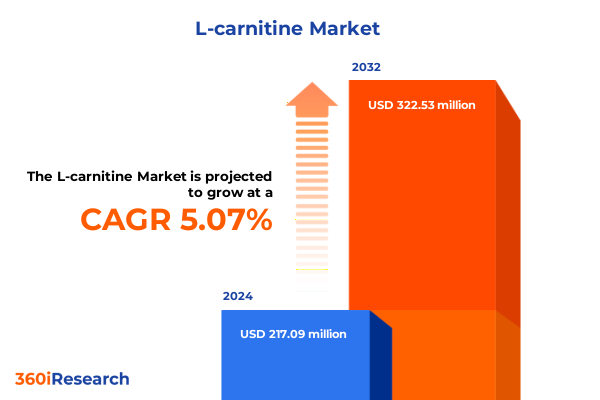

The L-carnitine Market size was estimated at USD 227.55 million in 2025 and expected to reach USD 238.66 million in 2026, at a CAGR of 5.10% to reach USD 322.53 million by 2032.

Exploring the multifaceted significance and rising prominence of L-carnitine across nutrition, pharmaceuticals, and animal feed applications

L-carnitine is a naturally occurring quaternary ammonium compound that plays an indispensable role in cellular energy metabolism by shuttling long-chain fatty acids into the mitochondrial matrix for β-oxidation. This small but critical molecule exists in several derivative forms-such as acetyl-L-carnitine, L-carnitine L-tartrate, and propionyl-L-carnitine-that offer unique absorption profiles and functional benefits. In human physiology, L-carnitine supports cognitive health, cardiovascular function, and physical performance, while in animal nutrition it enhances growth rates and feed conversion efficiency. Its multifaceted biochemical properties have positioned it as a keystone ingredient across dietary supplements, functional foods and beverages, personal care formulations, and pharmaceutical therapies.

Discovering paradigm shifts driven by bioavailable derivatives, sustainable production, personalized nutrition, and digital wellness integration

The L-carnitine landscape has undergone transformative shifts driven by advances in molecular science, consumer expectations, and sustainability imperatives. Manufacturers are prioritizing bioavailable derivatives such as acetyl-L-carnitine and propionyl-L-carnitine, which exhibit enhanced cellular uptake and targeted physiological outcomes. These specialized forms have gained traction in cognitive health and sports nutrition applications, where absorption efficiency directly influences product efficacy and consumer satisfaction.

Simultaneously, the industry is experiencing a shift toward eco-conscious production, with fermentation-based bioprocesses reducing reliance on energy-intensive chemical synthesis. Plant-derived and cruelty-free L-carnitine alternatives are emerging to meet the demands of vegan and sustainability-focused consumers, creating new supply chain paradigms that emphasize green chemistry and lifecycle considerations.

Digital wellness platforms and wearable integration represent another inflection point. Companies are leveraging activity trackers and personalized health data to optimize L-carnitine dosing regimens, aligning supplementation with individual metabolic profiles and lifestyle patterns. This convergence of nutrigenomics, mobile health, and data analytics is redefining consumer engagement and opening avenues for subscription-based, tailored nutrition solutions.

Unveiling the cumulative effects of evolving United States tariff policies on the global L-carnitine supply chain and cost structures

In early 2025, United States tariff policies applied acute pressure on L-carnitine supply chains by imposing additional duties on imports from China, the world’s primary production hub. On February 1, a 10% levy went into effect under an executive order targeting precursor chemicals, including amino acids, to curb illicit trade and bolster domestic sourcing. Following limited corrective measures by Chinese authorities, the U.S. escalated this rate to 20% on March 4, amplifying cost impacts for nutraceutical and feed additive manufacturers reliant on Chinese volumes.

However, a significant reprieve arrived on April 24, when the White House exempted essential dietary ingredients-among them L-carnitine-from both universal and reciprocal tariffs in recognition of their strategic importance to public health and agricultural productivity. This exemption effectively removed the added 20% duty, preserving affordability for U.S. end users and stabilizing procurement costs for compounders and formulators.

Despite the exemption, the cumulative impact of phased tariffs created supply chain bifurcations and short-term price volatility, prompting importers to diversify sources toward India, Germany, and domestic producers. The policy cycle underscored the imperative for resilient sourcing strategies, near-term inventory hedging, and potential vertical integration to mitigate future trade-driven disruptions.

