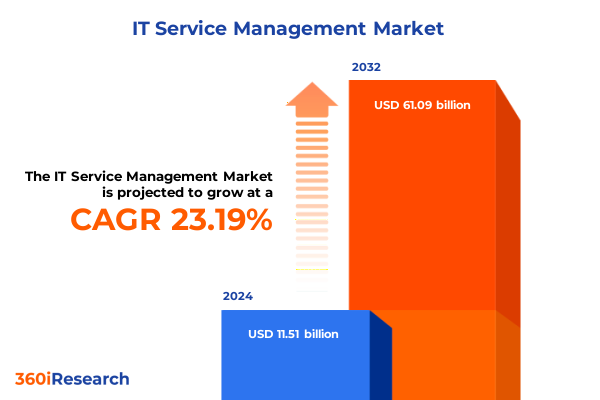

The IT Service Management Market size was estimated at USD 14.03 billion in 2025 and expected to reach USD 17.10 billion in 2026, at a CAGR of 23.38% to reach USD 61.09 billion by 2032.

Understanding the Evolving Foundations of Modern IT Service Management Amid Rapid Digital and AI-Driven Transformations

Modern organizations are navigating an increasingly complex landscape of digital services, where the traditional reactive approach to managing IT operations is no longer sufficient. As businesses integrate artificial intelligence, cloud ecosystems, and hybrid environments, the expectations placed on IT service management have evolved from simply resolving incidents to driving operational resilience and innovation. This shift demands a holistic framework that unites service delivery with strategic objectives, ensuring alignment between technology investments and business goals.

In this transformative era, IT teams are under pressure to deliver seamless experiences for both internal stakeholders and external customers. The rise of AI-powered automation and predictive analytics has begun to redefine the role of service desks, enabling proactive incident prevention and accelerating resolution times. These advancements, coupled with the steady growth in IT services spending reported by industry analysis, underscore a critical inflection point where strategic IT service management becomes essential for sustaining competitive advantage.

Exploring the Groundbreaking Shifts Reshaping IT Service Management Through AI, Cloud, and Next-Generation Innovative Platforms

Across the IT service management landscape, organizations are embracing transformative technologies that are redefining traditional support models. Generative AI and machine learning tools are no longer novelties but core components that enable intent-driven support and self-service experiences. By embedding AI copilots and virtual agents into service portals, enterprises can triage and resolve routine issues autonomously, freeing human experts to focus on high-value, strategic priorities. This convergence of AI and ITSM accelerates a shift from form-based ticketing to context-aware problem-solving, driving productivity gains and elevating the user experience.

Simultaneously, the migration to cloud-native architectures has unlocked unprecedented scalability and flexibility for service management platforms. Organizations are integrating ITSM with DevOps, SecOps, and FinOps to create unified platforms that manage incidents, vulnerabilities, and financial operations within a single governance framework. This unified approach enhances visibility across tech, security, and budget dimensions, enabling real-time orchestration of services and fostering a culture of continuous improvement. As enterprises adapt to hybrid and multi-cloud environments, these convergent platforms become the backbone of resilient and agile IT operations.

Examining the Cascading Economic and Operational Impact of US Tariff Changes on ITSM and Infrastructure Strategies Reshaping Technology Sourcing

In early 2025, the Office of the United States Trade Representative concluded its statutory review and announced significant increases in Section 301 tariffs on Chinese imports, raising duties on key technology components such as solar wafers, polysilicon, and certain semiconductor materials to 50 percent and tungsten products to 25 percent effective January 1, 2025. These measures, aimed at counterbalancing state-subsidized industries abroad, coincide with preexisting tariffs on electric vehicles and lithium-ion batteries, some of which reached 100 percent duty in late 2024.

The cascading effects on IT service management are profound. Elevated tariffs on semiconductor materials and hardware components drive up the cost of on-premises infrastructure, compelling organizations to reassess total cost of ownership and consider cloud and hybrid deployments more seriously. At the same time, supply chain disruptions linked to tariff-driven import delays can impede the rollout of new data center hardware, forcing IT teams to prolong equipment lifecycles or optimize existing assets through advanced monitoring and orchestration tools. As a result, service management strategies must adapt to navigate these economic headwinds while maintaining service quality and operational continuity.

