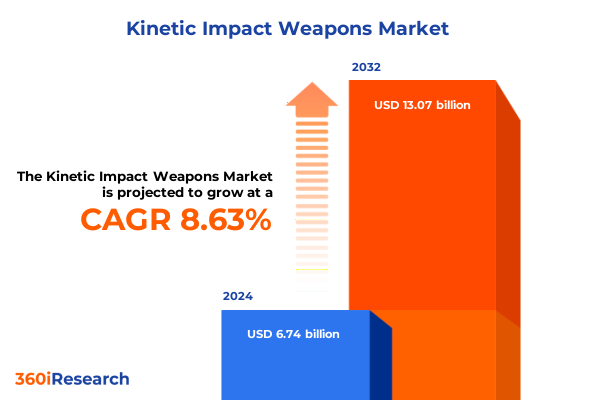

The Kinetic Impact Weapons Market size was estimated at USD 7.26 billion in 2025 and expected to reach USD 7.82 billion in 2026, at a CAGR of 8.76% to reach USD 13.07 billion by 2032.

Exploring the critical evolution and strategic importance of kinetic impact weapons in contemporary security and defense operations

The dynamic field of kinetic impact weapons has evolved from rudimentary tools into sophisticated systems that balance operational effectiveness with safety mandates. These weapons, ranging from hand-thrown projectiles to shoulder-launched systems, serve critical roles in law enforcement, military, and private security contexts. Their core value lies in delivering incapacitating force without resorting to lethal measures, thereby reducing the risk of fatal outcomes in crowd engagements, perimeter defense, and targeted tactical operations. As security challenges grow more complex, stakeholders are demanding agile solutions that integrate seamlessly into existing protocols while offering precise control over impact energy and accuracy.

This executive summary establishes the foundational context and outlines the scope of the ensuing analysis. We will examine the transformative factors reshaping the market landscape, evaluate the cumulative effects of recent United States tariff policies, and distill insights from a multifaceted segmentation framework. Regional dynamics across the Americas, Europe, the Middle East & Africa, and Asia-Pacific will highlight divergent growth drivers and adoption patterns. Additionally, profiles of industry-leading companies will illuminate competitive strengths and innovation trajectories. The summary concludes with strategic recommendations and a transparent overview of the research methodology employed. Together, these components provide a comprehensive narrative designed to equip decision-makers with the clarity required to navigate an increasingly nuanced kinetic impact weapons environment.

How technological innovations and shifting operational doctrines are redefining the kinetic impact weapons landscape across global security environments

Technological advancements have sparked a paradigm shift in how kinetic impact weapons are conceived, manufactured, and deployed. High-strength polymers and composite materials now enable lighter launchers without sacrificing durability, reducing operator fatigue during extended missions. Meanwhile, precision-engineered projectiles incorporating smart-tip designs ensure consistent energy transfer upon impact, improving effectiveness while minimizing unintended harm. Autonomous targeting modules and sensor arrays are increasingly integrated into launcher systems, enabling remote engagement in high-risk scenarios and setting the stage for broader robotics interoperability. Collectively, these innovations are redefining operational doctrines, as end users transition from traditional blunt-force tactics to data-driven deployment strategies.

Beyond technological progress, evolving threat environments and regulatory frameworks are accelerating shifts in adoption patterns. Urban crowd management scenarios have become more intricate, prompting agencies to seek nonlethal alternatives that uphold civil liberties while preserving public order. In parallel, military units are exploring kinetic impact solutions for stabilization missions, where discerning proportional response is crucial. Private security firms, too, are capitalizing on modular launchers that can adapt between low- and high-impact payloads, enabling rapid adjustment to varying threat levels. Consequently, the market is witnessing an unprecedented convergence of R&D investments, cross-sector partnerships, and multi-domain use cases.

Assessing the multifaceted consequences of the 2025 United States tariff policy on the supply chain and acquisition of kinetic impact weapons

The introduction of targeted tariffs by the United States in early 2025 has generated deep ramifications across the kinetic impact weapons supply chain. A 25% levy on steel and aluminum imports extends to both primary alloys and derivative products, reshaping input cost structures for launcher frames and projectile casings. Simultaneously, a baseline 10% tariff on the majority of foreign goods has applied upward pressure on specialized components such as high-strength polymers, precision-machined barrels, and advanced optics, many of which were previously sourced from low-cost international partners.

