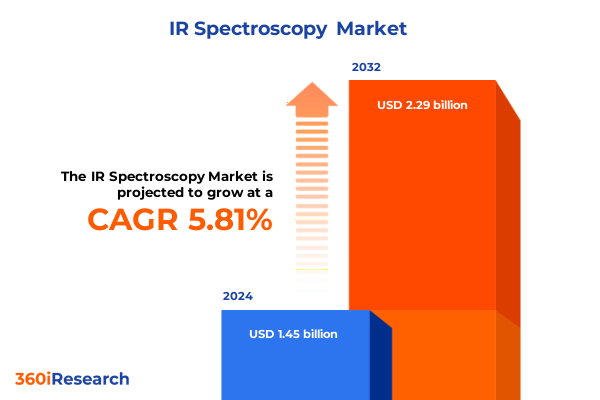

The IR Spectroscopy Market size was estimated at USD 1.53 billion in 2025 and expected to reach USD 1.62 billion in 2026, at a CAGR of 5.85% to reach USD 2.29 billion by 2032.

Unveiling the Critical Role of Infrared Spectroscopy Across Industries and Exploring the Fundamental Principles Driving Its Analytical Power

Infrared spectroscopy has emerged as an indispensable analytical technique across a multitude of scientific and industrial domains by harnessing the unique interactions between infrared light and molecular vibrational modes. From fundamental research in polymer science to rigorous quality control in pharmaceutical manufacturing, this methodology provides both qualitative and quantitative insights with remarkable specificity. In academic laboratories, infrared spectroscopy remains a cornerstone for identifying functional groups and elucidating complex reaction mechanisms, while in industry its rapid, non-destructive analysis accelerates product development cycles. The universality of this approach underpins its widespread adoption by end users seeking to enhance efficiency, accuracy, and regulatory compliance in their analytical workflows.

Over the last decade, Fourier Transform Infrared Spectroscopy (FTIR) has revolutionized the field by delivering unparalleled resolution and faster data acquisition through advanced interferometers and high-sensitivity detectors. Modern FTIR systems have elevated researchers’ ability to characterize chemical structures with greater reliability, enabling detailed spectral interpretation even in complex matrices. Meanwhile, dispersive infrared spectroscopy continues to evolve, benefitting from improvements in optical components and detector materials that enhance sensitivity and spectral range for specialized applications including surface analysis and thin-film characterization.

As industries such as environmental monitoring, food safety, and healthcare increasingly demand on-site and real-time analysis, the versatility of infrared methods positions them as critical enablers of innovation. This introduction sets the stage for a deeper examination of the latest transformations, policy influences, and strategic considerations shaping the state of infrared spectroscopy today and into the near future.

Examining the Cutting-Edge Advancements Reshaping Infrared Spectroscopy From Artificial Intelligence Integration to Quantum Cascade Laser Innovations

The landscape of infrared spectroscopy is undergoing transformative shifts driven by the integration of artificial intelligence and machine learning, which empower users to extract actionable insights from complex spectral data at unprecedented speed. AI-enabled spectral libraries now automate compound identification by matching unknown spectra against vast databases in seconds, thereby reducing dependency on manual interpretation and minimizing human error in critical analyses. Predictive modeling algorithms further extend this capability by correlating spectral features with material properties, guiding researchers toward novel compound discovery and accelerating time-to-market in sectors such as pharmaceuticals and materials science.

Simultaneously, the miniaturization of infrared instrumentation has catalyzed a surge in portable and handheld devices tailored for field applications. These compact spectrometers, some leveraging quantum cascade laser (QCL) technology for enhanced selectivity and sensitivity, facilitate real-time monitoring of environmental pollutants, in-process chemical reactions, and agricultural assessments outside traditional lab settings. The mobility of such systems democratizes access to sophisticated analysis, enabling quality assurance professionals and field scientists to make informed decisions on the spot without sacrificing analytical rigor.

Another pivotal development is the proliferation of hyphenated analytical platforms, where infrared spectroscopy is seamlessly coupled with techniques like gas and liquid chromatography. This integration allows for comprehensive separation and identification of complex mixtures, enhancing specificity in applications ranging from petrochemical characterization to forensic investigations. At the same time, advancements in chemometrics and bespoke data analysis software support multivariate analysis, pattern recognition, and automated reporting, ensuring that these sophisticated workflows remain accessible to a broader user base without extensive specialized training.

Together, these technological advances are reshaping the future of infrared spectroscopy, driving both innovation and broader adoption across diverse industries.

