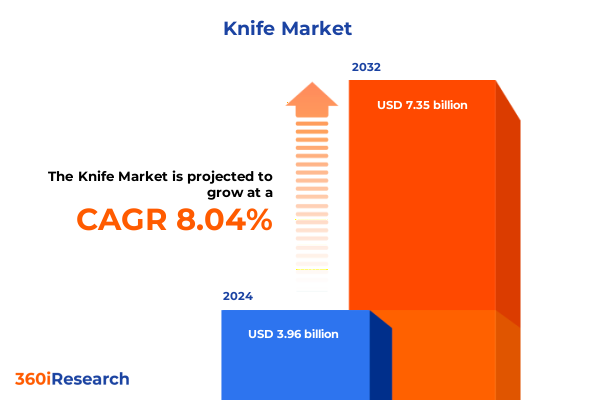

The Knife Market size was estimated at USD 4.28 billion in 2025 and expected to reach USD 4.62 billion in 2026, at a CAGR of 8.24% to reach USD 7.45 billion by 2032.

Introduction to the Evolving Global Knife Market Uncovering Key Drivers, Strategic Imperatives, and Core Competitive Dynamics Influencing Industry Growth

The global knife market has witnessed marked diversification in recent years, shaped by evolving consumer behaviors, technological advancements, and shifts in distribution paradigms. Culinary enthusiasts, outdoor adventurers, and tactical professionals increasingly demand products that blend precision engineering with aesthetic appeal and durability. Concurrently, manufacturers are racing to refine their value propositions through innovative materials research, ergonomic handle design, and purpose-driven product portfolios. This introduction outlines the critical parameters under examination that will frame our understanding of the current landscape and future possibilities.

Moreover, this analysis delves into the strategic imperatives driving industry consolidation, competitive differentiation, and channel optimization. By examining core competitive dynamics-ranging from brand heritage and artisanal craftsmanship to lean manufacturing and digital supply chains-stakeholders can pinpoint opportunities to refine their go-to-market strategies. Subsequent sections will illuminate how technological breakthroughs, regulatory developments, and consumer sophistication coalesce to redefine what constitutes a compelling knife offering, ultimately setting the stage for informed decision-making.

Identifying the Major Disruptive Forces and Technological Innovations Redefining Knife Manufacturing, Distribution, and Consumer Engagement Landscape

In recent years, rapid advances in materials science have redefined manufacturing processes for knife producers worldwide. High-performance alloys, ceramic composites, and proprietary coatings now enable blades that resist corrosion, retain edge sharpness longer, and withstand extreme temperatures. These innovations have spurred a wave of product differentiation, with brands emphasizing unique value-adds such as nonstick surfaces, quick-sharpening geometries, and rust-proof treatments. Consequently, traditional production methods are adapting to incorporate additive manufacturing and precision forging techniques, underscoring a broader shift toward leaner, more flexible operations.

Simultaneously, digital transformation is reshaping how consumers engage with knife brands. E-commerce platforms, social media influencers, and virtual try-on tools have emerged as powerful conduits for brand storytelling and customer acquisition. This pivot toward omnichannel fulfillment not only broadens market reach but also demands robust back-end logistics and a seamless user experience. As digital touchpoints multiply, companies that fail to integrate real-time data analytics and personalized marketing risk ceding ground to more agile competitors. Consequently, supply chain transparency, predictive demand forecasting, and responsive fulfillment strategies have become table stakes for industry leaders.

Analyzing the Effects of 2025 United States Tariff Measures on Raw Material Sourcing, Production Costs, and Import Dynamics Affecting Knife Manufacturers

In early 2025, the United States implemented a series of tariffs targeting imported steel, specialty alloys, and finished metal goods, directly affecting knife manufacturers that rely on globally sourced blade and handle materials. These levy changes have elevated production costs for firms importing premium carbon and stainless steel, prompting a reassessment of procurement strategies. Manufacturers now face the dual challenge of mitigating cost pressures while preserving the quality and performance standards that discerning consumers expect.

Consequently, many companies have accelerated efforts to localize their supply chains, forging partnerships with domestic steel mills and composite suppliers. Although nearshoring raw material sourcing enhances tariff resilience, it introduces complexities related to capacity constraints and qualifying alternative suppliers against stringent performance criteria. This transition phase has illuminated the importance of robust quality assurance protocols and strategic inventory buffering to balance lead-time fluctuations.

Moreover, the tariff landscape has spurred a nuanced import-export dynamic, wherein some manufacturers establish satellite production facilities in tariff-exempt zones or bonded warehouses. These structural adjustments not only alleviate immediate cost burdens but also create strategic flexibility to respond to future trade policy shifts. As a result, tariff-driven adaptation has become a critical strategic consideration for global and domestic knife producers seeking sustainable competitive advantage.