These policy shifts have introduced greater uncertainty into procurement cycles. Government agencies and private integrators now face extended lead times as original equipment manufacturers pivot supply routes or diversify sourcing strategies to mitigate tariff exposure. In some cases, domestic producers have ramped up production capacities, capitalizing on the policy environment to secure new contracts and strengthen their market footprints. Nevertheless, price volatility has intensified for calibers and materials typically imported in high volumes, compelling procurement teams to reallocate budget reserves and renegotiate long-term service agreements.

In response, many stakeholders have accelerated localization of research and development efforts, establishing regional testing and certification centers to streamline compliance processes. This regionalization trend reduces dependency on cross-border logistics while fostering innovation ecosystems closer to end users. Moving forward, adaptive sourcing frameworks and strategic stockpiling are emerging as critical enablers for maintaining operational readiness amid evolving tariff landscapes.

Uncovering nuanced insights from product, end user, application, distribution channel, deployment mode, and caliber segmentation to guide strategic decisions

A coherent understanding of market segmentation reveals vital pathways for growth and innovation. When analyzing by product type, accessories, launchers, and projectiles form the core categories, with launchers further divided into hand held, mounted units, and shoulder launched systems. Each subcategory serves distinct operational preferences: hand held launchers for mobility in close-quarter engagements, mounted options for vehicle integration, and shoulder systems for stand-off capabilities.

End user segmentation captures the spectrum of demand across law enforcement, military, and private security. Within law enforcement, correctional facilities and police departments leverage kinetic impact solutions for inmate management and urban deployments. Military applications span air force, army, navy, and special forces, where tactical requirements range from base perimeter security to stabilization missions. Private security providers, including corporate security teams, event security specialists, and residential security services, increasingly adopt these weapons to ensure rapid and controlled responses to emerging threats.

Application-based analysis underscores use cases such as border control, crowd control, perimeter security, and riot control. Border control operations bifurcate into land and maritime deployments, necessitating ruggedized systems for harsh environments. Crowd management differentiates between outdoor events and urban centers, each demanding tailored projectile profiles. Perimeter security is split between fixed installations and mobile patrol units, driving distinct launcher mobility needs.

Distribution channel segmentation encompasses direct sales, local and regional distributors, and online retail through e-commerce platforms and manufacturer websites. Each channel exhibits unique advantages in delivery speed, after-sales support, and customer engagement. Finally, deployment mode-whether hand held, shoulder launched, or vehicle mounted-alongside key calibers like 12 gauge, 37 mm, and 40 mm, further refines product positioning and operational applicability.

This comprehensive research report categorizes the Kinetic Impact Weapons market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Caliber

- End User

- Application

- Distribution Channel

- Deployment Mode

Evaluating divergent regional dynamics across the Americas, EMEA, and Asia-Pacific to contextualize growth trajectories and strategic demands

Regional dynamics in the Americas reflect a mature ecosystem characterized by extensive law enforcement adoption and a robust domestic manufacturing base. The United States, as a central hub, benefits from well-established R&D clusters and a broad network of federal procurement contracts, which drive innovation in advanced launchers and projectiles. Latin American markets show rising demand for crowd control solutions, particularly in urban centers grappling with civil unrest, leading to increased imports and emerging local assembly partnerships to address cost constraints and logistical complexities.

In Europe, Middle East & Africa (EMEA), distinct geopolitical and security needs shape adoption patterns. European nations emphasize stringent regulatory compliance and interoperability across NATO forces, fostering standardization of calibers and launcher specifications. Middle Eastern markets, characterized by extensive border security initiatives, have driven interest in long-range shoulder-launched systems and mounted solutions for vehicle patrols. Across diverse African contexts, both fixed perimeter installations and mobile deployment modes are increasingly adopted by government and private entities seeking scalable, low-lethality options.

