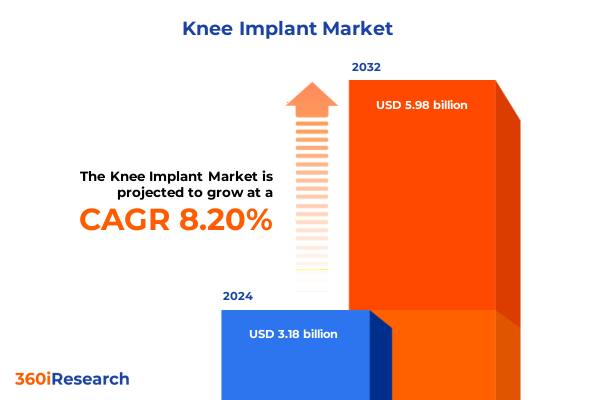

The Knee Implant Market size was estimated at USD 3.44 billion in 2025 and expected to reach USD 3.72 billion in 2026, at a CAGR of 8.22% to reach USD 5.98 billion by 2032.

Exploring the Rapid Evolution and Emerging Opportunities in the Knee Implant Market Fueled by Demographic Shifts and Clinical Innovations

The global burden of knee osteoarthritis has surged in recent years, driven by aging populations and rising rates of obesity in many regions. As disease progression leads to debilitating pain and reduced mobility, knee implant solutions have emerged as indispensable clinical interventions to restore patient quality of life. Beyond simply replacing damaged joint surfaces, modern knee implants integrate biomechanical design principles to preserve natural kinematics and reduce surgical trauma. With an increasing number of younger, active patients seeking durable solutions, the industry is compelled to develop next-generation materials and precision techniques that address diverse anatomical and lifestyle needs. Against this backdrop, healthcare providers, payers, and manufacturers are navigating a rapidly evolving ecosystem defined by innovation, regulatory scrutiny, and shifting patient expectations.

Amidst these dynamics, the competitive landscape has expanded to include not only established orthopedic giants but also agile startups pioneering personalized implants and digital platforms. Collaborative research between academic centers, medical device firms, and technology vendors has accelerated the translation of novel materials, such as polyethylene composites and bioceramics, into clinical practice. Meanwhile, the integration of real-world evidence and post-market surveillance is raising the bar for safety and performance standards. As a result, stakeholders across the value chain are aligning on strategies that balance cost pressures with the imperative to enhance patient outcomes. This introduction outlines the fundamental drivers shaping the knee implant market and sets the stage for a detailed exploration of transformative shifts, tariff implications, segmentation insights, and regional variations.

Uncovering Pivotal Transformations in Knee Implant Design, Surgical Techniques, and Regulatory Approaches Reshaping Patient Outcomes and Market Dynamics

Over the past decade, the knee implant landscape has been reshaped by pivotal transformations in design philosophy, surgical techniques, and regulatory frameworks. Patient-specific instrumentation and three-dimensional preoperative planning have gained traction, enabling surgeons to customize implant placement with millimeter precision. Concurrently, the advent of robotic-assisted platforms has introduced new paradigms for soft tissue balancing and component alignment, leading to improved functional outcomes and reduced revision rates. These technological advances are complemented by minimally invasive approaches that minimize soft tissue disruption, shorten hospital stays, and accelerate rehabilitation protocols.

