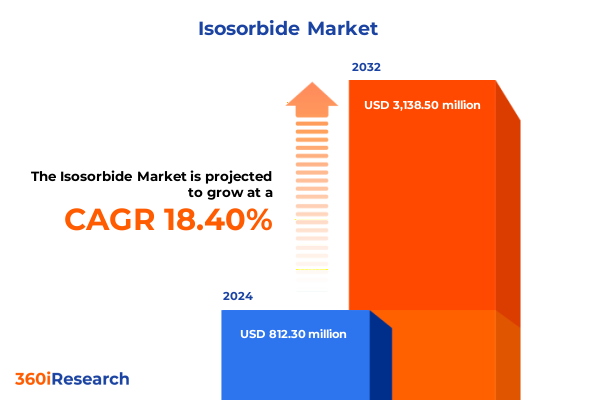

The Isosorbide Market size was estimated at USD 962.18 million in 2025 and expected to reach USD 1,128.20 million in 2026, at a CAGR of 18.40% to reach USD 3,138.50 million by 2032.

Exploring the Multifaceted Role of Isosorbide as a Sustainable Bio-Based Diol Transforming Diverse Industrial Applications and Driving Innovation

Isosorbide has emerged as a cornerstone in the pursuit of sustainable materials, representing a versatile bio-based diol derived from renewable glucose sources. Its molecular structure, characterized by rigid bicyclic rings, imparts exceptional thermal stability and hardness, making it a compelling alternative to conventional petrochemical diols. These intrinsic properties enable formulators and manufacturers to develop materials with enhanced mechanical performance while simultaneously reducing their carbon footprint. As companies across automotive, packaging, and specialty chemical industries intensify their commitments to lower greenhouse gas emissions, isosorbide’s appeal continues to grow.

In recent years, isosorbide has seamlessly transitioned from niche laboratory applications into broader industrial use. Advances in catalytic dehydration technologies and process optimization have lowered production costs and bolstered supply reliability. This progress has facilitated the adoption of isosorbide–based plasticizers that offer superior compatibility with polyvinyl chloride, reactive diluents that improve the crosslink density in polymer matrices, and green solvents that minimize volatile organic compound emissions. Consequently, isosorbide has gained traction among product designers seeking to marry performance with sustainability.

Given the rapid momentum behind bio-based chemicals, stakeholders are now navigating a landscape shaped by evolving regulatory frameworks and shifting consumer expectations. Companies that recognize isosorbide’s potential as a multifunctional building block are positioning themselves to lead in markets demanding both high performance and environmental responsibility. This introduction sets the stage for a detailed exploration of the transformative forces driving isosorbide’s widespread adoption and the strategic considerations essential for industry success.

Examining the Critical Transformations Reshaping the Isosorbide Industry Landscape Amidst Technological Advancements and Regulatory Evolutions

The isosorbide market is experiencing a profound transformation fueled by technological breakthroughs and progressive regulations. Traditional production pathways have evolved from energy-intensive methods to more efficient two-step dehydration processes that marry acid-catalyzed conversion with precision catalytic dehydration. These innovations not only enhance yield and purity but also reduce process waste, positioning isosorbide favorably against its petrochemical counterparts. Concurrently, research into novel catalysts and continuous-flow reactors promises further improvements in throughput and operational scalability.

Regulatory landscapes have likewise shifted in favor of bio-based materials. Governments across North America and Europe are implementing incentives and labeling schemes that reward higher biocarbon content, incentivizing manufacturers to integrate isosorbide into their formulations. Meanwhile, voluntary environmental commitments from leading corporations are prompting tier-one suppliers to adopt sustainable raw materials, driving upstream demand for isosorbide. As regulatory agencies tighten limits on volatile organic compounds and single-use plastics, isosorbide’s low toxicity and renewability become increasingly valuable.

These technology and policy developments are complemented by a growing focus on circular economy principles. End-of-life considerations, including recyclability and biodegradability, are influencing material selection across end use industries. Within this context, isosorbide stands out for its potential to contribute to closed-loop systems when incorporated into polymer backbones designed for mechanical recycling or chemical depolymerization. Altogether, transformative shifts in production, policy, and environmental stewardship are redefining the contours of the isosorbide landscape.

