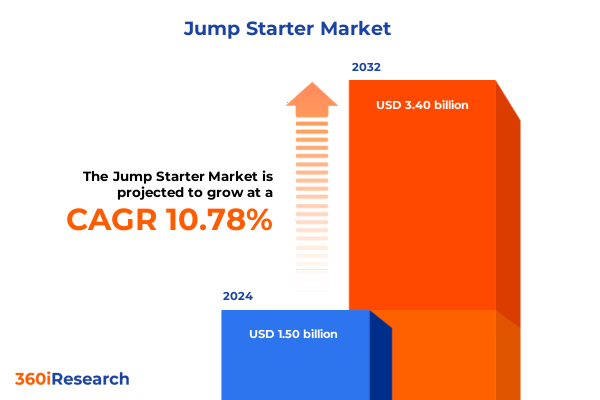

The Jump Starter Market size was estimated at USD 1.64 billion in 2025 and expected to reach USD 1.81 billion in 2026, at a CAGR of 10.92% to reach USD 3.40 billion by 2032.

Igniting the Path Forward with an Executive Overview of Key Dynamics, Emerging Trends, and Strategic Opportunities in the Automotive Battery Sector

The landscape of the automotive battery industry is undergoing unprecedented transformation, driven by a confluence of technological breakthroughs, shifting regulatory frameworks, and evolving consumer preferences. As the global push for electrification gains momentum, the demand for versatile battery solutions spans from traditional lead acid systems to advanced lithium-ion chemistries. In this context, understanding the current state of market dynamics and strategic imperatives has never been more critical.

Against this backdrop, this executive summary distills key observations and actionable insights to inform decision-makers at every level. It provides a concise yet thorough overview of the forces reshaping competitive advantage, the regulatory environment, and the structural factors influencing supply chain resilience. By framing these developments within a holistic narrative, readers will gain clarity on where opportunities lie and which challenges require immediate attention.

Uncovering the Transformative Shifts Redefining Innovation, Supply Chains, Regulatory Paradigms, and Competitive Forces across the Automotive Battery Landscape

Over the past several years, the automotive battery landscape has witnessed seismic shifts in both innovation and market structure. Electrification of powertrains has accelerated rapidly, compelling original equipment manufacturers to collaborate more closely with battery suppliers and invest heavily in research and development. Concurrently, advancements in cell chemistry and energy density have unlocked new performance benchmarks, fostering a competitive environment where differentiation hinges on technological prowess.

Moreover, supply chain shocks have underscored the importance of diversification and strategic sourcing. Manufacturers are increasingly prioritizing local content and resilience, navigating complex trade policies and geopolitical pressures. At the same time, the rise of circular economy models has placed a premium on recycling infrastructures, pushing stakeholders to rethink end-of-life battery management and closed-loop supply chains. Taken together, these transformative shifts are forcing incumbents and newcomers alike to continuously recalibrate strategies to maintain relevance and drive long-term growth.

Assessing the Cumulative Impact of Recent United States Tariffs on Automotive Batteries and Parts in 2025 with Industry Response Dynamics

In 2025, the United States introduced sweeping tariff measures that have reverberated across the global automotive battery ecosystem. By invoking Section 232 of the Trade Expansion Act of 1962, the administration imposed a 25 percent tariff on imported passenger vehicles, light trucks, and certain automotive parts, aiming to shield domestic manufacturing and address perceived national security concerns. The measures, effective April 3 for fully assembled vehicles and slated for automobile parts by May 3, applied uniformly to imports from all nations absent negotiated exemptions under agreements such as USMCA.

Beyond Section 232, early 2025 saw additional tariffs targeting key trading partners. A 25 percent ad valorem tariff was levied on goods from Canada and Mexico, while a 10 percent surcharge affected imports from China, including critical battery materials like nickel and cobalt. These actions prompted swift retaliatory measures, notably from Canada’s promise to match tariff levels and China’s imposition of duties on energy and industrial commodities. Industry stakeholders have expressed concerns that the broad application of these tariffs, rather than focused targeting of specific high-risk products, may elevate component costs and disrupt long-standing supplier relationships.

As a result, major battery producers have begun adjusting production footprints and diversifying end markets in anticipation of shifting demand patterns. LG Energy Solution, for instance, forecasted potential slowdowns in electric vehicle battery orders through early 2026, attributing this outlook in part to the tariff headwinds and the scheduled conclusion of federal EV purchase incentives on September 30, 2025. Amid these pressures, companies are exploring alternative growth vectors, including expanded energy storage system production and targeted localization of high-value components to mitigate the financial impact of cross-border duties.

