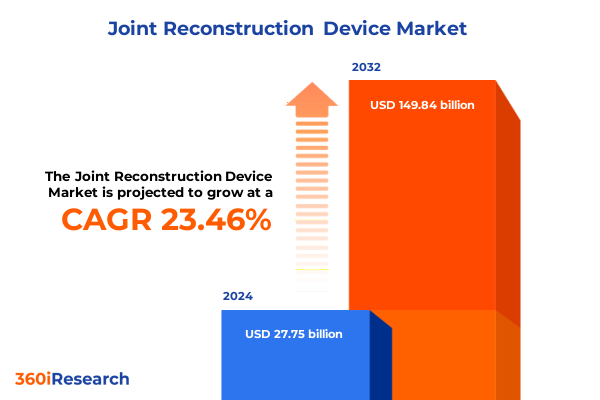

The Joint Reconstruction Device Market size was estimated at USD 34.15 billion in 2025 and expected to reach USD 41.83 billion in 2026, at a CAGR of 23.51% to reach USD 149.84 billion by 2032.

Navigating the Transformative Era of Joint Reconstruction Devices Through Demographic Changes, Innovative Technologies, Evolving Care Models, and Global Demand Dynamics

Navigating the Transformative Era of Joint Reconstruction Devices Through Demographic Changes, Innovative Technologies, Evolving Care Models, and Global Demand Dynamics

Musculoskeletal disorders affect over 1.7 billion people worldwide, creating an urgent need for advanced joint reconstruction solutions that restore mobility and quality of life. Demographic shifts, particularly aging populations in North America, Europe and parts of Asia, are driving a sustained rise in hip, knee, shoulder and spinal reconstruction procedures. In parallel, healthcare systems are under pressure to improve outcomes while controlling costs, leading to new care models that emphasize outpatient settings and value-based frameworks.

As the industry enters one of its most dynamic innovation cycles, joint reconstruction device manufacturers are simultaneously navigating evolving reimbursement environments and geopolitical uncertainties. Recent policy changes, supply chain disruptions, and tariff reinstatements have underscored the need for strategic agility. Against this backdrop, companies are accelerating investments in next-generation materials, patient-specific implants, robotics, biologics, and digital solutions to meet growing demand and deliver personalized care.

Unprecedented Technological and Therapeutic Innovations Including 3D Printing, Robotics, Biologics, and AI Are Redefining Joint Reconstruction Procedures Worldwide

Unprecedented Technological and Therapeutic Innovations Including 3D Printing, Robotics, Biologics, and AI Are Redefining Joint Reconstruction Procedures Worldwide

Advancements in additive manufacturing have ushered in a new era of patient-specific implants that can precisely match individual anatomy. Laser powder bed fusion techniques now enable porous titanium and PEEK structures that promote rapid osseointegration and mechanical stability, while emerging magnesium alloys offer bioresorbable options for temporary supports that naturally degrade as healing progresses. Yet, challenges remain in replicating the hierarchical complexity of bone and ensuring long-term mechanical reliability, driving ongoing research into composite powders, post-processing treatments, and computational modeling to optimize implant performance.

Concurrent advances in surgical robotics and digital platforms are transforming procedural precision and workflow efficiency. Stryker’s Mako 4 system now supports hip, knee, spine and shoulder applications, integrating haptic guidance with 3D CT planning and real-time analytics to reduce variability and improve alignment accuracy. Similarly, Zimmer Biomet’s recent acquisition of Monogram Technologies for $177 million extends its portfolio into semi- and fully autonomous knee replacement solutions, positioning the company to bring next-generation robotic workflows to market by 2027. In parallel, Johnson & Johnson’s VELYS™ robotic platform and AI-enabled power tools are streamlining both joint reconstruction and spine procedures, underscoring how data-driven enabling technologies are shaping the future of orthopaedics.

Assessing the Cumulative Impact of U.S. Tariffs on Joint Reconstruction Device Supply Chains, Costs, Innovation Trajectories, and Strategic Responses in 2025

Assessing the Cumulative Impact of U.S. Tariffs on Joint Reconstruction Device Supply Chains, Costs, Innovation Trajectories, and Strategic Responses in 2025

In March 2025, the United States reinstated Section 301 tariffs on Class I and II medical devices imported from China, imposing duties of up to 25%, while also extending 25% tariffs on steel and aluminum derivative products used in implant manufacturing. These measures have compounded earlier announcements of 10% across-the-board duties on all imports, creating new cost pressures for precision implants and raw materials such as cobalt chrome, stainless steel and titanium alloys. Hospitals and outpatient centers are grappling with increased procurement costs, with some reporting year-over-year rises in implant expenditure exceeding 15% due to tariffs and supply chain volatility.