Assessing the Comprehensive Impact of the 2025 United States Tariff Measures on Isosorbide Supply Chains and Domestic Market Dynamics

In 2025, the United States implemented targeted tariff measures affecting imports of key bio-based chemicals, including isosorbide sourced from select regions. These duties, imposed with the intent to bolster domestic production, have reshaped supply chain strategies and pricing dynamics. Importers now face increased landed costs, prompting them to reassess sourcing from traditional suppliers in Asia and to explore local or regional alternatives. This shift has created a window of opportunity for national producers to expand capacity and secure long-term contracts with major end users seeking tariff-insulated supply lines.

The tariff environment has also accelerated strategic partnerships between domestic manufacturers and biotechnology firms. By leveraging advanced enzymatic conversion platforms, local producers have worked to mitigate cost pressures while maintaining high purity grades suitable for pharmaceutical and food-grade applications. This collaboration underscores a broader trend of vertical integration, where firms aim to control feedstock sourcing, process technology, and product development to capture value across the entire value chain.

End use industries, particularly those in cosmetics and personal care as well as food and beverage, have responded by diversifying supplier networks to safeguard against tariff-driven disruptions. Companies are conducting rigorous supplier audits and qualifying multiple production sites, ensuring continuity of supply for technical and USP-grade isosorbide. At the same time, innovation teams are exploring alternative monomers and plasticizers to hedge against future trade uncertainties.

Looking forward, the tariff measures are likely to spur discussions at multilateral trade forums regarding the classification of bio-based chemicals and their alignment with environmental trade agreements. Such dialogues may ultimately influence the scope and duration of these duties, reshaping the competitive landscape once again. For now, industry stakeholders must navigate the immediate impacts through strategic procurement adjustments, investment in local capabilities, and proactive engagement with policy makers.

Revealing Deep Segmentation Insights Across Application Purity Physical Form Production Process and End Use Industry Dynamics Governing Isosorbide Market

Deep insights emerge when analyzing isosorbide’s segmentation across application, purity grade, physical form, production process, and end use industries. When considering application, isosorbide’s versatility as a chemical intermediate has unlocked novel polyester formulations while its role as a plasticizer has addressed performance gaps in flexible films. Other segments such as reactive diluents illustrate how isosorbide integrates into epoxy and polyurethane resins to enhance crosslink density, and its function as a solvent facilitates greener paint and coating systems.

Purity grade segmentation highlights the distinct requirements of technical applications versus stringent pharmaceutical or food contexts. Technical-grade isosorbide satisfies performance criteria for most industrial polymers, whereas USP-grade material commands rigorous quality controls and certification pathways to meet health and safety standards. The divergence in quality requirements underlines the necessity for manufacturing flexibility and robust quality management systems.

Physical form plays an equally crucial role in downstream processing. Isosorbide delivered as flakes offers ease of handling and dosing in melt-processing equipment, whereas granules have gained favor for high-throughput extrusion lines seeking uniform feed rates. Powdered forms, by contrast, excel in solvent-based formulations where rapid dissolution and homogeneity are paramount.

The production process segmentation reveals two main routes: the single-step dehydration method, prized for its simplicity and lower capital expenditure, and the two-step approach combining acid-catalyzed dehydration with advanced catalytic dehydration, which optimizes yield and target selectivity. Within the latter, acid-catalyzed dehydration provides an initial conversion step, while catalytic dehydration refines purity and minimizes byproducts, making it the process of choice for USP-grade requirements.

Finally, end use industry segmentation underscores isosorbide’s broad applicability. In the cosmetics and personal care sector, its natural origin and low irritation profile have led to its adoption in emollients and pH-modifiers. The food and beverage industry values isosorbide derivatives for heat-stable packaging materials, whereas pharmaceutical manufacturers leverage USP-grade isosorbide for excipient and drug-delivery platforms. Plastics and polymers continue to drive volume through high-performance polyesters that benefit from isosorbide’s rigidity and heat resistance.

This comprehensive research report categorizes the Isosorbide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Purity Grade

- Physical Form

- Production Process

- End Use Industry

Mapping Regional Market Realities in the Americas Europe Middle East Africa and Asia Pacific to Uncover Opportunities and Challenges for Isosorbide Adoption

Regional dynamics have become increasingly influential in shaping isosorbide’s adoption patterns and commercial viability. In the Americas, heightened government incentives for bio-based investments and proximity to large polymer manufacturing hubs have catalyzed capacity expansions and collaborative research initiatives. North American producers have focused on integrating corn-derived feedstocks with continuous dehydration technologies to meet rising demand in automotive and packaging sectors.

