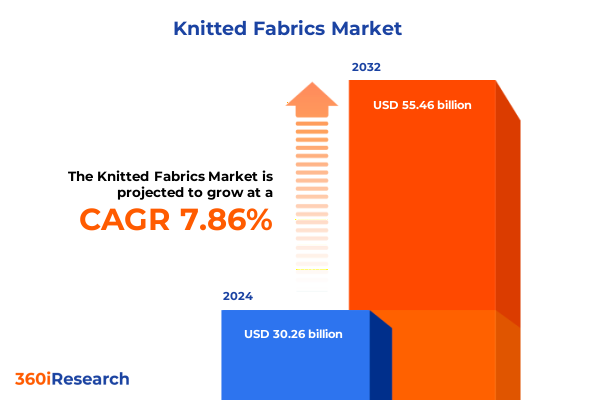

The Knitted Fabrics Market size was estimated at USD 32.62 billion in 2025 and expected to reach USD 35.18 billion in 2026, at a CAGR of 7.87% to reach USD 55.46 billion by 2032.

Revealing the Defining Dynamics of Knitted Fabrics Shaped by Consumer Demands, Sustainability Imperatives, and Technological Innovation

Knitted fabrics have evolved from simple textile constructions into complex, multifunctional materials that underpin a wide spectrum of end-use applications, ranging from high-performance sportswear to advanced medical textiles. This transformation is driven by a convergence of consumer demand for comfort, performance, and sustainability, together with rapid advancements in manufacturing technology. As consumer preferences shift toward athleisure and versatile wardrobe staples, knitted fabrics have become central to both fashion and industrial segments, reaffirming their importance across global supply chains.

Furthermore, the adoption of eco-conscious production methods, including the use of bio-based and recycled fibers, is reshaping how yarns are developed and selected. Innovations in low-impact dyeing and energy-efficient knitting machines are helping manufacturers align with environmental goals while enhancing production efficiency. These developments highlight a new era in the knitted fabrics industry, where innovation and sustainability intersect to meet evolving customer expectations.

Examining the Convergence of AI-Driven Automation, Digital Design, and Sustainable Practices Redefining Knitting Production

The knitting industry is experiencing a paradigm shift marked by the integration of artificial intelligence and automation in core production processes. Advanced knitting machines now leverage AI-driven software to anticipate defects, dynamically adjust tension settings, and optimize pattern accuracy in real time, thereby reducing material waste and elevating product quality. Robotic knitting arms and automated flat and circular knitting systems have also become more prevalent, enabling the production of intricate, customizable designs with minimal human intervention while maintaining precision and consistency.

Concurrently, digital design tools and virtual sampling platforms are revolutionizing how designers conceptualize and validate new knitwear collections. Computer-aided design systems facilitate rapid iteration of patterns, textures, and colorways, and virtual prototyping reduces the need for physical samples, shortening development cycles and conserving raw materials. Direct-to-knit digital printing further enhances flexibility, allowing for seamless integration of diverse color palettes and designs without interrupting the knitting workflow.

Moreover, the rise of sustainable practices and localized, on-demand manufacturing is reshaping supply chains. Sustainable materials such as recycled PET yarns, lab-grown fibers, and biodegradable alternatives are gaining traction, supported by closed-loop recycling initiatives. At the same time, micro-factories and local knitting hubs in Europe and North America are enabling brands to respond swiftly to market trends, reduce lead times, and minimize carbon footprints by producing knitwear closer to end consumers.

Unpacking How 2025’s Layered U.S. Tariff Policies Intensify Cost Pressures and Drive Supply Chain Realignments in Knitted Fabrics

In 2025, the cumulative effect of evolving U.S. tariff policies is exerting significant pressure on the knitted fabrics sector. With Executive Order 14257 and its subsequent amendments, the Harmonized Tariff Schedule of the United States introduced a 10 percent additional ad valorem duty on Chinese-origin textile goods effective May 14, 2025, while concurrent provisions set a 34 percent rate for articles of China, Hong Kong, and Macau under HTS heading 9903.01.63. Simultaneously, a 90-day suspension of certain country-specific rates introduced a uniform 10 percent duty on imports from affected trading partners from April 10 through July 9, 2025, further complicating cost structures for importers and domestic processors.

These tariff adjustments have reverberated across supply chains, prompting many manufacturers to seek alternative sourcing strategies for both raw materials and finished knitted goods. The increased duty burden has accelerated the onshoring and nearshoring of production activities, driven by the need to mitigate tariff exposure and maintain competitive price points. In addition, companies are investing in material innovation and vertical integration to reduce reliance on high-tariff imports and secure greater control over their value chains.