The tariffs have prompted a significant strategic pivot toward supply chain diversification and nearshoring. Leading manufacturers are expanding production footprints in Mexico, Costa Rica and select U.S. states to mitigate tariff exposure and shorten lead times, while simultaneously pursuing tariff exemption petitions for critical orthopedic components. Despite these efforts, smaller niche players without scale advantages are facing the greatest headwinds, as rising material and logistics costs erode margins and slow adoption of novel solutions such as smart implants and 3D-printed systems.

Looking ahead, sustained policy uncertainty may dampen innovation incentives unless more medical device categories secure exemptions. Industry leaders and trade bodies continue to advocate for carve-outs on essential healthcare goods, warning that prolonged tariff regimes risk delaying the deployment of life-saving technologies and elevating out-of-pocket costs for patients in value-based care settings.

Deep Diving into Application, Product Type, Material, and End User Segmentation Insights Shaping Joint Reconstruction Device Strategies and Market Focus

Deep Diving into Application, Product Type, Material, and End User Segmentation Insights Shaping Joint Reconstruction Device Strategies and Market Focus

Application-based dynamics reveal that hip reconstruction remains dominated by total hip approaches, leveraging advanced femoral stems and acetabular components for durable load-bearing performance, while partial hip implants are gaining traction in younger, active cohorts seeking bone-preserving options. Knee reconstruction trends highlight robust demand for total knee arthroplasty driven by aging populations, alongside a resurgence in unicompartmental knee implants favored for targeted knee preservation and faster recovery. Shoulder reconstruction continues to evolve with reverse shoulder systems delivering enhanced joint stability in rotator cuff-deficient patients, complemented by total shoulder systems improving range of motion. Spine reconstruction demand spans cervical applications reliant on segmental fixation devices and lumbar innovations emphasizing dynamic stabilization.

From a product type perspective, the 3D printed implants segment-encompassing metal and polymer additive solutions-has become synonymous with patient-matched designs and porous architectures that facilitate osseointegration, whereas biological scaffolds are carving out a critical niche in regenerative therapies aimed at soft tissue and cartilage repair. Instrumentation, fixation plates & screws, and traditional implants maintain foundational roles, but are increasingly augmented by smart sensors and guided systems that support intraoperative decision-making. Material considerations underscore the enduring importance of titanium and cobalt chrome for load-bearing strength, while PEEK and UHMWPE retain prominence in articulating surfaces and interbody cages due to their biocompatibility and wear properties.

End users are also diversifying; hospital settings continue to command the bulk of complex reconstructions, while ambulatory surgical centers-both hospital-affiliated and independent-are rapidly expanding their orthopedic offerings to capture cost-efficient, high-volume procedures. Orthopedic centers and specialty clinics are emerging as centers of excellence for targeted joint care, leveraging streamlined workflows and outcome-driven protocols to enhance patient satisfaction and throughput.

This comprehensive research report categorizes the Joint Reconstruction Device market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Product Type

- Material

- End User

Regional Dynamics in Joint Reconstruction Devices Explored Across the Americas, EMEA, and Asia-Pacific Markets Revealing Growth Drivers and Challenges

Regional Dynamics in Joint Reconstruction Devices Explored Across the Americas, EMEA, and Asia-Pacific Markets Revealing Growth Drivers and Challenges

North America leads the global joint reconstruction device landscape, supported by high per capita healthcare spending, comprehensive reimbursement systems, and leading academic medical centers driving adoption of cutting-edge technologies. Nearly 42% of global orthopedic implant revenues originate from this region, where hospitals and ambulatory surgical centers are investing heavily in robotics and mixed reality navigation platforms to enhance procedural precision and efficiency. Europe, Middle East & Africa (EMEA) represents the second-largest regional market, underpinned by aging demographics in Western Europe, robust public funding for joint replacement programs, and regulatory harmonization efforts that facilitate cross-border device approvals. Germany, the UK and France are notable hubs, yet emerging markets in the Middle East and North Africa are witnessing an uptick in elective reconstruction volumes as healthcare infrastructure expands.

