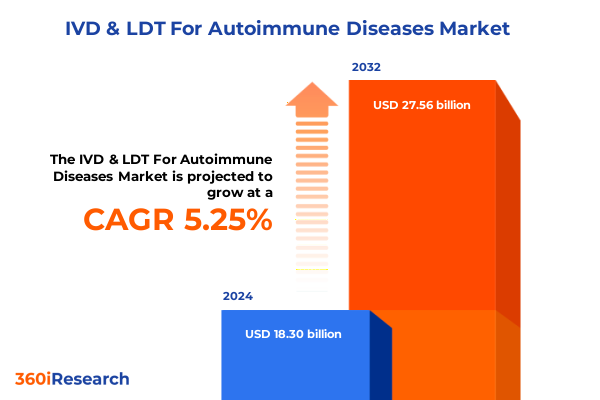

The IVD & LDT For Autoimmune Diseases Market size was estimated at USD 19.26 billion in 2025 and expected to reach USD 20.28 billion in 2026, at a CAGR of 5.25% to reach USD 27.56 billion by 2032.

Establishing the Foundation for Understanding the Intricacies and Imperatives of IVD and LDT in Autoimmune Disease Diagnostics

The diagnosis of autoimmune diseases has become increasingly complex, given the spectrum of disorders and the intricate immunological markers they present. In this evolving environment, both in vitro diagnostic devices and lab developed tests play pivotal roles in identifying key biomarkers that guide clinical decision-making. As diagnostic laboratories seek higher levels of precision, sensitivity, and throughput, the interplay between these testing modalities has emerged as a critical focal point for researchers, clinicians, and industry stakeholders alike.

Moreover, the escalating prevalence of conditions such as rheumatoid arthritis, systemic lupus erythematosus, and type 1 diabetes underscores the urgent need for streamlined testing pathways. Recent advances in assay technologies now offer unprecedented opportunities to refine diagnostic accuracy through targeted biomarker detection. From antibody subsets to cell-mediated immune profiles, the expanding test repertoire promises to transform patient care by enabling earlier interventions and personalized treatment strategies.

Consequently, understanding the current dynamics of the autoimmune diagnostic market lays the foundation for anticipating future developments. By mapping key drivers, challenges, and technological inflection points, leaders can position themselves to address unmet clinical needs and capitalize on emerging opportunities. This introduction provides the context for a comprehensive exploration of the landscape, illuminating the forces shaping the trajectory of IVD and LDT for autoimmune diseases.

Navigating Disruptive Technological Innovations and Strategic Realignments Shaping the Autoimmune Diagnostics Ecosystem

Over the past several years, transformative shifts in the autoimmune diagnostics landscape have accelerated as novel assay platforms and digital health solutions converge. High-throughput multiplex immunoassays now enable simultaneous measurement of multiple autoantibodies, significantly reducing time to result and improving cost efficiency compared to traditional single-target approaches. Concurrent developments in chemiluminescence immunoassay platforms have elevated sensitivity and specificity, while fluorescence methods bring enhanced dynamic ranges for detecting low-abundance biomarkers. These innovations are redefining the clinical utility of tests such as anti cyclic citrullinated peptide and antinuclear antibody assays, driving deeper insights into disease onset and progression.

In parallel, the regulatory environment for lab developed tests has undergone substantial realignment, with increased scrutiny on analytical validation and quality control. As a result, stakeholders are adopting more rigorous frameworks for test design and performance verification. Partnerships between diagnostic manufacturers and academic research institutes are proliferating, fostering co-development initiatives that bridge translational research with commercial-scale manufacturing. This collaborative ethos extends to reference laboratories, where integration of advanced platforms and data analytics is empowering clinicians with real-time decision support.

Looking ahead, emerging digital tools such as artificial intelligence–augmented interpretation and cloud-based data sharing will further disrupt traditional testing paradigms. These shifts underscore the need for flexibility and strategic foresight, as organizations navigate both technological convergence and evolving stakeholder expectations in autoimmune disease diagnostics.

