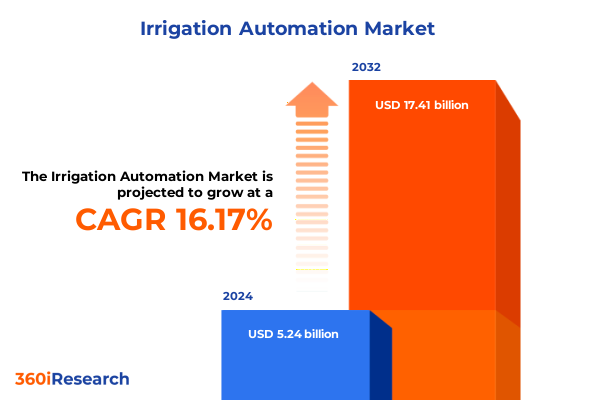

The Irrigation Automation Market size was estimated at USD 6.04 billion in 2025 and expected to reach USD 6.98 billion in 2026, at a CAGR of 16.30% to reach USD 17.41 billion by 2032.

Pioneering the Future of Agriculture with Intelligent Irrigation Solutions That Confront Global Water Scarcity While Enhancing Farm Productivity

In an era where water scarcity and environmental pressures are reshaping global agriculture, irrigation automation has emerged as a cornerstone for sustainable farm management. Advanced control systems and digital platforms now enable stakeholders to precisely deliver water and nutrients, optimizing every drop for peak productivity. As climate variability intensifies, farmers and landscape managers alike are under increasing scrutiny to demonstrate responsible resource stewardship. Against this backdrop, intelligent irrigation technologies are redefining traditional practices by integrating real-time monitoring, data-driven decision making, and remote system management capabilities.

The convergence of embedded sensors, cloud connectivity, and analytics platforms marks a paradigm shift from manual scheduling to dynamic irrigation strategies. This evolution not only enhances water-use efficiency but also reduces labor costs and mitigates crop stress by adjusting irrigation schedules based on soil moisture, weather forecasts, and crop growth stages. Moreover, the proliferation of user-friendly interfaces and mobile applications has democratized access to sophisticated tools, empowering smallholders and large-scale operations to adopt precision irrigation.

As digital agriculture gains momentum, early adopters are reporting significant improvements in yield quality, operational resilience, and regulatory compliance. However, the road to widespread adoption requires overcoming challenges related to infrastructure, interoperability, and investor confidence. By exploring the latest innovations, market drivers, and competitive dynamics, this executive summary provides a foundational perspective for decision-makers seeking to harness irrigation automation for long-term value creation.

Navigating the Technological Revolution in Irrigation Driven by IoT Connectivity AI Analytics and Sustainability-Focused Practices Transforming Agritech

The landscape of irrigation automation is currently undergoing a profound technological revolution, driven by an unprecedented convergence of connectivity, analytics, and sustainability imperatives. Connectivity protocols spanning wired Ethernet and RS-485 to wireless options such as Bluetooth, cellular, LoRaWAN, and Wi-Fi now enable seamless data exchange across sprawling agricultural sites and densely populated landscape installations. This proliferation of network topologies is complemented by a surge in sensor innovation, encompassing flow, humidity, rain, soil moisture, and temperature sensing to create a holistic environmental profile in real time.

Simultaneously, artificial intelligence and machine learning engines are transforming raw sensor output into actionable insights. Predictive algorithms leverage historical crop performance, localized weather forecasts, and real-time soil conditions to generate optimized irrigation schedules that adapt dynamically to evolving field conditions. By automatically tuning controllers and irrigation hardware components, these solutions facilitate a shift from reactive to proactive water management.

Sustainability-driven practices are increasingly dictating technology adoption, with stakeholders prioritizing solutions that minimize water consumption and carbon footprint. Hybrid and solar-powered systems are gaining traction in off-grid and remote deployments, reducing reliance on traditional power sources while aligning with corporate environmental objectives. This wave of innovation is further bolstered by the emergence of modular software frameworks that integrate seamlessly with existing farm management systems, enabling rapid scalability without extensive capital outlay. As a result, decision-makers can leverage turnkey irrigation automation ecosystems that deliver both ecological benefits and operational excellence.

