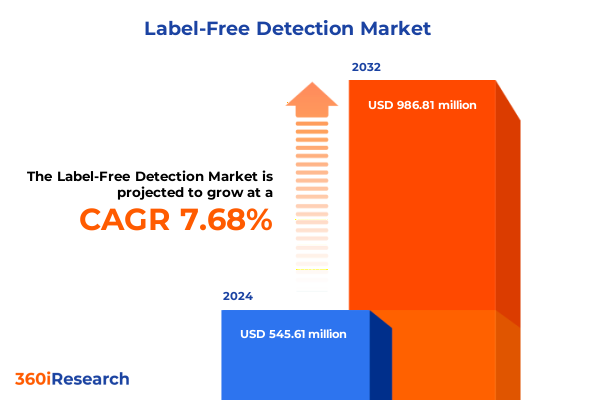

The Label-Free Detection Market size was estimated at USD 586.85 million in 2025 and expected to reach USD 629.29 million in 2026, at a CAGR of 7.70% to reach USD 986.81 million by 2032.

Defining the Strategic Imperative Behind the Migration to Label-Free Detection Technologies and Their Transformative Role

The label-free detection sector has undergone a profound transformation, evolving from niche laboratory applications into a central pillar of modern biosensing and analytical workflows. This executive summary provides an overarching exploration of the pivotal role that label-free technologies play in reducing assay complexity, accelerating time to result, and improving data fidelity across sectors ranging from drug development to environmental monitoring. By examining the foundational principles, such as real-time binding kinetics and refractive index changes, this introduction establishes the context for why organizations are increasingly turning away from label-based assays in favor of label-free alternatives.

Moreover, the dynamics driving adoption-such as the need for higher throughput, regulatory compliance pressures, and the imperative to lower the total cost of experimentation-are highlighted to frame the ensuing discussions. The interplay between technological maturation and application demands sets the stage for understanding transformative shifts, market impacts, and strategic priorities. Through this lens, stakeholders can appreciate that label-free detection is more than a laboratory method; it represents a strategic enabler that underpins innovation cycles, mitigates risk, and fosters deeper mechanistic insights.

Uncovering the Technological and Data-Driven Revolution Redefining Label-Free Detection Across Disciplines

Over recent years, the landscape of label-free detection has been reshaped by rapid technological advancements and cross-sector convergence. Initially characterized by bulky, expensive instruments confined to specialized research institutions, modern label-free platforms have become significantly more accessible through miniaturization, automation, and streamlined user interfaces. This democratization has stimulated adoption in nontraditional settings, including point-of-care diagnostics and decentralized contract research facilities.

Concurrently, software-driven analytics leveraging machine learning have become integral to extracting actionable insights from kinetic and affinity data streams. The fusion of data science with optical and calorimetric detection modalities has unlocked new layers of sensitivity and specificity, enabling researchers to decipher complex biological interactions in real time. As a result, label-free detection is not merely replacing established techniques; it is catalyzing a broader paradigm shift toward integrated, data-centric workflows that prioritize agility, reproducibility, and scalability. Ultimately, these transformative shifts underscore the critical need for organizations to reassess legacy approaches and align research strategies with emerging capabilities.

Assessing the Multifaceted Consequences of 2025 United States Tariffs on the Label-Free Detection Supply Chain

In 2025, the imposition of targeted tariffs on critical components used in label-free detection systems has introduced a new layer of complexity for suppliers and end users in the United States. These trade measures, which focus on imported optical sensors, specialty reagents, and precision engineered calorimetric modules, have triggered cost re-engineering across the value chain. Vendors have responded by diversifying supply sources, onshoring key manufacturing processes, and renegotiating supplier agreements to mitigate margin pressure.

On the demand side, life sciences organizations have recalibrated procurement strategies, placing greater emphasis on total cost of ownership rather than device sticker price. Collaborative procurement consortia and leasing models are gaining traction as viable alternatives to direct capital expenditure. Moreover, service providers are leveraging tariff-induced volatility to expand consumable and reagent offerings, underscoring the importance of flexible business models in an environment of evolving trade policies. Looking forward, adaptation to these tariffs will remain a strategic priority as the global ecosystem continues to reorient toward supply chain resilience and regulatory alignment.