Assessing the Far-Reaching Consequences of Newly Implemented U.S. Tariff Policies on Autoimmune Diagnostic Supply Chains

The implementation of new U.S. tariff policies in early 2025 has introduced multifaceted consequences for the autoimmune diagnostics supply chain and operational strategies. Diagnostic kit components sourced from international suppliers, including key reagents used in enzyme linked immunosorbent assay and fluorescence immunoassay platforms, have experienced tariff-driven cost escalations. As import duties increased, manufacturers were compelled to reassess their sourcing strategies, often reallocating supplier agreements or pursuing local contract manufacturing to mitigate financial pressures.

This tariff environment has also influenced the pricing dynamics of serum and plasma sample processing instruments commonly utilized in hospital and diagnostic laboratories. In response, some end users have accelerated investments in dried blood spot testing capabilities, recognizing the reduced logistical burden and lower dependency on imported consumables. Academic and research institutes have likewise restructured procurement protocols, consolidating vendor relationships to leverage volume discounts and supply chain resilience.

Moreover, the cumulative impact of tariffs extends beyond direct costs. Extended lead times for overseas shipments have prompted organizations to refine inventory management practices and expand warehousing capacities. Consequently, lab developed test developers are incorporating tariff considerations into their product roadmaps, evaluating alternative substrate formulations and modular design approaches to ensure uninterrupted test availability. As the market adapts, strategic alignment between procurement, manufacturing, and regulatory teams will be paramount to sustaining streamlined operations under the evolving policy framework.

Unveiling Critical Diagnostic Segmentation Trends Spanning Test Types, Technologies, Product Offerings, End Users, Applications, and Sample Formats

Delving into the intricate segmentation of the autoimmune diagnostics market reveals differential growth trajectories and innovation hotspots across test types, technologies, product classifications, end users, applications, and sample formats. Tests detecting anti cyclic citrullinated peptide have gained prominence in rheumatoid arthritis management, while antinuclear antibody assays remain foundational in systemic lupus erythematosus screening and monitoring workflows. Celiac disease–specific antibody tests cater to both diagnostic and monitoring needs, whereas rheumatoid factor assays continue to offer essential baseline information for autoimmune evaluations.

Technology preferences further shape competitive positioning, with chemiluminescence immunoassay solutions prized for their high sensitivity in detecting low-abundance autoantibodies, and enzyme linked immunosorbent assay platforms favored for their cost-effectiveness in large-scale screening initiatives. Fluorescence immunoassay technologies deliver enhanced multiplex capabilities, enabling simultaneous measurement of multiple analytes, while multiplex immunoassay systems are increasingly adopted to consolidate panel testing and reduce per-test labor overhead.

On the product spectrum, in vitro diagnostics maintain broad adoption across hospital laboratories and reference centers due to stringent regulatory clearances and standardized quality assurance. Lab developed tests are carving out niches within specialized academic and research environments, where customized assay formats support exploratory studies in type 1 diabetes and multiple sclerosis. Sample type segmentation highlights a shift toward serum and plasma matrices for their established performance, though dried blood spot testing is gaining traction in decentralized settings and pediatric applications. Whole blood assays, combining minimal preparation with rapid turnaround, underscore the push for point-of-care autoimmune diagnostics.

This comprehensive research report categorizes the IVD & LDT For Autoimmune Diseases market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Technology

- Product Type

- Sample Type

- End User

- Application

Deciphering Regional Dynamics and Market Drivers Across the Americas, EMEA, and Asia-Pacific in Autoimmune Disease Diagnostics

Regional market dynamics in autoimmune diagnostics reflect a tapestry of healthcare infrastructure maturity, regulatory landscapes, and patient demographics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, expansive insurance coverage and consolidated reference laboratory networks underpin robust demand for advanced immunoassay platforms, particularly chemiluminescence and multiplex solutions that address rheumatoid arthritis and systemic lupus erythematosus burdens. Innovative reimbursement models in certain subregions are catalyzing adoption of lab developed tests within academic and diagnostic laboratories.