Across Europe Middle East and Africa, stringent environmental directives and circular economy targets have accelerated the shift toward renewable diols like isosorbide. European Union regulations on single-use plastics and packaging waste have prompted material substitution campaigns, driving partnerships between chemical producers and converters to certify bio-content and enable product differentiation. Meanwhile, Middle East stakeholders, eyeing petrochemical diversification, are exploring isosorbide production using local sugar feedstocks, underscoring a broader resource realignment.

In the Asia Pacific region, where the majority of isosorbide manufacturing capacity has traditionally resided, low-cost feedstocks and established chemical clusters continue to offer competitive advantages. Producers in China and Southeast Asia are investing in downstream integration, moving beyond commodity grades into specialty applications requiring higher purity and tailored physical forms. At the same time, end users in India and Australia are evaluating local production ventures to alleviate import dependency and mitigate the impact of trade measures.

Taken together, regional insights highlight the interplay between policy, feedstock availability, and end use requirements. Stakeholders that align their strategic initiatives with localized drivers-whether through joint ventures, technology licensing, or targeted investments-will be best positioned to capture growth and navigate evolving regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Isosorbide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Partnerships Driving Innovation Production and Commercialization in the Competitive Isosorbide Landscape

A cadre of pioneering companies is steering the trajectory of the isosorbide market by leveraging unique capabilities and strategic collaborations. Leading global chemical suppliers have directed capital toward scaling advanced dehydration facilities, ensuring the reliable production of high-purity diols for diverse customers. Biotechnology enterprises specializing in enzyme optimization have forged alliances with industrial partners, co-developing catalyst systems that enhance conversion rates and reduce energy consumption.

Innovative start-ups and midsize firms have contributed through niche offerings and agile business models. Their focus on specialty solvents and custom reactive diluents has enabled rapid prototyping and small-batch trials with end users. These companies often provide value-added services such as formulation advisory and co-branding opportunities, supporting brand owners in differentiating sustainable product lines.

In parallel, pharmaceutical ingredient manufacturers and food-grade chemical specialists invest in stringent quality systems and regulatory dossiers to secure approvals for USP-grade isosorbide. Their expertise in process validation and compliance with international pharmacopoeias has been critical to expanding isosorbide’s footprint in highly regulated markets.

Cross-sector partnerships are emerging as a defining characteristic of the competitive landscape. Chemical multinationals collaborate with renewable feedstock suppliers to integrate upstream agricultural supply chains, while performance polymer producers work alongside additive specialists to co-engineer next-generation isosorbide-based materials. Together, these strategic alignments are accelerating product launches and broadening application horizons.

This comprehensive research report delivers an in-depth overview of the principal market players in the Isosorbide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AK Scientific Inc.

- Alfa Aesar

- Ambeed Inc.

- Apollo Scientific Ltd.

- Archer Daniels Midland Company

- AstaTech Inc.

- Biosynth Carbosynth

- BLD Pharmatech Ltd.

- BOC Sciences

- Carbosynth Limited

- Cargill Incorporated

- ChemScene LLC

- Combi-Blocks Inc.

- Finetech Industry Limited

- Key Organics Limited

- LGC Limited

- Merck KGaA

- Otto Chemie Pvt. Ltd.

- Santa Cruz Biotechnology Inc.

- Sigma-Aldrich Corporation

- SimSon Pharma Limited

- TCI Chemicals

- VWR International LLC

Strategic Roadmap and Pragmatic Recommendations to Guide Industry Leaders in Optimizing Isosorbide Value Chains and Accelerating Sustainable Growth

In light of evolving market conditions and regulatory demands, industry leaders should prioritize a strategic balance between process optimization and value chain integration. Investments in continuous-flow dehydration technologies will yield operational efficiencies and enable flexible output across purity grades. Concurrently, forging alliances with feedstock providers can secure raw material access and mitigate volatility in agricultural commodity prices.

To maintain competitive differentiation, companies must expand their application development capabilities. Establishing dedicated innovation centers focused on functional testing of isosorbide in high-performance polymers, coatings, and specialty fluids will expedite time to market and foster co-development opportunities with key end users. Integrating sustainability metrics into product design processes-such as life cycle assessments and carbon footprint modeling-will enhance customer engagement and support environmental claim substantiation.