Illuminating How Diverse Raw Materials, Fabric Structures, and Application Demands Drive Strategic Segmentation Insights

The knitted fabrics landscape is shaped by diverse raw material choices, each presenting distinct performance attributes and sustainability considerations. Acrylic continues to serve as a cost-effective synthetic fiber renowned for colorfastness and ease of care, while cotton remains the material of choice for comfort and breathability in apparel applications. Nylon and polyester meet the demands of high-performance and durable textiles, favored in activewear and technical segments, whereas wool retains its premium positioning in luxury and cold-weather products due to its insulating and moisture-managing properties.

Fabric type segmentation further highlights the importance of structural versatility. Fleece knits deliver warmth and softness for casual and loungewear, interlock constructions offer stability and opacity for sportswear, and jacquard techniques enable complex patterns and textures that enhance aesthetic appeal. Rib knit’s elasticity makes it a staple for cuffs, collars, and form-fitting garments, while single jersey fabrics provide lightweight, versatile base materials across multiple end-use categories.

Application-wise, apparel remains the largest segment, spanning casual wear, formal attire, innerwear, and sportswear, all demanding distinct functionality and comfort characteristics. Home textiles leverage knit constructions for bedding, curtains, and upholstery, prioritizing softness, durability, and ease of maintenance. Industrial uses encompass automotive textiles, filtration components, medical fabrics, and technical applications, where precision in knit density, strength, and specialized finishes ensure performance under rigorous conditions.

End-user segmentation underscores demographic and gender-based preferences, from infants’ need for hypoallergenic, gentle knits to men’s and women’s fashion demands that blend style with function. Kids’ apparel necessitates durable, easy-care fabrics that withstand frequent washing, while adult segments focus on fit, textile innovation, and sustainability credence. Distribution channels span traditional brick-and-mortar outlets-including department stores, specialty shops, and supermarkets-and increasingly robust digital platforms, where direct-to-consumer and third-party marketplaces expand market reach and enable personalized, on-demand offerings.

This comprehensive research report categorizes the Knitted Fabrics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Raw Material

- Fabric Type

- Application

- End User

- Distribution Channel

Revealing Regional Dynamics from North America to Asia-Pacific Showcasing Production Hubs, Sustainability Efforts, and Market Leadership

In the Americas, North America leads in embracing performance-oriented knitted textiles, particularly in activewear and medical applications, driven by consumer demand for comfort and innovation. Automated knitting hubs and on-demand micro-factories are proliferating across the United States and Canada, enabling brands to respond rapidly to market shifts while reducing logistics costs and carbon emissions. This localized approach fosters agility in product development and strengthens regional resilience amid tariff fluctuations.

Europe, the Middle East, and Africa demonstrate a strong emphasis on sustainable and high-tech knitted solutions. Western European countries, notably Germany and Italy, house advanced manufacturing facilities that pioneer zero-waste knitting, closed-loop recycling, and integration of wearable technologies. Meanwhile, Middle Eastern markets are emerging as specialized production centers for compression garments and smart textiles, leveraging investments in infrastructure and digital capabilities to serve both local and international demand.

Asia-Pacific remains the dominant force in knitted fabric production, accounting for over 60 percent of global output with China, India, and Bangladesh as manufacturing powerhouses. Rising domestic consumption in countries such as Vietnam, South Korea, and Taiwan complements robust export activity, while continued investment in sustainable fibers and 3D knitting technologies ensures the region’s competitive edge. The convergence of cost-effective manufacturing and technological innovation is expected to preserve Asia-Pacific’s leadership position in the knitted fabrics sector.

This comprehensive research report examines key regions that drive the evolution of the Knitted Fabrics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Driving Seamless Knitting Dominance While Key Equipment and Fiber Suppliers Shape Fabric Innovation

The computerized seamless knitting machine market is predominantly led by three key players-Santoni, Shima Seiki, and Stoll-who together command more than 80 percent of the global market. Santoni’s modular full-garment knitting systems enable zero-waste production and are widely adopted for high-speed seamless activewear lines by leading sportswear brands. Shima Seiki’s WholeGarment® technology further advances single-piece garment manufacturing, catering to the luxury knitwear segment with unparalleled cycle times and precision. Stoll’s customization-centric solutions, featuring independently programmable knit heads and real-time stitch control, meet the demands of region-specific, limited-edition apparel runs.

Beyond seamless knitting, other influential companies shape the broader knitted fabrics ecosystem. Karl Mayer Group and Mayer & Cie. GmbH specialize in warp and flat knitting machines for technical textiles and automotive applications, offering high-speed, low-defect production platforms. Brother Industries, Pailung Machinery, and Fukuhara supply compact, versatile machines favored in small to medium-sized facilities, emphasizing ease of use and maintenance. Meanwhile, yarn suppliers such as INVISTA, Reliance Industries, and Unifi advance fiber innovations, providing sustainable and performance-oriented raw materials that underpin modern knitted fabric offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Knitted Fabrics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- APEX MILLS

- Baltex

- Boho Fabrics

- Bosforus Textile

- Clover Knits, Inc.

