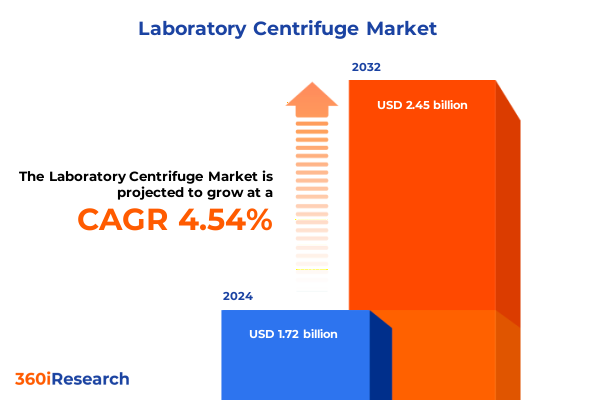

The Laboratory Centrifuge Market size was estimated at USD 1.78 billion in 2025 and expected to reach USD 1.85 billion in 2026, at a CAGR of 4.63% to reach USD 2.45 billion by 2032.

Setting the Stage for the Laboratory Centrifuge Market with an Executive Overview of Drivers, Innovations, and Strategic Opportunities

Laboratory centrifuges have become indispensable instruments across scientific disciplines, enabling precise separation, purification, and analysis of biological, chemical, and physical samples. As advanced life sciences research converges with clinical diagnostics and pharmaceutical innovation, the demand for versatile, high-performance centrifuges continues to accelerate. This executive summary serves as an authoritative primer, mapping out the key forces shaping the centrifuge landscape and highlighting the critical drivers that laboratories, manufacturers, and distributors must navigate.

In today’s research and clinical environments, centrifugation plays a foundational role in genomics, proteomics, haematology, and drug discovery workflows. Continuous technological advancements-from rotor materials to automation and digital integrations-have amplified throughput, enhanced reproducibility, and streamlined laboratory processes. Against this backdrop of rapid innovation, stakeholders require a clear, consolidated perspective on market dynamics, technological inflection points, and regulatory undercurrents that will define growth trajectories within the next five years.

By synthesizing insights across transformative shifts, tariff impacts, segmentation nuances, regional demands, and competitive benchmarks, this introduction lays the groundwork for a comprehensive exploration of opportunities and challenges. It sets the stage for an informed strategic dialogue, empowering decision-makers to align product development, supply chain strategies, and go-to-market initiatives with evolving customer needs and macroeconomic considerations.

Uncovering the Transformational Forces Redefining the Centrifuge Landscape through Automation, Digital Integration, and Sustainable Technology Adoption

Over the last decade, the centrifuge market has undergone a profound evolution, spurred by the convergence of digital technologies and a growing emphasis on sustainability. Automation has emerged as a pivotal catalyst, with manufacturers integrating programmable protocols, touchscreen interfaces, and remote monitoring capabilities that allow laboratories to optimize workflows, minimize human error, and accelerate sample processing. This shift from manual operation to digitally enhanced platforms has redefined expectations around throughput and reproducibility.

Alongside automation, the rise of miniaturization has transformed product form factors. Benchtop units equipped with advanced microcentrifuge rotors now deliver performance once reserved for larger floor standing centrifuges. Parallel emphasis on modular designs and plug-and-play rotor systems has empowered end users to tailor configurations for specific applications, from genomic library prep to clinical sample fractionation. Collectively, these developments illustrate a move toward versatile, multipurpose instruments that can adapt to evolving research demands.

A parallel trend toward green laboratory practices has driven the adoption of energy-efficient motors, optimized cooling systems, and recyclable rotor materials. By lowering power consumption and extending equipment lifespans, sustainable centrifuge designs contribute to both cost savings and environmental stewardship. Taken together, these transformative forces underscore a market in flux-one where digital integration, miniaturization, and sustainability converge to redefine the very notion of centrifugation performance and value.

Assessing the Consequences of New 2025 United States Tariffs on Import Dynamics, Supply Chain Resilience, and Cost Structures in Centrifuge Manufacturing

In early 2025, the United States introduced a new tranche of tariffs affecting a range of precision laboratory instruments, including components integral to centrifuge manufacturing. These measures, targeting key imports from major manufacturing hubs, have reverberated across the supply chain, increasing the landed cost of rotors, electric motors, and electronic control modules. End users and distributors now face elevated procurement expenses, prompting a reevaluation of sourcing strategies.

The immediate impact of enhanced import duties has manifested in extended lead times as suppliers navigate customs clearance and levy adjustments. Manufacturing partners are seeking alternative component sources in low-tariff jurisdictions, while some centrifuge producers have begun adjusting their global production footprints to mitigate cost pressures. In parallel, distributors are exploring value-added services-such as equipment repair and refurbishment-to offset margin constraints and preserve customer loyalty in the face of rising list prices.

Despite these headwinds, the tariff landscape has also catalyzed innovation in domestic manufacturing. Several original equipment manufacturers have expedited investments in in-country rotor fabrication and motor winding facilities, aiming to shield critical production processes from future trade policy volatility. Ultimately, the interplay between cost inflation and reshaped supply chains is driving stakeholders to adopt more resilient procurement models and deeper strategic partnerships across borders.

