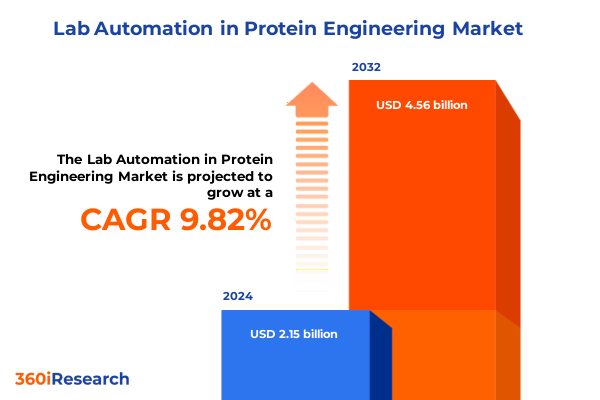

The Lab Automation in Protein Engineering Market size was estimated at USD 2.36 billion in 2025 and expected to reach USD 2.60 billion in 2026, at a CAGR of 9.80% to reach USD 4.56 billion by 2032.

Revolutionizing Protein Engineering Through Lab Automation Unlocking Accelerated Research and Enhanced Precision Across the Biotech Ecosystem

The advent of sophisticated automation technologies is fundamentally altering the trajectory of protein engineering research, bringing unprecedented speed and precision to laboratory workflows. Modern robotic platforms equipped with advanced liquid handling capabilities are seamlessly orchestrating complex protocols, replacing repetitive manual tasks with consistent, high-fidelity operations. Concurrently, the integration of artificial intelligence into these systems enables intelligent decision-making that dynamically optimizes experimental parameters based on real-time data, minimizing cycle times and mitigating the risk of human error. This convergence of robotics and AI is not only accelerating discovery but also democratizing access to high-throughput experimentation across research institutions.

Moreover, the trend towards modular and scalable automation solutions is empowering laboratories to tailor their infrastructure to evolving project demands. By adopting reconfigurable systems that support incremental expansion, researchers can align capital investments with immediate needs while retaining the agility to scale operations as throughput requirements increase. As a result, teams can pivot rapidly between small-scale feasibility studies and large-scale protein libraries without the overhead of reinstalling or revalidating entire workstations. This adaptability is reinforced by robust software platforms that facilitate seamless data management, integrating experiment design, execution, and analysis under a unified interface. By enhancing reproducibility and traceability, these digital infrastructures ensure that insights derived from automated experiments can be reliably replicated and shared across collaborative networks.

Unprecedented Technological Advances Driving a Paradigm Shift in Lab Automation for Protein Engineering and Biopharmaceutical Discovery

The lab automation landscape is undergoing transformative shifts as next-generation technologies redefine the boundaries of what’s possible in protein engineering. One of the most significant developments involves the harmonization of cloud-based analytics with laboratory robotics. By enabling remote monitoring and control of workflows, cloud connectivity ensures that researchers can oversee operations from any location, reducing downtime and expediting troubleshooting. Real-time telemetry from integrated sensors feeds into centralized dashboards, allowing teams to identify performance bottlenecks and adjust protocols on the fly. This interconnected approach fosters operational resilience and aligns research activities with broader organizational goals.

In parallel, the emergence of digital twin technology is changing how laboratories model and optimize experimental processes before actual deployment. By creating virtual replicas of physical workflows, scientists can simulate reagent volumes, incubation times, and device calibrations to predict outcomes and refine designs without expending consumables. This proactive optimization reduces trial-and-error cycles, conserves resources, and enhances experimental throughput. Combined with augmented reality interfaces, digital twins also facilitate intuitive training for new operators, accelerating onboarding and ensuring consistent execution of complex protocols. Collectively, these advancements are ushering in a new era where data-driven planning and real-world execution converge to deliver unprecedented efficiency and innovation in protein engineering.

