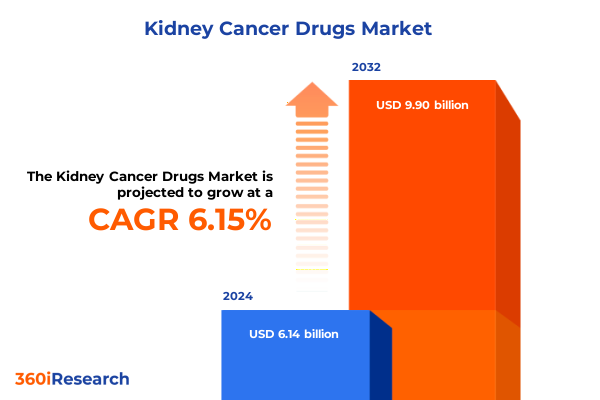

The Kidney Cancer Drugs Market size was estimated at USD 6.51 billion in 2025 and expected to reach USD 6.89 billion in 2026, at a CAGR of 6.16% to reach USD 9.90 billion by 2032.

An Overview of the Kidney Cancer Treatment Market Exploring Core Drivers, Key Stakeholders, Clinical Innovations, and Emerging Therapeutic Pathways

The field of kidney cancer therapeutics has witnessed profound advancements in recent years, catalyzed by breakthroughs in molecular biology and precision medicine. An evolving understanding of tumor biology, driven by high-throughput genomic profiling, has shifted the focus from broadly cytotoxic regimens to more targeted and biologically informed treatments. At the same time, regulatory agencies worldwide have adopted more adaptive approval pathways, emphasizing patient-reported outcomes and real-world evidence. These shifts have encouraged both established pharmaceutical companies and agile biotechs to invest in next-generation candidates that promise improved efficacy and tolerability.

Against this backdrop, the market landscape is increasingly defined by the interplay between scientific innovation, strategic collaborations, and patient-centric care models. Cross-disciplinary partnerships among academic institutions, contract research organizations, and digital health vendors have accelerated the translation of promising preclinical findings into clinical pipelines. Moreover, the rising incidence of renal malignancies, particularly in aging populations, underscores the urgent need for more effective and less toxic therapies. As a result, stakeholders must navigate a complex mosaic of therapeutic modalities, evolving regulatory frameworks, and diverse patient needs to capture emerging opportunities and deliver meaningful clinical value.

The Evolutionary Paradigm Shifts Reshaping Kidney Cancer Drug Development Through Breakthrough Science and Strategic Collaborations

The kidney cancer drug landscape has been redefined by an array of transformative shifts, each reshaping the path from discovery to commercial success. The advent of immunotherapy marked a watershed moment, as checkpoint inhibitors targeting PD-1 and CTLA-4 receptors demonstrated durable responses in subsets of patients who previously had few options. Concurrently, advances in targeted therapy have exploited the vulnerabilities of aberrant signaling pathways, such as VEGF and mTOR, delivering highly specific agents with favorable safety profiles. In parallel, the integration of liquid biopsy technologies and sophisticated biomarker strategies has enabled more precise patient selection, enhancing response rates and minimizing exposure to ineffective treatments.

Beyond scientific breakthroughs, the ecosystem has been enriched by a surge in strategic alliances that span licensing agreements, co-development partnerships, and joint ventures. By pooling resources and expertise, companies have accelerated clinical programs and optimized regulatory submissions across multiple jurisdictions. At the same time, digital and data-driven platforms are enabling decentralized trial models, real-time safety monitoring, and more seamless integration of patient-reported outcomes. Taken together, these evolutionary forces are creating a paradigm in which rapid iteration, collaborative innovation, and patient-centric trial design are the new norms in kidney cancer drug development.

Assessing the Multifaceted Impact of 2025 United States Tariffs on Kidney Cancer Drug Supply Chains, Pricing Structures, and Manufacturer Strategies

Starting April 5, 2025, a 10 percent global tariff was applied to nearly all goods entering the United States, including critical healthcare imports such as active pharmaceutical ingredients and diagnostic equipment. While intended to bolster domestic manufacturing, these measures have had an immediate inflationary effect on drug production costs, raising concerns about increased prices across both branded and generic oncology therapies as healthcare providers seek to manage constrained budgets.

