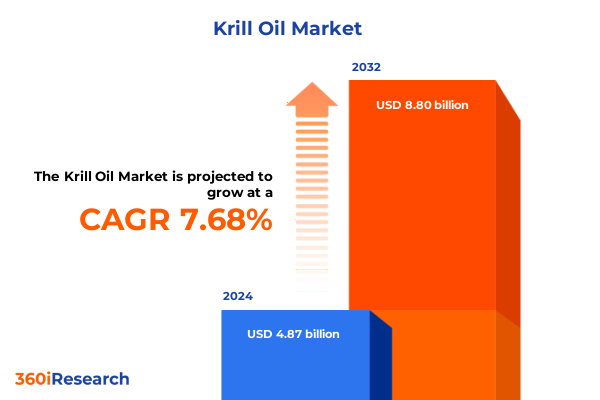

The Krill Oil Market size was estimated at USD 5.23 billion in 2025 and expected to reach USD 5.61 billion in 2026, at a CAGR of 7.72% to reach USD 8.80 billion by 2032.

Exploring the Dynamic Emergence of Krill Oil as a Premium Omega-3 Source Fueled by Rising Consumer Health Focus and Cutting-Edge Scientific Breakthroughs

Krill oil, extracted from tiny shrimp-like crustaceans in polar waters, is celebrated for its high concentrations of omega-3 fatty acids-namely eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA)-as well as the powerful antioxidant astaxanthin, providing a unique nutritional profile that differentiates it from traditional fish oil supplements.

Clinical investigations have demonstrated krill oil’s potential for reducing systemic inflammation, alleviating symptoms of arthritis, and improving cardiovascular biomarkers through effective modulation of blood lipid levels, positioning it as a versatile ingredient in both preventive and therapeutic health applications.

Driven by growing consumer awareness of bioavailability advantages and environmental concerns associated with overfishing, demand has expanded beyond traditional softgel capsules to encompass liquid formulations, powders, and tablets, supported by brands investing in sustainable harvesting technologies and transparent supply chains.

The intersection of an aging global population, rising incidence of chronic joint conditions, and intensifying focus on heart health has propelled krill oil into mainstream wellness dialogues. Healthcare professionals and consumers alike are integrating krill oil as a complementary supplement to address metabolic, cognitive, and inflammatory health objectives.

This executive summary synthesizes critical developments across market drivers, evolving regulations, segmentation dynamics, regional performance, leading competitors, and actionable recommendations, offering a comprehensive foundation for strategic planning in the rapidly advancing krill oil sector.

Charting the Transformative Trends Redefining the Krill Oil Landscape through Sustainable Harvesting, Personalized Nutrition and Evolving Regulations

Innovations in sustainable harvesting have become a cornerstone of the krill oil industry’s transformation, with technologies such as Eco-Harvesting enabling minimal bycatch, reduced carbon footprints, and enhanced traceability from ocean to supplement capsule. Major producers have forged partnerships with conservation organizations to validate their environmental stewardship and reinforce brand integrity.

Concurrently, personalization has reshaped product development, prompting manufacturers to offer differentiated dosage strengths across softgels, capsules, and liquid formats. High-dosage, medium-dosage, and low-dosage formulations are tailored to specific wellness goals-from cardiovascular support to cognitive optimization-while innovative delivery systems enhance consumer convenience.

Digital transformation has accelerated direct-to-consumer e-commerce growth, with emerging business units reporting double-digit online sales increases. Leading companies are leveraging data analytics to refine targeting, deploy subscription models, and foster community engagement through educational content on social platforms, thereby deepening customer loyalty and expanding market reach.

Regulatory evolution has played a pivotal role in market expansion, as European novel food approvals have recognized lipid extracts from Antarctic krill as safe for human consumption under defined usage limits, thereby enabling broader incorporation into functional foods and beverages. This formal recognition by the European Commission and EFSA paves the way for enriched dairy analogues, dressings, and breakfast cereals containing specified levels of EPA and DHA.

As the landscape continues to evolve, the convergence of environmental accountability, bespoke nutrition, digital engagement, and regulatory endorsement is redefining value creation within the global krill oil sector.

Evaluating the Cumulative Consequences of U.S. Tariff Measures on Krill Oil Imports and Their Ripple Effects across Global Seafood Supply Chains

Recent U.S. tariff measures have introduced a baseline 10% duty on nearly all imported seafood products, including krill oil, while imposing higher ad valorem rates-up to 30%-on select Chinese aquatic exports, reshaping cost structures for importers and downstream consumers.

The cumulative impact of these duties has been particularly pronounced for krill oil, which often relies on Antarctic and remote harvesting operations. Importers are absorbing increased freight and compliance costs, translating into elevated shelf prices and incentivizing some manufacturers to explore alternative sourcing arrangements and tariff mitigation strategies.

Consumer price inflation has been amplified by concurrent tariffs on steel and aluminum, which have driven up shipbuilding and shipping expenses. These compounded factors exert upward pressure on the landed cost of krill oil, prompting a reassessment of supply chain efficiency and potential reassignment of production investments closer to end markets.