Unlocking Strategic Perspectives from Component, Deployment, Organizational Size, and Vertical Segmentation in IT Service Management Markets

Analyzing market segmentation provides nuanced insights that inform targeted strategies for IT service management offerings. When considering components, services such as managed and professional offerings play pivotal roles in complementing solution suites that encompass configuration and change management, service desks, and portfolio management capabilities. This dual focus ensures that organizations can both maintain day-to-day operations and drive systematic improvements across their IT environments.

Deployment models further influence service priorities and operational models, where cloud-based services offer scalability and agility while on-premises solutions deliver control and customization for sensitive workloads. The choice between these models often correlates with an organization’s size, as large enterprises tend to balance hybrid estates with complex governance requirements, whereas small and medium enterprises may favor cloud solutions for their simplicity and cost-effectiveness.

Vertical-specific dynamics also shape ITSM adoption patterns. Industries such as banking, financial services, and insurance demand stringent compliance and risk management capabilities, while healthcare organizations prioritize patient-centric support and data privacy. Media, retail, telecommunications, and travel and hospitality sectors emphasize rapid incident response and customer experience, driving demand for flexible, automated service management platforms.

This comprehensive research report categorizes the IT Service Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Organization Size

- Vertical

Revealing Regional Dynamics and Growth Patterns Across Americas, Europe Middle East Africa, and Asia Pacific IT Service Management Landscapes

Regional dynamics reveal diverse priorities and growth patterns across the global IT service management landscape. In the Americas, enterprises leverage mature service management practices to optimize large-scale data centers, integrating AI-driven automation to support complex regulatory frameworks and advanced analytics initiatives. This region’s emphasis on innovation accelerators has made it a testbed for next-generation service management approaches.

Across Europe, Middle East, and Africa, the focus lies in harmonizing cross-border compliance and developing unified platforms that span multiple legal jurisdictions. Organizations in these markets are investing in multilingual service portals and robust security operations integrations to ensure consistent service experiences while managing diverse regulatory environments.

Asia-Pacific stands out for its rapid digital transformation and aggressive adoption of cloud-native solutions. Businesses across the region, from China to emerging Southeast Asian markets, are prioritizing scalable service delivery models and AI-enhanced platforms. The drive for competitive differentiation and operational resilience underpins significant investments in advanced ITSM capabilities that support the demands of an increasingly digital economy.

This comprehensive research report examines key regions that drive the evolution of the IT Service Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading IT Service Management Providers and Their Differentiation Strategies That Drive Innovation and Competitive Advantage

A review of leading IT service management providers highlights the varying approaches to innovation and market positioning. Some focus on delivering comprehensive, integrated suites that cover the full spectrum of incident, problem, and change management workflows, leveraging embedded AI and predictive analytics to minimize downtime. Others differentiate by specializing in modular solutions that allow for rapid implementation and tight integration with existing enterprise ecosystems.

Key players are advancing their platforms with low-code customization, enabling clients to tailor workflows without extensive development efforts. Strategic partnerships with cloud hyperscalers and security vendors further enhance these providers’ offerings, creating holistic solutions that address both operational and risk management requirements. As the market evolves, competitive advantage increasingly hinges on the ability to blend service excellence with forward-looking capabilities such as AI-driven orchestration and unified digital experience monitoring.

This comprehensive research report delivers an in-depth overview of the principal market players in the IT Service Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 4me, Inc.

- Atlassian Corporation PLC

- AutomationEdge Pvt. Ltd.

- BMC Software, Inc.

- Broadcom Inc.

- Cisco Systems, Inc.

- Citrix by Cloud Software Group, Inc.

- ClickUp Service

- Freshworks Inc.

- Halo Service Desk

- Hewlett Packard Enterprise Company

- Hornbill Corporate Limited

- International Business Machines Corporation

- ITarian LLC

- Ivanti, Inc.

- Kaseya Inc.