Asia-Pacific exemplifies one of the fastest-evolving landscapes, where modernization programs in law enforcement and defense sectors fuel procurement of kinetic impact solutions. Nations with extensive maritime border challenges leverage specialized formulations for maritime-grade projectiles, while urbanizing megacities invest in crowd control capabilities for large-scale public gatherings. Government initiatives to foster domestic manufacturing have also begun to influence supply chains, reducing reliance on imports and stimulating regional R&D collaborations.

This comprehensive research report examines key regions that drive the evolution of the Kinetic Impact Weapons market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling industry-leading innovators and established manufacturers shaping the kinetic impact weapons market with advanced technologies and strategic positioning

Industry-leading companies continue to shape the trajectory of kinetic impact weaponry through targeted investments and groundbreaking innovations. Amtec Less-Lethal Systems, Inc. has positioned itself at the forefront of introducing advanced polymer-based launch tubes that balance structural integrity with operator ergonomics. ASP, Inc. leverages its legacy in law enforcement equipment to refine modular accessories that optimize launcher adaptability for various mission profiles.

Axon Enterprise, Inc. stands out for integrating digital evidence management with its kinetic impact offerings, enabling end users to synchronize engagements with automated reporting tools. BAE Systems PLC and Combined Systems, Inc. maintain their competitive edge by combining expansive defense sector experience with agile development cycles, rapidly iterating on projectile designs that enhance safety and accuracy.

Byrna Technologies Inc. and Defense Technology, LLC capitalize on rapid prototyping capabilities to test novel kinetic payload compositions, while FN Browning Group and FN HERSTAL capitalize on their precision engineering roots to ensure consistency across high-volume production. Established defense primes like Heckler & Koch GmbH and Lockheed Martin Corporation underpin market stability with deep supply chain networks and extensive testing protocols.

Emerging players such as PepperBall Technologies, Inc. and Sage International, Ltd., along with private security specialists like Safariland, LLC, are bridging the gap between tactical requirements and next-generation technologies. Meanwhile, Northrop Grumman Corporation brings its systems integration expertise to deliver turnkey solutions that merge launchers with surveillance and command-and-control platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Kinetic Impact Weapons market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAE Systems plc

- Combined Systems, Inc.

- FN Herstal SA

- General Dynamics Ordnance and Tactical Systems

- Lockheed Martin Corporation

- Mission Less Lethal Technologies

- Nammo AS

- NonLethal Technologies, Inc.

- Pepperball Technologies, Inc.

- Rheinmetall AG

- RTX Corporation

- Safariland, LLC

- Security Equipment Corporation

- TASER International, Inc.

- Thales S.A.

- The Boeing Company

- Ultra Electronics Holdings plc

- Zarc International, Inc.

Delivering pragmatic and forward-looking strategies for industry leaders to navigate emerging challenges and capitalize on evolving kinetic impact weapons opportunities

To navigate an increasingly complex market landscape, decision-makers must adopt a multifaceted approach. First, diversifying supply chains to include both domestic and international sources mitigates tariff exposure and enhances resilience in the face of policy shifts. Investing in supplier partnerships that prioritize capacity expansion and joint R&D efforts ensures access to critical materials and components under fluctuating trade environments.

Second, organizations should accelerate integration of digital technologies into kinetic impact systems by collaborating with software and sensor specialists. Embedding telemetry and situational awareness tools into launchers and projectiles enhances post-engagement analysis, streamlines compliance reporting, and supports data-driven training protocols. This digital overlay not only optimizes operational effectiveness but also fortifies product differentiation.

Third, targeted investments in material science and modular design can yield long-term cost savings and performance gains. By prioritizing lightweight composites and interchangeable payload modules, manufacturers can serve diverse mission requirements without reengineering core systems. Concurrently, establishing regional testing and certification centers reduces compliance bottlenecks and fosters closer alignment with end-user specifications.

Finally, cultivating strategic alliances with end users-law enforcement agencies, military branches, and private security firms-provides real-time feedback loops that drive iterative innovation. Through dedicated pilot programs and joint capability assessments, industry leaders can refine product roadmaps to reflect evolving operational doctrines and regulatory standards.