Moreover, retaliatory trade actions by key seafood exporters have further complicated global distribution. As major producers redirect their shipments away from the U.S. market toward Asia and Europe, the availability of krill oil products in North America faces intermittent constraints, creating windows of scarcity that magnify price volatility and open opportunities for domestic or near-shore alternatives.

Looking ahead, sustained tariff pressures underscore the necessity for industry stakeholders to engage constructively with trade authorities, pursue preferential trade agreements, and invest in vertically integrated operations to manage cost fluctuations and secure resilient access to vital omega-3 resources.

Uncovering Critical Insights from Multifaceted Krill Oil Market Segmentation across Product Forms, Applications, End Users, Distribution Channels and Source Categories

The krill oil market exhibits pronounced diversity in delivery formats, spanning softgels, capsules, liquid concentrates, powders, and tablets. Within the capsule segment, differentiated high-dosage, medium-dosage, and low-dosage offerings cater to elevated cardiovascular support, general wellness maintenance, or foundational omega-3 supplementation, respectively, enabling brands to align product portfolios with precise consumer health objectives.

Applications extend well beyond human dietary supplements, encompassing functional food and beverage fortification, animal nutrition for both aquaculture feed and pet feed, and personal care formulations that leverage krill oil’s antioxidant potency. This multifaceted application spectrum underscores the ingredient’s versatility and the importance of targeted formulation strategies.

End user groups reveal further complexity, with adult health enthusiasts, aging geriatric populations seeking joint and heart health solutions, elite athletes prioritizing recovery and inflammation control, as well as pediatric formulations positioned to support developmental needs. Meanwhile, livestock feed and pet supplements have emerged as adjunct markets, reflecting the broadening acceptance of krill-derived nutrients across species.

Distribution channels bifurcate into offline and online domains, where traditional retail outlets such as health stores, pharmacies, hypermarkets, and direct sales coexist alongside growing e-commerce platforms. Within digital commerce, brands navigate general marketplaces and specialty health portals, while also leveraging proprietary manufacturer websites to cultivate brand communities and subscription services.

Sourcing diversity-spanning Antarctic krill, Arctic krill, and coastal krill-adds another dimension, as ecological considerations, regulatory permissions, and supply chain logistics drive strategic decisions around raw material procurement and traceability commitments.

This comprehensive research report categorizes the Krill Oil market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Application

- End User

- Distribution Channel

- Source

Illuminating Regional Dynamics Shaping the Krill Oil Market Growth and Consumer Preferences across the Americas, EMEA and Asia-Pacific

In the Americas, the United States and Canada dominate krill oil consumption, supported by high consumer spending on health supplements, an extensive network of retail and e-commerce channels, and a regulatory environment that encourages nutraceutical innovation. Market leaders leverage omni-channel strategies and direct-to-consumer services to capture demand from both proactive wellness advocates and clinical practitioners.

Europe, the Middle East & Africa (EMEA) present a landscape characterized by stringent novel food regulations and strong emphasis on sustainable sourcing. European novel food approvals and partnerships with conservation bodies reinforce consumer trust, while Middle Eastern markets show increasing interest in functional foods, and African trends underscore the nascent stages of supplement adoption amid growing urbanization and disposable incomes.

Asia-Pacific is experiencing robust growth driven by rising health consciousness, expanding fitness and wellness sectors, and greater collaboration between marine biotechnology firms and local supplement manufacturers. Innovative joint ventures in markets such as China, India, Japan, and Australia are introducing krill-based products tailored to regional taste preferences and traditional medicine systems, signaling a fertile environment for new product launches and distribution network expansions.

This comprehensive research report examines key regions that drive the evolution of the Krill Oil market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Moves and Competitive Strengths of Leading Krill Oil Producers Driving Innovation and Market Expansion Globally

Aker BioMarine stands as the market frontrunner, controlling over 65% of global fishing quotas and pioneering vertical integration that spans sustainable harvesting, advanced extraction, and branded product development. The company’s alliances with environmental NGOs and investments in pet nutrition segments have solidified its leadership in both human and animal health applications.

Rimfrost AS differentiates through patented low-temperature extraction technology that preserves the integrity of omega-3 phospholipids and astaxanthin. Its focus on clinical research collaborations substantiates health claims for cardiovascular and cognitive benefits, establishing a premium positioning within therapeutic nutrition markets.

Neptune Wellness Solutions has built a reputation for rigorous quality control and transparency, emphasizing third-party testing and certifications to assure consumers of product purity. Its strategic expansion into natural health and personal care segments highlights a proactive diversification approach amid evolving consumer expectations for clean, traceable ingredients.

Enzymotec Ltd. (now part of IFF) commands attention with proprietary lipid technologies that enhance the bioefficacy of its krill oil extracts. The company’s integration of krill-derived phospholipids into specialty nutrition formulations underscores its role as an innovation leader, catering to functional food and medical nutrition markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Krill Oil market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker BioMarine ASA

- AmbioPharm Inc.

