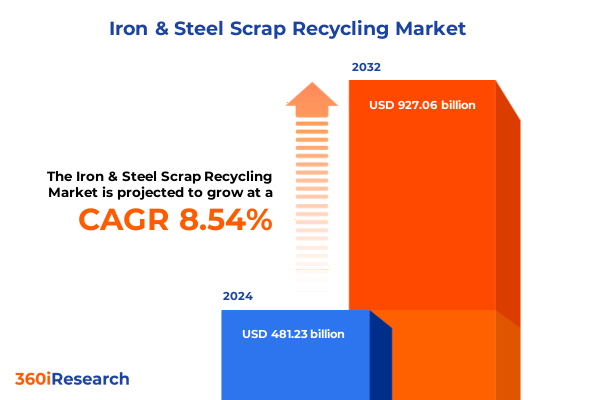

The Iron & Steel Scrap Recycling Market size was estimated at USD 521.64 billion in 2025 and expected to reach USD 563.92 billion in 2026, at a CAGR of 8.56% to reach USD 927.06 billion by 2032.

Exploring Iron and Steel Scrap Recycling Market Drivers, Environmental Imperatives, and Value Chain Dynamics to Guide Strategic Industry Decisions

A deep understanding of iron and steel scrap recycling is essential for industry stakeholders seeking to navigate the evolving landscape of supply chains, sustainability goals, and economic pressures. The recycling of ferrous materials has emerged as a critical component in reducing greenhouse gas emissions, conserving natural resources, and enhancing economic resilience. As manufacturers and recyclers redefine their operational strategies, the market has become increasingly complex, driven by shifts in technology, policy, and trade dynamics.

This executive summary sets the stage by outlining the significance of scrap recycling within the broader steel industry. It examines how value chain participants-from collection and processing to end-use manufacturing-can leverage emerging trends to optimize efficiency and profitability. As we delve deeper, the report will illuminate the structural factors and strategic imperatives shaping the sector, offering decision-makers a robust foundation for informed action.

Revolutionary Advances and Ecosystem Collaboration Are Transforming Sourcing, Processing, and Sustainability Outcomes in Scrap Recycling

The iron and steel scrap recycling landscape is in the midst of transformative shifts that are redefining how materials are sourced, processed, and reintegrated into manufacturing cycles. Technological innovation has accelerated the adoption of advanced sorting and digital tracking systems. These tools enable processors to achieve greater purity and traceability, reducing contamination rates and enhancing the quality of secondary feedstocks. Concurrently, integration of circular economy principles has encouraged manufacturers to embrace design for recyclability, fostering collaboration with scrap suppliers to align product end-of-life considerations with upstream production processes.

Simultaneously, environmental regulations and corporate sustainability commitments are intensifying pressure on stakeholders to minimize carbon footprints. Electric arc furnaces (EAFs) have gained traction as a low-emission alternative to traditional blast furnaces, driving increased demand for high-grade scrap inputs. This convergence of regulatory and market forces has incentivized investment in pre-consumer recycling facilities and on-site shredding operations, streamlining material flows from demolition projects and industrial complexes. Consequently, companies are revisiting their strategic priorities, channeling capital toward scalable and automated recycling infrastructures that can adapt to fluctuating supply and demand conditions.

Amid these shifts, partnerships across the value chain are becoming more prevalent. Collectors, brokers, and end-users are forging integrated alliances that leverage shared data analytics and forecasting capabilities. This collaborative approach not only mitigates supply chain risks but also unlocks opportunities for co-innovation, such as customized alloy formulations derived from scrap blends. As a result, the sector is evolving from a series of transactional interactions into an interconnected ecosystem, where transparency and agility underpin competitive advantage.

Navigating the Complex Aftermath of 2025 Trade Measures and Strategic Exemptions to Maintain Momentum in Scrap Recycling Demand

The cumulative impact of United States tariffs in 2025 has introduced both complexities and opportunities for iron and steel scrap recycling stakeholders. Although recycled steel and aluminum scrap remain excluded from the reinstated Section 232 tariffs, the broader trade measures on primary metals have created ripple effects throughout global markets. By exempting scrap from tariff imposition, policymakers have preserved a critical channel for low-carbon feedstocks, maintaining incentives for domestic recycling and ensuring continuity in supply chains for electric arc furnaces.