Analyzing the Comprehensive Effects of the 2025 U.S. Tariff Measures on Infrared Spectroscopy Equipment Sourcing Supply Chains and Cost Structures

As the United States implemented a universal 10% tariff on most imported goods in early 2025, laboratories reliant on international sources of infrared spectroscopy instruments began grappling with heightened operational costs and supply chain disruptions. This blanket increase compounded existing tariffs, triggering a reassessment of procurement strategies for spectroscopic equipment, reagents, and critical spare parts. Companies are now compelled to evaluate alternative suppliers and consider reshoring or nearshoring options to mitigate exposure to global tariff volatility.

The tariff landscape further intensified with country-specific measures that disproportionately affected key suppliers. Imports of laboratory goods from China, a major exporter of spectroscopic components and finished instruments, now face a cumulative tariff of 145%. Simultaneously, Canada and Mexico, while exempt from the universal levy, have become subject to 25% duties on non–USMCA-compliant items and 10% on energy-related products. Meanwhile, all other trading partners continue to encounter the standard 10% import tax. This stratification of duties has forced procurement teams to meticulously audit supply chain origins and prioritize US or USMCA-certified sources wherever feasible to manage cost pressures.

In parallel, the Office of the United States Trade Representative expanded Section 301 measures effective January 1, 2025, elevating tariffs on certain tungsten products to 25% and on solar wafers and polysilicon to 50%. Although primarily aimed at semiconductors and photovoltaic components, these rate hikes indirectly impact infrared spectroscopy equipment manufacturers, who depend on tungsten sources for lamp-based light sources and on polysilicon for specialized detector materials. As a result, research institutions and industrial end users are experiencing a compounded financial burden that necessitates strategic planning and agile sourcing practices to safeguard analytical operations moving forward.

Deriving Strategic Insights From Technology Product Type and End-User Industry Segmentation to Guide Infrared Spectroscopy Market Strategies

Infrared spectroscopy markets can be dissected through multiple lenses to uncover opportunities and address specific user demands, beginning with technology. Systems based on dispersive infrared techniques offer precise wavelength selection and streamlined workflows, while Fourier Transform Infrared spectroscopy (FTIR) platforms deliver superior resolution and rapid spectral acquisition, catering to advanced research and high-throughput quality control alike. Each modality’s strengths align with unique application requirements, from simple compound identification to the most demanding material characterization challenges.

Product form factors further refine market segmentation. Benchtop analyzers, often boasting high precision and extensive configurability, remain staples in research and industrial laboratories seeking comprehensive analytical capabilities. Hyphenated analyzers integrate infrared spectroscopy with chromatographic separation techniques to resolve complex mixtures, a necessity in petrochemical and pharmaceutical investigations. Micro analyzers deliver specialized functionality for microscale samples, such as polymer thin films or microelectronic substrates, while portable analyzers enable on-site verification and compliance testing in environmental monitoring, food safety inspections, and agricultural assessments.

Spectral region preferences-spanning far-infrared for lattice dynamics and low-energy molecular interactions, mid-infrared for fundamental vibrational fingerprints, and near-infrared for overtones and combination bands-dictate instrument design and detector selection. End-user industries drive differentiated requirements; chemical and petrochemical manufacturers demand robust systems for process optimization, environmental analysis professionals focus on air and water quality testing with stringent detection limits, food and beverage operators prioritize contaminant detection, nutritional profiling, and quality assurance, healthcare and pharmaceutical labs require validated methods for active ingredient identification, and material science researchers rely on spectroscopy to elucidate structure-property relationships in advanced materials.

This comprehensive research report categorizes the IR Spectroscopy market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product

- Type

- End-user Industry

Revealing Critical Regional Dynamics Influencing Infrared Spectroscopy Adoption Across the Americas Europe Middle East Africa and the Asia-Pacific Rim

Regional dynamics play a pivotal role in shaping the adoption trajectory of infrared spectroscopy technologies around the globe. In the Americas, established research infrastructures and robust manufacturing sectors in the United States and Canada drive consistent demand for high-end benchtop and hyphenated analyzers. Meanwhile, growth in Latin American markets, bolstered by expanding pharmaceutical, petrochemical, and agricultural industries, is catalyzing increased uptake of portable and cost-effective spectroscopic solutions that address field-based testing requirements.