Exploring Nuanced Insights Across Technology Platforms, Product Categories, Applications, and End-User Dynamics in Label-Free Detection

Segmentation based on technology reveals that bio-layer interferometry, isothermal titration calorimetry, and surface plasmon resonance each contribute unique performance attributes and workflow benefits to the broader label-free detection ecosystem. While bio-layer interferometry excels in high-throughput screening with robust automation, isothermal titration calorimetry provides unparalleled thermodynamic insights. Surface plasmon resonance continues to set benchmarks for sensitivity and kinetic resolution, particularly in early-stage drug discovery assays. These differentiated strengths are driving tailored adoption across application pipelines.

When viewing the market through a product type lens, consumables and reagents represent recurring revenue streams that underpin long-term vendor-customer relationships, whereas instrument purchase models range from benchtop configurations suited for core laboratories to portable devices ideal for field or point-of-care deployments. Services encompassing assay development, instrument maintenance, and data analysis further enrich the value proposition, positioning vendors as strategic collaborators. Moreover, segmentation by application highlights distinct growth drivers: drug discovery and development maintain a strong emphasis on kinetic profiling, while environmental testing and food and beverage safety leverage label-free methods for rapid contaminant screening.

Finally, end-user segmentation underscores the diversity of adoption pathways. Academic and research institutes frequently pioneer novel methodologies and validate emerging platforms. Contract research organizations capitalize on scalable, turnkey solutions that accelerate client timelines. Hospitals and diagnostic centers emphasize rapid, high-throughput diagnostics to meet patient-centric imperatives. Pharmaceutical and biotechnology companies integrate label-free detection at multiple nodal points-ranging from lead identification to bioprocess monitoring-to optimize pipeline throughput and ensure product quality.

This comprehensive research report categorizes the Label-Free Detection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Application

- End-User

Delineating the Divergent Regional Trajectories Influencing Label-Free Detection Adoption and Innovation Worldwide

Regional dynamics play a pivotal role in shaping the competitive contours of the label-free detection market. In the Americas, strong investment in biopharmaceutical R&D and supportive regulatory frameworks have fostered early adoption of advanced biosensing technologies. Leading hubs such as Boston and San Diego serve as epicenters for pilot deployments and collaborative innovation. Meanwhile, cross-border supply chains underscore the importance of tariff strategies and logistics optimization.

Across Europe, the Middle East, and Africa, the landscape reflects a mosaic of regulatory regimes and research infrastructures. Western European nations benefit from concerted public-private partnerships that subsidize core facilities, whereas emerging markets in the Middle East are prioritizing diagnostic modernization and environmental surveillance. Africa’s burgeoning research centers are gradually integrating label-free platforms to address pressing public health challenges, often through philanthropic and development-oriented programs.

Asia-Pacific continues to demonstrate robust momentum, driven by large-scale investments in both academic and industrial research. Japan and South Korea lead in instrumentation innovation, while China’s biopharma sector accelerates pipeline proliferation, spurring demand for high-throughput label-free assays. Additionally, regional initiatives to localize reagent production and instrument assembly are enhancing market resilience and driving cost efficiencies.

This comprehensive research report examines key regions that drive the evolution of the Label-Free Detection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Competitive Landscape of Leading Instrument Manufacturers, Specialized Tool Providers, and Agile New Entrants

Key players in the label-free detection ecosystem are competing on the axes of technological innovation, service breadth, and global footprint. Several established instrument manufacturers have augmented their portfolios with modular platforms that accommodate multiple detection modalities and streamline workflow integration. At the same time, specialized life science tool providers are capitalizing on deep domain expertise to deliver tailored consumable and reagent solutions that complement core instrumentation.

Strategic partnerships and mergers have further consolidated capabilities, enabling vendors to offer end-to-end service models encompassing assay development, instrument calibration, and data analytics. Moreover, emerging entrants are challenging conventional incumbents by focusing on portable, user-friendly systems that cater to decentralized diagnostics and field applications. These competitive dynamics underscore the importance of agility and ecosystem collaboration as determinants of long-term market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Label-Free Detection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Ametek, Inc.

- Attana AB

- Bio-Rad Laboratories

- BioNavis Ltd.

- Biosensing Instrument

- BMG Labtech

- Bruker Corporation

- Carterra, Inc.

- Corning Incorporated

- Danaher Corporation

- Gator Bio

- Horiba, Ltd.

