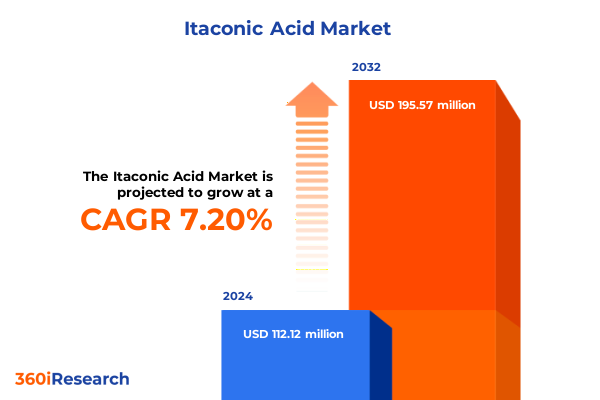

The Itaconic Acid Market size was estimated at USD 120.13 million in 2025 and expected to reach USD 132.93 million in 2026, at a CAGR of 7.20% to reach USD 195.56 million by 2032.

Unraveling the Multifaceted Role of Itaconic Acid as a Sustainable Building Block and High-Value Bio-Based Platform Chemical in Modern Industrial Applications

Itaconic Acid has emerged as a versatile bio-based platform chemical, renowned for its unique molecular structure and diverse functional properties. Derived through fermentation processes, its origin in renewable feedstocks aligns with the global shift toward sustainable solutions. As a dicarboxylic acid, it offers remarkable reactivity, enabling its use as a monomer, co-monomer, crosslinking agent, and chemical intermediate within a wide array of industrial applications.

Over recent years, increased emphasis on circular economy principles has propelled itaconic acid into the spotlight. Its biodegradability and low toxicity position it as a preferred alternative to petroleum-derived analogues, particularly in sectors where environmental compliance intersects with performance demands. Simultaneously, advances in microbial strain engineering and process optimization have driven down production costs, making itaconic acid commercially viable at scale.

This introduction sets the stage for exploring the transformational forces reshaping production methodologies, regulatory impacts influencing cost structures, and market segmentation insights that reveal shifting consumption patterns. By understanding both the intrinsic chemical advantages and the evolving context of industrial demand, stakeholders can better navigate the complexities of a maturing itaconic acid market and identify pathways for sustainable innovation and growth.

Exploring the Paradigm Shift Driven by Biotechnological Innovations and Sustainability Imperatives in the Evolution of Itaconic Acid Production Processes

Recent years have witnessed a paradigm shift that transcends incremental improvements, driven by breakthroughs in biotechnological processes and heightened sustainability mandates. Traditional fermentation platforms, once constrained by low yields and high operational costs, have been revolutionized by genetically optimized microbial strains capable of converting carbohydrate feedstocks into high-purity itaconic acid with unprecedented efficiency. These proprietary strains, coupled with advanced fermentation management systems, have slashed downstream purification requirements, fundamentally altering production economics.

Moreover, the rising prevalence of green chemistry principles has galvanized investment into catalysis-based conversion pathways, enabling chemical modifications without generating hazardous by-products. Industries historically reliant on petrochemical derivates are increasingly adopting bio-derived itaconic acid for polymer synthesis, adhesives, and coatings, a trend fueled by stringent regulations on volatile organic compound emissions. As a result, collaborative partnerships between biotech firms and specialty chemical companies have become commonplace, with joint ventures focusing on expanding production capacities and scaling novel process technologies.

In parallel, digital transformation initiatives-ranging from predictive maintenance of bioreactors to AI-driven yield optimization-are enabling producers to refine operational efficiencies and accelerate time-to-market. Collectively, these shifts underscore a landscape in which technological innovation and environmental stewardship converge, setting the trajectory for the next generation of itaconic acid production and utilization.

Assessing the Strategic Consequences of 2025 United States Tariff Policies on the Supply Chain Dynamics and Competitive Landscape of Itaconic Acid Market

The introduction of new U.S. tariff measures in early 2025 has reshaped cost structures and supply chain dynamics for itaconic acid, prompting stakeholders to reassess sourcing and production strategies. Tariffs imposed on key intermediates and import categories have elevated landed costs of certain chemical inputs, compelling manufacturers to pivot toward greater domestic integration or to absorb incremental expenses to maintain market presence.

Consequently, North American producers with in-region fermentation facilities have gained a strategic advantage, as their vertically integrated setups mitigate exposure to tariff volatility. Purchasing managers are reevaluating vendor contracts, renegotiating terms with suppliers, and exploring alternative feedstocks to offset escalated raw material outlays. At the same time, distributors have had to adapt their pricing structures, balancing margin preservation against end-user affordability requirements.

Furthermore, these trade policies have sparked renewed interest in backward integration, with some specialty chemical suppliers accelerating plans to acquire or develop fermentation assets within tariff-protected jurisdictions. Meanwhile, end-market manufacturers in high-growth segments such as adhesives and personal care continue to weigh the ramifications of cost pass-through against competitive pricing pressures. Overall, the cumulative impact of tariff adjustments underscores the importance of supply chain resilience and strategic flexibility in an increasingly complex global trading environment.