- Contempora Fabrics

- Far Eastern New Century Corporation

- Gehring-Tricot Corporation

- Georg + Otto Friedrich GmbH

- Haining Jinmao Warp Knitting Co., Ltd.

- Huafu Fashion Co., Ltd.

- Huvis Corporation

- Jante Textiles Company Limited

- Jason Mills, LLC

- Jiangsu Sunshine Co., Ltd.

- Koninklijke Ten Cate B.V.

- Loyal Textile Mills Ltd.

- Lu Thai Textile Co., Limited

- MONTEREY MILLS

- Nilit Ltd.

- Pacific Textiles Holdings Limited

- Parkdale, Incorporated

- Shandong Ruyi Technology Group Co., Ltd.

- SSM Industries

- Teijin Frontier Co., Ltd.

- The MAS Holdings (Pvt) Limited

- Toray Industries, Inc.

- TORAY INDUSTRIES, INC.

- Trelleborg Group

- Unifi, Inc.

- Vardhman Textiles Limited

- Welspun India Limited

- Zhejiang Chaoda New Materials Co., Ltd.

Strategic Recommendations for Leaders to Diversify Supply Chains, Embrace Sustainable Tech, and Enhance Competitive Resilience

Manufacturers and brands should prioritize supply chain diversification to mitigate tariff exposure and geopolitical risks. By establishing dual sourcing strategies that include both on-shore and near-shore partners, companies can maintain continuity of supply while capitalizing on regional trade agreements and preferential treatment. Investments in domestic capacity for high-performance and specialty knit fabrics will further reduce reliance on high-tariff imports and strengthen control over quality and lead times.

Additionally, businesses must accelerate adoption of advanced digital and sustainable knitting technologies. Embracing AI-enabled production systems, 3D and seamless knitting processes, and closed-loop recycling frameworks will not only drive operational efficiencies but also enhance brand credibility among eco-conscious consumers. Collaboration with technology providers, fiber innovators, and research institutions will unlock opportunities for novel product development and support long-term differentiation in a competitive global market.

Detailed Research Methodology Incorporating Secondary Data Analysis, Structured Primary Interviews, and Rigorous Data Triangulation

This analysis integrates a comprehensive secondary research phase, drawing on government publications, trade bulletins, industry reports, and company disclosures to establish foundational insights and contextual understanding. Primary research was conducted through structured interviews with equipment manufacturers, yarn producers, and knitwear brand executives, ensuring that real-world perspectives informed our interpretation of market dynamics. Data triangulation was applied across multiple sources to validate findings and mitigate individual biases, while expert comments were synthesized to enrich the strategic narrative.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Knitted Fabrics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Knitted Fabrics Market, by Raw Material

- Knitted Fabrics Market, by Fabric Type

- Knitted Fabrics Market, by Application

- Knitted Fabrics Market, by End User

- Knitted Fabrics Market, by Distribution Channel

- Knitted Fabrics Market, by Region

- Knitted Fabrics Market, by Group

- Knitted Fabrics Market, by Country

- United States Knitted Fabrics Market

- China Knitted Fabrics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Technological, Sustainability, and Trade Insights to Navigate the Future of Knitted Fabrics with Strategic Clarity

In summary, the knitted fabrics industry stands at a critical juncture where technological breakthroughs, sustainability imperatives, and complex trade environments converge to redefine competitive landscapes. The accelerating shift toward AI-driven automation, digital design, and eco-friendly materials underscores the sector’s innovation trajectory, while evolving tariff policies and regional supply chain realignments demand agile strategic responses.

By leveraging segmentation insights, regional dynamics, and a clear understanding of leading companies’ capabilities, stakeholders can chart informed pathways to growth. The recommendations provided herein will enable decision-makers to navigate immediate challenges, capitalize on emerging opportunities, and secure a robust position in the rapidly evolving knitted fabrics market.

Unlock Exclusive Knitted Fabrics Market Intelligence by Connecting with Our Associate Director for Your Essential Report Access

If you’re ready to translate these insights into a competitive edge and inform your strategic decisions with in-depth data and expert analysis, reach out today to Ketan Rohom, Associate Director, Sales & Marketing. Secure your copy of the comprehensive knitted fabrics market research report and unlock the detailed findings that will guide your next move toward innovation and growth.

- How big is the Knitted Fabrics Market?

- What is the Knitted Fabrics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?