- Microsoft Corporation

- NinjaOne, LLC

- Open Text Corporation

- Oracle Corporation

- Rworks, Inc.

- Serviceaide, Inc.

- ServiceNow, Inc.

- SolarWinds Corporation

- SymphonyAI Summit

- SysAid Technologies Ltd.

- Tata Consultancy Services Limited

- TeamDynamix

- TOPdesk Nederland BV

- Vivantio Holdings Inc.

- Wipro Limited

- Zendesk, Inc.

Strategic Roadmap for Industry Leaders to Optimize IT Service Management Practices and Navigate Emerging Challenges with Confidence

To stay ahead of emerging challenges, industry leaders should prioritize the integration of AI-powered automation within service management frameworks. By embedding intelligent assistants and predictive analytics tools, organizations can shift from reactive incident handling to proactive problem prevention, reducing mean time to resolution and improving user satisfaction.

In parallel, adopting a platform convergence strategy that unites IT operations, security, and financial workflows can eliminate operational silos and provide a comprehensive view of service health. This holistic perspective enables efficient resource allocation and more effective governance across complex hybrid environments.

Finally, continuous investment in talent development and change management practices is critical. Equipping service teams with up-to-date skills in AI, cloud orchestration, and agile methodologies ensures that organizations can fully realize the benefits of advanced ITSM capabilities while cultivating a culture of innovation and resilience.

Comprehensive Overview of Research Design Data Collection and Analytical Approaches Underpinning This IT Service Management Study

This study was underpinned by a rigorous research design that combined primary interviews with senior IT and business decision-makers across multiple industries and geographies, alongside in-depth secondary research. The primary phase involved structured discussions to capture firsthand perspectives on service management priorities, technological adoption, and organizational challenges.

Secondary research encompassed the analysis of recent regulatory announcements, industry reports, and reputable news sources to validate emerging trends and quantify the impacts of policy shifts. Analytical approaches included qualitative trend analysis and cross-segmentation evaluation, ensuring that insights reflect the nuanced realities of diverse deployment models, organizational sizes, and vertical requirements.

By triangulating primary and secondary inputs, the methodology delivers a comprehensive view of the IT service management landscape, offering actionable intelligence that aligns strategic imperatives with real-world operational considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IT Service Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IT Service Management Market, by Component

- IT Service Management Market, by Deployment

- IT Service Management Market, by Organization Size

- IT Service Management Market, by Vertical

- IT Service Management Market, by Region

- IT Service Management Market, by Group

- IT Service Management Market, by Country

- United States IT Service Management Market

- China IT Service Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesis of Key Findings and Strategic Implications for Future-Proofing IT Service Management in an Era of Continuous Innovation

As the IT service management landscape continues to evolve under the influence of AI, cloud, and policy-driven cost pressures, organizations must adopt a balanced approach that emphasizes both innovation and operational stability. The integration of intelligent automation and platform convergence will be instrumental in driving efficiency gains and delivering superior user experiences.

Simultaneously, strategic responses to external factors such as tariff increases underscore the importance of flexible deployment strategies and robust lifecycle management. By fostering cross-functional collaboration and investing in continuous learning, businesses can future-proof their service operations and maintain resilience in the face of economic uncertainties.

Ultimately, IT service management will serve as a critical enabler for digital transformation, equipping enterprises with the agility, visibility, and control needed to navigate an increasingly complex technology environment.

Engage with Ketan Rohom to Acquire the Definitive IT Service Management Market Research Report and Unlock Tailored Strategic Insights

Thank you for considering this comprehensive market research report. To access the complete analysis and receive tailored insights that align with your organization’s strategic objectives, please reach out to Ketan Rohom. As the Associate Director of Sales & Marketing, he is ready to guide you through the report’s rich findings and demonstrate how they can support your IT service management initiatives. Engaging with Ketan will ensure you secure a solution that addresses your specific challenges, leverages emerging opportunities, and equips your team with actionable intelligence. Contact him today to acquire the definitive report and unlock the strategic insights you need to drive transformative outcomes.

- How big is the IT Service Management Market?

- What is the IT Service Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?