Evaluating the Far-Reaching Consequences of 2025 U.S. Tariff Policies on Lab Automation Supply Chains and Protein Engineering Workflows

The introduction of sweeping U.S. tariff measures in early 2025 has significantly impacted global supply chains for lab automation equipment, creating cost pressures and prompting strategic adjustments across the industry. On April 5, the administration implemented a universal 10% tariff on most imported laboratory goods, immediately raising baseline costs for consumables, instruments, and spare parts. Within days, country-specific levies followed, with Chinese imports of lab-related equipment subject to a cumulative 145% duty as of April 9, effectively pricing many core instruments beyond the reach of domestic budgets. In contrast, Canada and Mexico were exempt from the universal tariff but incurred a separate 25% levy on non‐USMCA supplies and a 10% tariff on energy-related products, influencing decisions around cold storage units and power-dependent systems.

In the context of biopharmaceutical manufacturing and protein engineering, these tariffs have compounded existing challenges. Government directives imposed a 15% tariff on specialized laboratory packaging, glass vials, and analytical instruments essential for biologics workflows, resulting in ripple effects that extend to downstream R&D timelines. As a result, leading organizations have prioritized diversifying procurement strategies, balancing the acquisition of domestically produced modules with the selective import of proprietary components. In response, some companies have expedited capital investments in onshore manufacturing facilities to mitigate exposure to ongoing trade uncertainties, a trend mirrored by major pharmaceutical firms announcing multibillion-dollar expansions of U.S. research sites in regions such as Virginia and North Carolina.

Detailed Multidimensional Segmentation Reveals Core Dynamics Shaping the Lab Automation Landscape in Protein Engineering

A nuanced segmentation analysis illuminates the multifaceted drivers that underpin innovation and adoption within the lab automation market for protein engineering. From a product perspective, recurring consumables such as microplates, reagents, and precision tips sustain the throughput demands of high-volume experiments, while bench-top and high-throughput instrument platforms enable flexible scaling of operations. Complementing this hardware ecosystem, software suites and professional services deliver the analytical frameworks and workflow support that ensure experimental integrity and regulatory compliance.

Examining the automation platforms themselves reveals diverse modalities tailored to specific experimental needs. Biosensor technologies, spanning electrochemical and optical detection, offer real-time insights into binding kinetics and enzymatic activity, whereas liquid handling systems optimized for micro- and nano-volume workflows afford unparalleled accuracy in sample dispensation. Microplate readers with absorbance, fluorescence, and luminescence capabilities facilitate multiplexed assays, and robotic workstations-both open and fully integrated systems-synchronize hands-off processing with data capture to streamline complex protocols.

On the application front, directed evolution and rational design approaches to enzyme engineering harness automated platforms for iterative optimization, just as high-throughput screening accelerates lead identification and lead optimization campaigns. Protein expression and purification workflows leverage automated chromatography and filtration modules to standardize yield and purity metrics, while advanced structure analysis via nuclear magnetic resonance and X-ray crystallography benefits from streamlined sample preparation and data acquisition. These technological pillars serve a broad spectrum of end users, including academic research institutes, biotechnology innovators, contract research organizations, and pharmaceutical companies. Underpinning these segments, emerging technologies such as acoustic liquid handling, magnetic bead separation, and droplet-based microfluidics are redefining experimental boundaries by enabling piezoelectric and ultrasonic precision, paramagnetic and superparamagnetic selectivity, and continuous flow control over reaction microenvironments.

This comprehensive research report categorizes the Lab Automation in Protein Engineering market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Automation Platform

- Technology

- Application

- End User

Regional Nuances and Market Drivers Across the Americas Europe Middle East Africa and Asia Pacific Influencing Lab Automation Trends

Regional dynamics are reshaping how labs adopt automation solutions and structure their research investments. In the Americas, the United States stands as a focal point for innovation, driven by substantial federal funding initiatives and a dense ecosystem of biopharma and academic institutions. Canadian and Latin American laboratories are forging partnerships to localize reagent manufacture and distribution, reducing lead times and buffering against cross-border tariff fluctuations.