Deriving Critical Segmentation Insights through Product, Technology, Distribution, and Vehicle Type Perspectives to Guide Strategic Decision-Making

A nuanced segmentation of the automotive battery sector reveals critical variations in product characteristics, technology choices, distribution channels, and vehicle applications that inform tailored strategic approaches. From a product standpoint, demand bifurcates between portable solutions, such as jump starters and auxiliary power packs, and under-hood batteries designed for starting, lighting, and ignition functions in internal combustion and hybrid vehicles.

In parallel, the technology prism highlights a clear separation between legacy lead acid architectures and the rapidly expanding lithium-ion segment. Lead acid remains ubiquitous for cost-sensitive starter applications, while lithium-ion cells, with superior energy density and cycle life, dominate in electric vehicles and growing energy storage installations. Distribution channels further differentiate market dynamics; offline distribution spans traditional automotive workshops as well as specialty stores, offering hands-on service and local support, whereas online channels provide rapid order fulfillment and digital engagement.

Finally, a vehicle type lens underscores distinct end-user requirements, with passenger vehicles prioritizing weight, cycle life, and reliability, and commercial fleets valuing robustness, maintenance intervals, and total cost of ownership. Together, these segmentation insights enable stakeholders to position offerings precisely, calibrating product development, marketing, and sales efforts to address unique customer profiles and emerging use cases.

This comprehensive research report categorizes the Jump Starter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Distribution Channel

- Vehicle Type

Navigating Strategic Regional Variations in the Automotive Battery Market across Americas, Europe Middle East Africa, and Asia Pacific Ecosystems

Regional market dynamics play a pivotal role in shaping strategic priorities and investment decisions for automotive battery stakeholders. In the Americas, a confluence of policy incentives, such as federal tax credits for domestically produced batteries, and infrastructure spending underpins robust development of both electric vehicle applications and energy storage systems. North American manufacturers continue to expand capacity, with notable investments in localized cell production and recycling facilities to fortify supply chains against external shocks.

Across Europe, the Middle East, and Africa, a heterogeneous regulatory environment drives differentiated adoption curves. Western European nations have instituted rigorous emissions targets, catalyzing accelerated EV penetration and an associated surge in high-performance lithium-ion demand. Simultaneously, emerging markets within the region exhibit growing aftermarket potential for traditional lead acid batteries, supported by expanding automotive fleets and aftermarket distribution networks.

In the Asia-Pacific region, leading economies are balancing rapid urbanization with sustainability initiatives. China’s dominant cell manufacturing base exerts significant influence over global supply, while Japan and South Korea continue to pioneer next-generation chemistries and advanced battery management systems. At the same time, Southeast Asian markets are emerging as critical hubs for component assembly, driven by favorable trade agreements and strategic positioning within global supply chains.

This comprehensive research report examines key regions that drive the evolution of the Jump Starter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Competitive Landscape by Profiling Leading Automotive Battery Producers and Their Strategic Innovations Shaping Market Evolution

The competitive landscape of the automotive battery industry is defined by a handful of global leaders and innovative challengers, each leveraging distinct strengths to penetrate key segments. Clarios, with a legacy in lead acid technology, announced a landmark $6 billion investment in U.S. manufacturing over the next decade, focusing on advanced low-voltage batteries, closed-loop recycling, and support for emerging applications such as artificial intelligence hardware. This bold strategy underscores Clarios’s commitment to sustainability and domestic supply chain resilience.

LG Energy Solution, ranked among the top global lithium-ion suppliers, reported strong second-quarter 2025 earnings buoyed by federal subsidies and strategic customer stockpiling. However, the company also cautioned that forthcoming tariff headwinds and the sunsetting of purchase incentives could constrain demand growth in early 2026. LG’s agile pivot to energy storage systems and intensified R&D into LFP cell chemistry reflect its forward-looking approach to portfolio diversification.

Panasonic’s energy unit has similarly reinforced its leadership position. It achieved a 42 percent year-over-year operating profit increase in Q2 2024, driven primarily by strong ESS deployments and streamlined production at its North American sites. Meanwhile, emerging players such as Exide Technologies and GS Yuasa continue to innovate within lead acid and lithium-ion starter markets, emphasizing smart battery integration and extended lifecycle solutions to capture aftermarket share. Together, these market actors illustrate the multifaceted nature of competition, where technological innovation, scale, and sustainability form the pillars of differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Jump Starter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGA Technology Co., Ltd.

- AGCO Corporation

- Antigravity Batteries LLC

- AstroAI Limited

- Boltpower Energy Co., Ltd

- Clore Automotive, LLC

- CNH Industrial N.V.

- Coburg Equipments Pvt. Ltd.

- Deere & Company

- GooLoo

- Guang Zhou Sunland New Energy Technology Co., Ltd.

- Hangzhou Weiwo Technology Co., Ltd.

- HELVI S.P.A.

- Hummer Jump Starter

- Komatsu Ltd.

- Marshell Green Power

- Newsmy Technology Co., Ltd.