Assessing the Comprehensive Effects of the 2025 United States Tariffs on Irrigation Automation Components and the Reshaping of Supply Chain Dynamics

The introduction of new tariffs by the United States in early 2025 has had a multifaceted impact on the irrigation automation industry, particularly affecting the importation of key hardware components. Pumps, valves, and sensor modules sourced from leading manufacturing hubs have experienced elevated duties, leading to increased landed costs for original equipment manufacturers and system integrators. This cost escalation has prompted a reassessment of procurement strategies, with many stakeholders exploring near-shoring or domestic sourcing to mitigate exposure to volatile trade policies.

While higher tariff rates have placed upward pressure on pricing, they have also catalyzed investment in local production capacity. By establishing assembly lines for controllers, pumps, and sensor subassemblies within the United States, certain market participants are striving to balance cost competitiveness with supply chain resilience. These efforts are further supported by incentives offered under federal and state programs aimed at bolstering advanced manufacturing, especially for agricultural technologies that contribute to national food security and resource conservation goals.

On the software front, tariffs have minimal direct effect, yet the overall shift toward locally manufactured hardware has accelerated demand for integrated platforms and analytics services. System developers are leveraging this trend to bundle software subscriptions with domestically assembled hardware configurations, creating differentiated value propositions. As a result, the tariff-induced realignment of the supply chain is fueling broader innovation in service delivery and pricing models, while also reshaping competitive dynamics across the irrigation automation ecosystem.

Unlocking Opportunities by Exploring Component Power Source Connectivity and End-User Segmentation to Guide Strategic Irrigation Automation Decisions

A nuanced understanding of market segmentation provides critical guidance for strategic decision-making in irrigation automation. Component type segmentation reveals that hardware remains foundational, with a growing emphasis on advanced controllers, pumps, sensors, sprinklers, and valves that form the physical backbone of any automated system. Within the sensor category, flow sensors, humidity sensors, rain sensors, soil moisture sensors, and temperature sensors are each experiencing varied adoption rates, driven by application-specific requirements and cost considerations. Services represent another pivotal segment, encompassing consulting services, installation services, and maintenance services that ensure system performance and longevity, particularly as installations grow in scale and complexity. Meanwhile, software segmentation including analytics platforms, monitoring solutions, and scheduling tools is evolving rapidly, as users demand intuitive dashboards and AI-driven insights that streamline operational workflows.

Examining irrigation type segmentation highlights the distinct growth trajectories of drip irrigation, sprinkler irrigation, and surface irrigation systems. Drip irrigation continues to benefit from water-use efficiency mandates and is a preferred solution for high-value crops, while sprinkler irrigation maintains broad applicability across diverse landscapes. Surface irrigation, though less technology-intensive, presents opportunities for cost-sensitive markets when paired with retrofitted automation capabilities.

Power source preferences further stratify market dynamics, with battery-powered systems offering flexibility for small-scale and remote sites, electric-powered systems serving grid-connected large operations, hybrid systems combining power sources for redundancy, and solar-powered systems emerging as a sustainable alternative in regions with high insolation. Connectivity technology segmentation underscores the importance of both wired (Ethernet and RS-485) and wireless (Bluetooth, cellular, LoRaWAN, and Wi-Fi) networks for delivering robust, scalable communication pathways.

End-user segmentation differentiates agricultural applications across field crops, orchards, and vineyards from non-agricultural applications such as commercial landscapes, gardens and lawns, and golf courses, each with unique performance, service, and integration needs. Installation mode segmentation across new installation and retrofit installation contexts also drives stakeholder priorities, as retrofit projects often require modular, non-invasive solutions that preserve existing infrastructure. Finally, distribution channel segmentation between offline and online channels highlights the transition to e-commerce and direct-to-farm models, even as traditional dealer networks remain integral for complex system deployments.

This comprehensive research report categorizes the Irrigation Automation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component Type

- Irrigation Type

- Power Source

- Connectivity Technology

- End User

- Installation Mode

- Distribution Channel

Decoding Regional Growth Patterns by Examining Americas Europe Middle East & Africa and Asia-Pacific Dynamics in the Irrigation Automation Market

Regional dynamics in the irrigation automation market are shaped by varying degrees of technology adoption, regulatory frameworks, and environmental stressors. In the Americas, advanced precision farming techniques and conservation programs have driven widespread acceptance of sophisticated irrigation systems. The United States, in particular, benefits from robust research institutions and government support for water-saving technologies, fostering an ecosystem where both legacy agricultural operations and emerging smart farms can access cutting-edge automation solutions.