- lino Biotech AG

- Malvern Panalytical

- NanoTemper Technologies GmbH

- Nicoya

- Sartorius AG

- Shimadzu Corporation

- Unchained Labs

Implementing Strategic R&D Investments, Flexible Commercial Models, and Collaborative Ecosystem Partnerships to Secure Leadership

Industry leaders must prioritize a dual focus on technological differentiation and customer-centric service models to maintain momentum in the label-free detection space. This involves continuous investment in R&D to enhance sensitivity, throughput, and data analytics capabilities, while also expanding consumable and reagent offerings to drive recurring revenue streams. In parallel, cultivating flexible commercial frameworks-such as subscription-based access and performance-based contracts-will alleviate customer capital constraints and foster deeper partnerships.

Furthermore, proactive engagement with regulatory agencies and standardization bodies is essential to streamline validation pathways, reduce time to market, and ensure compliance across jurisdictions. Companies should also explore vertical integration opportunities, including localized manufacturing and end-to-end solution bundles, to mitigate supply chain risks and enhance resilience. Lastly, forging strategic alliances with academic consortia, contract research organizations, and diagnostic networks can accelerate technology adoption, unlock new applications, and reinforce market positioning.

Detailing the Integrated Primary, Secondary, and Scenario Modeling Approach Employed to Uncover Evidence-Based Market Insights

The research underpinning this executive summary is founded on a robust methodology that integrates primary and secondary data sources. Primary research involved in-depth interviews with industry experts, site visits to leading academic and corporate laboratories, and structured workshops with technology developers and end users. These activities provided qualitative insights into emerging application trends, user experience preferences, and procurement drivers.

Secondary research encompassed a rigorous review of peer-reviewed journals, regulatory filings, patent databases, and publicly available financial reports. This was supplemented by an analysis of trade association publications, conference proceedings, and market intelligence from specialized biosensing consortia. Data triangulation techniques were applied to ensure consistency and validate findings.

In addition, scenario modeling exercises were conducted to assess the potential impacts of trade policy shifts, technological breakthroughs, and evolving healthcare priorities. The resulting framework offers a comprehensive, evidence-based view of the label-free detection landscape, equipping decision-makers with actionable insights rooted in methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Label-Free Detection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Label-Free Detection Market, by Technology

- Label-Free Detection Market, by Product Type

- Label-Free Detection Market, by Application

- Label-Free Detection Market, by End-User

- Label-Free Detection Market, by Region

- Label-Free Detection Market, by Group

- Label-Free Detection Market, by Country

- United States Label-Free Detection Market

- China Label-Free Detection Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Technological Evolution, Market Dynamics, and Competitive Factors to Illuminate Strategic Imperatives in Label-Free Detection

In summary, label-free detection has transcended its origins as a niche analytical method to become a critical enabler of innovation across pharmaceuticals, diagnostics, environmental science, and beyond. Technological advancements in miniaturization, automation, and data analytics have democratized access and heightened performance benchmarks. Meanwhile, external pressures such as trade tariffs have catalyzed supply chain resilience and spurred creative procurement solutions.

Segmentation analysis highlights the value of tailoring strategies to specific technology platforms, product types, applications, and end-users, while regional insights reveal divergent adoption pathways shaped by R&D ecosystems, regulatory environments, and local manufacturing dynamics. Competitive analysis underscores the importance of integrated service offerings, ecosystem partnerships, and nimble product development.

Armed with these insights, industry stakeholders are well-positioned to seize emerging opportunities and navigate challenges in this rapidly evolving field. The comprehensive nature of this executive summary lays the groundwork for informed strategic planning and underscores the transformative potential of label-free detection as a cornerstone of next-generation biosensing applications.

Empower Your Organization with Comprehensive Insights by Engaging with Our Associate Director to Acquire the Full Label-Free Detection Report

To explore deeper insights and elevate your strategic planning, reach out to Ketan Rohom, Associate Director of Sales & Marketing, and secure your personalized access to the full market research report on label-free detection. By partnering with our seasoned analyst team, you can benefit from tailored briefings, customized data packages, and ongoing support as you navigate the evolving biosensing landscape. Don’t let critical market intelligence remain out of reach-take the next step toward informed decision-making and sustained competitive differentiation today

- How big is the Label-Free Detection Market?

- What is the Label-Free Detection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?