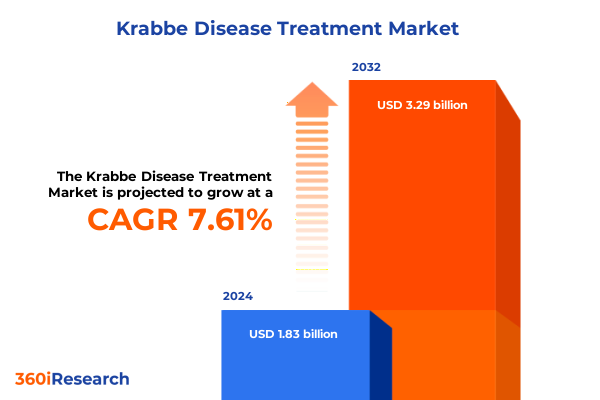

The Krabbe Disease Treatment Market size was estimated at USD 1.95 billion in 2025 and expected to reach USD 2.09 billion in 2026, at a CAGR of 7.74% to reach USD 3.29 billion by 2032.

Pioneering Therapeutic Approaches and Urgent Clinical Needs Shape the Evolving Landscape of Krabbe Disease Treatment Strategies

Krabbe disease is a rare, inherited neurodegenerative disorder caused by mutations in the galactocerebrosidase (GALC) gene, resulting in a deficiency of the GALC enzyme responsible for breaking down psychosine and other sphingolipids in the central and peripheral nervous systems. This enzymatic failure leads to toxic accumulation of psychosine, triggering widespread demyelination, rapid neurological decline, and severe multisystem involvement that often becomes apparent within the first few months of life. Without intervention, the early infantile form of Krabbe disease carries a mortality rate of approximately 90% before the age of two, necessitating urgent diagnosis and treatment to alter its otherwise fatal trajectory.

Current standard of care centers on hematopoietic stem cell transplantation (HSCT), which, when performed before symptom onset, can partially stabilize neurological decline by introducing donor-derived cells capable of producing functional GALC. However, HSCT does not fully address peripheral neuropathy, and its efficacy diminishes significantly if initiated after clinical manifestations. Supportive therapies, including physical rehabilitation and nutritional management, provide symptomatic relief but fail to halt underlying disease progression. As a result, the field has remained compelled by an urgent unmet need: therapies that not only address central nervous system degeneration but also correct peripheral nerve damage, offer durable enzyme restoration, and integrate seamlessly with early detection protocols to maximize patient outcomes.

Breakthrough Innovations and Multimodal Paradigm Shifts Are Revolutionizing Krabbe Disease Treatment Through Precision Gene Therapy and Enhanced Newborn Screening

The therapeutic landscape for Krabbe disease has undergone transformative shifts driven by advances in gene editing, viral vector technologies, and combinatorial treatment paradigms. AAV-based gene therapies in systemic administration following HSCT have emerged as a cornerstone of next-generation interventions. Early clinical updates on FBX-101, an investigational AAVrh10-GALC vector delivered intravenously after HSCT, demonstrated safety, increased GALC enzyme expression, and reduced psychosine levels in all five treated infants identified through newborn screening, highlighting a potential for comprehensive central and peripheral nervous system correction. These encouraging human data align with preclinical studies in Krabbe mouse models, where brain-targeted AAV1-GALC administration significantly extended lifespan and normalized motor function, underscoring the feasibility of direct CNS gene transfer to complement HSCT and address residual neuropathology.

Concurrently, research efforts have broadened to identify novel molecular targets beyond enzyme replacement. University at Buffalo investigators, supported by Rosenau Family Research Foundation funding, are elucidating the role of hyperactive NF-κB signaling in oligodendrocyte and microglial inflammation. This work aims to determine whether NF-κB pathway modulation can mitigate neuroinflammatory cascades that exacerbate demyelination in GALC deficiency and support synergistic application alongside existing gene and cell therapies. These converging strategies-combining genetic, cellular, and immunomodulatory modalities-are redefining treatment paradigms and fueling a new era of precision therapeutics for this devastating disorder.