Detailing the rigorous research approach, data sources, and analytical frameworks underpinning the comprehensive kinetic impact weapons market study

The findings presented in this report are grounded in a rigorous research framework that integrates both primary and secondary methodologies. Primary data collection involved structured interviews with industry executives, technical experts, and procurement officers across key geographies. These dialogues provided firsthand perspectives on technology adoption, procurement hurdles, and regional policy impacts.

Secondary research encompassed a comprehensive review of trade publications, regulatory filings, and customs data to map tariff schedules and import-export flows. Proprietary databases were analyzed to cross-validate company profiles, product launches, and patent trends. Market intelligence from government procurement portals supplemented insights into end-user purchasing patterns and contract award histories.

Data triangulation techniques were employed to reconcile disparate data points, ensuring consistency in segmentation definitions and geographic breakdowns. Quantitative analysis leveraged statistical modeling to identify correlations between tariff actions and cost-per-unit fluctuations, while qualitative assessments illuminated strategic responses from manufacturers and public agencies.

Quality assurance protocols included peer reviews by subject-matter analysts and iterative validation of key assumptions. This methodological rigor underpins the credibility of our strategic recommendations and ensures that stakeholders can confidently rely on the insights to inform decision-making in the kinetic impact weapons domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Kinetic Impact Weapons market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Kinetic Impact Weapons Market, by Product Type

- Kinetic Impact Weapons Market, by Caliber

- Kinetic Impact Weapons Market, by End User

- Kinetic Impact Weapons Market, by Application

- Kinetic Impact Weapons Market, by Distribution Channel

- Kinetic Impact Weapons Market, by Deployment Mode

- Kinetic Impact Weapons Market, by Region

- Kinetic Impact Weapons Market, by Group

- Kinetic Impact Weapons Market, by Country

- United States Kinetic Impact Weapons Market

- China Kinetic Impact Weapons Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesizing core findings and articulating the strategic imperative of adaptive planning in the rapidly evolving kinetic impact weapons sector

In synthesizing the multifaceted dynamics of the kinetic impact weapons sector, several core themes emerge. Technological convergence-spanning advanced materials, digital integration, and modular architectures-is elevating product performance while enabling tailored responses to diverse operational scenarios. At the same time, evolving legislative and tariff landscapes underscore the necessity for agile sourcing strategies and proactive policy engagement.

Segment-level analyses reveal that both product innovation and end-user specialization will drive differentiation, as manufacturers tailor offerings to distinct law enforcement, military, and private security needs. Regional market trajectories further highlight how localized security imperatives and procurement frameworks shape adoption patterns, creating pockets of opportunity for targeted investments in supply chain resilience and regional R&D collaborations.

Ultimately, the capacity to harness emerging technologies, adapt to regulatory flux, and forge collaborative partnerships with end users will delineate industry leaders from laggards. By embedding a culture of continuous innovation and strategic foresight, stakeholders can navigate uncertainties and capitalize on the full spectrum of kinetic impact weapons applications. This dynamic sector demands vigilant monitoring and nimble execution to maintain competitive advantage and ensure operational readiness.

Engaging with Ketan Rohom to secure advanced market intelligence and actionable insights through a tailored kinetic impact weapons research report purchase

Are you ready to elevate your strategic decision-making with unparalleled insights into the kinetic impact weapons market? Ketan Rohom, Associate Director of Sales and Marketing, stands ready to guide your organization through the complexities of procurement, development, and deployment. By securing this comprehensive market research report, you will access tailored analysis that identifies emerging opportunities, competitive dynamics, and regulatory shifts shaping the industry.

Unlock exclusive data visualizations, in-depth company profiles, and scenario-based forecasts that inform investment, sourcing, and innovation roadmaps. Engage directly with Ketan Rohom to craft a customized briefing that aligns with your operational priorities and budgetary constraints. Whether you aim to expand your product portfolio, optimize supply chains, or strengthen your market positioning, this report delivers the actionable intelligence you need.

Don’t miss the opportunity to partner with a specialist who can streamline your research process and deliver targeted recommendations. Reach out to Ketan Rohom now and secure your copy of the market research report that will empower your team to anticipate trends and drive growth in the kinetic impact weapons domain.

- How big is the Kinetic Impact Weapons Market?

- What is the Kinetic Impact Weapons Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?