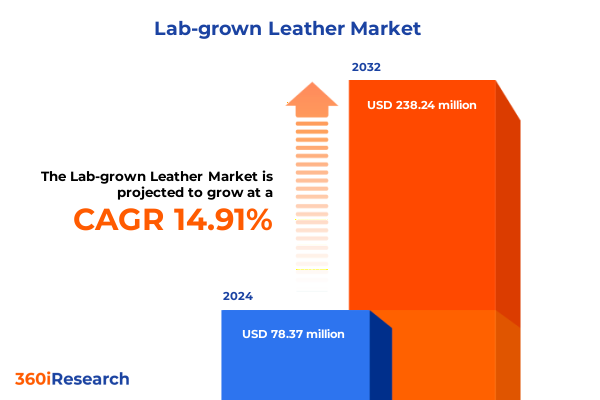

The Lab-grown Leather Market size was estimated at USD 90.23 million in 2025 and expected to reach USD 103.70 million in 2026, at a CAGR of 14.87% to reach USD 238.24 million by 2032.

Exploring the Emergence and Significance of Lab-Grown Leather as a Pivotal Solution for Sustainable Fashion and Industry Transformation

Lab-grown leather represents one of the most compelling frontiers in sustainable materials, marrying biotechnology, design innovation, and ethical manufacturing into a transformative solution for fashion, automotive, furniture, and beyond. By harnessing cutting-edge cell culture, microbial fermentation, and plant-based biopolymers, this category delivers authentic leather characteristics without reliance on animal hides or petrochemical-derived synthetics.

This emerging paradigm addresses long-standing environmental and ethical challenges. Traditional leather production contributes to deforestation, greenhouse gas emissions, and water pollution due to intensive livestock farming and chemical tanning processes. In contrast, lab-grown leather dramatically reduces land use, water consumption, and pollution risk, while eliminating animal welfare concerns. Early adopters and visionary brands are redefining luxury and performance expectations through iterative product development and strategic partnerships with biofabrication pioneers.

Coupled with evolving consumer preferences and regulatory pressures, lab-grown leather is poised to disrupt established supply chains and catalyze new manufacturing ecosystems. Stakeholders across upstream and downstream segments-from raw material innovators to end-product designers-are actively exploring synergies that can accelerate scale-up, enhance functional performance, and validate sustainability credentials. As the market advances beyond niche prototypes toward commercial viability, understanding the critical drivers, challenges, and stakeholder dynamics becomes essential for informed decision-making and strategic investment.

Unveiling the Transformative Technological and Market Shifts Redefining How Lab-Grown Leather is Developed, Produced, and Commercialized Worldwide

The lab-grown leather landscape has undergone seismic shifts over the past several years, driven by breakthroughs in molecular fermentation, bioreactor engineering, and bioinformatics-guided material design. Initial ventures focused on mycelium-derived substrates and plant protein scaffolding have been joined by cell-cultured collagen networks and microbial-synthesized polymers, each offering distinct performance and environmental advantages. This diversification reflects an industry seeking to optimize durability, tactile qualities, and aesthetic versatility while minimizing ecological footprints.

Strategic collaborations and high-profile partnerships have accelerated validation cycles and market readiness. Sustainable luxury brands teaming up with biotech innovators have created proof-of-concept prototypes that resonate with consumers and regulators alike. At the same time, venture capital and corporate R&D funding have shifted toward integrated platforms capable of both material formulation and process scale-up. However, the sector’s notable pause in certain flagship projects underscores ongoing technical and financial hurdles in achieving cost-competitive, high-volume production without sacrificing quality.

Meanwhile, regulatory frameworks and sustainability standards are evolving to recognize biofabricated alternatives, offering potential for preferential procurement and emerging eco-label certifications. As the ecosystem converges around a diversified technology stack, stakeholders are recalibrating risk profiles, aligning innovation roadmaps with consumer expectations, and redefining conventional value chains. These transformative shifts herald a new era in materials science, positioning lab-grown leather as a cornerstone in the transition to circular, low-impact manufacturing.

