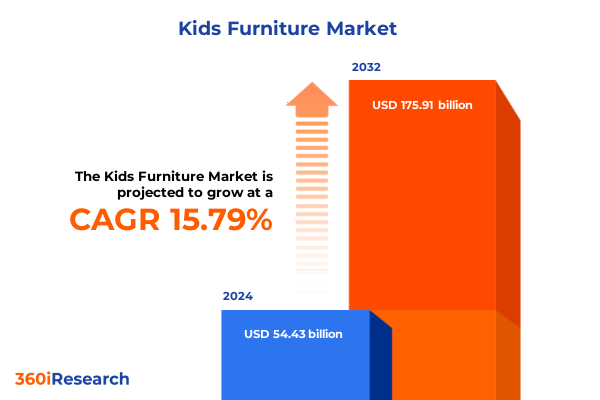

The Kids Furniture Market size was estimated at USD 62.33 billion in 2025 and expected to reach USD 71.39 billion in 2026, at a CAGR of 15.97% to reach USD 175.91 billion by 2032.

Unveiling the Foundations of a Dynamic Kids Furniture Market Driven by Evolving Consumer Preferences, Innovative Design, and Regulatory Landscapes

In today’s dynamic consumer environment, the children’s furniture segment is poised for a transformative phase characterized by heightened design innovation, shifting regulatory mandates, and rapidly evolving lifestyle preferences. Parents and caregivers are increasingly seeking pieces that blend functionality with environmental responsibility, driving demand for products that not only support growing children but also align with broader sustainable living goals. As urban living spaces shrink and remote learning becomes a staple, versatile, space-efficient solutions are gaining traction, reshaping traditional conceptions of nursery, bedroom, and playroom furnishings.

Revolutionizing the Children’s Furniture Ecosystem with Sustainability, Technological Integration, Personalization, and Supply Chain Resilience

The children’s furniture ecosystem is undergoing a sweeping shift fueled by four pivotal forces. First, sustainability has moved beyond a buzzword to become an essential criterion for product design and material selection, as evidenced by a surge in demand for items crafted from reclaimed and non-toxic components, underscoring a broader eco-conscious movement within home interiors. Second, personalization is reshaping value propositions, with families gravitating toward customizable cribs, desks, and storage units that adapt as children develop, reflecting a deeper engagement with modular and theme-based configurations. Third, technology integration is elevating user experience through smart features such as height-adjustable study desks with LED lighting and Bluetooth connectivity, catering to growing expectations for multifunctional, tech-enabled living spaces. Finally, supply chain realignments-intensified by geopolitical tensions and pandemic-era disruptions-are propelling shifts toward nearshoring and diversification of sourcing hubs, as companies seek resilience by balancing Chinese imports with alternative manufacturing bases in Mexico and Vietnam.

Assessing the Heightened Burden of 2025 U.S. Tariffs on Children’s Furniture: Inflationary Pressures, Supply Chain Disruptions, and Industry Responses

In 2025, U.S. import tariffs reached their most elevated levels in over a century, imposing an average rate of approximately 17 percent across U.S. imports-a sharp increase from the historical baseline of 2.3 percent-placing significant pressure on cost structures within the children’s furniture industry. Infant furniture, in particular, has felt the brunt of these duties, with effective import barriers averaging nearly 128.8 percent when accounting for cumulative rates from prior rounds of trade actions. As a result, leading manufacturers have confronted acute challenges in balancing regulatory compliance, safety testing mandates, and tariff-induced cost escalations, leading to pauses in shipments and inventory shortages at major retailers.

Illuminating Consumer Pathways in Kids Furniture Through Product Type, Age Group, Distribution Channel, Price Tier, Material, and End User Segmentation Strategies

Market analysts employ a granular segmentation framework to map the children’s furniture landscape, beginning with product typologies that span beds, desks, seating, and storage solutions-each subdivided into familiar categories such as single beds, study desks, bean bags, and toy boxes-illuminating distinct user needs and aesthetic preferences. Layered atop product types, age group segmentation separates early infancy from preschool stages (0 to 3 years and 3 to 5 years), school-age cohorts, and teenage requisites, recognizing the evolving ergonomic and developmental requirements across life stages. Distribution channels constitute another crucial axis, as direct sales, specialty retailers, general merchandise outlets, and a burgeoning e-commerce ecosystem-comprising both branded websites and online marketplaces-determine customer touchpoints and fulfillment models. Price tiers further refine the competitive landscape, spanning mass-market value propositions to midrange and premium offerings, while material differentiation-metal, plastic, and wood-underscores both cost considerations and stylistic leanings. Finally, end-user segmentation bifurcates residential applications from commercial venues such as schools and childcare facilities, guiding strategic priorities around durability, compliance, and bulk procurement dynamics.

This comprehensive research report categorizes the Kids Furniture market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- Material

- Distribution Channel

- End User

Distilling Critical Regional Dynamics in Children’s Furniture Across the Americas, Europe Middle East Africa, and Asia-Pacific Market Landscapes

Regional dynamics exert profound influence on the children’s furniture sector, beginning with the Americas, where North American purchasing power and the expansion of online sales channels have spurred a sophisticated retail environment. In the United States, online household furniture revenues surpassed $96.5 billion in 2024, reflecting a 3.3 percent annual growth rate and underscoring the centrality of digital platforms in omnichannel strategies. Transitioning to Europe, the Middle East, and Africa, regulatory frameworks and cultural design sensibilities shape market heterogeneity: Western European markets emphasize eco-certifications and minimalist aesthetics, while Middle Eastern demand centers on customization and high-end artisanal craftsmanship. In contrast, Asia-Pacific is characterized by rapid urbanization and rising middle-class incomes in China and India, catalyzing demand for multifunctional pieces that optimize constrained living spaces and align with shifting preferences toward Montessori-inspired layouts.