Illuminating segmentation insights spanning product types, delivery forms, purity grades, manufacturing methods, applications, and distribution channels

The global L-carnitine market can be examined through multiple lenses that reveal nuanced dynamics across product evolution, manufacturing routes, and end-use pathways. From a product type standpoint, acetyl-L-carnitine has emerged as a leading cognitive support agent, L-carnitine L-tartrate predominates in sports nutrition formulations, and propionyl-L-carnitine has found niche applications in vascular health. Form portfolios span capsules, liquids, powders, softgels, and tablets, reflecting consumer preferences for both convenience and palatability. Grade differentiation drives positioning strategies: feed grade caters to large-scale livestock and pet nutrition, food grade targets functional snacks and beverages, and pharma grade aligns with rigorous pharmaceutical standards. Underlying these offerings, two principal production processes coexist: bioprocessing via microbial fermentation for sustainability gains, and chemical synthesis for cost efficiency and scale.

Application segmentation further highlights the molecule’s versatility. In animal feed, L-carnitine enhances livestock and pet performance; in functional foods and beverages it energizes products such as energy drinks, fortified foods, and protein shakes; within nutritional and dietary supplements it supports sports nutrition and weight management objectives; in personal care it enriches anti-aging and skin care innovations; and in pharmaceuticals it contributes to cardiovascular health protocols, male fertility therapies, and renal disease treatments. Distribution channels bifurcate into offline-comprising health and nutrition stores, pharmacies, and supermarkets-and online through company websites and e-commerce platforms, illustrating an omnichannel migration that balances traditional retail’s experiential value with digital convenience.

This comprehensive research report categorizes the L-carnitine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Grade

- Process

- Application

- Distribution Channel

Revealing regional dynamics shaping consumption patterns and growth opportunities across the Americas, Europe Middle East Africa, and Asia-Pacific markets

The Americas region exhibits robust demand underpinned by a well-established supplement culture, high obesity prevalence, and a mature animal nutrition sector. North America in particular benefits from a large geriatric demographic seeking preventive and therapeutic supplementation, as well as sports nutrition enthusiasts prioritizing performance recovery. The United States and Canada also leverage sophisticated feed additive protocols that incorporate L-carnitine to optimize animal welfare and production efficiency. Rapid adoption of digital health solutions and direct-to-consumer models further accelerates market penetration in this region.

In Europe, Middle East & Africa, the nutraceutical industry is buoyed by strong regulatory frameworks favoring quality certifications and functional claims. European consumers increasingly prefer natural and herbal supplements as alternatives to pharmaceuticals, driving L-carnitine’s integration into preventive health regimens. Regulatory alignment under EU directives and collaborations among regional feed associations have facilitated broader acceptance of feed grade L-carnitine, especially in Western Europe’s livestock and aquaculture segments. In the Middle East and Africa, growing affluence and infrastructure investments in animal husbandry are creating new entry points for L-carnitine-fortified feed pellets and supplements.

This comprehensive research report examines key regions that drive the evolution of the L-carnitine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading market participants and their strategic differentiators in fermentation, synthesis, and integrated supply chain models for L-carnitine

A concentrated cohort of global producers underpins the L-carnitine supply chain, each leveraging differentiated capabilities to capture premium segments. Lonza Group AG leads through its proprietary microbial fermentation technology, delivering high-yield acetyl-L-carnitine and ensuring premium purity levels for pharmaceutical and specialty nutrition applications. Lonza’s vertically integrated approach-from precursor sourcing to Drug Master File submissions-affords regulatory advantages and advanced market access in key geographies. Northeast Pharmaceutical Group Co., Ltd. dominates volume metrics in China with automated biosynthesis platforms that achieve cost leadership in feed grade offerings, while Switzerland’s Biosynth Carbosynth harnesses CRISPR-optimized strains to produce enantiomerically pure L-carnitine derivatives with sustainable process credentials.

Beyond these frontrunners, established chemical and life sciences companies such as BASF, Evonik, Teva Pharmaceutical Industries, Merck KGaA, and Sigma-Aldrich contribute breadth to the market landscape. Their global manufacturing footprints, cGMP-compliant facilities, and extensive product portfolios allow them to serve both commodity and specialized segments. Strategic collaborations, patent portfolios, and evolving delivery formats-such as liposomal encapsulations-further differentiate these incumbents as they vie for share in a competitive yet innovation-driven environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the L-carnitine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvaCare Pharma USA

- AIDP, Inc.

- Alfasigma S.p.A.

- AVANSCURE Lifesciences Pvt. Ltd.

- BASF SE

- Cayman Chemical Company

- Ceva Santé Animale

- Evonik Industries AG

- Foodchem International Corporation

- Glanbia Plc

- Glentham Life Sciences Limited

- Hefei TNJ Chemical Industry Co., Ltd.