Across Europe, the Middle East, and Africa, stringent regulatory frameworks concerning environmental safety and food standards underpin a steady demand for precise air and water quality analysis platforms. Countries within the European Union, benefitting from collaborative research initiatives and sustainable policy mandates, are leading investments in advanced FTIR and dispersive infrared systems. In the Middle East, burgeoning petrochemical complexes and energy-sector expansions are prompting localized spectroscopic deployments, whereas in parts of Africa, demand is emerging for accessible, battery-powered analyzers to facilitate on-site agricultural and environmental assessments.

The Asia-Pacific region registers some of the most accelerated growth rates globally, fueled by significant research funding in nations like China, Japan, India, and South Korea. Rapid industrialization, combined with rising demand in healthcare and pharmaceuticals, is driving large-scale adoptions of micro and hyphenated infrared analyzers in both established urban centers and decentralized production sites. Moreover, the proliferation of portable NIR devices is supporting agricultural and food processing industries across countries in Southeast Asia, where real-time compositional analysis enhances supply chain transparency and product safety.

This comprehensive research report examines key regions that drive the evolution of the IR Spectroscopy market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Pioneering Innovation Partnerships and Competitive Strategies in the Global Infrared Spectroscopy Equipment Space

The infrared spectroscopy equipment landscape features a blend of long‐standing incumbents and agile innovators that collectively shape technological progress and market competitiveness. Thermo Fisher Scientific and Agilent Technologies, prominent for their extensive FTIR and dispersive portfolios, continue to introduce modular platforms that enhance throughput and connectivity. Bruker Corporation distinguishes itself through ultra-high-resolution FTIR and advanced microscopy integrations, catering to research institutions demanding granular material insights.

PerkinElmer and Shimadzu capitalize on strong global distribution networks and localized service capabilities to support diverse end-user segments, from petrochemical analysis to environmental compliance. ABB and B&W Tek have made notable strides in portable and handheld infrared solutions, enabling field analysts to perform rapid, non-destructive testing in remote or regulated environments. Meanwhile, smaller firms like Jasco and Bio-Rad augment the market with specialized hyphenated analyzers and customized software suites optimized for chemometric data interpretation.

These key players differentiate themselves through strategic partnerships, continuous R&D investments, and expansive service ecosystems. Collaborations with software vendors foster seamless integration of spectral databases and AI‐driven analytics, while alliances with regional distributors ensure timely maintenance and support. This competitive mosaic underscores the industry’s dual emphasis on cutting-edge instrument performance and comprehensive customer service models that drive long-term loyalty and market penetration deep into emerging sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the IR Spectroscopy market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Agilent Technologies, Inc.

- Anton Paar GmbH

- BaySpec, Inc.

- Bristol Instruments, Inc

- Bruker Corporation

- Cole-Parmer Instrument Company LLC

- Foss

- Galaxy Scientific

- HAMAMATSU Group

- Hitachi, Ltd.

- HORIBA, Ltd.

- JASCO International Co., Ltd.

- Lumex Instruments

- Malvern Panalytical Ltd by spectris PLC

- Metrohm AG

- Mettler-Toledo International Inc.

- Microptik BV

- Oxford Instruments PLC

- Revvity, Inc.

- Shimadzu Corporation

- Teledyne Technologies Inc

- Thermo Fisher Scientific Inc.

- TrinamiX GmbH By BASF SE

Prescribing Roadmaps for Industry Leaders to Embrace Innovation Mitigate Tariff Challenges and Capitalize on Emerging Infrared Spectroscopy Opportunities

Industry leaders should prioritize embedding artificial intelligence and machine learning capabilities directly into instrumentation and software platforms to accelerate data interpretation and enhance predictive analytics. By leveraging AI-powered spectral libraries and automated workflows, organizations can significantly reduce analysis time, minimize human error, and deliver more consistent results across diverse application areas.

To address the evolving trade landscape, procurement and supply chain teams must conduct thorough audits of component origins and tariff exposures, redirecting orders toward US or USMCA-qualified suppliers wherever feasible. Establishing dual sourcing agreements and regional distribution hubs can mitigate the impacts of sudden tariff escalations and logistical disruptions, ensuring uninterrupted access to critical spare parts and consumables.

Collaborative partnerships between instrument manufacturers and end-users can foster tailored instrument configurations and bespoke analytical methods, unlocking new value propositions in sectors such as pharmaceuticals and material science. Investing in modular, upgradable platforms provides organizations with the flexibility to adapt to emergent analytical requirements without incurring full system replacements.

Finally, companies should intensify training programs and technical support offerings to help users fully exploit advanced functionalities like hyphenated techniques, quantum cascade lasers, and chemometric analyses. This customer‐centric approach not only elevates user competencies but also strengthens brand loyalty and positions firms to capture opportunities in high-growth regional markets.