Analyzing the Comprehensive Effects of 2025 U.S. Import Tariff Policies on the Emerging Lab-Grown Leather Supply Chain and Cost Structures Across Industries

In April 2025, the United States introduced a universal 10% import tariff across nearly all categories, including leather and allied materials, effective April 5. This baseline levy, enacted under a national emergency declaration, aimed to address trade imbalances by applying broad duties on imports regardless of origin, with temporary exceptions for USMCA-compliant goods from Canada and Mexico. Just days later, additional “reciprocal” duties on top trading partners were scheduled to take effect on April 9, though those higher, country-specific rates have since been paused amid economic deliberations.

These tariff measures influence the cost structures of lab-grown leather in multiple ways. Imported inputs such as specialized culture media, biopolymer feedstocks, and precision enzymes now incur baseline duties, potentially compressing margins for nascent producers dependent on global supply chains. Moreover, volatility in tariff policy adds uncertainty to long-term procurement strategies, underscoring the need for localized production and vertically integrated models to mitigate exposure to fluctuating trade barriers.

Conversely, the evolving tariff landscape may spur strategic onshoring initiatives and public-private collaborations aimed at building domestic biofabrication capacity. Federal incentives and research grants could emerge as counterbalances to import duties, fostering innovation clusters and resilient supply networks. For industry participants, assessing the interplay between tariff obligations, regulatory incentives, and capital investment incentives is critical to optimizing cost competitiveness and maintaining agile sourcing approaches in 2025 and beyond.

In-Depth Examination of Market Segmentation Dimensions in Lab-Grown Leather Spanning Source Types, Forms, Production Methods, Applications, and Distribution Models

The market for lab-grown leather is characterized by nuanced segmentation that spans raw material sources, product forms, production techniques, end applications, and distribution pathways. At the base level, animal-derived collagen matrices coexist with plant-derived alternatives sourced from cactus, coconut, and pineapple, each offering unique aesthetic and performance profiles tailored to distinct brand narratives. Moving from substrate to supply, manufacturers convert these biomaterials into rolls or sheets, optimizing production workflows to accommodate varied downstream finishing and cutting processes.

Diving deeper into technology platforms, cell-cultured leather leverages tissue engineering techniques to cultivate collagen-rich matrices in bioreactors, while microbial-based leather employs fermentation processes to generate polymeric leather analogs through genetically optimized strains. These production methods cater to an expanding portfolio of applications ranging from automotive interior trim and fashion accessories to home furnishings, industrial components, and sports equipment. Within the automotive segment, for instance, focus areas include car seats, dashboard covers, and floor liners, whereas the fashion segment prioritizes premium belts, footwear, and designer handbags and wallets.

Distribution strategies reflect consumer buying preferences and supply chain complexity. Offline channels encompass direct sales to original equipment manufacturers and traditional retailers and distributors, while online avenues leverage brand-owned websites and third-party e-commerce platforms to engage end consumers directly. This layered segmentation underscores the importance of customizable material properties, agile production capabilities, and targeted go-to-market approaches to capture value across the diverse landscape of lab-grown leather demand.

This comprehensive research report categorizes the Lab-grown Leather market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source Type

- Form

- Production Method

- Application

- Distribution Channels

Key Regional Dynamics Shaping the Adoption, Regulation, and Commercial Prospects of Lab-Grown Leather in the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the trajectory of lab-grown leather adoption, driven by variations in regulatory regimes, consumer sentiment, and industrial capacity. In the Americas, North American stakeholders benefit from robust biotech ecosystems, favorable research funding, and growing consumer awareness of sustainability ethics. Policy incentives, including federal R&D grants and state-level innovation credits, foster partnerships between startups and academic institutions, accelerating pilot-scale initiatives and paving the way for early commercialization.

Europe, the Middle East, and Africa (EMEA) showcase a complex mosaic of market drivers. Within the European Union, comprehensive green policy frameworks and eco-design directives incentivize alternative materials that align with circular economy principles. Luxury fashion hubs in Italy and France have emerged as early adopters, collaborating closely with biofabrication firms to prototype high-performance, certified low-impact leather substitutes. Meanwhile, Gulf Cooperation Council nations are exploring bio-based materials to reduce reliance on imported leathers and mitigate environmental footprints of construction and automotive sectors.