Investigating Distinct Market Segmentation Approaches Across Product Types, Distribution Channels, End Users, Blade Materials, Handles, and Applications

Consumer demand diverges significantly across distinct product categories, with hunting knives prioritizing rugged durability and retention in outdoor environments, while kitchen knives emphasize precision slicing, ergonomic comfort, and aesthetic design. Within the kitchen segment, specialized blades such as bread knives bring serrated edges for uniform loaf slicing, chef knives offer versatile chiseling and chopping functionality, and paring knives deliver refined control for delicate trimming tasks. Tactical blades, differentiated between law enforcement and military applications, underscore features like rapid deployment mechanisms, reinforced tip durability, and nonreflective coatings engineered for critical operational contexts.

Distribution strategies compartmentalize through diverse channels, ranging from direct sales that foster brand loyalty and firsthand customer feedback to online retail platforms where manufacturer-owned websites coexist with third-party marketplaces, driving both reach and price competition. Specialty stores offer curated experiences, allowing consumers to handle and inspect premium offerings, whereas supermarkets deliver mass-market accessibility that attracts casual buyers and gift purchasers alike. These channel variations require brands to tailor marketing and logistical approaches to sustain consistent service levels and margin expectations.

End-user segmentation further refines the picture: home users seek ease of maintenance, intuitive handling, and affordability, whereas professional users-specifically butchers and chefs-demand industrial-grade resilience, frequent sharpening cycles, and compliance with sanitary regulations. The choice of blade material, spanning carbon steel’s sharpening potential, ceramic’s inert properties, composite blends for weight optimization, and stainless steel variants such as austenitic and martensitic grades for enhanced toughness, directly correlates with performance expectations. Similarly, handle materials that include composite polymers, metals, plastics, and traditional woods influence grip ergonomics, durability, and sensory appeal.

Finally, the knife’s application context drives tailored design: cooking blades segment into carving and food preparation tools, outdoor offerings bifurcate into camping and fishing implements, and tactical products diverge for law enforcement or military missions. Each niche carries distinct durability, corrosion resistance, and multifunctionality requirements, illustrating the market’s rich tapestry of specialized demands.

This comprehensive research report categorizes the Knife market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Blade Material

- Handle Material

- Distribution Channel

- Application

- End User

Understanding Regional Market Variations and Consumer Preferences Across the Americas, Europe Middle East Africa, and Asia Pacific Knife Market Environments

Regional markets for knives display marked contrasts shaped by consumer preferences, regulatory environments, and local cultural practices. In the Americas, strong demand persists for multipurpose and outdoor-oriented blades, driven by recreational hunting, fishing, and adventure sports cultures. North American consumers prioritize ergonomic comfort and all-weather performance, encouraging suppliers to innovate around corrosion-resistant coatings and modular handles suitable for diverse climates. Simultaneously, Latin American markets are witnessing growth in budget-friendly segments, reflecting a rise in home cooking and small-scale outdoor tourism activities.

Across Europe, the Middle East, and Africa, regional nuances influence knife usage. European consumers often favor heritage brands with centuries-old craftsmanship reputations, while stringent EU regulations on food-contact materials and blade safety shape product certification requirements. In the Middle East and Africa, occupational uses in agriculture, construction, and tactical operations dictate demand for heavy-duty utility and tactical knives built to endure harsh environments.

In Asia-Pacific, diverse culinary traditions and outdoor pursuits drive broad market adoption. East Asian countries such as Japan maintain a discerning market for artisan-forged kitchen blades, whereas Southeast Asian regions exhibit a rising appetite for affordable, mass-market utility knives used in both home cooking and small-scale commercial ventures. Additionally, growing awareness of self-defense and security applications in urban centers has increased interest in compact tactical models.

This comprehensive research report examines key regions that drive the evolution of the Knife market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Knife Industry Players, Their Strategic Collaborations, Innovation Portfolios, and Competitive Positioning in a Rapidly Evolving Marketplace

Leading industry players have adopted differentiated strategies to secure competitive positioning. Established heritage brands continue to leverage artisanal craftsmanship and proprietary blade-forging processes to justify premium pricing. Simultaneously, agile challengers deploy lean manufacturing methods and modular design principles, enabling rapid product iterations aligned with emerging consumer trends. Strategic collaborations between material science firms and knife makers have also proliferated, facilitating co-development of hybrid steel composites and advanced coating solutions that enhance edge retention and corrosion resistance.

Furthermore, key companies are investing in digital ecosystems to elevate customer engagement. By integrating virtual blade-selection tools, online sharpening tutorials, and community forums highlighting user-generated content, these innovators strengthen brand loyalty and foster peer-to-peer advocacy. Partnerships with specialty retailers and outdoor equipment chains further extend physical presence, while premium subscription services-offering routine sharpening, maintenance accessories, and exclusive limited-edition releases-create recurring revenue streams. Collectively, these strategic moves underscore a competitive environment where innovation, experiential engagement, and ecosystem development are critical to long-term success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Knife market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Benchmade Knife Company, Inc.

- Buck Knives, Inc.