- Ningbo Geostar PhotoElectric Technology Co., Ltd.

- Powervamp Ltd.

- Schumacher Electric Corporation

- Scosche Industries

- Shenzhen CARKU Technology Co., Ltd.

- Shenzhen Veestb Technology Co., Ltd.

- Stanley Black & Decker, Inc.

- The NOCO Company

- Wagan Corporation

Delivering Actionable Recommendations for Industry Leaders to Mitigate Risks, Capitalize on Opportunities, and Enhance Supply Chain Resilience

To thrive amid evolving market conditions, industry leaders must adopt a multifaceted approach that balances immediate risk mitigation with long-term strategic positioning. First, diversifying production footprints across multiple geographies can buffer against trade policy fluctuations and safeguard continuity in critical component supply. This entails forging local partnerships and leveraging regional incentives to align capacity expansions with government priorities.

Second, accelerating investments in next-generation chemistries and manufacturing processes will be paramount to maintaining a competitive edge. By deepening R&D collaborations with automotive OEMs and academic institutions, companies can accelerate the time-to-market for high-nickel cells, solid-state prototypes, and battery management innovations. Concomitantly, scaling circular economy initiatives-such as closed-loop recycling and second-life repurposing-will enhance resource security and meet rising stakeholder expectations on sustainability.

Finally, firms should refine segmentation strategies, tailoring product portfolios and service offerings to distinct customer cohorts. Whether adjusting marketing approaches for commercial fleet operators or optimizing online channels for end-users seeking rapid fulfillment, a granular understanding of distribution and application nuances will drive revenue resilience. By embedding these recommendations into their core strategies, battery industry leaders can capitalize on emergent opportunities while safeguarding against systemic disruptions.

Detailing a Robust Research Methodology Combining Primary Interviews, Secondary Data, and Rigorous Analytical Frameworks for Unbiased Insights

This research synthesized insights from a combination of primary and secondary data sources to ensure robust, unbiased findings. Primary research comprised in-depth interviews with executives from major battery manufacturers, automotive OEM procurement specialists, and policy experts, providing firsthand perspectives on operational challenges and strategic priorities.

Complementing these qualitative inputs, secondary research drew from reputable government proclamations, industry association briefings, and peer-reviewed publications. Publicly available trade fact sheets and tariff proclamations were meticulously reviewed to assess policy impacts, while financial disclosures from leading companies informed a holistic understanding of competitive positioning. Data triangulation techniques were employed to reconcile potential discrepancies and validate emerging themes.

Analytical rigor was maintained through structured frameworks, including SWOT assessments, Porter’s Five Forces analyses, and scenario modeling for trade policy scenarios. This comprehensive methodology supports decision-makers in contextualizing findings within broader market dynamics and tailoring strategies that align with both near-term imperatives and long-term objectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Jump Starter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Jump Starter Market, by Product Type

- Jump Starter Market, by Technology

- Jump Starter Market, by Distribution Channel

- Jump Starter Market, by Vehicle Type

- Jump Starter Market, by Region

- Jump Starter Market, by Group

- Jump Starter Market, by Country

- United States Jump Starter Market

- China Jump Starter Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Key Takeaways and Strategic Implications to Empower Stakeholders with a Clear Forward-Looking Vision for Automotive Battery Developments

In summary, the automotive battery industry stands at a pivotal juncture where technological innovation, geopolitical forces, and shifting consumer expectations converge. Strategic clarity on segmentation, regional variances, and competitive capabilities is indispensable for companies aiming to solidify market leadership. Key takeaways highlight the necessity of flexible supply chains, the urgency of sustainable practices, and the promise of next-generation chemistries to unlock new revenue streams.

By weaving together insights on tariffs, segmentation, regional dynamics, and company strategies, this report equips stakeholders with a nuanced roadmap for navigating complexity. As electrification efforts accelerate and policy landscapes evolve, the proactive measures outlined herein will serve as a blueprint for resilience and growth. Ultimately, the ability to adapt swiftly and invest judiciously will determine which organizations emerge as the enduring champions of the automotive battery revolution.

Empower Your Strategy Today with Exclusive Expert Insights and Secure the Complete Automotive Battery Market Report by Engaging with Ketan Rohom

To harness these insights and gain comprehensive clarity on the evolving dynamics of the automotive battery market, we invite you to engage directly with Ketan Rohom, an authority in market intelligence. Ketan will guide you through the methodologies, findings, and strategic imperatives detailed within the full market research report. His expertise in sales and marketing ensures a tailored discussion aligned with your organizational objectives, enabling you to make informed, data-driven decisions.

Reach out to Ketan today to secure access to this indispensable resource and position your company at the forefront of the automotive battery industry’s next phase of transformation.

- How big is the Jump Starter Market?

- What is the Jump Starter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?