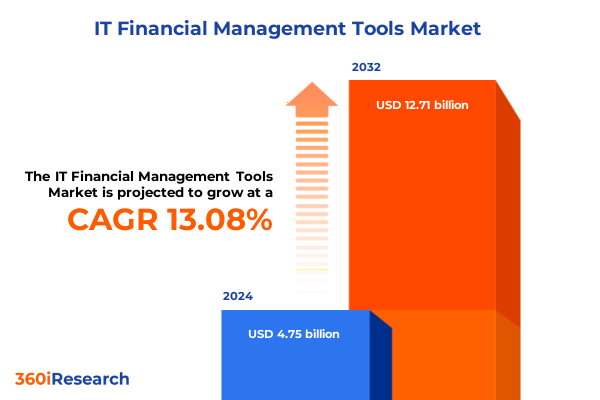

The IT Financial Management Tools Market size was estimated at USD 5.28 billion in 2025 and expected to reach USD 5.88 billion in 2026, at a CAGR of 13.34% to reach USD 12.71 billion by 2032.

Unveiling How IT Financial Management Tools Enhance Financial Transparency and Streamline Operational Efficiency Amid Digital Transformation

IT Financial Management (ITFM) tools have become critical enablers of organizational resilience and fiscal accountability in an era defined by relentless digital transformation. As enterprises accelerate their adoption of cloud architectures and AI-driven analytics, the ability to align IT expenditures with strategic objectives has shifted from a desirable capability to a foundational requirement. Finance professionals and IT stakeholders are no longer operating in silos; instead, they collaborate around a shared data ecosystem that demands real-time visibility into cost drivers, consumption patterns, and value delivery.

Transitioning from manual spreadsheet exercises to integrated platforms, leading organizations now harness sophisticated solutions that automate budgeting, forecasting, and cost transparency processes. This evolution fosters operational efficiency and empowers decision-makers with granular insights into software licensing, infrastructure utilization, and service delivery economics. By integrating financial planning with scenario modeling, businesses can simulate the impact of emerging technologies, adapt to market disruptions, and optimize resource allocation.

Against this backdrop, the growing complexity of multi-cloud deployments, hybrid environments, and consumption-based pricing underscores the need for a unified approach to IT financial management. The drive toward continuous optimization is further reinforced by stakeholder demands for accountability and the imperative to support sustainable business models. In essence, ITFM tools are no longer optional auxiliary systems; they are integral to realizing strategic objectives, controlling costs, and unlocking new avenues of innovation.

Exploring the Game-Changing Advances in AI, Cloud Connectivity, and Predictive Analytics Reshaping IT Financial Management

The landscape of IT financial management is undergoing transformative shifts driven by the convergence of advanced analytics, artificial intelligence, and cloud-native architectures. Organizations are increasingly leveraging AI to automate expense categorization, detect anomalies in real time, and generate actionable recommendations for cost optimization, elevating expense management from a transactional process to a strategic function.

Simultaneously, cloud-based ITFM platforms are gaining traction as they enable centralized governance, seamless integration with enterprise resource planning systems, and scalable infrastructure models that align costs with actual usage patterns. This shift towards consumption-based cost visibility fosters greater accountability across business units, minimizes budget variances, and accelerates financial close cycles.

Meanwhile, predictive analytics is reshaping forecasting and planning capabilities, allowing finance teams to anticipate future spending trends, mitigate risks, and adjust budgets dynamically. These insights reduce reliance on static forecasts and empower stakeholder collaboration through scenario modeling. Additionally, the emphasis on sustainability and ESG compliance has expanded the remit of ITFM solutions to include carbon tracking for travel and digital services, reflecting a broader commitment to responsible financial stewardship.

Collectively, these trends underscore a paradigm shift: IT financial management is no longer a retroactive reporting exercise but a proactive catalyst for business agility, cost governance, and technology-driven value creation.

Assessing the Broad Cost Ripples Triggered by 2025 U.S. Tariff Measures Across IT Hardware, Software Costs, and Service Models

The imposition of new U.S. tariffs in 2025 has introduced significant cost pressures across the IT ecosystem, with direct consequences for hardware procurement and broader operational expenses. Notably, servers and networking equipment from leading vendors such as Cisco and HPE are subject to additional import duties, resulting in price escalations estimated between 10% and 20% for enterprise-grade infrastructure components.

This surge in hardware costs has begun to cascade into software-related expenditures as organizations reassess infrastructure refresh cycles and recalibrate budget allocations. Although software licenses themselves are not directly tariffed, the higher baseline costs of hosting platforms often necessitate delayed upgrades and extended maintenance agreements, which in turn amplify total cost of ownership. Moreover, increased infrastructure spend has compelled many enterprises to explore alternative sourcing strategies, including vendor diversification and onshoring of critical component manufacturing.

In addition to hardware implications, the ripple effects of these tariffs are evident in IT service engagements and cloud migration initiatives. Providers are adjusting their pricing models to accommodate elevated capital outlays, while customers seek flexible arrangements such as usage-based subscriptions and infrastructure-as-a-service to mitigate upfront investments. The pursuit of hybrid and multi-cloud strategies has also gained momentum as organizations aim to optimize costs across geographically dispersed data centers and leverage regional trade agreements to avoid tariff-exposed supply chains.