Cumulative Consequences of 2025 U.S. Pharmaceutical Tariff Policies on Access, Cost Structures, and Innovation in Krabbe Disease Treatment Supply Chains

In April 2025, the U.S. government instituted a global 10% tariff on nearly all imported goods, including critical pharmaceutical inputs such as active pharmaceutical ingredients (APIs), ancillary reagents, and medical devices, under the rationale of bolstering domestic manufacturing. These measures, however, have resulted in immediate cost increases for drugmakers and healthcare providers. APIs sourced from China and India, which account for roughly 40% of U.S. generic drug production, now face duties up to 25% and 20% respectively, creating inflationary pressures on production costs and complicating procurement planning for orphan drug developers, including those advancing therapies for Krabbe disease.

Heightened duties extend beyond raw materials to medical packaging, lab equipment, and essential manufacturing machinery, all of which underpin cell and gene therapy development. The 15% tariff on sterile vials and analytical instruments, coupled with 25% duties on freeze-dryers and bioreactors sourced internationally, disrupts downstream supply chains by delaying equipment acquisitions and elevating project budgets. Early-stage biotechs, with limited capital reserves, are particularly vulnerable; an analysis by industry associations has warned that tariff-induced cost spikes could force delays or suspensions of critical IND filings, thereby slowing the overall Krabbe therapy pipeline.

Rare disease and cell-gene therapy coalitions have urged policymakers to exempt orphan drugs and their components from punitive trade measures, highlighting that any disruption to access would deprive the most vulnerable patients of potentially life-saving treatments. Industry stakeholders, including the Rare Disease Company Coalition and the Alliance for Regenerative Medicine, emphasize that reshoring entire supply chains for small patient populations is economically impractical and risks stalling innovation. Without targeted relief, these tariffs threaten to undermine recent advancements in Krabbe disease therapeutics by increasing manufacturing complexities and stretching already constrained R&D budgets.

Critical Segmentation Perspectives Reveal Nuanced Patient Subpopulations, Administration Routes, and Therapy Modalities Shaping Krabbe Disease Treatment Pathways

An in-depth examination of Krabbe disease treatment pathways reveals critical segmentation insights that inform clinical development, regulatory strategy, and patient access planning. When dissecting the market by therapy type, enzyme replacement and supportive care remain foundational, yet the swift emergence of gene therapy modalities underscores a shift toward durable, one-time interventions. AAV-based approaches bifurcate into AAV2 and AAV9 serotypes, while lentiviral systems are evolving from second to third generation vectors, each offering distinct safety profiles and transduction efficiencies. These differences shape trial design, manufacturing considerations, and long-term safety monitoring frameworks.

Routes of administration further refine development priorities, as intrathecal delivery via intracerebroventricular injection or lumbar puncture enables direct CNS targeting, whereas intravenous infusion through central venous catheters or peripheral veins facilitates systemic distribution post-HSCT. Selection of administration routes carries implications for clinical endpoints, patient tolerability, and healthcare infrastructure readiness.

Treatment setting segmentation highlights that inpatient specialty clinics and tertiary hospitals must be equipped for complex cell-based procedures, while outpatient modalities, including ambulatory clinics and home care services, play a vital role in long-term follow-up and supportive therapy management. Distribution channels span from hospital and specialty pharmacies to online platforms, with independent and managed specialty providers ensuring continuity of care for rare disease patients requiring specialized handling and cold chain logistics.

End users encompass a spectrum from multispecialty and specialty clinics to home care agencies and both general and children’s hospitals, each serving varied patient volumes and clinical expertise levels. Patient age stratification, spanning neonatal pre-symptomatic screening to infantile symptomatic and adolescent or adult late-onset cohorts, necessitates tailored study protocols and risk-benefit assessments, underscoring the importance of early diagnosis and intervention to optimize neurodevelopmental outcomes.

