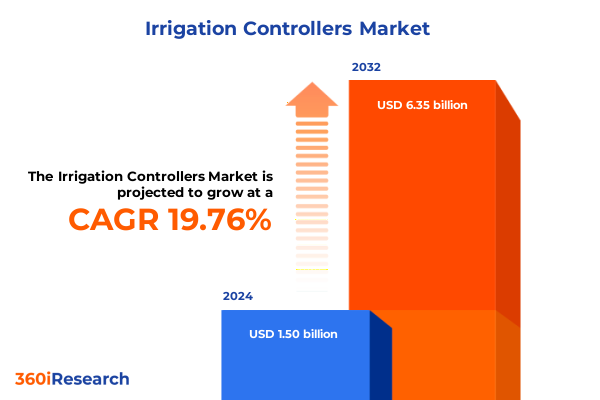

The Irrigation Controllers Market size was estimated at USD 1.80 billion in 2025 and expected to reach USD 2.13 billion in 2026, at a CAGR of 19.73% to reach USD 6.35 billion by 2032.

Strategic Introduction to Intelligent Irrigation Controllers and Their Role in Revolutionizing Water Management Practices for Diverse Stakeholders

In an era defined by the dual imperatives of resource optimization and sustainable development, irrigation controllers have emerged as a cornerstone technology in modern water management. These intelligent devices orchestrate the precise delivery of water, integrating sensors, connectivity protocols, and analytics to respond dynamically to environmental variables. As municipalities, agricultural enterprises, and residential communities confront tightening water regulations and shifting climate patterns, the demand for advanced irrigation control solutions has never been stronger.

This executive summary aims to provide an authoritative overview of the current irrigation controller landscape, spotlighting the technological innovations, market forces, and stakeholder priorities that are shaping adoption and growth. By examining key trends from connectivity capabilities to regulatory influences, we offer decision-makers a clear, concise entry point into the complexities of this rapidly evolving sector. The objective is not only to present a snapshot of where the market stands today but also to chart a trajectory for future developments, enabling stakeholders to anticipate disruptions and seize new opportunities.

Through this comprehensive introduction, readers will gain a foundational understanding of how irrigation controllers fit within broader smart infrastructure ecosystems, why their deployment is critical in meeting sustainability goals, and what core factors drive investment and innovation in this domain. This sets the stage for deeper analysis in subsequent sections, all designed to equip industry leaders with the insights they need to make informed strategic choices.

Unveiling the Transformative Technological and Market Shifts Redefining Irrigation Controller Landscape Amidst Evolving Environmental and Regulatory Pressures

The irrigation controller market is undergoing a profound metamorphosis driven by rapid advances in connectivity, data analytics, and automation. Traditional timer-based systems are giving way to IoT-enabled controllers that leverage real-time soil moisture readings, weather forecasts, and historical usage patterns to optimize watering schedules. This convergence of sensor networks and cloud-based platforms has unlocked new levels of precision, empowering users to reduce water waste by adjusting irrigation rates in response to site-specific conditions.

Concurrently, the adoption of artificial intelligence and machine learning algorithms is enhancing predictive maintenance and anomaly detection capabilities. Controllers can now learn usage patterns over time, preverting system failures and flagging inefficiencies before they escalate into costly downtime or resource losses. This shift toward self-learning systems is complemented by the integration of mobile and web applications that enable remote monitoring and control, further democratizing access to complex irrigation strategies.

Moreover, growing regulatory mandates aimed at conserving water resources have prompted the development of controllers that automatically comply with local watering restrictions and drought-management ordinances. These compliance features not only simplify operational oversight for end users but also protect vendors from potential liabilities. Taken together, these transformative shifts are redefining how irrigation controllers are designed, marketed, and deployed, heralding a new age of intelligent water management.