Illuminating Key Market Segmentation Revealing Diverse Grade, Form, Distribution Channel, and Application Patterns Shaping Itaconic Acid Consumption Trends

A granular view of the itaconic acid market reveals distinct consumption behaviors across various segmentation criteria. When examining the market based on grade, itaconic acid finds applications in food-grade products for flavor enhancement and as an acidulant, in industrial-grade formulations for specialty polymers and coatings, and in pharmaceutical-grade preparations for drug delivery systems and excipient functions.

Shifting the lens to form, crystalline powder remains the preferred choice for processes requiring precise dosing and solid-state reactions, whereas solution form is gaining traction in continuous flow operations and downstream polymerization systems due to its ease of integration into liquid processing lines.

Turning to distribution channels, direct procurement by large-scale industrial end users enables just-in-time inventory management, while traditional distributors facilitate access for mid-tier manufacturers who rely on regional stocking hubs. In parallel, online platforms have emerged as a convenient avenue for smaller enterprises and R&D laboratories to source technical-grade materials with rapid delivery and minimal order quantities.

Additionally, application-based segmentation underscores the diversity of itaconic acid usage. In adhesives and sealants, non-structural formulations exploit its crosslinking ability for pressure-sensitive tapes, while structural adhesives leverage its polymer backbone to enhance bond strength. Coatings applications range from eco-friendly architectural paints to automotive finishes and industrial protective layers. In personal care and cosmetics, itaconic acid derivatives serve as viscosity modifiers in hair care, pH stabilizers in oral formulations, and texture enhancers in skin care products. Pharmaceutical applications capitalize on its biodegradability for controlled release matrices, and resins & plastics segments utilize acrylic, polyester, and unsaturated polyester resins to achieve tailored mechanical and thermal properties.

This comprehensive research report categorizes the Itaconic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Distribution Channel

- Application

Mapping Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia-Pacific to Understand Itaconic Acid Demand Variations

Geographical analysis of itaconic acid consumption highlights distinctive drivers and adoption rates across major regions. In the Americas, robust investment in sustainable building materials and a strong pharmaceutical manufacturing base have fostered demand for environmentally friendly monomers. The presence of fermentation infrastructure and supportive regulatory frameworks has accelerated the substitution of petrochemical alternatives with bio-based itaconic acid.

Meanwhile, Europe, the Middle East, and Africa reflect a heterogeneous landscape where stringent chemical regulations and ambitious carbon reduction targets have incentivized green chemical adoption. Western European nations lead in specialty polymer applications, whereas emerging markets in Eastern Europe and North Africa show nascent interest driven by increasing industrialization. Middle Eastern petrochemical hubs are exploring derivative pathways to diversify their downstream portfolios beyond traditional olefins.

In the Asia-Pacific region, rapid urbanization and expansion of the construction sector have generated significant opportunities in coatings and adhesives. Moreover, key markets such as China, South Korea, and Japan have intensified R&D initiatives focused on microbial strain improvement, underscoring an ambition to secure leadership in sustainable chemical production. At the same time, Southeast Asian economies are emerging as important hubs for contract manufacturing due to competitive feedstock availability and improving biotechnology ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Itaconic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Leaders Driving Innovation, Strategic Collaborations, and Competitive Differentiation in the Global Itaconic Acid Value Chain Ecosystem

The competitive landscape of the itaconic acid market is characterized by a blend of specialized bioprocessing innovators and established chemical conglomerates. Leading technology developers have focused on strain enhancement and process intensification while traditional chemical players have leveraged their distribution networks and capital resources to scale fermentation-based production.

A number of first movers have established pilot and commercial-scale facilities, securing supply agreements with downstream polyurethane and polyester resin manufacturers. These alliances illustrate a strategic emphasis on collaborative innovation, with co-development projects aimed at producing tailored itaconic acid derivatives for high-value performance segments. At the same time, some regional producers have differentiated themselves through proprietary purification technologies that deliver ultra-high-purity grades suitable for pharmaceutical and personal care applications.

Beyond production capabilities, market leaders are investing in sustainability certifications and life cycle assessments to validate the environmental advantages of their bio-based offerings. Additionally, several entities have formed research partnerships with academic institutions to explore novel catalytic conversion routes, reflecting a longer-term vision toward expanded chemical diversity. Collectively, these strategic maneuvers underscore an industry in transition, where technological prowess and go-to-market agility determine competitive positioning.

This comprehensive research report delivers an in-depth overview of the principal market players in the Itaconic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha Chemika

- Biomol GmbH

- Chengdu Jinkai Biology Engineering Co., Ltd.

- ENSINCE Chemical Co.. Ltd

- Glentham Life Sciences Limited

- Hongda Group

- LKT Laboratories

- Merck KGaA

- NOVASOL N.V./S.A.

- Otto Chemie Pvt. Ltd.

- Qingdao Kehai Biochemistry Co., Ltd.

- Qingdao Langyatai Group Co., Ltd.