Across Europe, the Middle East, and Africa, government-led research consortia and public–private collaborations are catalyzing the modernization of laboratory infrastructure. Leading academic hubs in Germany, the United Kingdom, and Switzerland are integrating high-throughput platforms into national research centers, while emerging biotech clusters in the Gulf region are deploying turnkey automated workstations to accelerate translational research. Regulatory harmonization efforts within the EU and collaborative frameworks across EMEA are further smoothing supply chain pathways for critical devices and consumables.

In the Asia-Pacific region, aggressive investments by governments and private entities are fueling rapid expansion. Chinese and Japanese research laboratories are embracing robotic workstations and IoT-enabled sensors to drive efficiency, while South Korea and Singapore focus on microfluidics-based continuous processing to support personalized medicine initiatives. Although Asia-Pacific markets contend with variable tariff regimes and intellectual property considerations, the proliferation of localized manufacturing capabilities for both hardware and consumables is steadily enhancing supply resilience and cost competitiveness.

This comprehensive research report examines key regions that drive the evolution of the Lab Automation in Protein Engineering market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Lab Automation Innovators Shaping Protein Engineering Through Integrated Platforms and Solutions

A cadre of leading technology providers is steering the evolution of lab automation in protein engineering through continuous innovation and strategic partnerships. Key instrument manufacturers have expanded their portfolios by acquiring niche robotics startups, integrating automated liquid handlers with AI-powered control software to deliver cohesive end-to-end solutions. Concurrently, established life science companies are collaborating with software developers to embed advanced analytics and machine learning modules within their platforms, transforming raw data into actionable experimental insights.

Strategic alliances between hardware vendors, cloud service providers, and analytics firms have yielded interoperable architectures that facilitate seamless connectivity across the laboratory ecosystem. These partnerships are accelerating the adoption of cloud-native lab automation, enabling real-time data harmonization, remote monitoring, and predictive maintenance. Innovative service providers are also offering consultative support, guiding end users through system validation, protocol standardization, and regulatory compliance-a critical differentiator in highly regulated sectors such as biologics development.

Emerging entrants specializing in microfluidic devices, acoustic dispensing, and magnetic bead separation are challenging incumbents by delivering compact, application-specific modules. Their agility in catering to niche workflows is fostering a modularization trend in which end users can assemble hybrid automation configurations that address unique research requirements. Collectively, these dynamic company-level forces are shaping a market environment where continuous collaboration and technology convergence drive both incremental enhancements and disruptive breakthroughs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lab Automation in Protein Engineering market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Analytik Jena AG

- Beckman Coulter Life Sciences

- Benchling, Inc.

- Bio-Rad Laboratories, Inc.

- Biosero, Inc.

- Biotage AB.

- Eppendorf AG

- GenScript Biotech Corporation

- Ginkgo Bioworks, Inc.

- Hamilton Company

- Hudson Robotics, Inc.

- Labcyte, Inc.

- Opentrons Labworks Inc.

- PerkinElmer, Inc.

- SPT Labtech Ltd.

- Tecan Group Ltd.

- Thermo Fisher Scientific Inc.

- Twist Bioscience Corporation

- Zymergen Inc.

Strategic Roadmap for Industry Leaders to Capitalize on Automation Trends and Navigate Evolving Protein Engineering Landscapes

Industry leaders should prioritize diversification of their automation portfolios to remain resilient amid evolving experimental demands and regulatory landscapes. Investing in modular, interoperable platforms that support rapid reconfiguration will enable organizations to pivot between discovery, optimization, and scale-up phases without significant capital redeployment. In parallel, embedding AI-driven protocol optimization within core systems can elevate throughput while reducing reagent consumption and cycle times.