Assessing the Cumulative Impact of 2025 United States Tariffs on Irrigation Controller Supply Chains Cost Structures and Innovation Incentives

In 2025, a series of United States tariff adjustments targeting imported electronic components used in irrigation controllers have begun to reshape cost structures and supply chain strategies. The imposition of additional duties on semiconductors, printed circuit boards, and wireless modules has translated into higher landed costs for manufacturers reliant on overseas sourcing. As a result, original equipment manufacturers are compelled to reevaluate their procurement practices and explore alternative suppliers in non-traditional trade jurisdictions to mitigate the financial impact.

This tariff environment has accelerated onshoring initiatives, encouraging select producers to invest in domestic assembly lines and partnerships with local contract manufacturers. Although upfront capital expenditures have increased, firms anticipate that reduced lead times and lower logistical complexities will yield long-term resilience and improved customer service levels. Moreover, the tariffs have spurred growth in modular design philosophies, with engineers prioritizing component interchangeability to facilitate rapid adaptation to shifting duty schedules.

Additionally, the uncertainty surrounding tariff permanence has prompted investors to demand greater transparency in cost forecasting and supply chain risk management. Financial teams are now modeling scenario-based sensitivities that incorporate potential future tariff escalations, trade negotiations, or exemptions. This heightened scrutiny underscores the critical interplay between trade policy and technological innovation, making tariff developments a core consideration for any strategic planning exercise in the irrigation controller sector.

Extracting Actionable Insights from Connectivity Installation and End Use Segmentation to Propel Next Generation Irrigation Controller Market Strategies

Analyzing market segmentation reveals nuanced opportunities and challenges across connectivity, installation, and end use dimensions. Connectivity options range from short-range Bluetooth links ideal for on-site device configuration to wide-area cellular networks that ensure continuous remote access, while Ethernet and Wi-Fi provide hybrid capabilities for both local network integration and cloud connectivity. These distinct modalities influence design trade-offs in terms of power consumption, security protocols, and data throughput requirements, shaping the value propositions offered by different solution providers.

Installation scenarios further diversify the market landscape, with new construction projects affording the flexibility to embed cutting-edge control systems from the ground up. Conversely, retrofit initiatives demand backward compatibility and cost-effective adaptors to upgrade legacy infrastructure without extensive civil works. This dual installation dynamic requires vendors to maintain dual product lines or customizable platforms that cater to both greenfield developments and renovation projects, often balancing advanced functionality with budget constraints.

End use segmentation underscores divergent requirements across agricultural, commercial, and residential contexts. Large-scale farms prioritize rugged, weather-proof controllers with advanced telemetry and data logging, while industrial and institutional facilities value centralized management consoles that can coordinate multiple sites. Single-family residences typically seek user-friendly interfaces and aesthetic form factors, whereas multi-family dwellings emphasize shared-system management and water-allocation fairness. Understanding these layered use cases is essential to aligning product roadmaps with customer expectations and achieving differentiated market positioning.

This comprehensive research report categorizes the Irrigation Controllers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Connectivity Type

- Installation Type

- End Use

Illuminating Regional Dynamics and Growth Opportunities Across the Americas Europe Middle East Africa and Asia Pacific Irrigation Controller Markets

The Americas continue to lead in the adoption of smart irrigation technologies, buoyed by robust government incentives and a high level of environmental awareness among end users. In North America, state-level rebates and water conservation mandates have driven rapid uptake of advanced controllers in both agricultural regions and urban green spaces. Meanwhile, Central and South American farmers are showing increased interest in cellular-enabled solutions that can bridge connectivity gaps in remote areas, opening new commercial avenues for solution providers.

In Europe, Middle East, and Africa, the landscape is shaped by regulatory harmonization efforts such as the EU’s Water Framework Directive and national drought-response programs. These initiatives have encouraged the integration of predictive irrigation technologies in commercial landscaping and institutional facilities. Africa’s variable infrastructure quality has sparked innovation in solar-powered controllers with offline data caching, while the Middle East has emerged as a testing ground for ultra-efficient drip irrigation networks governed by smart controllers to optimize water usage in arid climates.