Overall, while the long-term trajectory of trade policy remains uncertain, the 2025 tariff landscape has already catalyzed a reimagining of procurement, cost governance, and vendor management practices within the IT financial management domain.

Delving into the Multifaceted Segmentation Landscape That Defines Functionality, Organization Size, Industry, Pricing, and Deployment Dynamics

The market segmentation by functionality reveals a comprehensive spectrum of capabilities, starting with budgeting and forecasting, which encompasses both traditional financial planning and sophisticated forecast modeling techniques like predictive forecasting and scenario planning. This is complemented by IT cost transparency solutions that empower stakeholders with detailed visibility into resource utilization and chargeback models, as well as lease accounting modules that address compliance for capitalized assets. In parallel, reporting and analytics platforms integrate advanced analytics, operational reporting, and self-service business intelligence, delivering data-driven decision support. Spend management tools round out the functionality landscape by automating invoice management workflows and streamlining travel and expense processes for enhanced compliance and control.

When viewed through the lens of organization size, adoption patterns vary significantly: large enterprises prioritize scalable, centralized frameworks capable of managing complex global operations, while midsize firms often seek modular solutions that balance feature depth with cost efficiency. Small and medium enterprises, meanwhile, gravitate towards turnkey offerings that can be quickly deployed and easily maintained, reflecting resource constraints and a need for rapid time-to-value.

Industry vertical segmentation highlights distinct use cases and regulatory imperatives: for instance, banking and capital markets demand rigorous audit trails and granular cost allocations, whereas pharmaceuticals and healthcare providers emphasize compliance with strict healthcare accounting standards. Manufacturing sectors-both process and discrete-leverage cost transparency to optimize production overhead, while state and local government entities focus on budgetary control and compliance. Retail segments like brick-and-mortar and online channels rely on spend analytics for promotional ROI insights, and telecom operators balance investment cycles across wireless and wireline networks.

Pricing model segmentation ranges from perpetual license structures favored by organizations seeking predictable capital expenditures to subscription models that align with operational cost paradigms, and usage-based pricing that offers elasticity in dynamic consumption environments. Finally, deployment preferences span cloud-native, hybrid, and on-premises models, reflecting varying risk tolerances, data sovereignty requirements, and integration complexities.

This comprehensive research report categorizes the IT Financial Management Tools market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Functionality

- Organization Size

- Industry Vertical

- Deployment Model

Uncovering the Distinct Regional Catalysts Driving IT Financial Management Adoption Across Americas, EMEA, and Asia-Pacific

Regional dynamics are shaping differential adoption trajectories in the Americas, where digital transformation initiatives are fueling demand for integrated financial management solutions that support a vast ecosystem of corporate headquarters, regional business units, and shared services centers. In this market, innovation is driven by the convergence of fintech advancements and enterprise resource management systems, with a focus on real-time cost visibility and agile financial planning.

Across Europe, the Middle East, and Africa, regulatory frameworks such as GDPR, IFRS 16, and regional tax regimes inform solution requirements, prompting vendors to embed compliance features and localized reporting functionality. Growth in this region is further propelled by government-driven digital agenda programs, which incentivize public sector entities to adopt transparent budgeting tools and leverage hybrid cloud architectures for secure data stewardship.

In the Asia-Pacific region, rapid cloud-first adoption and robust mobile-first economies are accelerating uptake of ITFM tools, particularly among technology-driven verticals like telecommunications and online services. Emerging markets in Southeast Asia showcase a surge in small and medium enterprise implementations, while mature economies such as Australia and Japan emphasize advanced analytics and AI-augmented forecasting to navigate market volatility and supply chain complexities.

This comprehensive research report examines key regions that drive the evolution of the IT Financial Management Tools market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Vendors and Innovative Challengers Are Elevating ITFM Solutions Through AI, ESG Integration, and Strategic Alliances

Leading technology providers are enhancing their ITFM portfolios through strategic investments in AI-driven analytics, seamless integrations, and expanded service ecosystems. One prominent vendor has augmented its cloud platform with predictive cost modeling capabilities, enabling finance teams to simulate budget scenarios against real-time usage metrics. Another market leader has introduced a unified data lake architecture that consolidates cost and performance data from multiple cloud environments, unlocking deep analytical insights and reducing reporting cycle times.

Innovative challengers are differentiating with specialized modules for travel and expense management, embedding sustainability tracking features that quantify carbon emissions associated with business travel. These solutions not only drive cost efficiency but also support corporate ESG objectives by providing transparency into environmental impact. Additionally, several firms have expanded their professional services offerings to include advisory engagements, helping organizations optimize licensing agreements, negotiate vendor contracts, and implement change management programs to maximize tool adoption.

Strategic partnerships are also reshaping the competitive landscape, with alliances formed between ITFM vendors and major ERP or cloud infrastructure providers. Such collaborations streamline integration pathways and enhance end-to-end visibility across financial and operational domains. Collectively, these developments underscore a dynamic vendor ecosystem characterized by continuous innovation, expanding capabilities, and evolving go-to-market models.