Within Europe, Middle East & Africa, a heterogeneous regulatory environment shapes market entry strategies and technology uptake. Western Europe’s well-established healthcare systems prioritize high-sensitivity assay platforms and integrated laboratory automation, while select markets in the Middle East invest heavily in hospital laboratory expansion. Africa’s diagnostic landscape is characterized by targeted initiatives to enhance access to celiac disease screening and rheumatology services, driving growth in portable ELISA and fluorescence immunoassay kits suited to decentralized settings.

Asia-Pacific presents a dual narrative of advanced market segments in Japan and South Korea, where established diagnostic players invest in next-generation multiplex immunoassays, and emerging economies such as India and Southeast Asia, where cost-sensitive solutions like enzyme linked immunosorbent assay and dried blood spot testing gain favor. Across the region, partnerships between local diagnostic manufacturers and global technology providers are forging pathways for knowledge transfer and localized innovation.

This comprehensive research report examines key regions that drive the evolution of the IVD & LDT For Autoimmune Diseases market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Most Influential Industry Leaders and Their Strategic Innovations Redefining the Competitive Autoimmune Diagnostics Landscape

Leading organizations in the autoimmune diagnostics arena are leveraging strategic collaborations, targeted acquisitions, and platform enhancements to fortify their market positions. Major diagnostic companies have expanded their assay portfolios to include high-sensitivity anti cyclic citrullinated peptide and antinuclear antibody tests, integrating chemiluminescence capabilities into next-generation immunoassay platforms. Concurrently, several enterprises are investing in digital pathology and artificial intelligence–driven interpretation algorithms to augment clinical decision support and improve diagnostic throughput.

In addition to organic innovation, alliances between global manufacturers and regional reference laboratories are facilitating co-development of localized lab developed tests tailored to prevalent autoimmune disorders. Strategic mergers have also reshaped the competitive landscape, enabling select vendors to consolidate their offerings across the product spectrum-from enzyme linked immunosorbent assays to multiplex immunoassays-and achieve scale efficiencies in production and distribution.

Furthermore, leading academic research institutes have forged partnerships with diagnostic companies to validate emerging biomarkers, driving evidence generation that informs product roadmaps. These combined efforts are accelerating the translation of novel targets, such as cell surface antigens in multiple sclerosis, into validated diagnostic solutions. As a result, the competitive environment is characterized by fluid alliances, diversified technology stacks, and a relentless focus on delivering clinical value across hospital laboratories, diagnostic centers, and research institutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the IVD & LDT For Autoimmune Diseases market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Adaptive Biotechnologies Corporation

- Agilent Technologies Inc.

- Atlas Link Technology Co., Ltd

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- bioMérieux SA

- Corgenix, Inc.

- Danaher Corporation

- DiaSorin S.p.A.

- EUROIMMUN AG

- F. Hoffmann‑La Roche Ltd.

- Grifols, S.A.

- Hologic Inc.

- ImmunoScience India Pvt. Ltd.

- Ortho Clinical Diagnostics, Inc.

- PerkinElmer, Inc.

- Quest Diagnostics, Inc.

- Quidel Corporation

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Trinity Biotech plc

Translating Market Insights into Strategic Actions to Strengthen Leadership Positions within the Autoimmune Diagnostics Sector

To navigate the dynamic autoimmune diagnostics market, industry leaders should prioritize investment in multiplex immunoassay technologies that deliver comprehensive autoantibody profiling in a single workflow, thus reducing per-sample costs and accelerating diagnostic timelines. By fostering cross-functional teams that integrate scientific, regulatory, and commercial expertise early in development cycles, organizations can streamline validation processes for both in vitro diagnostics and lab developed tests, mitigating time-to-market risks.

Moreover, forging strategic alliances with academic and research institutions can unlock access to novel biomarker discoveries and patient cohorts, enriching product pipelines and ensuring clinical relevance. Engaging with regional distribution partners is equally critical, as localized market insights inform tailored go-to-market strategies that address diverse reimbursement frameworks and healthcare delivery models.

Leaders should also enhance supply chain resilience by diversifying procurement channels, including nearshoring critical reagent production to offset tariff impacts and minimize lead time variability. Investing in advanced analytics and digital integration across laboratory networks supports predictive maintenance and demand forecasting, thereby optimizing inventory management and reducing operational bottlenecks. By adopting these actionable measures, organizations can strengthen their competitive foothold and deliver higher-value solutions to clinicians and patients in the autoimmune disease space.