In the Asia-Pacific region, manufacturing scale and supply chain integration define market potential. Countries such as China, India, and Australia are increasingly investing in bioprocessing infrastructure and talent development to establish regional hubs. Simultaneously, consumer markets in Japan and South Korea exhibit strong interest in premium, ethically sourced materials, driven by millennial and Gen Z purchasing behaviors that prioritize transparency and cradle-to-cradle traceability. Collectively, these regional insights highlight the interdependence of policy environments, industry collaboration, and market cultivation in advancing lab-grown leather on a global scale.

This comprehensive research report examines key regions that drive the evolution of the Lab-grown Leather market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Insights into Leading Innovators and Collaborators Driving the Commercialization and Scale-Up of Lab-Grown Leather Technologies Globally

The commercial landscape of lab-grown leather is defined by a cohort of innovative companies forging new pathways in material science, scale-up, and market integration. Modern Meadow has distinguished itself through the launch of its BIO-VERA® and INNOVERA™ platforms, delivering high-performance, renewable carbon-content materials that blend plant-protein scaffolds with biopolymers. At Lineapelle 2025, Modern Meadow’s scaled pilot production capability of over 500,000 square meters annually showcased its readiness for industrial partnerships across furniture, automotive, and fashion applications.

On the cell-cultured front, VitroLabs Inc has progressed its tissue engineering platform toward pilot-scale manufacturing, supported by a $46 million Series A investment led by Agronomics and backed by Kering, Leonardo DiCaprio, and leading venture funds. The company’s proprietary bioreactors and optimized cell expansion processes have achieved authentic collagen matrices, laying the groundwork for full-scale commercialization within the next two years. Both VitroLabs and its acquiring entity Faircraft hold extensive patent portfolios, signaling intensified focus on intellectual property defense and collaborative licensing models.

Beyond these flagships, emerging startups and research consortia are exploring mycelium variants, microbial-synthesized polymers, and hybrid formulations to address cost, performance, and lifecycle considerations. Strategic alliances with established luxury brands, OEMs, and material science institutes underscore a shared recognition that no single technology will dominate. Instead, a diversified ecosystem of complementary innovations is converging to meet the multifaceted demands of durability, aesthetics, and sustainability across global market segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Lab-grown Leather market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arda Biomaterials Limited

- Biofabricated Materials Inc.

- Bioleather Limited

- Biophilica Limited

- BITE Studios LLC

- Bolt Threads

- BSF Enterprise PLC.

- Ecovative Design LLC

- FAB Leather Corporation

- Faircraft

- FungusChain S.L.

- Furoid GmbH

- Le Qara SAC

- Modern Meadow, Inc.

- Mushroom Material GmbH

- Mycelium Materials B.V.

- Mycotech Lab Pte. Ltd.

- MycoTecLab GmbH

- MycoWorks, Inc.

- Natural Fiber Welding, Inc.

- PEELSPHERE

- Polybion SL

- Provenance Biofabrics Inc.

- Rheom Materials

- Spiber Inc.

- SQIM S.p.A.

- TÔMTEX

- VitroLabs Inc

- Winner Nippon Leatherette Pvt. Ltd.

- Zoa Materials Corporation

Actionable Recommendations for Industry Stakeholders to Accelerate Adoption, Optimize Supply Chains, and Navigate Regulatory Frameworks in Lab-Grown Leather

To navigate the evolving landscape and harness emerging opportunities, industry leaders should consider forging cross-sector consortia that align biofabrication innovators, academic research centers, and government agencies. Such collaborations can pool resources to de-risk scale-up, accelerate regulatory validation, and develop standardized testing protocols that bolster market confidence and facilitate product certification.

Building vertically integrated supply chains is critical for cost control and resilience. Organizations may invest in modular bioreactor facilities co-located with biopolymer feedstock production sites or explore joint ventures with local agricultural cooperatives to secure plant-derived substrates. This approach reduces reliance on volatile international logistics and mitigates exposure to tariff fluctuations and trade policy uncertainties.

Engaging proactively with policymakers and sustainability standard bodies can unlock incentives and favorable procurement mechanisms. By demonstrating alignment with circular economy principles and credible lifecycle assessments, companies can position lab-grown leather as a preferred material under emerging green public procurement frameworks.