This comprehensive research report examines key regions that drive the evolution of the Kids Furniture market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players in Children’s Furniture: Strategic Innovations, Market Positioning, and Competitive Differentiation Strategies

Leading players in the children’s furniture arena demonstrate distinct strategic orientations. Delta Children, the dominant U.S. crib and nursery brand, exemplifies supply chain agility, having temporarily suspended Chinese shipments in response to tariff surges and leveraging domestic manufacturing facilities to mitigate shortages. Newell Brands, owner of Baby Jogger and Graco, has adopted a preemptive inventory build-up strategy, raising prices by approximately 20 percent to offset import levies while exploring alternative production sites to maintain safety compliance and availability. IKEA’s global circular economy initiative, including furniture take-back and refurbishment programs, reinforces its leadership in sustainability, resonating with eco-aware consumers and differentiating its value proposition. Meanwhile, e-commerce disruptors Wayfair and Amazon continue to redefine convenience and selection breadth, driving digital investment as evidenced by sector-wide e-commerce revenues reaching over $68.9 billion in 2024 and commanding a 30-35 percent share of total U.S. furniture sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Kids Furniture market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashley Furniture Industries, LLC

- Babyletto, LLC

- Blu Dot, Inc.

- Boingg, Inc.

- C&T International Inc.

- Casa Kids, Inc.

- Circu Magical Furniture, Lda.

- Crate and Barrel Holdings Inc.

- DaVinci Group, LLC

- Delta Enterprise Corporation

- Dorel Industries Inc.

- Dream On Me, Inc.

- Flexa4dreams A/S

- Inter IKEA Systems B.V.

- KidKraft International Ltd.

- Klaussner Home Furnishings, Inc.

- NatArt Furniture S.A.

- Stokke AS

- Wayfair Inc.

- Williams-Sonoma, Inc.

Strategic Imperatives for Industry Leaders: Navigating Sustainability, Tariff Challenges, Digitalization, and Consumer-Centric Innovation

To thrive amid regulatory headwinds and shifting consumer priorities, industry leaders must adopt a multifaceted approach. Embedding sustainability into product life cycles-through the use of certified wood, non-toxic finishes, and modular designs that prolong utility-can command premium positioning while resonating with environmentally conscious families, reflecting the fact that 78 percent of consumers prioritize sustainable living when making purchase decisions. Concurrently, diversifying sourcing geographies beyond China and incorporating nearshoring options can buffer against tariff volatility, supply chain disruptions, and compliance complexities, as illustrated by alternative manufacturing migration to Mexico and Vietnam under earlier tariff regimes. In parallel, accelerating digital transformation via immersive e-commerce experiences-leveraging augmented reality for product visualization and robust CRM systems for personalized recommendations-will be essential to capture the projected 35-40 percent share of U.S. furniture sales flowing through online channels by 2025. Lastly, fostering collaborative partnerships with childcare institutions and educational designers can open commercial demand streams, ensuring product specifications align with institutional durability, safety standards, and volume procurement dynamics.

Comprehensive Research Methodology Overview Combining Primary Engagement, Secondary Intelligence, and Data Validation in Kids Furniture Analysis

This analysis integrates primary and secondary research methodologies to ensure rigor and relevance. Primary engagement encompassed in-depth interviews with senior executives across manufacturing, retail, and logistics sectors, providing firsthand insights into strategic responses to tariff pressures and consumer trends. Secondary intelligence was gathered from an exhaustive review of industry publications, customs and trade databases, regulatory filings, and news outlets, offering quantitative context and trend validation. Data triangulation and iterative cross-verification were applied throughout the research cycle to reconcile discrepancies, enhance reliability, and establish a cohesive market narrative. Where applicable, advanced analytics were employed to interpret e-commerce revenue patterns, regional demand indicators, and supply chain shifts, resulting in a robust framework that underpins strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Kids Furniture market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Kids Furniture Market, by Product Type

- Kids Furniture Market, by Age Group

- Kids Furniture Market, by Material

- Kids Furniture Market, by Distribution Channel

- Kids Furniture Market, by End User

- Kids Furniture Market, by Region

- Kids Furniture Market, by Group

- Kids Furniture Market, by Country

- United States Kids Furniture Market

- China Kids Furniture Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Perspectives on the Future Trajectory of the Children’s Furniture Market Amid Evolving Trends and Regulatory Shifts

The children’s furniture market stands at an inflection point defined by evolving parental expectations, heightened regulatory scrutiny, and geopolitical flux. Sustained momentum will hinge on the industry’s capacity to marry purpose-driven design with resilient operational models, balancing environmental stewardship with cost efficiency and technological advancement. As sustainability becomes a non-negotiable criterion and digital ecosystems assume greater prominence, companies that align product innovation with strategic supply chain realignment will secure enduring competitive advantage. In sum, the path forward calls for an integrated approach that anticipates regulatory shifts, deciphers consumer psyches, and leverages data-driven insights to shape the next generation of children’s furniture.

Engage with Our Associate Director of Sales & Marketing for Tailored Insights and to Unlock Comprehensive Kids Furniture Market Intelligence Today

Ready to deepen your understanding of the children’s furniture sector and gain a competitive edge? Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how our comprehensive intelligence can inform your strategy. His expertise in translating market insights into actionable growth initiatives can guide your organization through evolving consumer demands, tariff landscapes, and sustainability transitions. Connect today to explore tailored research packages that align with your business priorities and secure the data-driven roadmap you need to excel in the rapidly changing kids furniture market.

- How big is the Kids Furniture Market?

- What is the Kids Furniture Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?