Detailing Rigorous Research Approaches and Methodological Frameworks Underpinning the Autoimmune Diagnostics Market Analysis

The research underpinning this analysis employed a robust, multi-tiered methodology to ensure depth and rigor. Initially, a comprehensive secondary research phase surveyed peer-reviewed publications, regulatory databases, and clinical trial repositories to map key biomarkers, assay technologies, and regulatory milestones in autoimmune diagnostics. This foundational work informed the development of detailed data collection frameworks.

Subsequently, primary research was conducted through structured interviews and workshops with a diverse cross-section of stakeholders, including laboratory directors, clinical researchers, regulatory experts, and procurement managers. These engagements provided qualitative insights into technology adoption drivers, operational challenges, and emerging clinical needs. Quantitative validation was achieved by triangulating input from leading diagnostic manufacturers, test developers, and independent reference laboratories to corroborate market dynamics and technological trends.

Data synthesizing processes incorporated iterative reviews by subject matter experts to refine interpretations and ensure accuracy. Methodological transparency was maintained through documentation of inclusion criteria, data sources, and analytical techniques, enabling reproducibility and critical appraisal. The resulting framework delivers a balanced, evidence-based perspective that aligns market intelligence with real-world laboratory practices across in vitro diagnostic and lab developed test domains.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our IVD & LDT For Autoimmune Diseases market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- IVD & LDT For Autoimmune Diseases Market, by Test Type

- IVD & LDT For Autoimmune Diseases Market, by Technology

- IVD & LDT For Autoimmune Diseases Market, by Product Type

- IVD & LDT For Autoimmune Diseases Market, by Sample Type

- IVD & LDT For Autoimmune Diseases Market, by End User

- IVD & LDT For Autoimmune Diseases Market, by Application

- IVD & LDT For Autoimmune Diseases Market, by Region

- IVD & LDT For Autoimmune Diseases Market, by Group

- IVD & LDT For Autoimmune Diseases Market, by Country

- United States IVD & LDT For Autoimmune Diseases Market

- China IVD & LDT For Autoimmune Diseases Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings and Strategic Perspectives to Conclude the Comprehensive Analysis of Autoimmune Diagnostic Innovations

This comprehensive examination of autoimmune diagnostics underscores the complex interplay between technological innovation, regulatory evolution, and market dynamics. From the advent of high-sensitivity chemiluminescence immunoassays to the proliferation of lab developed tests addressing niche indications, the landscape is characterized by rapid progress and competitive recalibration. The influence of U.S. tariff policies in 2025 has further emphasized the importance of supply chain strategy and local manufacturing agility.

Segmentation insights reveal that targeted test types and multiplex assay technologies are central to meeting diverse clinical demands, while regional analyses highlight the criticality of aligning product strategies with local healthcare infrastructures. Leading companies are deploying strategic collaborations and digital toolkits to differentiate their offerings, reinforcing the shift toward data-driven, patient-centric diagnostics.

As industry participants integrate these findings into strategic roadmaps, the emphasis must remain on building adaptive platforms, optimizing operational resilience, and fostering innovation ecosystems. By synthesizing emerging trends with stakeholder needs, organizations can chart a course toward sustainable growth and enhanced patient outcomes in the autoimmune diagnostics arena.

Inviting Decision-Makers to Engage with Associate Director Ketan Rohom for Exclusive Market Intelligence to Accelerate Growth

To explore deeper insights into autoimmune diagnostic trends and leverage tailored market intelligence, engage with Associate Director Ketan Rohom for an in-depth consultation and customized research briefing. Connect today to secure your strategic advantage with a comprehensive market report that delivers actionable data, expert analysis, and the forward-looking perspectives your organization needs to make high-impact decisions. Reach out to Ketan Rohom to discuss how this report can unlock new growth opportunities, tailor solutions to evolving challenges, and reinforce your competitive leadership in the autoimmune diagnostics space.

- How big is the IVD & LDT For Autoimmune Diseases Market?

- What is the IVD & LDT For Autoimmune Diseases Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?