Despite the exclusion, increased duties on imported virgin steel and aluminum have elevated the relative attractiveness of recycled materials. Higher costs for primary metals have spurred manufacturers to secure greater volumes of scrap, driving up domestic demand and prompting processors to negotiate price premiums. This dynamic, while beneficial for scrap generators, has also heightened competition among mills seeking reliable, high-quality inputs. In response, scrap suppliers have invested in enhanced segregation and decontamination protocols, striving to meet the stringent grade requirements of modern EAF operations. Furthermore, the potential for retaliatory tariffs in key export markets such as Canada, the European Union, and Brazil has cast uncertainty over international trade flows, leading some recyclers to prioritize domestic partnerships and localized supply chains.

Looking ahead, industry participants must navigate an environment marked by policy volatility. While the tariff framework favors scrap use in U.S. steelmaking, uncertainties surrounding future negotiations and legal challenges could trigger shifts in trade patterns. Consequently, recyclers and end-users alike are adopting hedging strategies, including long-term supply agreements and diversified sourcing networks, to mitigate possible disruptions. Such proactive measures will be essential to sustaining growth and ensuring the resilience of the iron and steel scrap recycling sector in an increasingly protectionist landscape.

Discerning Critical Market Forces Through Multifaceted Segmentation to Enable Precision Targeting and Enhanced Value Capture

Examining the iron and steel scrap recycling market through a segmentation lens unveils critical insights that inform targeted strategies for value capture. When assessing scrap type distributions, cast iron fragments continue to present stable volumes given their prevalence in infrastructure demolition, whereas heavy melting steel remains the dominant commodity, reflecting strong demand for robust feedstocks in electric arc furnace operations. Manganese steel scrap is gaining traction among specialized steel mills deriving from mining equipment wear components, and shredded scrap, often derived from old car bodies, commands high attention due to its favorable density and high-margin potential.

Recycling methods further influence operational efficiency. Baling operations provide the densest form of raw material handling, optimizing transport economics, while shearing and shredding techniques enable rapid size reduction, facilitating throughput at melt shops. Melting facilities with enhanced furnace controls are able to accommodate variable chemistry inputs, broadening the range of acceptable scrap blends. As processing infrastructures become more sophisticated, operators are aligning recycling methodologies with the requirements of high-precision steel grades.

The source of scrap generation also delineates market opportunities. Automotive and construction and demolition sectors remain prolific, supplying vast quantities of end-of-life steel. Electrical and electronics waste contributes specialized alloys, and household appliances continue to supply predictable volumes of steel. Industrial offcuts from machinery fabrication and stamping operations are another significant feedstock. Grade differentiation underscores the value chain: prompt scrap, with its minimal processing history, typically fulfills the strictest EAF specifications, whereas home scrap and obsolete scrap commands pricing adjustments reflective of their variable cleanliness and alloy consistency.

Finally, end-use industries dictate demand drivers. Steel production facilities dominate scrap consumption given their reliance on recycled inputs to meet production targets, followed by equipment manufacturing, which seeks dimensional consistency. Shipbuilding operations value high-strength steel varieties found in obsolete scrap derived from marine structures, and the automotive sector remains a key off-taker, recycling a portion of its own discarded bodies back into production loops. These segmentation insights collectively shape the value proposition for market participants striving to align their product offerings with the precise needs of end-users.

This comprehensive research report categorizes the Iron & Steel Scrap Recycling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Scrap Type

- Recycling Method

- Source of Generation

- Grade

- End-Use Industry

Understanding Regional Supply Chain Variances and Policy Interventions to Optimize Scrap Recycling Strategies Across Global Markets

Regional dynamics exert a profound influence on iron and steel scrap recycling flows and pricing structures. In the Americas, robust infrastructure renewal programs and evolving environmental policies have elevated domestic demand for recycled steel inputs. The absence of tariffs on scrap trade within North American Free Trade Agreement partners ensures seamless cross-border material exchanges, supporting the logistical efficiencies of large scrap brokers and regional foundries. Meanwhile, ecosystem synergies between the United States, Mexico, and Canada have fostered integrated recycling corridors that capitalize on spatial proximities and competitive labor costs.

