That Underpin the Modern IP PBX Market Landscape for Decision Makers

In today’s fast-moving business environment, the IP PBX market stands at the intersection of communication innovation and enterprise efficiency. Organizations of all sizes are increasingly prioritizing digital transformation initiatives that hinge on seamless, scalable, and feature-rich telephony solutions. As such, the evolution of IP PBX platforms has been shaped by a convergence of cloud computing, unified communications, and interoperability standards that enable organizations to optimize voice, video, and data flows within a single cohesive system. This landscape offers not only cost savings but also enhanced productivity, simplified management, and advanced analytics that support data-driven decision making.

Moreover, the competitive landscape underscores a shift away from traditional on-premise deployments toward hybrid and fully cloud-based models that deliver flexibility and resilience. Businesses are seeking solutions that can rapidly adapt to distributed workforces, integrate seamlessly with CRM and collaboration tools, and scale in line with fluctuating demand. Therefore, understanding the foundational dynamics of this market is essential for stakeholders aiming to navigate vendor selection, architectural planning, and long-term technology roadmaps with confidence. In this executive summary, we unveil the strategic imperatives and core principles underpinning today’s IP PBX ecosystem to inform impactful decision making.

Examining the Pivotal Technological, Regulatory and User Behavior Shifts That Are Redefining the IP PBX Ecosystem and Driving Innovation

The IP PBX space has experienced transformative shifts driven by technological breakthroughs, evolving user expectations, and regulatory developments. Cloud adoption has accelerated in recent years, enabling organizations to offload infrastructure burdens while benefiting from rapid feature rollouts and subscription-based pricing. Concurrently, the integration of artificial intelligence into call management systems and interactive voice response frameworks is revolutionizing customer engagement, empowering businesses to deliver personalized experiences through speech analytics, sentiment detection, and automated self-service.

In parallel, mobile and remote work trends have redefined telephony requirements, pushing vendors to develop APIs and soft-client solutions that ensure uninterrupted connectivity on any device. Security considerations and compliance mandates-such as GDPR and CCPA-have further shaped product roadmaps, driving enhancements in encryption, identity management, and audit capabilities. Regulatory bodies around the world are also influencing market direction through spectrum management, VoIP licensing frameworks, and net neutrality debates. These converging forces, coupled with ongoing consolidation among key players, are reshaping the IP PBX ecosystem and creating new opportunities for innovative, agile vendors.

Analyzing the Comprehensive Ripple Effects of the United States Tariff Adjustments on Hardware, Software, Services and Supply Chains Across 2025

In 2025, a series of tariff adjustments enacted by the United States government have had far-reaching implications across IP PBX hardware, software, and services supply chains. Tariffs on imported semiconductor components and telecommunications equipment have increased capital expenditure requirements for both on-premise servers and gateway devices. As a result, many organizations have experienced upward pressure on procurement costs, prompting a reevaluation of sourcing strategies and accelerated efforts to negotiate volume discounts with domestic manufacturers or nearshore suppliers.

Service providers and system integrators have also felt the impact, as professional and managed service engagements now carry higher component costs, which in turn affect project pricing and profit margins. To mitigate these challenges, vendors are redesigning hardware architectures to utilize alternative chipsets and modular platforms that allow for greater flexibility in procurement. Additionally, software vendors are placing renewed emphasis on subscription models and cloud-based licensing to offset capital outlay. Consequently, the tariff landscape has catalyzed a broader shift toward hybrid deployment strategies, increased collaboration with local supply ecosystem partners, and a concerted focus on total cost of ownership analyses during procurement cycles.

Deriving Strategic Insights from Component Technology Application Deployment Vertical and Organizational Segmentation Trends in the IP PBX Arena

When examining the IP PBX market through the lens of component segmentation, it becomes clear that hardware, services, and software each play a distinct role in driving customer value. Hardware offerings encompass gateways and IP PBX servers that form the foundation of on-premise solutions; in response to rising tariff pressures, manufacturers are optimizing designs to deliver modular, energy-efficient platforms that can be upgraded in-field. Services, which are categorized into managed and professional offerings, have grown in strategic importance as enterprises seek expertise in deployment, maintenance, and user training; businesses are increasingly outsourcing routine management tasks to specialist providers in order to focus internal resources on core competencies. Software components, including call management systems, CRM integrations, and voicemail applications, continue to evolve toward open-architecture frameworks that facilitate rapid customization and third-party interoperability.

From a technological standpoint, the choice between Session Initiation Protocol (SIP) and Voice over Internet Protocol (VoIP) frameworks influences network design, feature compatibility, and quality-of-service considerations. SIP has gained traction for its ability to support multi-media sessions and standardized interconnectivity, while VoIP remains a versatile option for organizations seeking cost-effective voice transport. Application segmentation highlights the diverse ways in which IP PBX platforms deliver value, ranging from automated call distribution that optimizes agent efficiency to conferencing solutions that underpin modern collaboration, interactive voice response systems that automate routine inquiries, and unified messaging that centralizes communication channels.

