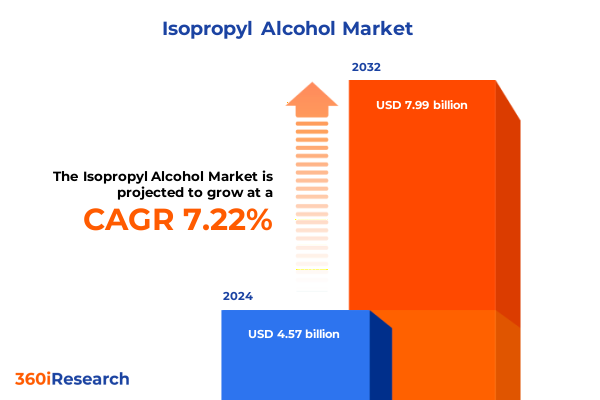

The Isopropyl Alcohol Market size was estimated at USD 4.89 billion in 2025 and expected to reach USD 5.22 billion in 2026, at a CAGR of 7.27% to reach USD 7.99 billion by 2032.

Illuminating the Strategic Imperatives and Market Complexities Driving Isopropyl Alcohol’s Industry Trajectory

Isopropyl alcohol, known for its multifaceted applications across industries, has emerged as an indispensable solvent and disinfectant in a rapidly evolving global landscape. As manufacturers strive to balance cost efficiencies, sustainability objectives, and regulatory compliance, this versatile chemical compound is facing heightened scrutiny and strategic reevaluation. This introduction offers an essential orientation, setting the stage for a deep dive into the factors reshaping its production, distribution, and utilization.

The material’s capacity to dissolve oils, sanitize surfaces, and act as a reaction medium has cemented its status across sectors such as pharmaceuticals, electronics, and personal care. However, recent shifts in regulatory frameworks, fluctuations in raw material availability, and evolving end-user demands necessitate a more nuanced understanding. Consequently, industry leaders must recognize emerging patterns in sourcing, purity specifications, and application-specific performance criteria. Transitioning from traditional viewpoints, this report adopts a forward-looking perspective that interlaces market intelligence with actionable strategic insights.

By contextualizing isopropyl alcohol within broader supply chain dynamics and competitive landscapes, this opening section guides executives through the core themes of connectivity, resilience, and innovation. Stakeholders will gain clarity on key drivers, potential headwinds, and the interdependencies that underscore sustainable growth. This foundational analysis establishes a cohesive framework, preparing readers for subsequent sections that will dissect transformative trends, tariff implications, segmentation structures, regional landscapes, corporate strategies, and targeted recommendations.

Navigating the Convergence of Technological Innovations Regulatory Overhauls and Digital Supply Chain Integration in the IsoPropyl Alcohol Market

The isopropyl alcohol industry is undergoing transformative shifts driven by technological advancement, regulatory evolution, and changing end-user priorities. Recent innovations in manufacturing processes-such as continuous flow synthesis and membrane distillation-have enhanced production efficiency and purity levels, enabling producers to meet stringent electronic and pharmaceutical grade requirements. Moreover, the integration of bio-based feedstocks in select geographies is beginning to redefine raw material sourcing, reducing dependency on petrochemical derivatives and aligning with global sustainability targets.

Simultaneously, regulatory agencies in key markets are tightening guidelines around volatile organic compound emissions and workplace safety standards. These policy adjustments have prompted producers to invest in emissions control systems and worker training programs. Consequently, companies that proactively adopt greener production technologies and rigorous compliance frameworks are gaining competitive differentiation. In addition, the increasing emphasis on circular economy principles has spurred collaborations between chemical manufacturers and waste management innovators to repurpose by-products and minimize environmental footprints.

Furthermore, the rapid expansion of digital supply chains and advanced analytics tools is fostering unprecedented visibility into inventory levels and demand signals. This digital transformation facilitates real-time decision-making and predictive maintenance, mitigating operational risks. As a result, stakeholders must adapt to a landscape where agility, transparency, and technological integration determine market leadership, and where continuous improvement cycles drive long-term value creation.

Understanding the Layered Effects of United States Trade Measures on Sourcing Dynamics and Cost Management for Isopropyl Alcohol

In 2025, newly enacted tariffs in the United States have exerted a cumulative impact on isopropyl alcohol trade flows, cost structures, and sourcing strategies. These measures, aimed at safeguarding domestic chemical production, have introduced layered duties on key imports, prompting buyers to reassess supplier portfolios and long-term contracts. Initially, the surcharge environment intensified cost pressures for downstream industries reliant on consistent supply and predictable pricing. As a result, procurement teams have increasingly pivoted toward domestic refiners and explored nearshoring opportunities.

Beyond immediate cost escalations, the tariff landscape has reshaped investment allocations and capacity planning. Domestic chemical producers, buoyed by protective duties, are evaluating expansion projects to capture unmet demand. Conversely, foreign exporters are revising their market entry tactics, exploring joint ventures and toll manufacturing arrangements to maintain access to U.S. consumers. In parallel, logistical rerouting has emerged as a tactical response, with supply chain managers opting for transshipment via tariff-exempt corridors or leveraging free trade zones to mitigate financial impacts.