In Europe, Middle East, and Africa markets, recent surveillance initiatives by the European Commission signal heightened scrutiny over scrap metal exports, as dwindling domestic stocks threaten low-carbon manufacturing goals. The diversion of critical volumes to Asia and Turkey, driven by premium pricing incentives, has intensified supply constraints across the EMEA region. Policymakers are weighing the imposition of export monitoring mechanisms to safeguard smelter inputs, while local recyclers adapt by prioritizing alloy diversification and bolstering reverse logistics for municipal scrap collection systems.

Asia-Pacific remains the largest importer of U.S. scrap, with Chinese, Indian, and Turkish steel complexes relying heavily on foreign feedstocks to supplement shrinking domestic scrap yields. Although shifting geopolitical alignments and trade negotiations occasionally disrupt these supply chains, the fundamental demand for high-grade scrap persists. Particularly in markets such as Japan and South Korea, where stringent EAF carbon targets drive preference for premium scrapedial materials, recyclers are investing in higher-end processing capabilities to meet specialized alloy requirements. These regional insights underscore the necessity for stakeholders to tailor their logistical, financial, and partnership strategies to the unique characteristics of each geography.

This comprehensive research report examines key regions that drive the evolution of the Iron & Steel Scrap Recycling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Titans and Innovators Harnessing Scale, Technology, and Sustainable Practices to Redefine Competitive Leadership

Leading players in the iron and steel scrap recycling sector are distinguishing themselves through strategic investments, vertical integration, and technological innovation. Global operators such as Schnitzer Steel and Sims Metal Management have expanded their footprint via acquisitions, capturing market share in key end-use geographies and diversifying their material portfolios. Meanwhile, integrated steel producers like Nucor and Steel Dynamics are leveraging in-house scrap processing assets to secure feedstock that aligns precisely with their metallurgical requirements, reducing exposure to market price swings.

Innovative mid-market firms are carving out niches by deploying advanced sorting systems that integrate artificial intelligence with sensor-based separation technologies. This approach not only enhances purity levels but also supports premium pricing structures for specialized alloys. At the same time, emerging regional recyclers are forming consortiums to co-invest in shared infrastructure, such as mobile shredding units and smart logistics networks, addressing capacity limitations and improving last-mile collection efficiencies.

Further, some market leaders are differentiating through sustainability certification programs that validate the carbon intensity of their recycled steel, catering to buyers with aggressive net-zero mandates. Collaborative initiatives between recyclers and steelmakers are yielding bespoke scrap blends designed for specific product applications, from construction-grade I-beam production to high-tensile automotive components. These orchestrated strategies by key companies are redefining competitive dynamics, as scale, technological prowess, and value-added services become the primary benchmarks of industry leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Iron & Steel Scrap Recycling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Algoma Steel Inc

- Alter Trading Corporation

- AMG Resources Corp

- ArcelorMittal SA

- Aurubis AG

- CMR Green Technologies Ltd

- Commercial Metals Company

- Dowa Holdings Co Ltd

- Ferrous Processing & Trading Corp

- Glencore International AG

- Gravita India Ltd

- Hugo Neu Corp

- Jain Metal Corporation

- Jindal Stainless Ltd

- Jindal Steel & Power Ltd

- Nippon Steel Corporation

- Nucor Corporation

- OmniSource Corporation

- Philip Metals Inc

- Schnitzer Steel Industries Inc

- Sims Limited

- Tata Steel Ltd

- The David J Joseph Company

- Tube City Inc

- Umicore

Implementing Strategic Partnerships, Policy Advocacy, and Technological Integration to Drive Operational Excellence and Market Resilience

In light of the evolving market environment, industry leaders must adopt a proactive posture to capitalize on emerging opportunities and mitigate risks. Strengthening supply chain resilience through diversified sourcing agreements should be a priority. By establishing long-term contracts with primary generators in automotive, construction, and industrial sectors, recyclers can secure consistent scrap volumes and negotiate favorable pricing frameworks. Furthermore, forging strategic partnerships with equipment manufacturers can facilitate the deployment of next-generation processing technologies, enhancing throughput and material quality.