This comprehensive research report categorizes the Krabbe Disease Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Therapy Type

- Administration Route

- Patient Age Group

- Treatment Setting

- Distribution Channel

- End User

Divergent Regional Dynamics in Krabbe Disease Treatment Highlight Varied Healthcare Infrastructure, Policy Frameworks, and Market Access Across Major Global Territories

The Americas, led by the United States, have established robust infrastructure for early detection and treatment of Krabbe disease. Federal adoption of infantile Krabbe screening into the Recommended Uniform Screening Panel in July 2024 marked a pivotal advancement, enabling newborns to be identified pre-symptomatically and referred for HSCT or emerging gene therapies. States now cascade funding to expand diagnostic laboratories and comprehensive care centers, fostering an integrated network that accelerates clinical trial enrollment and real-world data collection.

In Europe, newborn screening programs vary widely across Member States, with panels including between eight and forty-nine conditions depending on national policies. While some countries have harmonized criteria through collaborative initiatives, discrepancies in funding, follow-up care, and rare disease registries persist. Advocacy by pan-European alliances is driving efforts to standardize screening protocols, streamline cross-border referral pathways, and align reimbursement frameworks for advanced therapies.

The Asia-Pacific region encompasses diverse implementation stages, from well-organized national screening programs in Australia, Japan, and South Korea to emerging pilot initiatives in Southeast Asia. Expanded newborn screening and genome-wide approaches are gaining traction in major urban centers, yet logistical and financial barriers in lower-income countries challenge equitable access. Public-private partnerships and grant-funded pilot projects are filling critical gaps, laying the groundwork for broader adoption of next-generation diagnostic and therapeutic innovations across the region.

This comprehensive research report examines key regions that drive the evolution of the Krabbe Disease Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Collaborations and Competitive Positioning Among Leading Biotech and Pharma Innovators Driving Advancements in Krabbe Disease Therapies

The competitive landscape of Krabbe disease treatments is defined by a mix of biotechnology pioneers, established pharmaceutical players, and emerging specialized therapy developers. Forge Biologics, now part of a global CDMO, leads the clinical arena with FBX-101, leveraging AAVrh10-mediated GALC delivery post-HSCT and securing designations such as Fast Track and Orphan Drug status in multiple regions, bolstering its strategic positioning.

Passage Bio’s PBKR03 employs an AAVhu68 capsid for targeted delivery to the cerebrospinal fluid via cisterna magna injection, aiming to correct central and peripheral GALC deficits while minimizing systemic exposure and immunogenicity. Complementary enzyme platform innovation has emerged from AbbVie’s expanded gene therapy trial roll-out across five new global sites, demonstrating significant improvements in neurological function metrics. Concurrently, Johnson & Johnson’s CNS-targeting enzyme candidate and GlaxoSmithKline’s pediatric transplant collaboration underscore the growing commitment of large pharma to rare demyelinating disorders.

Diagnostic and disease monitoring advancements by CENTOGENE, with enhanced genetic panels identifying over 20% more mutations, and Acorda Therapeutics’ AI-powered progression modeling highlight the critical role of precision diagnostics in stratifying patients and optimizing therapeutic interventions. Together, these strategic investments and partnerships are accelerating the translation of cutting-edge research into clinical reality, positioning these companies at the forefront of a rapidly evolving therapeutic frontier.

This comprehensive research report delivers an in-depth overview of the principal market players in the Krabbe Disease Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Acorda Therapeutics Inc.

- Apteeus SAS

- Centogene N.V.

- Forge Biologics, Inc.

- Gain Therapeutics, Inc.

- GlaxoSmithKline Plc

- Johnson & Johnson

- M6P Therapeutics

- Neurogene Inc.

- Novartis AG

- Pfizer Inc.

- Polaryx Therapeutics Inc

- Polaryx Therapeutics, Inc

- Polpharma

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Ltd.

- UCB Pharmaceuticals

Targeted Strategic Recommendations to Guide Industry Leaders in Optimizing Research Investment, Regulatory Engagement, and Patient Access for Krabbe Disease Treatments

Industry leaders should prioritize forging cross-disciplinary partnerships that integrate gene therapy developers, stem cell experts, and neuroinflammation researchers to build robust combination treatment approaches. Engaging early with regulatory agencies to secure accelerated pathways-such as Orphan Drug and Rare Pediatric Disease designations-can expedite approval timelines and unlock grant funding opportunities.