Europe, the Middle East, and Africa collectively present a tapestry of market conditions. In Europe, stringent water regulation and sustainability goals are accelerating investments in drip and precision irrigation, while high labor costs are incentivizing automation adoption. The Middle East’s acute water scarcity has made irrigation automation a strategic imperative, with solar-powered and remote monitoring solutions proliferating across arid agricultural zones. In Africa, growth is led by pilot projects and development initiatives aiming to boost food security, although fragmented infrastructure and skills gaps pose challenges for scale.

Asia-Pacific remains the fastest-growing region owing to its vast agricultural footprint and government initiatives promoting modern farming practices. China and India are notable for significant deployments of low-cost sensor networks and pumping solutions aimed at supporting smallholder farmers, whereas Australia and New Zealand often serve as testbeds for climate-resilient irrigation models and advanced analytics. Across the region, the convergence of mobile connectivity, local manufacturing, and micro-financing options is unlocking new avenues for irrigation automation uptake.

This comprehensive research report examines key regions that drive the evolution of the Irrigation Automation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves by Industry Leaders Driving Innovation Partnerships and Sustainability Initiatives in the Irrigation Automation Market

Leading companies in the irrigation automation space are pursuing a range of strategies to strengthen their market positions and unlock new revenue streams. Many are investing heavily in research and development to enhance the intelligence and resilience of their sensor and controller portfolios, integrating machine learning capabilities that optimize water delivery based on predictive modeling. Partnerships between established hardware manufacturers and software innovators are becoming increasingly common, resulting in seamless end-to-end solutions that bridge the divide between physical infrastructure and digital insights.

Mergers and acquisitions remain a central tactic for gaining rapid access to new technologies and geographic markets. Companies are selectively acquiring startups specializing in cloud-native analytics, remote monitoring platforms, and specialty sensor development to bolster their innovation pipelines. At the same time, channel expansion through strategic alliances with agricultural equipment dealers, irrigation contractors, and technology integrators is helping to extend reach into emerging segments such as golf courses, municipal landscapes, and specialty crop producers.

Sustainability initiatives are also shaping corporate agendas, with leading firms committing to carbon neutrality targets and the adoption of eco-friendly materials in their product designs. Subscription-based software licensing and service agreements are another focal point, delivering recurring revenue while ensuring continuous engagement with end users. Collectively, these company-level strategies underscore a market in transition, where agility, collaboration, and environmental stewardship define the new benchmarks for success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Irrigation Automation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Blurain

- Dorset Group B.V

- FarmBot Inc.

- Galcon Kfar Blum

- Gures Technology

- Hortau Inc.

- Hunter Industries Inc.

- HydroPoint Data Systems, Inc.

- Jain Irrigation Systems Ltd.

- Kothari Group Pvt Limited

- Lindsay Corporation

- Mottech Water Solution Ltd. by MTI Wireless Edge Ltd

- Nelson Irrigation Corporation

- Netafim by Orbia Advance Corp SAB

- Novedades Agrícolas S.A.

- Ondo Ltd.

- Rain Bird Corporation

- Rubicon Water

- SemiosBio Technologies Inc.

- Sense it Out Intelligent Solutions Pvt Ltd.

- SOLEM

- Valmont Industries Inc.

- Weathermatic by Telsco Industries, Inc.

Implementing Strategic Recommendations to Advance Irrigation Automation Adoption Enhance Technology Integration and Mitigate Market Disruptions

To navigate the rapidly evolving irrigation automation landscape, industry leaders should prioritize the diversification of their supply chains to mitigate risks associated with geopolitical shifts and tariff fluctuations. Establishing regional manufacturing hubs and forging closer relationships with component suppliers will enhance resilience and cost competitiveness. Concurrently, investing in modular technology architectures that support seamless integration with third-party platforms will enable organizations to attract a broader customer base and accelerate deployment timelines.

Expanding service portfolios beyond installation to encompass consulting, maintenance, and outcome-based agreements will unlock new value streams and foster deeper customer relationships. By adopting subscription-generated revenue models for software and analytics platforms, companies can ensure predictable income while delivering continuous feature enhancements and support. Additionally, offering flexible financing solutions such as leasing, equipment-as-a-service, and pay-per-acre models will make advanced automation technologies accessible to smallholders and budget-constrained operators.