Synthesizing Critical Segmentation Insights to Reveal How Product Types, Applications, End Users, and Speed Categories Shape Market Trajectories

A nuanced understanding of market segmentation reveals the forces that will steer product development and targeted marketing initiatives. Based on product type, the centrifuge ecosystem encompasses benchtop and floor standing platforms alongside specialized microcentrifuge and ultracentrifuge systems. Within benchtop solutions, both fixed angle rotors and swinging bucket rotors cater to distinct application requirements, while floor standing variants mirror this rotor diversity at elevated capacities. These product categories underscore the balance between throughput, footprint, and configurability that end users demand across research and clinical environments.

Application segmentation further delineates market dynamics, as academic research in life sciences and physical sciences coexists with biotechnology pursuits in genomics and proteomics. Clinical diagnostics laboratories are subdivided into haematology, immunology, and microbiology streams, each with stringent operational benchmarks. Meanwhile, pharmaceutical companies driving drug discovery and formulation processes rely heavily on robust centrifugation workflows to support high-volume screening and nanoparticle analysis. Recognizing these distinct application lanes is fundamental to aligning product portfolios with evolving protocol requirements.

End user segmentation extends across academic institutes, biotech firms, contract research organisations, hospitals, and pharmaceutical companies, with each cohort exhibiting unique purchasing cycles and service expectations. Simultaneously, speed category segmentation-ranging from low and medium speed to high and ultra high speed offerings-provides a lens into performance thresholds dictated by sample viscosity and throughput demands. Taken together, these four segmentation pillars offer a comprehensive framework for tailoring centrifuge solutions to precise customer use cases and operational imperatives.

This comprehensive research report categorizes the Laboratory Centrifuge market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Speed Category

- Application

- End User

Dissecting Key Regional Dynamics across the Americas, EMEA, and Asia-Pacific to Illuminate Growth Drivers and Market Nuances in Centrifuge Demand

Regional dynamics in the centrifuge market are shaped by distinct research infrastructures, regulatory environments, and funding landscapes across the Americas, EMEA, and Asia-Pacific. In the Americas, robust investment in clinical diagnostics and pharmaceutical research drives demand for high-throughput benchtop and floor standing units, while a mature distribution network supports aftermarket services and refurbishment offerings. Regulatory frameworks here are evolving to accommodate next-generation sample preparation techniques, encouraging innovation in rotor design and automation.

Across Europe, the Middle East, and Africa, a diverse mosaic of academic research institutions and contract research organisations underpins centrifuge adoption. Public-private partnerships and pan-regional funding initiatives have elevated demand for microcentrifuge systems in genomics research, while stringent environmental regulations in certain European markets incentivize energy-efficient designs. The Middle East and Africa, though nascent in comparison, are witnessing accelerated growth in clinical diagnostics infrastructure, creating new entry points for mid-range centrifuge platforms.

In Asia-Pacific, the convergence of expansive life sciences hubs in China, India, Japan, and South Korea has fueled demand across the entire speed spectrum, from low-speed clinical bench models to ultra high speed platforms required for advanced bioprocessing. Government-backed R&D incentives and the proliferation of contract research organisations are bolstering localized manufacturing capabilities, contributing to shorter lead times and cost competitiveness. Collectively, these regional insights illuminate how localized priorities and investment climates will shape global centrifuge market dynamics.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Centrifuge market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Innovation Portfolios of Leading Centrifuge Manufacturers to Unveil Competitive Positioning and Growth Tactics

Leading centrifuge manufacturers have embraced diversified strategies to maintain competitive advantage and address heterogeneous customer needs. Companies at the forefront are expanding their innovation pipelines through targeted acquisitions of specialized rotor and sensor technology providers, enabling integrated solutions that span from liquid handling to data analytics. Concurrently, partnerships with software developers are yielding platforms that provide predictive maintenance alerts and remote performance dashboards, reinforcing service differentiation.

In response to tariff-driven sourcing challenges, several key industry players have accelerated investments in regional production facilities, thereby reducing reliance on high-duty import channels. This shift has not only attenuated cost pressures but also facilitated faster customization cycles for end users in critical markets. Innovation arms within these organizations are likewise advancing toward modular architecture, permitting rapid adaptation of rotor adapters and enhanced safety features for pathogen containment in diagnostic workflows.

Strategically, the competitive landscape is witnessing a dichotomy between global conglomerates and specialized incumbents. While larger players leverage broad distribution networks and bundled product-service offerings, niche manufacturers differentiate through deep application expertise, particularly in high-speed and ultracentrifuge segments. This interplay between scale-driven outreach and domain-specific innovation underscores a dynamic ecosystem where collaboration, differentiation, and operational agility define market success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Centrifuge market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Laval AB

- Bio Era Life Sciences Pvt Ltd.

- Centri-Force Engineering Co Ltd

- Cotaus

- CVS Controls Ltd.