In addition to this baseline levy, the U.S. government imposed steep duties of up to 245 percent on imports from China-comprising a 125 percent reciprocal tariff and a 20 percent penalty related to fentanyl precursor materials. These escalated tariffs have directly impacted the cost structure of kidney cancer drugs that rely on Chinese-sourced APIs, forcing manufacturers to evaluate alternative suppliers or onshore production to mitigate tariff exposure.

Industry stakeholders have underscored the vulnerability of generic oncology medicines to these punitive measures. According to the United States Pharmacopeia chief, the fragile generics ecosystem could be uniquely at risk, as any supply chain disruption may precipitate production discontinuations and exacerbate existing drug shortages for essential cancer treatments.

In anticipation of such trade actions, Biogen has announced a $2 billion investment to expand its North Carolina manufacturing capabilities, specifically enhancing fill-finish lines, automation, and artificial intelligence–driven analytics. This strategic move aims to ensure uninterrupted supply of gene-targeted therapies and greater resilience against tariff-induced cost spikes.

Looking ahead, the persistent uncertainty surrounding tariff exemptions and potential new levies under Section 232 investigations underscores the imperative for manufacturers to diversify sourcing, fortify domestic infrastructure, and actively engage with policymakers to safeguard patient access and maintain competitive pricing.

Uncovering Critical Insights from Cancer Type, Treatment Modalities, Administration Routes, Dosage Forms, and Healthcare Settings Shaping Market Dynamics

The kidney cancer therapeutics landscape is dissected through multiple segmentation lenses, each revealing unique opportunities and challenges. When analyzed by Cancer Type, the market spans Renal Cell Carcinoma, Renal Sarcoma, Transitional Cell Carcinoma, and Wilms Tumor, each with its own biological characteristics and unmet medical needs. Renal Cell Carcinoma, the most prevalent subtype, has attracted significant investment in angiogenesis inhibitors and immune checkpoint modulators, while rarer forms such as Renal Sarcoma prompt explorations of novel cytotoxic combinations.

From the perspective of Treatment Type, traditional approaches like Chemotherapy and Hormone Therapy coexist with Immunotherapy, Novel Therapies, and Targeted Therapy. Within immuno-oncology, checkpoint inhibitors represent the vanguard, subdivided into cytokine-based treatments and PD-1 inhibitors that leverage the body’s immune system to achieve durable tumor control. This layered treatment taxonomy underscores the progressive shift from non-selective cytotoxic drugs to highly specific molecular and immunologic interventions.

Route of Administration further refines the patient and provider experience, distinguishing between Intravenous protocols, which enable precise dosing in controlled settings, and Oral regimens that afford greater convenience and adherence potential. Correspondingly, Dosage Form segmentation captures the transition from Capsules to Tablets and Injections, with formulation science optimizing stability, release kinetics, and patient tolerability. Finally, End User segmentation illuminates the distribution channels through which advanced therapies reach patients, highlighting the roles of Ambulatory Surgical Centers in outpatient infusion, Hospitals with integrated oncology services, and specialized clinics focusing on precision oncology care. This multidimensional segmentation framework enables stakeholders to tailor product development, market access strategies, and patient support programs to the nuanced demands of each segment.

This comprehensive research report categorizes the Kidney Cancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Cancer Type

- Treatment Type

- Route Of Administration

- Dosage Form

- End User

Analyzing Regional Variations in Kidney Cancer Therapeutic Adoption and Patient Outcomes Across the Americas, Europe Middle East Africa, and Asia Pacific

Regional disparities in kidney cancer treatment adoption and patient outcomes reflect a confluence of healthcare infrastructure, reimbursement environments, and clinical practice patterns. In the Americas, advanced diagnostic networks and broad payer coverage have catalyzed rapid integration of immune checkpoint inhibitors and targeted therapies. The United States, in particular, benefits from extensive clinical trial networks and a regulatory framework that prioritizes accelerated approvals, which facilitate early access to promising agents.

Over in Europe, Middle East & Africa, divergent national reimbursement systems and variable access to specialty medications present a complex landscape. Western European markets exhibit mature adoption curves for next-generation therapeutics, supported by centralized health technology assessments that emphasize cost-effectiveness. Conversely, emerging markets in the Middle East and Africa grapple with supply chain constraints and budgetary limitations, spurring interest in biosimilars and cost-containment strategies to expand patient access.