This comprehensive research report delivers an in-depth overview of the principal market players in the IT Financial Management Tools market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anaplan, Inc.

- Board International S.A.

- CCH Tagetik

- Centage Corporation

- IBM Corporation

- Infor, Inc.

- Jedox GmbH

- Kepion Solutions, Inc.

- Longview Solutions, Inc

- Lucanet GmbH

- OneStream Software LLC

- Oracle Corporation

- Planful, Inc.

- Prophix Software, Inc.

- SAP SE

- Solver, Inc.

- Unit4 N.V.

- Vena Solutions, Inc.

- Wolters Kluwer N.V.

- Workday, Inc.

Actionable Strategies for Embedding AI, Cloud-Native Frameworks, and Sustainability Metrics into IT Financial Management Ecosystems

Industry leaders should prioritize the integration of AI-powered analytics into core IT financial workflows to drive proactive cost management and elevate the strategic role of finance teams. By embedding machine learning models that detect spend anomalies, organizations can uncover hidden savings opportunities and reduce budget variances before they materialize.

Furthermore, adopting a cloud-first deployment strategy-augmented by hybrid models where necessary-enables flexible scaling of resources and optimizes infrastructure costs. Leaders are encouraged to evaluate usage-based pricing agreements to ensure that expenditure aligns with consumption, thereby avoiding overcommitment and underutilization of resources.

Collaboration between IT, finance, and procurement functions is essential to establish a culture of accountability and continuous improvement. A governance framework that aligns cost transparency metrics with organizational objectives will facilitate informed decision-making, while executive sponsorship can accelerate adoption and drive measurable outcomes.

Finally, incorporating sustainability metrics into IT financial management practices can support ESG commitments and meet stakeholder expectations. By tracking carbon emissions associated with technology consumption and travel, organizations not only enhance their corporate responsibility profiles but also identify efficiency gains that contribute to both financial and environmental goals.

Detailing the Comprehensive Primary, Secondary, and Validation Processes That Underpin Our ITFM Market Insights

The research methodology combines primary interviews, secondary analysis, and rigorous validation to ensure comprehensive coverage and factual accuracy. In the primary phase, in-depth discussions were conducted with CFOs, IT directors, and financial controllers across diverse industry verticals, capturing firsthand insights into current challenges, solution requirements, and best practices.

Secondary research involved a thorough review of industry publications, regulatory documentation, vendor whitepapers, and publicly available case studies. This desk research provided context on macroeconomic influences-such as trade policy and compliance mandates-and informed the understanding of regional market dynamics.

Quantitative data was collected through a structured survey targeting finance and IT professionals, enabling segmentation analysis across functionality, organization size, industry vertical, pricing model, and deployment preference. The data was triangulated against vendor-reported metrics and third-party reports to validate trends and ensure consistency.

Finally, a validation workshop engaged industry experts and solution providers to challenge assumptions, refine insights, and verify conclusions. This multi-step approach underpins the robustness of the findings and supports actionable recommendations for market participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IT Financial Management Tools market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IT Financial Management Tools Market, by Functionality

- IT Financial Management Tools Market, by Organization Size

- IT Financial Management Tools Market, by Industry Vertical

- IT Financial Management Tools Market, by Deployment Model

- IT Financial Management Tools Market, by Region

- IT Financial Management Tools Market, by Group

- IT Financial Management Tools Market, by Country

- United States IT Financial Management Tools Market

- China IT Financial Management Tools Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights on the Future of IT Financial Management as a Driver of Governance, Agility, and Sustainable Value Creation

As organizations navigate an increasingly complex technology landscape, IT financial management tools emerge as indispensable catalysts for transparent governance and strategic agility. The confluence of AI, cloud architectures, and predictive analytics has redefined the role of finance teams, enabling them to partner effectively with IT counterparts and transform cost data into actionable intelligence.

Looking ahead, the ability to integrate sustainability considerations, adapt to dynamic pricing models, and respond to evolving trade policies will determine the leaders in this space. By embracing a forward-looking approach to budgeting, real-time cost transparency, and scenario-driven planning, businesses can not only control expenditures but also unlock new value streams through optimized technology investments.

Ultimately, success in the ITFM domain hinges on the seamless convergence of people, processes, and platforms. Organizations that foster collaboration across finance and IT, invest in advanced analytics capabilities, and maintain agile governance frameworks will be best positioned to thrive amidst market uncertainties and drive sustained competitive advantage.

Seize the Opportunity to Partner with Ketan Rohom for Exclusive Access to the Definitive IT Financial Management Tools Market Research Report

Unlock unparalleled insights and strategic foresight by securing your copy of the comprehensive market research report on IT Financial Management Tools. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored licensing options, discuss customizable research add-ons, and gain immediate access to actionable intelligence. Connect with Ketan today to navigate complex market dynamics with confidence and position your organization at the forefront of financial transformation.

- How big is the IT Financial Management Tools Market?

- What is the IT Financial Management Tools Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?