The Asia-Pacific region exhibits one of the fastest growth trajectories, driven by the dual forces of rapid urbanization and agricultural modernization. Countries in Southeast Asia are increasingly deploying Wi-Fi and Bluetooth-backed devices to manage intensive crop patterns, whereas Australia’s water scarcity challenges have fueled demand for controllers with advanced soil moisture and weather-integration capabilities. In East Asia, dense urban centers are adopting integrated water management platforms that seamlessly connect irrigation controllers with broader smart city initiatives.

This comprehensive research report examines key regions that drive the evolution of the Irrigation Controllers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology Innovators and Strategic Collaborators Shaping the Competitive Irrigation Controller Industry Ecosystem With Differentiated Offerings

Several leading technology innovators have emerged as pivotal forces in the current irrigation controller ecosystem. These firms leverage strengths in areas such as network security, sensor integration, and cloud analytics to deliver differentiated offerings. Partnerships between sensor manufacturers and software developers have become increasingly common, enabling end-to-end solutions that streamline installation and accelerate time-to-value for end users.

Strategic collaborations with utility companies and municipal water authorities are also on the rise, as vendors seek to embed their products within broader water management frameworks. Such alliances not only facilitate large-scale deployments but also generate valuable operational data that can be fed back into iterative product enhancements. Meanwhile, selective M&A activity has consolidated specialized players with niche capabilities in soil sensing or telemetry, broadening the technology portfolios of established incumbents.

In parallel, forward-leaning research and development teams are driving the next wave of innovation by incorporating artificial intelligence into controller firmware. These initiatives aim to refine irrigation algorithms through continuous learning and to introduce self-healing network architectures that minimize downtime. Collectively, these company-level strategies are setting the stage for a more integrated, data-driven future in irrigation management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Irrigation Controllers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Baccara

- Calsense

- Deere & Company

- Galcon Ltd

- Hunter Industries Inc

- HydroPoint Data Systems Inc

- Jain Irrigation Systems Limited

- Kothari Agritech Private Limited

- Lindsay Corporation

- Mahindra EPC Irrigation Limited

- Mottech Water Management Ltd

- Nelson Irrigation Corporation

- Netafim Ltd

- Orbit Irrigation Products LLC

- Rachio Inc

- Rain Bird Corporation

- REINKE MANUFACTURING CO INC

- Rivulis Irrigation Limited

- Signature Control Systems Inc

- T-L Irrigation Co

- The Toro Company

- Valmont Industries Inc

- Weathermatic LLC

Crafting Actionable Strategic Recommendations to Empower Industry Leaders and Drive Sustainable Growth in the Evolving Irrigation Controller Landscape

Industry leaders should prioritize the adoption of modular platform architectures that allow for seamless integration of emerging connectivity protocols and sensor types. By decoupling hardware components from firmware logic, organizations can rapidly iterate on new features without incurring full platform redesign costs. This approach fosters agility and positions companies to capitalize quickly on evolving market demands.

Additionally, forging strategic partnerships across the value chain-from semiconductor suppliers to landscape services providers-can unlock synergies that drive cost efficiency and accelerate innovation. Collaborative ecosystems facilitate shared data streams that enhance algorithm accuracy and enable predictive maintenance models, reducing non-revenue-generating downtime for end users.

To mitigate trade policy risks, firms are advised to diversify their manufacturing footprint and pursue joint ventures with regional contract manufacturers. Such diversification not only buffers against tariff volatility but also improves access to local incentives and reduces logistical lead times. Moreover, a targeted investment in sustainability certifications and compliance monitoring will enhance brand credibility, satisfying the growing preference for environmentally responsible solutions among regulatory bodies and customers alike.