Deployment preferences are also shifting: cloud-based architectures attract organizations prioritizing agility and scalability, whereas on-premise configurations appeal to enterprises with strict data sovereignty and control requirements. Industry vertical segmentation reveals that banking, financial services, and insurance sectors demand high-availability solutions with advanced security controls; education and healthcare organizations emphasize integration with learning management systems or patient care workflows; government bodies seek compliance with stringent regulatory standards; IT and telecom companies look for customizable, carrier-grade platforms; and retail businesses focus on point-of-sale integrations and customer experience enhancements. Lastly, organization size and end-user segmentation differentiate solution portfolios for large enterprises, which require robust feature sets and global deployment capabilities, versus small and medium enterprises that emphasize ease of use and cost-effectiveness, as well as corporate end-users versus individual consumers accessing VoIP soft-clients for personal communications.

This comprehensive research report categorizes the IP PBX market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Applications

- Deployment Types

- Industry Verticals

- Organization Size

- End-User

Assessing Regional Growth Patterns and Strategic Market Drivers Across the Americas Europe Middle East Africa and Asia Pacific IP PBX Sectors

Regional dynamics reveal distinctive growth drivers and adoption patterns across the Americas, Europe Middle East Africa, and Asia Pacific markets. In the Americas, strong demand for unified communications and cloud-first strategies in North America is complemented by burgeoning digital transformation initiatives across Latin America. The United States continues to serve as a bellwether for IP PBX innovation, with end users increasingly consolidating voice and collaboration platforms onto integrated cloud services. Meanwhile, Brazil and Mexico are witnessing accelerated deployments fueled by supportive regulatory reforms and rising internet penetration rates.

Across Europe Middle East Africa, Western Europe leads in the adoption of next-generation IP PBX solutions, leveraging extensive fiber networks and regulatory incentives for unified communications. In the Middle East, government-sponsored smart city programs and major infrastructure projects are driving demand for resilient telephony frameworks, while in Africa, newer market entrants are forging partnerships with local system integrators to expand coverage and functionality.

The Asia Pacific region stands out for its rapid growth, with China and India at the forefront of both manufacturing and large-scale adoption. In Southeast Asia, medium-sized businesses are capitalizing on affordable cloud-based offerings to modernize legacy voice systems, and in Australia, stringent data privacy regulations are influencing hybrid deployment models. Each region’s unique combination of regulatory environments, technological maturity, and economic drivers underscores the importance of tailored market strategies and localized partnerships.

This comprehensive research report examines key regions that drive the evolution of the IP PBX market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading IP PBX Innovators and Key Market Players to Understand Competitive Dynamics Partnerships and Strategic Positioning

The competitive landscape of the IP PBX market is defined by a blend of established communications titans and nimble innovators, each vying to differentiate through advanced feature sets, service models, and ecosystem partnerships. Leading players have expanded their portfolios to include cloud-native architectures, AI-driven analytics, and broad partner networks that deliver end-to-end solutions encompassing hardware, software, and managed services. These firms are also pursuing strategic acquisitions to bolster their capabilities in areas such as contact center as a service, unified communications as a service, and intelligent routing.

Meanwhile, mid-tier vendors and emerging challengers are capitalizing on agility and niche focus, offering specialized integrations with industry-specific applications or disruptive pricing models tailored to small and medium enterprises. Collaboration between technology startups and system integrators is fostering the development of turnkey solutions targeted at vertical markets such as healthcare, education, and retail, where compliance and user experience requirements are paramount. Furthermore, open-source platforms are gaining traction among organizations that prioritize customization and community-driven innovation. Collectively, these competitive dynamics illustrate a market in flux, where speed to market, strategic alliances, and continuous product innovation serve as the primary levers for growth and differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the IP PBX market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3CX Ltd.

- 8x8 Inc.

- Atlantech Online, Inc.

- Avaya Holdings Corp.

- Cisco Systems Inc.

- Cohesive Technologies (P) Ltd.

- CoreIP Technology Pvt. Ltd.

- Epygi Technologies, LLC

- Grandstream Networks, Inc.

- HoduSoft Pvt. Ltd.

- Huawei Technologies Co., Ltd.

- Matrix Comsec

- Microsoft Corporation

- Mitel Networks Corporation

- MyOperator Inc.

- NEC Corporation

- Nextiva, Inc.

- Patton Electronics Company

- RingCentral, Inc.

- Sangoma Technologies Corporation

- Sterlite Technologies Limited

- Verizon Communications Inc.