Navigating complex trade dynamics requires a proactive approach to regulatory and policy engagement. Companies should monitor tariff negotiations and collaborate with industry associations to advocate for clear definitions and favorable classifications of bio-based chemicals. Simultaneously, diversifying manufacturing footprints across free-trade regions and enabling in-region distribution centers will reduce exposure to import duties and logistical constraints.

Finally, sustaining growth in high-value market segments demands a robust quality management framework. Implementing advanced analytical techniques, including process analytical technology and real-time monitoring, will ensure consistency across physical forms and purity grades. By embedding these practices into corporate governance, organizations can uphold the rigorous standards necessary for pharmaceutical, food, and personal care applications while scaling to serve broader industrial markets.

Detailing Rigorous Research Methodology Combining Primary and Secondary Data Collection and Analytical Frameworks Ensuring Comprehensive Market Intelligence

The research foundation for this report combines primary and secondary data sources to deliver an integrated view of the isosorbide market. Primary insights derive from in-depth interviews with industry executives, technology experts, and key decision makers across the value chain. These discussions explored process innovations, regulatory developments, and commercial strategies, providing context for emerging trends and competitive dynamics.

Secondary research encompassed a comprehensive review of academic literature, patent filings, technical white papers, and public regulatory disclosures. This phase enabled cross-validation of production methodologies and assessment of global capacity expansions. Additional inputs included analysis of corporate annual reports, sustainability filings, and conference proceedings to capture strategic investments and partnership announcements.

Analytical frameworks such as SWOT analysis, PESTEL evaluation, and competitive benchmarking were applied to distill critical success factors and anticipate market shifts. Segmentation analyses were conducted to examine variations in application requirements, purity gradations, physical delivery formats, process technologies, and end-use industry demands. Regional mapping assessed policy drivers, feedstock availability, and logistics infrastructure, while company profiling highlighted technological leadership and collaborative models.

Together, these methodological components ensure a holistic and data-driven perspective, equipping stakeholders with the insights required to navigate the evolving isosorbide landscape and make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Isosorbide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Isosorbide Market, by Application

- Isosorbide Market, by Purity Grade

- Isosorbide Market, by Physical Form

- Isosorbide Market, by Production Process

- Isosorbide Market, by End Use Industry

- Isosorbide Market, by Region

- Isosorbide Market, by Group

- Isosorbide Market, by Country

- United States Isosorbide Market

- China Isosorbide Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Concluding Perspectives on Isosorbide’s Strategic Importance and Future Trajectory Amidst Evolving Market Conditions and Sustainability Imperatives

As the drive toward sustainable materials intensifies, isosorbide stands at the nexus of performance and environmental stewardship. Its multifaceted attributes-ranging from high thermal stability to bio-based origin-have elevated it beyond a specialty chemical into a strategic enabler for industries seeking to decouple growth from fossil feedstocks. The market’s evolution is being shaped by technological advances in production, supportive policy regimes, and an expanding portfolio of applications that benefit from isosorbide’s unique properties.

Tactical decisions made today regarding capacity investments, process innovation, and regulatory positioning will determine which companies lead the next wave of expansion. The interplay between tariff measures and domestic capabilities underscores the importance of geography in supply chain resilience. Simultaneously, segmentation nuances in purity, physical form, and application requirements demand flexible manufacturing platforms and stringent quality controls.

Looking ahead, the ability to forge cross-sector collaborations and align product development with circular economy objectives will define the pace and scale of adoption. Companies that integrate sustainability metrics into their core strategies, optimize value chains through partnerships, and advance production science will capture the greatest share of high-value opportunities. Ultimately, isosorbide’s strategic importance will be measured by its contribution to a more sustainable chemical industry and the tangible benefits it delivers across end use sectors.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure the Comprehensive Market Research Report on Isosorbide’s Industry Outlook

Unlocking the full potential of isosorbide’s market intelligence begins with a direct conversation. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to discuss how this comprehensive research report will address your strategic questions, identify untapped opportunities, and guide your organization through complex regulatory and supply chain environments. Seize the chance to gain unparalleled insights into the evolving dynamics of isosorbide, leveraging expert analysis and actionable data. Connect today to tailor your report package and take the next step in reinforcing your competitive edge with a resource designed to inform high-impact decision making.

- How big is the Isosorbide Market?

- What is the Isosorbide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?