Advocacy for supportive policy frameworks is equally important. Engaging in targeted dialogues with trade associations and government agencies can help shape regulations that preserve scrap tariff exemptions and incentivize investments in low-carbon recycling infrastructure. Concurrently, implementing robust digital platforms for real-time tracking of material flows and pricing analytics will empower executives to anticipate market shifts and adapt procurement strategies swiftly. These systems can also integrate sustainability metrics, enabling transparent reporting to customers and investors aligned with environmental, social, and governance objectives.

Lastly, nurturing talent and fostering a culture of continuous improvement will be instrumental. Investing in workforce training programs and embracing cross-functional teams comprised of operations, data science, and sustainability experts can drive innovation and operational excellence. By prioritizing these actionable recommendations, industry leaders can not only navigate the current landscape but also position themselves at the forefront of the iron and steel scrap recycling transformation.

Leveraging Comprehensive Secondary Research, Primary Stakeholder Interviews, and Multivariate Analysis to Deliver Robust Market Intelligence

This research report is underpinned by a comprehensive methodology that synthesizes multiple data sources and analytical frameworks. The study commenced with an extensive review of publicly available industry reports, trade association publications, and regulatory filings to establish a foundational understanding of market drivers, policy impacts, and competitive dynamics. Secondary research was complemented by proprietary databases tracking scrap pricing trends and transaction volumes across major global hubs.

Primary insights were garnered through in-depth interviews with senior executives, metallurgists, and supply chain managers at leading scrap processors, steel producers, and end-use industries. These qualitative inputs were triangulated with quantitative data derived from financial statements, trade flow statistics, and customs records to validate key findings. Scenario analysis was employed to assess the potential implications of varying tariff regimes, technological adoptions, and environmental policies, providing a range of strategic pathways for stakeholders.

The research team also applied segmentation modeling to elucidate demand patterns across scrap types, processing methods, source categories, grades, and end-use applications. Regional analyses incorporated macroeconomic forecasts, infrastructure spending programs, and trade policy trajectories. By integrating both top-down and bottom-up perspectives, this methodology ensures a holistic and robust representation of the iron and steel scrap recycling market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Iron & Steel Scrap Recycling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Iron & Steel Scrap Recycling Market, by Scrap Type

- Iron & Steel Scrap Recycling Market, by Recycling Method

- Iron & Steel Scrap Recycling Market, by Source of Generation

- Iron & Steel Scrap Recycling Market, by Grade

- Iron & Steel Scrap Recycling Market, by End-Use Industry

- Iron & Steel Scrap Recycling Market, by Region

- Iron & Steel Scrap Recycling Market, by Group

- Iron & Steel Scrap Recycling Market, by Country

- United States Iron & Steel Scrap Recycling Market

- China Iron & Steel Scrap Recycling Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Market Drivers, Policy Impacts, and Competitive Dynamics to Chart a Sustainable Growth Path for Scrap Recycling Industry Leaders

In summary, the iron and steel scrap recycling sector stands at an inflection point defined by technological innovation, policy evolution, and shifting global trade dynamics. The exclusion of scrap from 2025 tariff measures has preserved a vital outlet for low-carbon feedstocks, reinforcing the economic case for recycling in steel production. Concurrently, advancements in processing technologies, circular economy adoption, and regional policy interventions are reshaping supply chain architectures and competitive strategies.

Segmentation insights reveal the nuanced ways in which scrap type, processing methods, and end-use requirements intersect to drive value creation. Regional analyses underscore the divergent fiscal and regulatory landscapes that stakeholders must navigate, while key company activities highlight the importance of scale, integration, and sustainability differentiation. By embracing targeted partnerships, enhanced digital capabilities, and proactive policy engagement, industry leaders can capitalize on robust demand and emerging market opportunities.

Ultimately, the path forward for the iron and steel scrap recycling market will be charted by those who combine operational agility with strategic foresight, leveraging data-driven insights and collaborative innovation to unlock sustainable growth in a decarbonizing global economy.

Elevate Your Strategic Advantage with Expert Consultation and Exclusive Access to a Definitive Iron and Steel Scrap Recycling Report

Unlock unparalleled insights into the iron and steel scrap recycling market with our comprehensive research report and secure your competitive edge today by connecting with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch).

- How big is the Iron & Steel Scrap Recycling Market?

- What is the Iron & Steel Scrap Recycling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?