Meanwhile, the Asia-Pacific region demonstrates striking heterogeneity. Established markets such as Japan and Australia have robust oncology guidelines and biotech innovation hubs, leading to early incorporation of precision medicine and combination immuno-oncology regimens. In contrast, other Asia-Pacific countries are investing in localized manufacturing and public-private partnerships to strengthen domestic capacity and improve affordability. Across these regions, evolving regulatory harmonization efforts and digital health initiatives are converging to reshape clinical trial conduct, data sharing, and cross-border collaborations aimed at enhancing patient outcomes on a global scale.

This comprehensive research report examines key regions that drive the evolution of the Kidney Cancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Pharmaceutical Innovators, Strategic Alliances, and Competitive Positioning in the Kidney Cancer Drug Arena

Within the competitive kidney cancer therapeutics arena, a cadre of established life science organizations and emerging biotechs are driving momentum through diverse innovation strategies. Large pharmaceutical leaders such as Pfizer, Merck, and Roche have leveraged expansive R&D platforms to advance both monotherapy and combination regimens, often in partnership with specialized biotechs that introduce novel mechanisms of action. These alliances facilitate shared risk, pooled expertise, and accelerated timelines from discovery through late-stage clinical development.

Concurrent with these marquee collaborations, a dynamic ecosystem of mid-sized companies is challenging conventional approaches by focusing on niche targets, biomarker-driven trial designs, and first-in-class modality exploration. Innovative biotech firms are pioneering next-generation antibody–drug conjugates, bispecific constructs, and emerging cell-based therapies that aim to overcome resistance pathways and broaden patient eligibility criteria. Moreover, CROs and CDMOs specializing in oncology are playing a critical role in managing complex biologics manufacturing and advanced analytics, helping sponsors optimize trial execution and maintain rigorous quality standards.

Competitive positioning within this landscape is further shaped by strategic in-licensing deals, global commercialization partnerships, and geographic expansions into emerging markets. These corporate maneuvers underscore the imperative for both traditional and nontraditional players to balance long-term pipeline investment with agile go-to-market strategies that respond to shifting payer priorities, regulatory nuances, and evolving patient expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Kidney Cancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agensys, Inc.

- Aravive, Inc.

- Arrowhead Pharmaceuticals, Inc.

- AstraZeneca PLC

- AVEO Pharmaceuticals, Inc. (an LG Chem company)

- Bayer AG

- Bristol-Myers Squibb Company

- Calithera Biosciences, Inc.

- Cytokinetics, Incorporated

- Eisai Co., Ltd.

- Exelixis, Inc.

- Ipsen SA

- Johnson & Johnson

- Merck & Co., Inc.

- Nektar Therapeutics

- Novartis AG

- Peloton Therapeutics, Inc. (a Merck & Co., Inc. company)

- Pfizer Inc.

- Roche Holding AG (F. Hoffmann-La Roche Ltd)

- Surface Oncology, Inc.

Strategic Recommendations for Industry Leaders to Optimize Investment, Foster Innovation, and Navigate Regulatory Pathways in Kidney Cancer Therapeutics

Industry leaders should prioritize robust investment in precision therapeutics that align with biomarkers predictive of durable response, thereby maximizing clinical benefit while minimizing unnecessary exposure. Establishing deeper collaborations with academic centers and diagnostic companies can accelerate companion diagnostic development, ensuring that patient stratification is an integral part of your clinical programs. At the same time, diversifying supply chains to include a mix of domestic production and strategic sourcing partnerships can mitigate the impact of trade disruptions and tariff fluctuations on manufacturing costs and drug availability.

To capitalize on the growing importance of real-world evidence, organizations should invest in digital platforms that capture patient-reported outcomes, longitudinal safety data, and utilization patterns across care settings. Integrating these insights into regulatory submissions and payer negotiations can strengthen value propositions and support differentiated pricing strategies. Separately, pursuing adaptive trial designs-such as basket and umbrella studies-enables rapid hypothesis testing, iterative protocol adjustments, and shortened development timelines, which are critical in a landscape where swift clinical validation translates directly into competitive advantage.