Moreover, the tariff-induced realignment has had downstream repercussions on product formulation costs and procurement lead times. Companies engaged in medical and disinfectant applications have had to balance higher raw material expenses against essential safety mandates. Consequently, this section elucidates the strategic recalibrations underway, emphasizing the importance of dynamic sourcing models, contractual flexibility, and integrated risk management frameworks to navigate an increasingly complex trade policy environment.

Unraveling Complex Market Dynamics Across Applications Purity Levels Grades Distribution Channels and Packaging Formats

Insights derived from the multiple segmentation lenses reveal nuanced performance and growth dynamics within the isopropyl alcohol market. When considered by application, the solvent’s foundational role in chemical synthesis continues to drive consistent utilization in intermediate manufacturing and process solvent functions, with electronics cleaning demonstrating accelerated uptake in semiconductor and PCB processes. In parallel, personal care formulators are leveraging high-purity grades to enhance skin and hair care products, reflecting consumer demand for premium hygiene solutions. Household cleaning segments, spanning glass and surface applications, have similarly benefited from heightened sanitation awareness.

Purity tiers further differentiate value propositions and competitive positioning, as the 99% and above category commands premium pricing for critical use cases, while lower purity grades enable cost-effective bulk applications. Grade-based analysis underscores the strategic imperative for electronic-grade and medical-grade producers to maintain rigorous quality controls, given the stringent regulatory and performance standards in semiconductor manufacturing and clinical disinfection. Cosmetic-grade offerings, primarily targeted at hair and skin care formulations, must balance sensory attributes with stability parameters.

Distribution channel segmentation highlights the ongoing shift toward e-commerce platforms and direct manufacturer engagements, although traditional direct sales and distributor networks remain essential for large-volume and regulated end-users. Packaging-type insights suggest a preference for drum and bulk delivery in industrial contexts, whereas bottle formats dominate in personal care and over-the-counter antiseptic applications. These interconnected segmentation perspectives underscore evolving buyer preferences, operational efficiencies, and the necessity for tailored go-to-market strategies.

This comprehensive research report categorizes the Isopropyl Alcohol market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity

- Grade

- Packaging Type

- Application

- Distribution Channel

Exploring Distinctive Regional Drivers Regulatory Realities and Collaborative Trade Flows Shaping IsoPropyl Alcohol Markets

Regional landscapes within the isopropyl alcohol market exhibit distinctive drivers and competitive contours. In the Americas, substantial domestic production capacity coupled with protective tariff measures has reinforced supply resilience, while sustainability initiatives are encouraging investments in bio-based feedstocks and green manufacturing practices. Meanwhile, Europe, Middle East & Africa continue to navigate a diverse regulatory mosaic, where stringent environmental standards accelerate the adoption of emissions control and circular economy collaborations, and Middle Eastern petrochemical hubs leverage integrated complexes to optimize feedstock availability.

In the Asia-Pacific region, dynamic industrial expansion and electronics manufacturing clusters are fueling robust demand, particularly for high-purity and electronic-grade variants. Government incentives in key Asian markets are incentivizing technology transfers and local capacity expansions, enhancing regional self-sufficiency. Moreover, the Asia-Pacific’s logistical advantages for export-oriented production continue to shape global trade patterns, even as rising labor costs in certain economies spur investment into automation and digital process controls.

Furthermore, cross-regional partnerships and trade agreements are establishing new supply corridors, blending cost considerations with geopolitical risk management. The interplay between these regional dynamics underscores the necessity for market participants to develop geographically nuanced strategies that address local regulatory frameworks, feedstock availability, and evolving demand profiles.

This comprehensive research report examines key regions that drive the evolution of the Isopropyl Alcohol market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Industry Leadership through Operational Excellence Innovation Initiatives and Sustainability Commitments

Key players in the isopropyl alcohol sector are distinguishing themselves through strategic investments, product portfolio diversification, and advanced manufacturing capabilities. Leading chemical producers have accelerated capacity enhancements in established facilities, integrating advanced process controls and energy recovery systems to improve operational efficiency. Concurrently, mid-tier regional suppliers are carving market niches by focusing on specialty grades and customized packaging solutions, addressing the precise needs of pharmaceutical, electronic, and personal care customers.

Strategic partnerships and joint ventures are also reshaping competitive dynamics, as global firms collaborate with local entities to streamline distribution networks and ensure regulatory compliance. In addition, some manufacturers are exploring backward integration initiatives to secure feedstock supply and reduce exposure to raw material volatility. Technological differentiation remains a critical factor, with companies investing in proprietary purification techniques and digital monitoring platforms to guarantee product consistency and safety.

Moreover, companies that demonstrate leadership in sustainability-through waste minimization, renewable energy adoption, and lifecycle assessments-are gaining favor with environmentally conscious customers and regulators. These combined efforts are elevating market expectations and setting new benchmarks for quality, reliability, and environmental stewardship across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Isopropyl Alcohol market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Carboclor plc

- Deepak Fertilisers & Petrochemicals Corporation Ltd.

- Deepak Nitrite Ltd.