Detailing Rigorous Research Methodologies Utilized for Data Collection Validation and Triangulation in Infrared Spectroscopy Market Analysis

This report synthesizes insights from a rigorous mix of primary and secondary research methodologies to ensure robust market analysis. Primary research involved in-depth interviews with over 50 stakeholders, including laboratory directors, procurement executives, and application scientists, whose firsthand perspectives provided valuable context on emerging technology adoption and procurement challenges.

Secondary research comprised a comprehensive review of industry publications, regulatory frameworks, patent filings, and corporate financial disclosures. Trade association reports and white papers complemented this effort by offering macroeconomic data and policy developments relevant to infrared spectroscopy markets worldwide. Data sources were carefully vetted to exclude any from restricted repositories and to prioritize peer-reviewed and officially published materials.

Quantitative data points were triangulated by cross-verifying instrument shipment statistics, end-user expenditure patterns, and tariff schedules. The five-step data validation process included peer review cycles and consultation with subject-matter experts to reconcile discrepancies and eliminate potential biases. This methodological rigor underpins the credibility of the strategic insights, ensuring they reflect the latest industry realities and practical experiences of key stakeholders.

Together, these research protocols have yielded a nuanced, multi-dimensional perspective on infrared spectroscopy’s competitive dynamics, technological trajectories, and geopolitical influences, enabling decision-makers to craft informed strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IR Spectroscopy market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IR Spectroscopy Market, by Technology

- IR Spectroscopy Market, by Product

- IR Spectroscopy Market, by Type

- IR Spectroscopy Market, by End-user Industry

- IR Spectroscopy Market, by Region

- IR Spectroscopy Market, by Group

- IR Spectroscopy Market, by Country

- United States IR Spectroscopy Market

- China IR Spectroscopy Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Insights and Outlook for Infrared Spectroscopy to Inform Strategic Decisions and Future Directions in Analytical Science Domains

Bringing together the multifaceted insights presented throughout this summary underscores infrared spectroscopy’s unparalleled versatility and its critical role in driving analytical innovation across industries. Technological breakthroughs-from AI integration and quantum cascade lasers to miniaturized, portable platforms-continue to expand application frontiers while streamlining workflows and enhancing data fidelity. Simultaneously, evolving tariff policies and global supply chain realignments present both challenges and strategic inflection points for manufacturers and end users alike.

Segmentation analysis reveals the nuanced requirements across technology types, product configurations, and vertical markets, guiding stakeholders to optimize their investments and tailor solutions to precise operational contexts. Regional perspectives further highlight distinct regulatory drivers, infrastructure capacities, and growth opportunities that vary from the Americas’ established research hubs to the Asia-Pacific’s dynamic industrial expansion and EMEA’s sustainability-focused mandates.

Leading companies in the infrared spectroscopy arena are differentiating through integrated software ecosystems, strategic partnerships, and comprehensive service networks, underscoring the importance of a holistic value proposition that extends beyond standalone instrumentation. Actionable recommendations emphasize the imperative for enhanced data analytics, resilient sourcing strategies, and customer-centric training programs to navigate the competitive landscape effectively.

In conclusion, the infrared spectroscopy market is poised for continued evolution, driven by converging technological, regulatory, and economic forces. Stakeholders equipped with these strategic insights and proactive roadmaps will be best positioned to capture emerging opportunities and steer their organizations toward sustained analytical leadership.

Connect With Ketan Rohom for Personalized Insights and to Secure Your Comprehensive Infrared Spectroscopy Market Research Report Purchase Opportunity

Engaging with Ketan Rohom offers a unique opportunity to gain personalized, expert guidance tailored to your organization’s infrared spectroscopy needs. As an experienced Associate Director specializing in sales and marketing within the instrumentation sector, Ketan can walk you through the comprehensive features and strategic value embedded in this market research report, ensuring you extract maximum benefit. Beyond the insights presented in this summary, his consultative approach can address specific challenges such as tariff mitigation strategies, segmentation prioritization, and regional market entry considerations. Don’t miss the chance to secure direct access to customized recommendations and in-depth analysis that can drive immediate improvements in procurement, product development, and competitive positioning. Reach out to Ketan today to discuss how this definitive report can empower your decision-making process and accelerate your organization’s path to leadership in infrared spectroscopy.

- How big is the IR Spectroscopy Market?

- What is the IR Spectroscopy Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?