- Blue BioTech International GmbH

- Calanus AS

- Coastside Bio Resources LLC

- ConnOils LLC

- GC Rieber Oils AS

- International Flavors & Fragrances Inc.

- Jedwards International, Inc.

- Neptune Technologies & Bioresources Inc.

- Norwegian Fish Oil AS

- Nutracode LLC

- Rimfrost AS

- Viva Naturals LLC

Presenting Strategic Recommendations for Industry Leaders to Capitalize on Emerging Krill Oil Opportunities through Innovation, Partnerships and Regulatory Engagement

Industry leaders should prioritize investment in cutting-edge sustainable harvesting technologies and transparent supply chain traceability to reinforce environmental stewardship and meet growing consumer demand for ethical products. By aligning with wildlife conservation initiatives and attaining third-party certifications, companies can strengthen brand credibility and unlock premium pricing opportunities.

To capitalize on market segmentation, organizations must develop a nuanced product portfolio that addresses distinct use cases-ranging from high-dosage clinical formulations to convenient, lower-dosage daily wellness capsules-and tailor marketing messages that resonate with specific end-user groups such as athletes, geriatrics, and pet owners.

Expanding omnichannel distribution strategies is essential; brands should integrate direct-to-consumer e-commerce platforms, leverage specialty health marketplaces, and maintain a steadfast presence in brick-and-mortar retailers. Data-driven customer engagement, subscription models, and dynamic pricing tactics will enhance retention and drive scalability.

Proactive engagement with regulatory bodies-particularly in jurisdictions like the EU, where novel food status governs market access-will expedite new product approvals. Collaborative dialogue with health authorities and participation in industry associations can streamline compliance and shape favorable policy outcomes.

Finally, companies should monitor tariff fluctuations and geopolitical developments, diversifying sourcing footprints across Antarctic, Arctic, and coastal krill stocks to mitigate supply disruptions and optimize landed costs through strategic trade agreements and localized processing facilities.

Detailing Comprehensive Research Methodology Integrating Primary Interviews, Secondary Analysis and Data Triangulation to Ensure Report Robustness

This report integrates a comprehensive mixed-method research framework to ensure analytical rigor. Secondary research encompassed an extensive review of peer-reviewed journals, government publications, regulatory databases, and industry association white papers to map historical developments and current regulatory landscapes.

Primary research involved in-depth interviews with senior executives, product developers, sustainability officers, and supply chain experts from leading krill oil companies across North America, Europe, and Asia-Pacific. These dialogues provided qualitative insights into strategic priorities, emerging challenges, and innovation roadmaps.

Data triangulation protocols were employed to validate findings, cross-referencing quantitative shipment data, tariff schedules, and financial disclosures with anecdotal evidence from industry insiders. This multi-layered approach facilitated the identification of convergent trends, competitive benchmarks, and growth catalysts, culminating in evidence-based conclusions and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Krill Oil market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Krill Oil Market, by Product Form

- Krill Oil Market, by Application

- Krill Oil Market, by End User

- Krill Oil Market, by Distribution Channel

- Krill Oil Market, by Source

- Krill Oil Market, by Region

- Krill Oil Market, by Group

- Krill Oil Market, by Country

- United States Krill Oil Market

- China Krill Oil Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Essential Takeaways and Forward-Looking Perspectives on the Krill Oil Market to Inform Strategic Decision Making and Growth Planning

In synthesis, the krill oil market is undergoing a pivotal evolution driven by sustainability imperatives, personalized nutrition demands, and regulatory endorsements. Tariff pressures and shifting trade dynamics present both challenges and opportunities, underscoring the need for strategic supply chain resilience.

Segmentation insights reveal extensive application potential across human health, animal nutrition, and personal care, necessitating targeted product innovations and channel strategies to capture diverse consumer sectors. Regional analysis highlights varying growth levers-from North America’s mature supplement ecosystem to Asia-Pacific’s rapid uptake supported by local collaborations and increasing wellness spending.

Competitive intelligence demonstrates that market leaders are distinguishing themselves through integrated value chains, proprietary extraction techniques, and transparent quality frameworks. However, rising entrants and evolving consumer preferences will continue to reshape competitive dynamics and spur differentiation through scientific validation and brand authenticity.

Ultimately, organizations that align sustainability with innovation, engage proactively with regulatory bodies, and leverage data-driven segmentation strategies will be best positioned to harness the forthcoming trajectory of the global krill oil market and deliver sustained growth.

Engage Directly with Ketan Rohom to Access Expert Krill Oil Market Intelligence and Drive Strategic Growth Initiatives

To secure a competitive advantage and access the comprehensive analysis of emerging opportunities in the krill oil market, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to explore tailored insights on sustainability innovations, tariff implications, segmentation strategies, regional dynamics, and the competitive landscape. Gain immediate access to the full research report, including proprietary data, executive interviews, and in-depth forecasts to inform your strategic roadmap. Elevate your decision-making with expert support and unlock the next phase of growth by partnering with Ketan Rohom today

- How big is the Krill Oil Market?

- What is the Krill Oil Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?