To mitigate supply chain vulnerabilities, companies can establish dual-source agreements for critical consumables and collaborate with regional distributors to maintain buffer inventories. Pursuing localized manufacturing partnerships in strategic geographies will further buffer against trade-related disruptions and align with regulatory preferences for domestic sourcing. At the same time, forging alliances with cloud and analytics providers can transform raw experimental outputs into strategic insights, empowering data-driven decision-making and facilitating compliance with emerging data integrity requirements.

Finally, cultivating cross-functional talent networks that bridge biology, engineering, and data science is essential for unlocking the full potential of automated platforms. By integrating multidisciplinary expertise, organizations can accelerate the translation of experimental findings into commercial applications, strengthen their innovation pipelines, and sustain competitive advantage.

Comprehensive Research Methodology Combining Primary Insights and Secondary Data for Robust Lab Automation Market Analysis

The research framework underpinning this analysis combines in-depth primary engagements with industry stakeholders and comprehensive secondary data synthesis. Primary research comprised structured interviews with senior executives at leading automation providers, laboratory directors, and specialist end users across academia, biotech, and pharmaceutical sectors. These dialogues yielded pragmatic perspectives on adoption barriers, technology priorities, and regional nuances that are not readily discernible from public sources.

Secondary research involved systematic reviews of trade publications, regulatory filings, and corporate financial reports to capture recent product launches, strategic partnerships, and investment trends. Proprietary databases were leveraged to track shipment volumes, patent filings, and funding rounds, enabling triangulation of market signals. Additionally, an assessment of macroeconomic indicators and trade policy developments provided context for forecasting supply chain impacts and regional growth trajectories.

Data validation protocols, including cross-referencing multiple sources and reconciling quantitative estimates with qualitative insights, ensured the robustness and credibility of the findings. This methodology delivered a holistic view of the lab automation landscape, underpinned by both empirical evidence and expert judgment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lab Automation in Protein Engineering market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lab Automation in Protein Engineering Market, by Product Type

- Lab Automation in Protein Engineering Market, by Automation Platform

- Lab Automation in Protein Engineering Market, by Technology

- Lab Automation in Protein Engineering Market, by Application

- Lab Automation in Protein Engineering Market, by End User

- Lab Automation in Protein Engineering Market, by Region

- Lab Automation in Protein Engineering Market, by Group

- Lab Automation in Protein Engineering Market, by Country

- United States Lab Automation in Protein Engineering Market

- China Lab Automation in Protein Engineering Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Synthesizing Key Findings to Illuminate Future Trajectories and Opportunities in Lab Automation for Protein Engineering

This executive summary has highlighted the profound ways in which advanced automation technologies are accelerating protein engineering research while reshaping operational and strategic priorities across the industry. The integration of AI, modular robotics, and cloud connectivity is driving efficiency, reproducibility, and collaborative innovation. At the same time, the ripple effects of 2025 tariff measures underscore the critical importance of supply chain agility and localization strategies.

Dissecting the market through multifaceted segmentation reveals the interplay among consumables, instruments, software, and services, as well as the diverse automation modalities tailored to specific applications and end-user requirements. Regional insights further demonstrate how funding ecosystems, regulatory frameworks, and local manufacturing capacities influence adoption patterns. Collectively, these dimensions converge to define a dynamic and opportunity-rich environment for companies poised to lead in protein engineering automation.

As the industry continues to evolve, forward-thinking organizations that invest in adaptable platforms, foster strategic partnerships, and leverage data-driven insights will be best positioned to capitalize on emerging trends and deliver transformative outcomes in biopharmaceutical discovery and beyond.

Connect with Ketan Rohom to Access In-Depth Lab Automation Market Insights and Propel Protein Engineering Initiatives with Expert Analysis

Reach out to Ketan Rohom to secure your comprehensive market research report on lab automation in protein engineering and equip your organization with the strategic insights needed to accelerate innovation and optimize decision-making.

- How big is the Lab Automation in Protein Engineering Market?

- What is the Lab Automation in Protein Engineering Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?