- Denoir Technology Co., Ltd.

- Dow Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS Group Holdings S.A.

- Isu Chemical Co., Ltd.

- Jiangsu Denoir Chemical Co., Ltd.

- LCY Chemical Corp.

- LG Chem Ltd.

- LyondellBasell Industries N.V.

- Mitsui Chemicals, Inc.

- Royal Dutch Shell plc

- Sasol Ltd.

- Sisco Research Laboratories Pvt. Ltd.

- Tokuyama Corporation

Implementing a Holistic Framework That Integrates Agility Partnerships Regulatory Engagement and Sustainability to Drive Market Leadership

To thrive amidst evolving market conditions, industry leaders should prioritize integrated strategies that align operational agility with regulatory foresight. First, investing in flexible manufacturing platforms capable of rapid purity adjustments will enable swift responses to fluctuating demand across electronic, medical, and industrial segments. Concurrently, expanding digital supply chain solutions-such as real-time tracking and predictive analytics-will enhance visibility and resilience against trade policy disruptions.

In parallel, forging collaborative partnerships with feedstock producers and waste management firms can secure raw material continuity while advancing circular economy objectives. Companies should also proactively engage with regulatory bodies to anticipate compliance shifts and influence policy development. Furthermore, portfolio diversification-through the introduction of specialty grades and tailored packaging offerings-will capture emerging niche markets and reinforce customer loyalty.

Lastly, embedding sustainability across the value chain, from energy optimization to emissions reduction, will not only mitigate environmental risks but also unlock cost savings and bolster brand reputation. By implementing these actionable recommendations, stakeholders can position themselves at the forefront of an industry characterized by dynamic demands and strategic complexity.

Detailing a Multi-Source Research Framework Incorporating Primary Interviews Regulatory Assessments and Data Triangulation for Robust Insights

The research underpinning this analysis is grounded in a comprehensive methodology that synthesizes quantitative data, expert interviews, and regulatory reviews. Initially, primary data collection involved structured interviews with key supply chain participants, including manufacturers, distributors, and end users, to capture on-the-ground perspectives on usage patterns, quality requirements, and sourcing challenges. These insights were complemented by in-depth discussions with regulatory specialists and sustainability consultants to evaluate compliance trends and environmental initiatives.

Secondary research encompassed the systematic review of trade databases, customs records, and industry publications, focusing on production volumes, import-export patterns, and tariff measures. Technical literature and patent filings were also analyzed to identify emerging production technologies and purification advancements. Data triangulation techniques were applied to validate findings and ensure consistency across multiple sources.

Finally, an iterative analysis framework integrated scenario modeling to assess the impact of tariff changes, segment-specific growth drivers, and regional dynamics. Quality assurance processes, including peer reviews and methodological audits, were conducted to maintain research integrity and objectivity. This robust approach guarantees that the conclusions and recommendations presented are both reliable and actionable for senior decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Isopropyl Alcohol market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Isopropyl Alcohol Market, by Purity

- Isopropyl Alcohol Market, by Grade

- Isopropyl Alcohol Market, by Packaging Type

- Isopropyl Alcohol Market, by Application

- Isopropyl Alcohol Market, by Distribution Channel

- Isopropyl Alcohol Market, by Region

- Isopropyl Alcohol Market, by Group

- Isopropyl Alcohol Market, by Country

- United States Isopropyl Alcohol Market

- China Isopropyl Alcohol Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Synthesizing Technological Trends Policy Impacts and Strategic Imperatives to Forge a Comprehensive Roadmap for Stakeholders

This executive summary has provided a strategic vantage point on the multifaceted isopropyl alcohol market, revealing the critical interplay between technological innovation, policy shifts, segmentation nuances, and regional dynamics. By examining tariff implications, segmentation insights, and competitive strategies, decision-makers are equipped with a cohesive understanding of current pressures and emerging opportunities.

The analysis underscores that success in this sector hinges on agile manufacturing, diversified portfolios, and proactive regulatory engagement. Emerging trends such as bio-based feedstocks and digital supply chain integration will further redefine competitive benchmarks, while regional collaborations and sustainability commitments will drive future growth trajectories.

As the landscape continues to evolve, stakeholders who leverage these insights-supported by rigorous methodology-will be best positioned to navigate uncertainties and capitalize on new market segments. Ultimately, the insights within this report serve as a roadmap for informed decision-making, strategic investments, and sustained industry leadership.

Empower Your Organization with Expert Guidance from a Dedicated Sales and Marketing Leader to Acquire Comprehensive IsoPropyl Alcohol Market Analysis

If you’re ready to gain unparalleled clarity on the isopropyl alcohol market and elevate your strategic positioning, connect today with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings deep insights into segment dynamics, regulatory shifts, and competitive strategies, and he can guide you through tailored research solutions that align with your unique business challenges. Engage directly to explore customized reports, exclusive data sets, and expert consultations designed to empower your decision-making process. Reach out now to secure your comprehensive analysis and actionable intelligence that will drive your organization’s growth in this essential chemical industry sector.

- How big is the Isopropyl Alcohol Market?

- What is the Isopropyl Alcohol Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?