Asia-Pacific is the fastest-growing region, fueled by rapidly aging populations in China, Japan and South Korea, coupled with burgeoning healthcare investments and medical tourism. China alone accounted for over a third of APAC revenues in 2024, driven by government initiatives under Healthy China 2030 and strong domestic manufacturing capabilities. India’s orthopedic sector is projected to expand at double-digit rates, powered by Ayushman Bharat reforms and growing middle-class access to advanced surgical care. Southeast Asian hubs such as Singapore, Thailand and Malaysia are also emerging as regional centers for joint reconstruction, leveraging favorable regulatory pathways and strategic partnerships with global device leaders.

This comprehensive research report examines key regions that drive the evolution of the Joint Reconstruction Device market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Competitive Insights on Leading Joint Reconstruction Device Manufacturers, Strategic Partnerships, and Innovation Pathways in 2025

Key Competitive Insights on Leading Joint Reconstruction Device Manufacturers, Strategic Partnerships, and Innovation Pathways in 2025

Zimmer Biomet has intensified its robotics and implant portfolio through two major acquisitions-Monogram Technologies for $177 million to secure semi-autonomous knee replacement capabilities, and Paragon 28 for $1.1 billion to broaden its foot, ankle and trauma offerings-underscoring a strategic pivot toward integrated surgical ecosystems. The company’s recent Persona IQ smart knee implant and Z1 Triple-Taper Femoral Hip System further reflect its commitment to data-driven outcomes and comprehensive reconstructive solutions highlighted at AAOS 2025.

Stryker remains a titan in robotic-assisted surgery with its Mako SmartRobotics suite. The rollout of Mako 4-extending coverage to shoulder and spine-and the introduction of first-to-market robotic hip revision workflows solidify its market leadership in the fast-growing $16 billion surgical robotics space. Johnson & Johnson MedTech continues to accelerate digital orthopaedics through its VELYS robotic solutions and AI-powered KINCISE automated tools, while DePuy Synthes invests in trauma and soft tissue platforms like VOLT and INHANCE to reinforce its broad product ecosystem.

Smith+Nephew is pushing the envelope in sports medicine and arthroscopic innovation, driving next-generation Spatial Surgery systems and bioinductive scaffolds such as CARTIHEAL AGILI-C and REGENETEN to expand its soft tissue repair leadership and complement its CORI robotics platform across knee, hip and shoulder applications. Together, these sector leaders are forging strategic alliances, pursuing targeted acquisitions, and leveraging regulatory clearances to stay ahead in a competitive and rapidly evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Joint Reconstruction Device market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aesculap Implant Systems LLC

- Arthrex, Inc.

- B. Braun Melsungen AG

- Conformis, Inc.

- CONMED Corporation

- Corin Group Ltd

- DePuy Synthes, Inc.

- DJO Global, Inc.

- Enovis Corporation

- Exactech, Inc.

- Globus Medical, Inc.

- Kyocera Medical Corporation

- LimaCorporate S.p.A.

- Medacta International SA

- MicroPort Scientific Corporation

- Smith & Nephew plc

- Stryker Corporation

- United Orthopedic Corporation

- Waldemar Link GmbH & Co. KG

- Zimmer Biomet Holdings, Inc.

Actionable Strategies for Industry Leaders to Optimize Supply Chains, Accelerate Innovation, and Navigate Regulatory and Geopolitical Complexities

Actionable Strategies for Industry Leaders to Optimize Supply Chains, Accelerate Innovation, and Navigate Regulatory and Geopolitical Complexities

To mitigate tariff-induced cost inflation and supply chain bottlenecks, device manufacturers should expand nearshore production capabilities and diversify their supplier base across low-tariff regions. Establishing flexible contract manufacturing partnerships and securing material sourcing agreements with quality-certified domestic producers can provide resilience against future trade policy shifts. Simultaneously, pursuing targeted tariff exemptions for essential orthopedic implants through industry associations and direct engagement with regulatory bodies will help stabilize input costs.