- Böker Messer-Manufaktur GmbH

- Cold Steel, Inc.

- Columbia River Knife & Tool, Inc.

- Cutco Corporation

- Fiskars Corporation

- Ka-Bar Knives, Inc.

- Kai Corporation

- Kershaw Knives

- MAC Knife, Inc.

- Ontario Knife Company

- Opinel S.A.S.

- Spyderco, Inc.

- Victorinox AG

- Wüsthof Dreizackwerk KG

- Yoshida Metal Industry Co., Ltd.

- Zwilling J.A. Henckels AG

Formulating Strategic Roadmaps and Actionable Industry Best Practices to Enhance Competitiveness, Operational Agility, and Sustainable Growth in Knife Enterprises

To thrive in this competitive environment, industry stakeholders must align innovation roadmaps with shifting consumer demands and supply chain realities. Emphasizing advanced research into high-performance alloys and sustainable composite materials can yield blades that meet both quality and environmental stewardship objectives. Simultaneously, brand owners should expand omnichannel distribution, combining direct-to-consumer digital platforms with targeted partnerships in both specialty and mass-market retail outlets to maximize reach and flexibility.

Operational resilience is equally crucial in light of tariff volatility and global logistics challenges. Executives should prioritize supplier diversification, including developing strategic alliances with regional material producers to mitigate geopolitical risk. Furthermore, embedding real-time analytics into procurement and inventory management systems will enable proactive responses to material price fluctuations and demand spikes. In parallel, investing in customer education initiatives-such as immersive virtual training on blade care and sharpening techniques-can deepen customer loyalty, differentiate offerings, and justify value-added service models.

Detailing Rigorous Research Design, Data Collection Methodologies, and Analytical Framework Employed to Ensure Comprehensive and Unbiased Market Insights

This analysis is underpinned by a dual-phased research approach combining rigorous primary and comprehensive secondary methodologies. In the primary phase, structured interviews were conducted with senior executives, product development engineers, procurement managers, and distribution channel experts to capture firsthand insights into strategic priorities, operational challenges, and innovation roadmaps. Additionally, focus group discussions with home users and professionals such as chefs and outdoorsmen provided qualitative perspectives on user experience, performance expectations, and purchase drivers.

The secondary research phase involved systematic review of industry publications, trade association reports, government trade documentation, and relevant academic studies on metallurgy and material science. Data triangulation methods ensured consistency and reliability by cross-verifying findings across multiple sources. Quantitative analysis of import-export statistics, tariff schedules, and online retail trends was complemented by expert panel validation, where subject-matter experts assessed the robustness of insights. Finally, the entire research process adhered to stringent quality-assurance protocols, including peer review and consistency checks, to deliver unbiased, actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Knife market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Knife Market, by Product Type

- Knife Market, by Blade Material

- Knife Market, by Handle Material

- Knife Market, by Distribution Channel

- Knife Market, by Application

- Knife Market, by End User

- Knife Market, by Region

- Knife Market, by Group

- Knife Market, by Country

- United States Knife Market

- China Knife Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Summarizing Critical Findings, Reflecting on Strategic Implications, and Outlining Future Directions for Stakeholders in the Global Knife Industry

This comprehensive review underscores the significance of technological innovation, evolving distribution models, and regulatory factors such as 2025 tariff measures in shaping the knife market. From the proliferation of advanced blade materials and additive manufacturing techniques to the strategic recalibration of supply chains, industry dynamics continue to evolve at a rapid pace. Segmentation insights-ranging from product typologies and distribution channels to nuanced end-user profiles-highlight the market’s multifaceted nature and underscore the importance of targeted, insights-driven strategies.

Looking ahead, industry participants must balance agility and resilience, leveraging regional strengths while anticipating global policy shifts. Embracing digital transformation, deepening customer engagement, and investing in sustainable material innovations will serve as key differentiators in a crowded marketplace. Ultimately, stakeholders who internalize these findings and adapt proactively will be best positioned to capture emerging opportunities and drive long-term value creation.

Unlock Critical Market Intelligence Exclusive Consultation with Ketan Rohom to Secure Comprehensive Knife Industry Insights and Strategic Guidance

To stay ahead in a rapidly changing knife market and gain unparalleled insights that inform strategic decision-making, reach out to Ketan Rohom (Associate Director, Sales & Marketing) for a personalized consultation. Leveraging his deep understanding of industry dynamics and commitment to excellence, Ketan can guide you through the key findings, actionable strategies, and nuanced perspectives uncovered in this comprehensive report.

By partnering with Ketan, you will secure tailored recommendations that address your organization’s unique challenges, ranging from navigating tariff implications to optimizing distribution and channel strategies. His expertise ensures you receive a bespoke executive summary, detailed segmentation analysis, and region-specific intelligence that will empower your next product launches and market expansion plans. Engage with him today to access the complete market research report and transform insights into competitive advantage.

- How big is the Knife Market?

- What is the Knife Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?