At the material level, high-performance polymers and hybrid bearings are redefining implant longevity, while surface coatings on femoral and tibial components enhance osteointegration and inhibit microbial adhesion. Emerging regulatory pathways that emphasize real-world data collection have incentivized manufacturers to invest in post-market registries and patient-reported outcome measures. These shifts are underpinned by a cultural focus on value-based care, prompting hospitals and payers to demand robust evidence of clinical and economic benefits. As a result, industry participants are forging alliances with digital health companies to capture longitudinal patient data and drive continuous improvement. This confluence of design innovation, surgical sophistication, and regulatory evolution is setting a new standard for knee implant performance and patient satisfaction.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Knee Implant Supply Chains, Pricing Structures, and Manufacturer Strategies

In 2025, the United States implemented a series of tariff adjustments targeting imported medical device components, including orthopedic implants and surgical instruments. Under the expanded Section 301 measures, duty rates of up to 25 percent have been applied to select harmonized tariff codes covering knee implant assemblies and precision instruments. These levies have directly impacted the cost structure for manufacturers reliant on overseas component sourcing, leading to upward price pressures throughout the supply chain. Hospitals and ambulatory surgical centers have responded by renegotiating supplier contracts and seeking alternative channels for procurement.

To mitigate the impact of elevated import duties, many implant providers have accelerated onshore manufacturing initiatives and established strategic partnerships with domestic contract manufacturers. This shift has been further supported by federal incentives aimed at bolstering domestic production of critical medical supplies. Nevertheless, the cumulative effect of tariffs has introduced complexity into global supply networks, prompting companies to diversify their raw material sourcing and reevaluate long-term supplier commitments. As price adjustments propagate to end-users, reimbursement negotiations have become more intricate, with providers advocating for modified payment models to offset increased implant costs. These developments underscore the critical importance of supply chain resilience and adaptive pricing strategies in maintaining market competitiveness.

Revealing Critical Segmentation Insights Across Product Types, Fixation Methods, Designs, Technologies, and Patient Demographics Driving Market Nuances

Distinct product categories in the knee implant sector reveal diverse adoption trajectories and clinical applications. Total knee replacement remains the cornerstone therapy for advanced osteoarthritis, yet partial replacements focused on compartment-specific degeneration are gaining traction due to their bone-preserving characteristics. Revision procedures continue to expand in response to an aging patient population with prior joint reconstructions. Analyses based on procedural classifications demonstrate that primary replacements still account for the majority of surgical volumes, but the rise in revision interventions underscores the imperative for durable implant solutions.

The method of fixation has also become a critical differentiator, as cementless implants leverage porous surfaces and hydroxyapatite coatings to facilitate long-term biological fixation, contrasting with traditional cemented systems. Hybrid approaches are emerging to combine the immediate stability of cement with the potential for bone ongrowth offered by cementless designs. Material insights indicate that the legacy metal-on-plastic bearings remain prevalent, while ceramic-on-plastic pairings are explored for their reduced wear debris and superior biocompatibility. Meanwhile, evolving design philosophies-spanning cruciate retaining, fixed bearing, mobile bearing, and posterior stabilized offerings-provide surgeons with tailored solutions, including medial rotation geometry for enhanced rotational kinematics.

Technological segmentation highlights a clear pivot toward computer navigated and robotic assisted procedures. While conventional instrumentation retains a robust installed base, semi-automated robotic systems are achieving notable penetration by balancing precision gains with capital investment considerations. In end-user settings, hospitals dominate the delivery of knee arthroplasty services, though ambulatory surgical centers are increasingly entrusted with lower-complexity cases due to operational efficiencies. Orthopedic clinics serve as crucial referral points for preoperative planning and postoperative care. The distribution mix favors direct sales in high-touch hospital environments, yet online channels and distributor networks, both exclusive and nonexclusive, have broadened access for smaller providers. Finally, patient demographics influence implant selection, with geriatric cohorts representing the largest share of procedures, adult patients demonstrating growing demand for moderate activity profiles, and pediatric cases remaining highly specialized. Constraint level considerations-ranging from unconstrained to semiconstrained and fully constrained designs-enable tailored biomechanical support across varying degrees of ligament integrity.