Organizations must diversify supply chains by qualifying multiple API and equipment vendors, investing in domestic manufacturing capability to mitigate tariff-driven cost fluctuations. Early alignment with payer networks and health technology assessment bodies will be critical to shape favorable reimbursement models for high-cost, single-administration therapies, ensuring sustainable patient access.

Leveraging real-world evidence from newborn screening registries and patient advocacy networks can inform trial design, demonstrate long-term safety and efficacy, and support post-approval commitments. Implementing modular manufacturing platforms will facilitate scalable vector production and agile responsiveness to emerging regulatory guidance, positioning companies to rapidly adapt to shifting market and policy landscapes.

Rigorous Multisource Research Methodology Combining Primary Expert Interviews, Comprehensive Data Triangulation, and Robust Quality Assurance Protocols

This report synthesizes insights from a comprehensive secondary research process, encompassing peer-reviewed journals, conference proceedings, and regulatory filings. Primary qualitative data was obtained through interviews with leading clinicians, bioprocess engineers, and patient advocacy representatives to validate emerging trends and identify unmet needs.

Quantitative market and clinical data were triangulated across proprietary databases, public registries, and newborn screening program records to ensure accuracy and relevance. All analyses adhered to rigorous quality assurance protocols, including dual-review of extracted data points and reconciliation of any discrepancies through consensus discussions among subject matter experts.

Methodological rigor was maintained through adherence to established reporting standards and transparency in data sourcing, ensuring that findings reflect a balanced, evidence-based perspective designed to support strategic decision-making in the Krabbe disease treatment domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Krabbe Disease Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Krabbe Disease Treatment Market, by Therapy Type

- Krabbe Disease Treatment Market, by Administration Route

- Krabbe Disease Treatment Market, by Patient Age Group

- Krabbe Disease Treatment Market, by Treatment Setting

- Krabbe Disease Treatment Market, by Distribution Channel

- Krabbe Disease Treatment Market, by End User

- Krabbe Disease Treatment Market, by Region

- Krabbe Disease Treatment Market, by Group

- Krabbe Disease Treatment Market, by Country

- United States Krabbe Disease Treatment Market

- China Krabbe Disease Treatment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Integrated Insights and Strategic Imperatives for Accelerating Next-Generation Krabbe Disease Therapies and Strengthening Global Patient Outcomes

The evolving Krabbe disease treatment ecosystem is characterized by a convergence of pioneering gene therapies, enhanced diagnostic capabilities, and targeted immunomodulatory strategies, all underpinned by expanded newborn screening initiatives. While novel AAV-based treatments offer unprecedented potential to address both central and peripheral neuropathology, emerging research on inflammatory pathways promises to refine therapeutic windows and optimize outcomes.

However, the 2025 U.S. tariff landscape introduces new complexities to supply chain management and R&D financing, underscoring the necessity for adaptive manufacturing strategies and proactive regulatory engagement. Strategic segmentation insights further emphasize the importance of tailored clinical protocols that consider patient age, therapy modality, and healthcare setting.

By integrating these multidimensional perspectives, stakeholders can navigate the intricate path from discovery to commercialization, ensuring that the next generation of Krabbe disease treatments not only reaches patients swiftly but does so sustainably and equitably.

Engage Directly with the Associate Director of Sales and Marketing to Secure Exclusive Krabbe Disease Market Research and Propel Your Strategic Decision-Making

To access the full in-depth market research report on Krabbe disease treatments, including all analytical models, detailed segmentation matrices, and actionable strategic insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will ensure you receive comprehensive guidance on how to leverage the report’s findings to optimize your product development, partnership strategies, and market access initiatives. Secure this critical resource today to stay ahead in the rapidly evolving Krabbe disease treatment landscape and drive informed decision-making across your organization.

- How big is the Krabbe Disease Treatment Market?

- What is the Krabbe Disease Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?