Finally, targeted consumer education campaigns are essential to overcome perception barriers. Transparent storytelling around research methodologies, environmental benefits, and product performance can drive mainstream acceptance. Thought-leadership initiatives-spanning digital engagement, trade exhibitions, and industry forums-will help shape market narratives and underscore the transformative potential of lab-grown leather.

Comprehensive Overview of the Primary and Secondary Research Methodologies Employed to Deliver Rigorous Analysis and Insights in Lab-Grown Leather Reporting

This analysis combines primary and secondary research methodologies to deliver a comprehensive view of the lab-grown leather market. Primary research involved in-depth interviews with material scientists, process engineers, and senior executives at leading biofabrication firms. These engagements provided qualitative insights into technology roadmaps, scale-up challenges, and strategic priorities across market segments.

Quantitative data was gathered through structured surveys with over 75 raw material suppliers, contract manufacturers, and downstream brand managers, assessing factors such as production cost drivers, quality benchmarks, and adoption timelines. Data from these surveys was triangulated with attendance metrics and buyer sentiment gathered at key industry events including Lineapelle and the Global Fashion Summit.

Secondary research drew upon peer-reviewed journals, patent filings, government trade publications, and company press releases to validate technological breakthroughs, funding trends, and intellectual property landscape. Trade policy impacts were mapped using government gazettes and regulatory databases, while consumer preference patterns were informed by analysis of industry-wide sustainability reports and targeted social media listening.

All data inputs underwent rigorous validation through cross-referencing multiple sources, ensuring integrity and reliability. Analytical frameworks, including SWOT assessments and scenario modeling, were applied to distill actionable insights and strategic imperatives for diverse stakeholder archetypes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Lab-grown Leather market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Lab-grown Leather Market, by Source Type

- Lab-grown Leather Market, by Form

- Lab-grown Leather Market, by Production Method

- Lab-grown Leather Market, by Application

- Lab-grown Leather Market, by Distribution Channels

- Lab-grown Leather Market, by Region

- Lab-grown Leather Market, by Group

- Lab-grown Leather Market, by Country

- United States Lab-grown Leather Market

- China Lab-grown Leather Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Perspectives on the Future Trajectory, Opportunities, and Challenges That Will Define the Continued Growth of the Lab-Grown Leather Sector

Lab-grown leather stands at a pivotal inflection point, transforming from experimental concept to a credible market alternative capable of challenging traditional leather’s dominance. The convergence of technological maturity, shifting consumer ethics, and supportive policy frameworks has created fertile ground for innovation, yet technical scale-up and cost competitiveness remain formidable hurdles.

The interplay of diverse production methods-ranging from plant-derived substrates to tissue-engineered collagen-and the ongoing refinement of bioreactor processes will shape the sector’s competitive dynamics. Integrated ecosystems that leverage complementary technologies, strategic intellectual property partnerships, and localized production networks are likely to outperform siloed approaches.

Regulatory clarity and sustainability certifications will play an increasingly decisive role in market entry. Companies demonstrating robust lifecycle assessments, supply chain transparency, and alignment with circular economy targets will secure preferential positioning among discerning stakeholders. Concurrently, agile engagement with evolving trade policies and incentive programs will be necessary to mitigate external risks and capitalize on domestic manufacturing incentives.

Ultimately, the trajectory of lab-grown leather depends on collaborative innovation, strategic foresight, and disciplined execution. Industry participants who adeptly navigate the complex matrix of technology development, supply chain orchestration, and market education will be best positioned to capture the transformative potential and define the next generation of sustainable materials.

Connect with Ketan Rohom to Gain Immediate Access to the Definitive Market Research Report on Lab-Grown Leather Trends, Strategies, and Opportunities

Are you ready to leverage cutting-edge insights and gain a competitive edge in the rapidly evolving lab-grown leather market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your exclusive access to the complete market research report. Our comprehensive analysis will equip you with the strategic intelligence needed to navigate emerging opportunities, optimize your product roadmap, and drive sustainable growth. Contact Ketan Rohom today to discuss tailored solutions, custom data requests, and premium advisory services designed to support your organization’s objectives and accelerate your path to market leadership.

- How big is the Lab-grown Leather Market?

- What is the Lab-grown Leather Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?