- Ronas Chemicals Ind. Co., Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Zhejiang Guoguang Biochemistry Co., Ltd.

Proposing Actionable Strategic Initiatives for Industry Stakeholders to Accelerate Adoption, Optimize Processes, and Strengthen Market Position in Itaconic Acid

Industry stakeholders can capitalize on the evolving itaconic acid landscape by prioritizing strategic initiatives that align with both market demands and regulatory imperatives. First, enhancing fermentation yield and productivity through iterative strain development remains critical; by allocating R&D resources toward the discovery of robust microbial platforms, players can reduce unit production costs and mitigate raw material volatility.

Concurrently, forging partnerships between biotech startups, specialty chemical companies, and end users can create co-development pipelines for application-specific derivatives, accelerating time-to-market and sharing technological risk. Embracing digital process controls-such as advanced analytics for real-time monitoring and predictive maintenance-will further optimize operational efficiencies and support scalable expansion.

On the market-facing side, diversifying channel strategies by strengthening direct-sales capabilities for key industrial clients while cultivating e-commerce channels for niche R&D markets can broaden revenue streams. Additionally, pursuing sustainability certifications and participating in industry consortia will enhance brand reputation and facilitate entry into regulated markets. Finally, proactive engagement with policymakers around trade policy and environmental standards will enable companies to anticipate regulatory shifts and advocate for balanced frameworks that support continued innovation.

Outlining Rigorous Research Methodology and Analytical Techniques Employed to Ensure Data Integrity, Comprehensive Coverage, and Actionable Market Insights

This study employs a hybrid research approach that integrates primary and secondary data sources to ensure comprehensive coverage of the itaconic acid sector. Primary insights derive from interviews with industry experts, including process engineers, R&D directors, and procurement managers, providing firsthand perspectives on technological advancements and market drivers.

Secondary research encompasses the analysis of scientific journals, patent filings, regulatory databases, and trade publications to track emerging fermentation methodologies and application developments. Detailed mapping of supply chain configurations, including feedstock sourcing and distribution networks, was conducted through proprietary supplier databases and customs data analysis. Quantitative inputs, such as production capacities and capacity utilization trends, were corroborated through company disclosures and cross-verified via direct communication with facility managers.

To ensure analytical rigor, data triangulation was applied, reconciling varying sources to validate key findings. In addition, an iterative review process involving external consultants and academic advisors was undertaken to refine methodological assumptions and strengthen the credibility of qualitative interpretations. This robust methodology provides the foundation for delivering actionable insights and strategic recommendations tailored to a diverse set of market participants.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Itaconic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Itaconic Acid Market, by Grade

- Itaconic Acid Market, by Form

- Itaconic Acid Market, by Distribution Channel

- Itaconic Acid Market, by Application

- Itaconic Acid Market, by Region

- Itaconic Acid Market, by Group

- Itaconic Acid Market, by Country

- United States Itaconic Acid Market

- China Itaconic Acid Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Critical Insights and Future Pathways to Empower Decision Makers with a Holistic Perspective on the Evolution and Growth Potential of Itaconic Acid

Our examination of the itaconic acid industry reveals a dynamic interplay between technological innovation, sustainability priorities, and evolving trade policies. The maturation of fermentation platforms, coupled with emerging catalysis routes, has expanded the scope of downstream applications and bolstered the appeal of itaconic acid as a renewable alternative to petrochemical counterparts.

Meanwhile, the implementation of new tariff measures in 2025 has underscored the importance of supply chain resilience, prompting a realignment of sourcing strategies toward regional integration and strategic partnerships. Distinct segmentation insights across grade, form, distribution, and application illustrate the varied adoption patterns that market participants must navigate. Additionally, regional analyses highlight the differentiated drivers shaping demand across the Americas, EMEA, and Asia-Pacific.

Looking ahead, success in this sector will hinge on the ability of industry leaders to integrate advanced bioprocess technologies, nurture collaborative innovation ecosystems, and proactively engage with policymakers to foster supportive regulatory environments. By synthesizing these critical insights, decision makers can chart a course that leverages itaconic acid’s intrinsic advantages and positions their organizations for sustained competitive growth in an increasingly bio-based chemical landscape.

Discover How You Can Secure Your Comprehensive Itaconic Acid Market Research Report with Expert Guidance from Ketan Rohom to Drive Strategic Business Growth

For tailored guidance on leveraging the insights detailed in this report, reach out to Ketan Rohom (Associate Director, Sales & Marketing) to secure your comprehensive Itaconic Acid market research package. Engage directly with a seasoned expert who can provide bespoke consultations to align our findings with your strategic goals. By partnering with a dedicated specialist, you’ll gain streamlined access to deeper data analyses, customized briefing sessions, and priority support for any follow-up inquiries. This collaboration ensures you maximize the value of our research, translating market understanding into actionable growth strategies. Don’t miss the opportunity to tap into nuanced trends, regulatory intelligence, and competitive benchmarks-all designed to strengthen your position within the evolving Itaconic Acid landscape

- How big is the Itaconic Acid Market?

- What is the Itaconic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?