- VirtualPBX

- Vodia Networks, Inc

- Vonage Holdings Corp. by Telefonaktiebolaget LM Ericsson

- Xiamen Yeastar Information Technology Co., Ltd.

- Xorcom

- Zycoo Co., Ltd.

Formulating Actionable Strategies for Industry Leaders to Capitalize on Emerging IP PBX Trends Optimize Investments and Drive Sustainable Growth

Industry leaders seeking to capitalize on the evolving IP PBX landscape should prioritize a multi-pronged approach that balances innovation with operational resilience. First, embracing cloud-native and hybrid deployment models will enable organizations to scale resources dynamically, lower total cost of ownership, and accelerate feature adoption. In addition, investing in AI-enabled call management and analytics tools can unlock new insights into customer behavior, optimize agent performance, and support proactive issue resolution.

Simultaneously, diversifying the supply chain to include multiple hardware and component providers will mitigate the risk posed by tariff fluctuations and geopolitical uncertainties. Collaborative partnerships with managed services providers can further extend an organization’s capabilities, allowing internal teams to focus on strategic initiatives rather than routine maintenance. Moreover, tailoring solution bundles to address the unique requirements of industry verticals-such as security enhancements for financial services or specialized integrations for healthcare workflows-will drive differentiation and customer loyalty. Finally, instituting robust change management and training programs is critical to ensuring user adoption, reducing resistance to new platforms, and maximizing return on investment.

Detailing a Robust and Transparent Research Methodology Integrating Qualitative Interviews Secondary Sources and Data Validation Protocols

The findings presented in this executive summary are the result of a rigorous, multi-phase research process designed to ensure accuracy, relevance, and depth of insight. Primary research involved structured interviews with senior executives, IT managers, and end users across key industry verticals, capturing firsthand perspectives on technology adoption drivers, deployment challenges, and future planning. These interviews were complemented by detailed discussions with solution vendors, system integrators, and industry analysts to validate emerging trends and competitive strategies.

Secondary research drew upon a wide array of publicly available sources, including industry whitepapers, technical journals, regulatory filings, and vendor documentation. Data points were triangulated across multiple sources to confirm consistency and reliability. A standardized segmentation framework was employed to classify market dynamics according to component, technology, application, deployment type, industry vertical, organization size, and end-user criteria. Quantitative data was further enriched through expert panel reviews and workshops, which facilitated scenario analysis and stress testing of key assumptions. Throughout the process, rigorous data validation protocols were applied to ensure methodological transparency and mitigate potential biases.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IP PBX market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IP PBX Market, by Component

- IP PBX Market, by Technology

- IP PBX Market, by Applications

- IP PBX Market, by Deployment Types

- IP PBX Market, by Industry Verticals

- IP PBX Market, by Organization Size

- IP PBX Market, by End-User

- IP PBX Market, by Region

- IP PBX Market, by Group

- IP PBX Market, by Country

- United States IP PBX Market

- China IP PBX Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Core Findings and Strategic Implications to Offer a Clear Concise Perspective on the IP PBX Market’s Current Trajectory

In synthesizing the core findings of this research, it becomes apparent that the IP PBX market is undergoing a period of accelerated transformation shaped by technological innovation, shifting deployment models, and evolving regulatory environments. Tariff adjustments in the United States have prompted a reexamination of supply chain strategies, while cloud and AI integration continue to redefine value propositions. Segmentation insights highlight the nuanced requirements across components, technologies, applications, deployment types, verticals, organization sizes, and end users, underscoring the necessity for tailored solutions.

Regional analyses reveal that growth trajectories differ markedly across the Americas, Europe Middle East Africa, and Asia Pacific, reinforcing the importance of localized go-to-market approaches. Competitive dynamics further illustrate that success hinges on a balanced emphasis on innovation, strategic partnerships, and operational agility. Ultimately, organizations that adopt a holistic strategy-one that integrates cloud flexibility, AI-driven efficiencies, diversified sourcing, and focused vertical engagement-will be best positioned to navigate market complexities and achieve sustainable growth in the IP PBX arena.

Inviting Engagement with Ketan Rohom to Secure Comprehensive IP PBX Market Intelligence That Empowers Strategic Decision Making Today

If you’re ready to leverage unparalleled intelligence and gain a strategic edge in the rapidly evolving IP PBX market, connect with Ketan Rohom, Associate Director of Sales and Marketing. He can guide you through our comprehensive market research report, tailor its insights to your organization’s needs, and ensure you’re equipped with the critical data and strategic analysis required to outmaneuver competitors. Reach out today to secure exclusive access to in-depth findings, expert perspectives, and actionable recommendations that will drive growth and optimize investments across your IP PBX initiatives

- How big is the IP PBX Market?

- What is the IP PBX Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?