This comprehensive research report categorizes the Knee Implant market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fixation Method

- Material

- Design

- Technology

- Patient Age Group

- Constraint Level

- End User

- Distribution Channel

Highlighting Regional Variations in Knee Implant Adoption, Reimbursement Policies, and Innovation across the Americas, EMEA, and Asia-Pacific Landscapes

Across the Americas, robust reimbursement frameworks and established clinical pathways have fostered high adoption rates for both conventional and advanced knee implant technologies. The United States market leads in the deployment of robotic assisted surgery platforms, supported by favorable coverage policies and growing acceptance among orthopedic surgeons. Canada and Latin America exhibit pockets of strong growth, driven by government-backed healthcare initiatives and rising investment in surgical infrastructure.

In Europe, Middle East & Africa, market dynamics are shaped by pronounced price sensitivity and variable reimbursement mechanisms. Western European nations maintain high penetration of premium implant systems, whereas Eastern European markets are characterized by cost-effective product segments and growing demand for generic designs. In the Middle East and Africa, healthcare modernization efforts are expanding the availability of joint replacement procedures, with leading hospitals in the Gulf Cooperation Council region adopting state-of-the-art technologies to attract medical tourism.

The Asia-Pacific region stands out for its rapid expansion, fueled by a burgeoning middle class, increasing public health expenditure, and government policies aimed at improving access to orthopedic care. Surgical volumes are climbing in China, Japan, India, and Australia, where domestic and international players compete on price, service, and clinical outcomes. Notably, local manufacturers are capitalizing on cost advantages to gain share, while multinational companies forge partnerships to optimize distribution networks. These regional variations underscore the necessity for market entrants to tailor strategies to distinct regulatory environments, reimbursement landscapes, and patient demographics.

This comprehensive research report examines key regions that drive the evolution of the Knee Implant market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives, Product Portfolios, and Competitive Positioning of Leading Knee Implant Manufacturers in a Dynamic Market Environment

Leading orthopedic device companies are advancing strategic roadmaps to secure market leadership in knee implant solutions. One global innovator has prioritized the integration of robotic-assisted platforms with proprietary software to deliver augmented reality guidance and intraoperative analytics. Another major manufacturer has focused investments on next-generation materials research, exploring bioactive coatings and polymer composites to enhance implant longevity and patient safety.

A third competitor has expanded its footprint through strategic acquisitions of start-ups specializing in patient-specific implant design, thereby strengthening its pipeline of personalized solutions. Simultaneously, established players are enhancing service offerings by deploying mobile surgical units and digital care platforms that enable remote monitoring of postoperative recovery. Strategic alliances with contract manufacturing organizations are also on the rise, as companies seek to localize production and mitigate tariff exposure. The competitive environment is further defined by partnerships between device firms and health technology providers to develop integrated care pathways that leverage real-time data collection and machine learning algorithms to predict implant performance and patient outcomes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Knee Implant market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- ConforMIS, Inc.

- Corin Group plc

- DePuy Synthes, Inc.

- Exactech, Inc.

- LimaCorporate S.p.A.

- MicroPort Scientific Corporation

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Empowering Industry Leaders with Targeted Recommendations to Capitalize on Technological Innovations, Regulatory Shifts, and Clinical Practices in Knee Implants

Industry leaders should prioritize the adoption of robotic-assisted and computer-navigated systems to achieve superior alignment accuracy and patient satisfaction, while balancing capital expenditures through flexible financing models. To counteract tariff pressures and supply chain disruptions, organizations are advised to establish dual-source strategies and invest in domestic manufacturing capabilities, leveraging regional tax incentives and government grants. It is imperative to cultivate strategic partnerships with material science innovators to accelerate the development of advanced bearing surfaces and porous coatings that enhance implant integration and longevity.

Engagement with regulatory authorities and clinical key opinion leaders is essential to shape post-market surveillance requirements and accelerate the uptake of value-based reimbursement models. Providers should align with ambulatory surgical centers to optimize case throughput, reduce costs, and broaden patient access to knee arthroplasty services. Tailoring product offerings to distinct patient demographics, including geriatric and active adult cohorts, will differentiate portfolios and address unmet needs. Finally, investing in digital health tools, such as remote rehabilitation platforms and real-time outcome monitoring, can fortify patient engagement and generate robust real-world evidence to support long-term value propositions.