Detailing Robust Research Methodology Incorporating Primary Secondary and Qualitative Quantitative Analysis Techniques for Market Insight Rigor

Our research methodology integrates a comprehensive blend of primary and secondary data sources to ensure both depth and accuracy of insights. Initial stages involved a thorough review of industry white papers, patent filings, regulatory documents, and trade publications to map the technological and policy environment surrounding irrigation controllers. This desk research laid the groundwork for identifying key market participants, emerging use cases, and critical innovation inflection points.

Building on this foundation, extensive interviews were conducted with engineering leaders at controller manufacturers, installation specialists, and water management consultants across multiple geographies. These discussions provided firsthand perspectives on product roadmaps, installation challenges, and end user expectations. Quantitative surveys supplemented these qualitative insights, capturing adoption rates, feature preferences, and decision-making criteria across agricultural, commercial, and residential segments.

Data triangulation techniques were employed to reconcile information from diverse sources, ensuring consistency and reliability. Statistical analyses, including cross-tabulations and trend extrapolations, were performed to discern underlying patterns without forecasting future values. The multi-stage validation process ensures that the conclusions drawn reflect the current state of the market and adhere to rigorous academic and industry research standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Irrigation Controllers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Irrigation Controllers Market, by Connectivity Type

- Irrigation Controllers Market, by Installation Type

- Irrigation Controllers Market, by End Use

- Irrigation Controllers Market, by Region

- Irrigation Controllers Market, by Group

- Irrigation Controllers Market, by Country

- United States Irrigation Controllers Market

- China Irrigation Controllers Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Concluding Synthesis Emphasizing Key Challenges Opportunities and Strategic Imperatives in the Global Irrigation Controller Ecosystem

In summary, the irrigation controller market stands at a pivotal juncture characterized by rapid technological innovation, evolving regulatory landscapes, and shifting trade dynamics. Intelligent connectivity options, from Bluetooth to Ethernet, are reshaping how products interact with broader water management platforms. Installation requirements continue to necessitate flexible solutions that serve both new builds and retrofit applications, while end use demands span from large-scale agricultural deployments to nuanced residential implementations.

Trade policy headwinds, exemplified by the 2025 United States tariff adjustments, have underscored the importance of resilient supply chains and agile manufacturing strategies. Regional dynamics further illustrate that growth trajectories differ substantially across the Americas, EMEA, and Asia-Pacific, each presenting unique regulatory, infrastructural, and climatic considerations. At the company level, partnerships, M&A activity, and R&D investment in AI-driven firmware are charting the course for next-generation controllers.

Ultimately, stakeholders who embrace modular design philosophies, diversify sourcing footprints, and engage collaboratively across the value chain are best positioned to thrive. As water management challenges intensify and sustainability imperatives grow more stringent, the leaders of tomorrow will be those who can deliver scalable, intelligent solutions that balance performance, compliance, and environmental stewardship.

Compelling Invitation to Engage with Ketan Rohom Associate Director Sales Marketing to Unlock Invaluable Insights in the Irrigation Controller Market

Engaging directly with Ketan Rohom, Associate Director of Sales Marketing, offers unparalleled access to deep-dive irrigation controller market intelligence tailored to strategic decision making. Through a personalized consultation, potential stakeholders can explore proprietary insights on emerging connectivity standards, installation best practices, and region-specific adoption trends that can inform product roadmaps and go-to-market strategies. This direct engagement ensures that organizational leaders receive timely answers to nuanced questions about technology roadblocks, regulatory shifts, and competitive positioning.

By securing this opportunity, clients unlock a suite of value-added deliverables, including bespoke data summaries, scenario planning tools, and expert commentary that can accelerate time-to-insight and drive competitive differentiation. Ketan Rohom’s expertise bridges the gap between raw data and actionable intelligence, empowering teams to align cross-functional objectives with market realities. To initiate this collaboration and gain privileged access to these insights, interested parties are invited to connect with Ketan Rohom for a confidential discussion and customized briefing.

- How big is the Irrigation Controllers Market?

- What is the Irrigation Controllers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?