Finally, maintaining proactive engagement with regulatory bodies and industry associations will allow you to influence policy discussions on drug pricing, tariff exemptions, and accelerated approval pathways. By aligning your strategic roadmap with evolving regulatory and reimbursement frameworks, you can secure a leadership position in a market that demands both scientific excellence and commercial agility.

Detailing the Rigorous Research Framework, Data Sources, and Analytical Techniques Underpinning Insights into the Kidney Cancer Drug Market

This report’s findings are underpinned by a rigorous mix of primary and secondary research designed to deliver balanced and validated insights. Primary research activities included in-depth interviews with key opinion leaders, oncology clinicians, biopharmaceutical executives, and procurement specialists across major regional markets. These qualitative engagements provided granular perspectives on clinical needs, formulary decision processes, and market access hurdles.

Secondary research involved an extensive review of scientific literature, regulatory filings, company press releases, and patent databases, complemented by analysis of clinical trial registries and healthcare policy documents. Through cross-comparison of public disclosures and proprietary data sources, we triangulated multiple viewpoints to ensure the credibility and relevance of our conclusions.

Analytical methods incorporated competitive benchmarking, pipeline mapping, and technology trend analysis, supported by a detailed assessment of tariff schedules and regulatory frameworks. Continuous validation cycles-featuring review sessions with industry experts and iterative hypothesis testing-ensured that the final recommendations reflect real-world applicability and strategic value. This systematic approach furnishes stakeholders with a robust decision-support tool grounded in both empirical evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Kidney Cancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Kidney Cancer Drugs Market, by Cancer Type

- Kidney Cancer Drugs Market, by Treatment Type

- Kidney Cancer Drugs Market, by Route Of Administration

- Kidney Cancer Drugs Market, by Dosage Form

- Kidney Cancer Drugs Market, by End User

- Kidney Cancer Drugs Market, by Region

- Kidney Cancer Drugs Market, by Group

- Kidney Cancer Drugs Market, by Country

- United States Kidney Cancer Drugs Market

- China Kidney Cancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Principal Insights and Future Imperatives for Stakeholders Navigating the Complex Kidney Cancer Therapeutic Landscape

The synthesis of qualitative insights and secondary data underlines a market in dynamic flux, driven by scientific innovation, regulatory evolution, and geopolitical considerations. Immunotherapies and targeted agents continue to transform treatment paradigms, while the pressure of tariffs has sparked a recalibration of supply chain resilience and cost management. Regional disparities in access and adoption remain a critical challenge, but also highlight opportunities for strategic investment in emerging markets and biosimilar development.

Leading organizations are those that balance long-term R&D commitments with nimble operational tactics-crafting adaptive clinical trial designs, forging data-driven partnerships, and engaging proactively with policymakers. The segmentation analysis reveals distinct pathways for value creation across cancer types, treatment modalities, and care settings, enabling tailored strategies that resonate with diverse stakeholder groups.

Looking forward, the trajectory of kidney cancer drug development will be shaped by the convergence of digital health innovations, precision oncology, and evolving reimbursement norms. Stakeholders that harness the full spectrum of available data and foster collaborative ecosystems will be best positioned to deliver transformative therapies and sustainable growth. With the insights presented herein, decision-makers can navigate complexity, mitigate risks, and seize opportunities in a market defined by both rapid change and unmet clinical needs.

Secure Your Comprehensive Kidney Cancer Drug Market Analysis Today by Connecting with Ketan Rohom to Gain Actionable Insights and Drive Strategic Decisions

Ready to elevate your strategic planning and gain a competitive edge in the kidney cancer therapeutics market? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how this comprehensive report will deliver in-depth analysis, actionable insights, and tailored guidance to inform your next move. Ketan can walk you through the detailed findings on clinical trends, regulatory impacts, and competitive positioning, and customize solutions that align with your organization’s priorities. Don’t miss the opportunity to leverage expert perspectives on transformative innovations, tariff implications, and regional dynamics that will influence your investment decisions and operational strategies. Get in touch with Ketan Rohom today to secure your copy and unlock the critical intelligence you need to drive growth and outperform in this rapidly evolving therapeutic space

- How big is the Kidney Cancer Drugs Market?

- What is the Kidney Cancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?