Outlining the Rigorous Research Methodology Employed to Gather Primary and Secondary Intelligence, Validate Findings, and Ensure Analytical Robustness

The foundation of this research involved a multi-tiered approach combining both primary and secondary sources to ensure analytical rigor. Primary research comprised in-depth interviews with orthopedic surgeons, hospital procurement officers, and supply chain managers across key geographies to capture firsthand insights into clinical preferences, procurement challenges, and emerging technology adoption. These qualitative inputs were augmented by surveys conducted with device sales representatives and distributors to gauge market sentiment and distribution dynamics.

Secondary research encompassed a thorough review of peer-reviewed journals, regulatory agency filings, clinical trial databases, and industry white papers to contextualize technological trends and regulatory changes. Trade association reports and government statistics provided supplemental data on procedure volumes and demographic shifts. All collected data were triangulated through cross-validation to reconcile discrepancies and enhance the robustness of findings. An expert advisory panel, comprising biomedical engineers and healthcare economists, reviewed the analytical framework and validated the key insights to ensure comprehensive coverage and methodological transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Knee Implant market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Knee Implant Market, by Fixation Method

- Knee Implant Market, by Material

- Knee Implant Market, by Design

- Knee Implant Market, by Technology

- Knee Implant Market, by Patient Age Group

- Knee Implant Market, by Constraint Level

- Knee Implant Market, by End User

- Knee Implant Market, by Distribution Channel

- Knee Implant Market, by Region

- Knee Implant Market, by Group

- Knee Implant Market, by Country

- United States Knee Implant Market

- China Knee Implant Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Summarizing Key Strategic Imperatives and Market Dynamics That Will Shape the Future Trajectory of the Knee Implant Industry Amid Ongoing Innovations

The knee implant industry is poised at an inflection point where clinical innovation, regulatory evolution, and geopolitical dynamics converge to redefine market trajectories. Strategic imperatives for manufacturers and providers include harnessing digital and robotic technologies to elevate surgical precision, fortifying supply chains against tariff-induced volatility, and deepening collaboration with clinical stakeholders to generate robust real-world evidence. Segment-specific insights underscore the opportunity to tailor solutions for diverse patient populations, fixation methods, and material preferences, while regional nuances highlight the importance of adaptive commercialization strategies across the Americas, EMEA, and Asia-Pacific.

Sustained competitiveness will hinge on the ability to anticipate regulatory shifts, invest in advanced material sciences, and deploy data-driven care models that demonstrate tangible improvements in patient outcomes. As the industry transitions toward value-based paradigms, aligning product development and market access initiatives with payer expectations will be critical for unlocking new growth avenues. By integrating these strategic considerations, stakeholders can chart a course that maximizes patient benefits, supports economic sustainability, and secures leadership in the rapidly evolving knee implant market.

Drive Informed Decisions in Knee Implant Innovation by Requesting an In-Depth Market Research Report from Associate Director Ketan Rohom

To secure unparalleled strategic insights and empower your organization to navigate the complexities of the knee implant market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to acquire the comprehensive market research report. Engaging with this meticulously curated research will furnish your team with actionable intelligence on emerging innovations, regulatory developments, and evolving clinical preferences. By partnering with Ketan Rohom, you will gain privileged access to bespoke data analyses, in-depth competitive profiling, and expert recommendations tailored to your business objectives. Do not miss this opportunity to capitalize on detailed market segmentation trends, tariff impact assessments, and regional growth strategies. Contact Ketan Rohom today to elevate your understanding, accelerate decision-making, and secure a competitive advantage in the rapidly advancing knee implant landscape.

- How big is the Knee Implant Market?

- What is the Knee Implant Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?