- Kaiyuan Hengtai Nutrition Technology Co., Ltd.

- Lonza Group AG

- Merck KGaA

- Nacalai Tesque, Inc.

- Nanjing NutriHerb BioTech Co.,Ltd

- Northeast Pharmaceutical Group Co., Ltd.

- NutraBio Labs, Inc.

- Shaanxi TNJONE Pharmaceutical Technology Co., Ltd.

- Tokyo Chemical Industry Co., Ltd.

- VIX Pharma International

Actionable strategic imperatives for industry leaders to capitalize on bioinnovation, supply chain resilience, and evolving consumer preferences in L-carnitine

To thrive in this dynamic environment, industry leaders should prioritize supply chain diversification by integrating regional manufacturing hubs and alternative sourcing partners. Establishing strategic alliances with biotech innovators can unlock next-generation bioprocess technologies that enhance yield efficiency and reduce carbon footprint. Simultaneously, strengthening inventory resilience through near-term stockpiling and forward procurement agreements will mitigate the volatility introduced by geopolitical tariff shifts.

Moreover, product development roadmaps must align with evolving consumer expectations for personalized nutrition and digital engagement. Investing in data analytics platforms and forming partnerships with digital health providers will enable tailored dosing regimens that resonate with health-conscious end users. Embracing sustainability credentials-including eco-friendly production and transparent lifecycle assessments-can further elevate brand equity among ethically minded consumers. By orchestrating these strategic levers-operational resilience, bioinnovation partnerships, consumer personalization, and sustainability leadership-industry players can capture emerging growth pockets and secure long-term competitive differentiation.

Outlining robust research methodology combining primary expert insights, secondary data triangulation, and rigorous validation for credible market analysis

This research framework leveraged a dual-phased methodology to ensure comprehensiveness and rigor. Secondary research encompassed a systematic review of specialty chemical databases, regulatory filings, patent registries, and peer-reviewed journals to map the competitive landscape and production technologies. Additionally, trade association reports and government tariff schedules were analyzed to quantify policy impacts.

Primary research involved in-depth interviews with over twenty industry stakeholders, including C-suite executives at ingredient suppliers, formulation scientists at contract manufacturers, procurement leaders at feed additive integrators, and regulatory experts. Insights from these discussions were triangulated against secondary data points to validate trends and identify emerging inflection points. A data triangulation process-cross-referencing input variables such as production capacities, margin structures, and regional consumption patterns-ensured the robustness of the conclusions. Quality control was enforced through multiple review cycles, including internal expert workshops and external peer consultations, to guarantee objectivity and analytical integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our L-carnitine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- L-carnitine Market, by Product Type

- L-carnitine Market, by Form

- L-carnitine Market, by Grade

- L-carnitine Market, by Process

- L-carnitine Market, by Application

- L-carnitine Market, by Distribution Channel

- L-carnitine Market, by Region

- L-carnitine Market, by Group

- L-carnitine Market, by Country

- United States L-carnitine Market

- China L-carnitine Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding reflections on the transformative trajectory and strategic imperatives defining the future of the L-carnitine industry landscape

The landscape of L-carnitine is characterized by continuous innovation, shifting regulatory frameworks, and evolving consumer demands. The confluence of bioavailable derivative development, sustainable manufacturing advancements, digital wellness integration, and strategic tariff navigation defines the current competitive paradigm. Regional nuances-from North American direct-to-consumer platforms to Asia-Pacific’s bioprocess leadership-underscore the importance of geographic agility.

As the industry advances, companies that balance operational resilience with forward-looking R&D, while maintaining transparent sustainability credentials, will be best positioned to lead. The imperative to adapt to trade policy fluctuations, harness personalized nutrition technologies, and pursue green production pathways will continue to shape strategic roadmaps. This dynamic ecosystem presents both challenges and opportunities for stakeholders seeking to capitalize on the multifaceted value proposition of L-carnitine.

Engage with our Associate Director to unlock comprehensive L-carnitine market intelligence and secure your competitive advantage today

For an in-depth exploration of L-carnitine market dynamics and to secure a tailored intelligence package, reach out to Ketan Rohom, our Associate Director of Sales & Marketing. You’ll gain access to comprehensive analysis, strategic insights, and actionable recommendations that can empower your organization to navigate supply chain complexities, capitalize on emerging bioinnovation trends, and strengthen your competitive positioning. Connect with Ketan today to discuss how this market research report can address your specific decision-making needs and fuel your growth agenda.

- How big is the L-carnitine Market?

- What is the L-carnitine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?