Innovation roadmaps should prioritize modular and data-driven implant platforms that integrate smart sensor technology, enabling post-operative monitoring and remote follow-up. Partnerships with software providers and AI specialists can accelerate the development of predictive maintenance algorithms and outcome optimization tools, driving better clinical results and value-based contracting opportunities. Cross-sector collaborations with biopharma and academic research centers are also critical for advancing next-generation biologic scaffolds and regenerative therapies.

Geographical strategies must balance footprint expansion in high-growth APAC markets with sustained investments in established hubs like North America and Europe. Tailoring product portfolios to regional reimbursement frameworks and pricing sensitivities-such as offering cost-efficient polymer implants in emerging economies-can enhance market penetration. Finally, establishing dedicated regulatory liaisons to navigate evolving medical device frameworks and harmonization efforts will reduce time-to-market and ensure compliance across multiple jurisdictions.

Methodological Framework Combining Primary Interviews, Secondary Data, and Quantitative Analysis Ensuring Robust Joint Reconstruction Device Market Insights

Methodological Framework Combining Primary Interviews, Secondary Data, and Quantitative Analysis Ensuring Robust Joint Reconstruction Device Market Insights

This report’s insights are grounded in a rigorous blend of primary and secondary research methodologies. Primary research comprised in-depth interviews with over 50 senior executives from leading device manufacturers, five orthopedic surgeons specializing in hip, knee, shoulder and spine procedures, and three health system procurement directors, providing first-hand perspectives on emerging trends and operational challenges.

Secondary research included comprehensive reviews of peer-reviewed journals, public filings, regulatory databases, conference proceedings, and credible news sources such as Reuters, MedTech industry publications, and company press releases. Trade association reports and government data from the U.S. Census Bureau, OECD and National Health Commissions supplemented these findings.

Quantitative analysis leveraged triangulation techniques to estimate regional performance and segment dynamics, while scenario modeling assessed tariff impacts under various policy frameworks. All data underwent validation through cross-referencing and quality checks, ensuring that the final insights are both reliable and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Joint Reconstruction Device market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Joint Reconstruction Device Market, by Application

- Joint Reconstruction Device Market, by Product Type

- Joint Reconstruction Device Market, by Material

- Joint Reconstruction Device Market, by End User

- Joint Reconstruction Device Market, by Region

- Joint Reconstruction Device Market, by Group

- Joint Reconstruction Device Market, by Country

- United States Joint Reconstruction Device Market

- China Joint Reconstruction Device Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Market Trends, Technological Advances, and Regulatory Developments to Chart the Future of Joint Reconstruction Devices

Synthesizing Market Trends, Technological Advances, and Regulatory Developments to Chart the Future of Joint Reconstruction Devices

The joint reconstruction device market stands at a pivotal juncture, driven by demographic imperatives, groundbreaking technologies, and complex geopolitical dynamics. As 3D printing, robotics, AI and biologics converge, the industry is poised to deliver more personalized, data-rich solutions that enhance surgical precision and patient outcomes. However, evolving tariff regimes and supply chain challenges underscore the need for strategic flexibility and proactive stakeholder engagement.

Segmentation insights reveal nuanced growth pockets across applications, product types, materials and end users, while regional analyses highlight differentiated opportunities in the Americas, EMEA and Asia-Pacific. Leading companies are advancing their competitive positions through targeted acquisitions, partnerships and regulatory clearances, setting the stage for continued innovation and market consolidation.

Looking forward, success will hinge on the ability to optimize supply chains, harness digital ecosystems and tailor strategies to regional nuances. Stakeholders who proactively adapt to these transformative shifts will be best positioned to deliver long-term value and drive the next wave of growth in joint reconstruction.

Connect with Ketan Rohom to Unlock Comprehensive Market Intelligence and Strategic Insights for Your Joint Reconstruction Device Initiatives Today

For a deeper dive into the transformative trends, strategic imperatives, and actionable intelligence driving the joint reconstruction device market, reach out today to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan’s expertise can help you secure the comprehensive market research report, empowering your organization with the insights needed to navigate tariff impacts, leverage emerging technologies, and capitalize on regional growth opportunities across the Americas, EMEA and Asia-Pacific. Don’t miss your chance to stay ahead in this rapidly evolving landscape-contact Ketan Rohom today to purchase the full report and unlock tailored strategic guidance for your next phase of growth

- How big is the Joint Reconstruction Device Market?

- What is the Joint Reconstruction Device Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?