- Danaher Corporation

- Drucker Diagnostics

- Eppendorf AG

- ESAW India

- HERMLE Labortechnik GmbH

- Hettich GmbH & Co. KG

- Hiper Centrifugation

- Jiangsu Kangjian Medical Devices Co., Ltd.

- Kubota Corporation

- Nes India Engineers

- NuAire, Inc.

- QIAGEN N.V.

- Remi Elektrotechnik Limited

- Sigma Laborzentrifugen GmbH

- Thermo Fisher Scientific Inc.

Formulating Actionable Recommendations for Industry Leadership to Capitalize on Technological Trends, Market Shifts, and Evolving Regulatory Landscapes

To seize emerging opportunities and mitigate risk in the evolving centrifuge market, industry leaders should prioritize investments in modular product architectures that align with diverse application requirements, enabling rapid rotor swaps and customizable performance profiles. By integrating digital twins and predictive analytics into equipment service models, manufacturers can offer value-added maintenance contracts that enhance uptime and foster long-term client relationships.

In parallel, building resilient supply chains by diversifying sourcing across low-tariff jurisdictions will reduce exposure to geopolitical disruptions. Establishing regional fabrication centers for critical components-such as rotors and motor assemblies-can ensure continuity of supply and support local customization demands. Collaboration with academic and clinical research consortia will also provide early visibility into evolving protocol needs, facilitating the co-creation of next-generation centrifuge solutions.

Finally, advancing sustainability through energy-efficient drive systems and recyclable rotor materials not only addresses regulatory pressures but also resonates with end-user values around environmental stewardship. Embedding these strategic imperatives into product roadmaps and marketing narratives will position organizations as forward-thinking leaders capable of delivering both performance excellence and long-term operational value.

Detailing a Rigorous Research Methodology Combining Comprehensive Primary Interviews and Methodical Secondary Data Analysis for Market Insights

This analysis draws upon a balanced blend of primary and secondary research methodologies to ensure robust, actionable insights. Primary research involved in-depth interviews with over 25 laboratory directors, procurement managers, and R&D heads across academic, clinical, and industrial settings. These qualitative discussions illuminated unmet needs, adoption barriers, and emerging preferences related to centrifuge performance, safety protocols, and digital integration.

Secondary research encompassed rigorous reviews of industry publications, patent filings, and technology white papers, complemented by detailed examinations of trade association reports and regulatory guidance documents. Market intelligence databases provided anonymized procurement data, enabling trend analysis around purchase lead times and service contract uptake. Cross-verification of these sources ensured consistency and reliability in identifying market drivers and competitive benchmarks.

Collectively, the methodological framework prioritized triangulation of quantitative and qualitative inputs, yielding a holistic perspective on equipment lifecycles, customer pain points, and innovation trajectories. This dual-track approach underpins the strategic recommendations and segmentation insights presented in this report, delivering a comprehensive foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Centrifuge market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Centrifuge Market, by Product Type

- Laboratory Centrifuge Market, by Speed Category

- Laboratory Centrifuge Market, by Application

- Laboratory Centrifuge Market, by End User

- Laboratory Centrifuge Market, by Region

- Laboratory Centrifuge Market, by Group

- Laboratory Centrifuge Market, by Country

- United States Laboratory Centrifuge Market

- China Laboratory Centrifuge Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Reflections on the Evolving Laboratory Centrifuge Arena Emphasizing Strategic Imperatives for Stakeholders in the Post-Tariff Era

The laboratory centrifuge market stands at an inflection point where technological innovation intersects with geopolitical and environmental imperatives. As automation, digital integration, and sustainable design ascend as core differentiators, stakeholders must adapt product strategies and supply chain frameworks to thrive. The ripple effects of new tariff regimes have underscored the need for resilient sourcing and regional manufacturing footprints, while segmentation analysis highlights the importance of tailoring solutions to specific use cases across research, clinical, and industrial domains.

Looking ahead, the convergence of data-driven maintenance models, modular architectures, and energy-efficient systems is poised to redefine value propositions in centrifuge platforms. End users will increasingly demand seamless interoperability with laboratory information management systems and real-time performance analytics. At the same time, emerging applications in cell and gene therapy processes will create novel performance requirements, particularly in ultra high speed and ultracentrifuge categories.

In this dynamic environment, proactive collaboration between equipment providers, end users, and regulatory bodies will be critical. Aligning innovation roadmaps with evolving protocol standards and sustainability goals will enable organizations to capture new growth avenues while maintaining operational resilience in the post-tariff era.

Engage with Ketan Rohom to Secure Your In-Depth Laboratory Centrifuge Market Research Report and Drive Strategic Decisions with Comprehensive Insights

To embark on a deeper understanding of evolving centrifuge technologies and capitalize on strategic market insights, reach out to Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. He stands ready to guide you through the comprehensive research findings, ensuring you have all the analytical support and actionable data needed to make high-impact decisions. Whether you’re exploring innovative rotor designs, assessing tariff implications, or refining segmentation strategies, a conversation with Ketan will illuminate the pathways to sustained competitive advantage. Engage now to secure your copy of the full laboratory centrifuge market research report and transform insights into outcomes

- How big is the Laboratory Centrifuge Market?

- What is the Laboratory Centrifuge Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?