Focusing on retrofit solutions will tap into mature agricultural and landscape markets that seek to modernize existing infrastructure without full system overhauls. Enhancing customer experiences through user-centric interfaces, mobile applications, and multilingual support will further differentiate offerings. Finally, engaging in public-private partnerships and industry coalitions focused on water conservation and climate resilience will reinforce corporate social responsibility credentials and open doors to grant funding and incentive programs.

Employing a Rigorous Multi-Source Research Methodology to Ensure Data Integrity and Comprehensive Insights in Irrigation Automation Analysis

This analysis is grounded in an exhaustive research methodology that combines primary and secondary data sources to ensure comprehensive and validated insights. Primary research was conducted through structured interviews and surveys with key stakeholders including farm operators, irrigation contractors, component manufacturers, software developers, and regional distributors. These interactions provided firsthand perspectives on adoption drivers, technology preferences, and procurement challenges.

Secondary research encompassed a review of industry publications, regulatory documents, white papers, patent filings, and company disclosures. Academic journals and technical reports offered depth on emerging sensor technologies and algorithmic advancements, while government databases and trade association records delivered contextual data on water usage policies and incentive programs. All data points were triangulated to cross-verify market observations and minimize potential biases.

The segmentation framework was applied consistently across component type, irrigation type, power source, connectivity technology, end-user application, installation mode, and distribution channel to facilitate structured analysis and enable comparability. Regional breakdowns adhered to established geographic definitions to reflect unique regulatory environments and infrastructure conditions. Throughout the research process, quality control measures including peer review and executive validation sessions were employed to uphold the integrity and reliability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Irrigation Automation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Irrigation Automation Market, by Component Type

- Irrigation Automation Market, by Irrigation Type

- Irrigation Automation Market, by Power Source

- Irrigation Automation Market, by Connectivity Technology

- Irrigation Automation Market, by End User

- Irrigation Automation Market, by Installation Mode

- Irrigation Automation Market, by Distribution Channel

- Irrigation Automation Market, by Region

- Irrigation Automation Market, by Group

- Irrigation Automation Market, by Country

- United States Irrigation Automation Market

- China Irrigation Automation Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2544 ]

Synthesizing Key Insights to Illuminate the Path Forward for Irrigation Automation Amidst Evolving Technological and Regulatory Landscapes

In summary, the irrigation automation market is poised for robust transformation as technological, regulatory, and environmental imperatives converge to redefine water management. The integration of IoT connectivity, AI-driven analytics, and sustainable power solutions is reshaping traditional irrigation paradigms, offering unprecedented levels of precision and efficiency. While the 2025 tariffs have introduced cost pressures, they have concurrently spurred local manufacturing initiatives and deeper innovation in service models.

Segmentation insights highlight the importance of tailoring strategies to distinct component categories, irrigation methods, power and connectivity options, and targeted end-user segments. Regional dynamics further underscore that growth opportunities vary by market maturity, regulatory support, and infrastructure readiness. Leading companies are capitalizing on these trends through strategic partnerships, mergers and acquisitions, and the expansion of subscription-based offerings, all while embedding sustainability at the core of their value propositions.

By adhering to the actionable recommendations outlined in this summary, industry participants can enhance their competitive positioning, unlock new revenue streams, and contribute meaningfully to global water stewardship efforts. As stakeholders chart their next steps, the emphasis on flexibility, interoperability, and customer-centric innovation will determine who thrives in this dynamic landscape.

Engage with Associate Director of Sales & Marketing for Customized Irrigation Automation Research Report Acquisition and Strategic Partnership

To secure a comprehensive understanding of the irrigation automation market and equip your organization with actionable intelligence, reach out directly to Ketan Rohom, who leads sales and marketing for customized research solutions. By partnering with this dedicated specialist, you will gain tailored access to the full report, including detailed data breakouts, deep-dive analyses, and executive briefings that are designed to fit your strategic priorities. Engage in a one-on-one consultation to define the scope and deliverables that best support your goals, whether you require targeted market entry guidance, competitor benchmarking, or innovation roadmaps. With expert support, you can expedite decision-making, align investments with emerging opportunities, and confidently navigate regulatory complexities to position your business for sustained growth in irrigation automation.

- How big is the Irrigation Automation Market?

- What is the Irrigation Automation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?