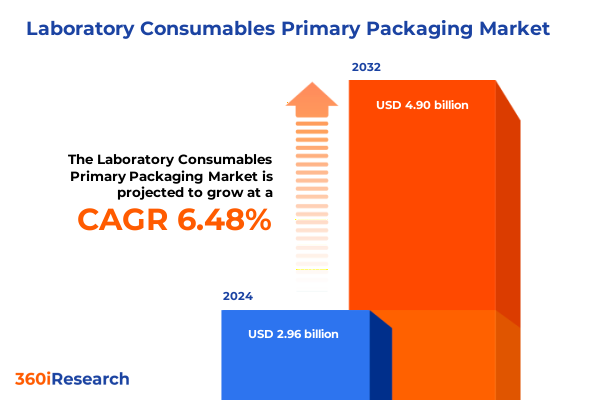

The Laboratory Consumables Primary Packaging Market size was estimated at USD 3.15 billion in 2025 and expected to reach USD 3.33 billion in 2026, at a CAGR of 6.48% to reach USD 4.90 billion by 2032.

Navigating the Foundations and Significance of Primary Packaging in Laboratory Consumables for Enhanced Integrity and Operational Efficiency

Laboratory consumables primary packaging forms the critical first barrier between valuable samples and the external environment, ensuring the integrity, sterility, and traceability of biological materials across research, clinical diagnostics, and pharmaceutical production. As laboratories evolve toward higher throughput, advanced analytics, and more stringent regulatory oversight, the performance and reliability of bottles, vials, tubes, and other primary packaging have never been more central to operational success.

In this context, the United States serves as both the world’s largest importer and exporter of laboratory and diagnostic agents, highlighting the extensive global value chain that underpins packaging supply and demand. These dynamics are shaped by robust R&D investment, increasing biopharmaceutical manufacturing, and emerging areas such as cell and gene therapy, all of which drive rigorous quality and compliance requirements for primary packaging materials and formats.

Unveiling the Pivotal Transformations Redefining Laboratory Consumables Primary Packaging Through Sustainability and Technological Integration

The landscape of laboratory consumables primary packaging is rapidly transforming as sustainability and technological integration become decisive factors in procurement and design decisions. Manufacturers are increasingly turning to recycled glass, known as cullet, to produce borosilicate bottles that reduce energy usage and CO₂ emissions. By incorporating up to 90 percent recycled content and adopting advanced decontamination and color-sorting technologies, glassware suppliers are responding to growing regulatory and customer demands for eco-friendly, high-performance packaging solutions.

Meanwhile, the rise of bio-based and circular materials is reshaping the palette of options for tubes, vials, and reagent bottles. Plant-derived polymers such as polylactic acid and novel mushroom mycelium foams are emerging as viable alternatives to conventional plastics, enabling laboratories to align their consumable choices with corporate sustainability mandates and circular economy principles. These materials offer comparable barrier properties and mechanical strength while presenting the potential for full compostability or closed-loop recycling, marking a significant shift in primary packaging philosophy.

At the same time, digital innovations in smart labels and connected packaging are delivering new layers of traceability and operational efficiency. QR codes and RFID tags embedded on tube racks, microplates, and sterile packaging provide real-time supply chain visibility and error reduction, while NFC-enabled labels facilitate automated logging of storage conditions and expiration dates. This convergence of materials and digital technology is defining a new era for laboratory primary packaging, where sustainability and data integration drive competitive differentiation.

Assessing the Cumulative Effects of 2025 United States Tariff Policies on Laboratory Consumables Primary Packaging and Supply Chains Worldwide

The United States introduced a universal 10 percent tariff on most imported goods on April 5, 2025, triggering immediate cost pressures across laboratory consumables primary packaging. Shortly thereafter, on April 9, country-specific escalations were applied, with Chinese imports of lab-related goods facing cumulative duties of 145 percent. North American suppliers outside USMCA provisions now contend with 25 percent tariffs on non-energy shipments, while energy and potash imports face a 10 percent surcharge. These measures have significantly disrupted historically stable supply chains for glass vials, plastic tubes, and presterilized containers, prompting laboratories to reevaluate sourcing strategies and domestic manufacturing partnerships.

In addition, a specific 15 percent tariff on medical packaging and laboratory equipment, including sterile glass vials and certain plastics used for reagent containment, has intensified budgetary challenges. This targeted levy has disrupted project timelines for biologics and temperature-sensitive therapies, as previously low-cost imports from Germany, China, and Japan now carry higher landed costs. Organizations are mitigating these effects by scrutinizing supplier origin certifications, expanding on-site sterilization capabilities, and adjusting inventory management to absorb longer lead times.

Consequently, laboratories and manufacturers are prioritizing domestic or USMCA-compliant sources to minimize tariff exposure. Audits of existing SKUs are identifying high-risk items, while strategic agreements with U.S. distributors and increased adoption of reusable glassware seek to reduce recurring import costs. These combined actions reflect an adaptive response to a shifting tariff landscape that fundamentally alters the economics and logistics of primary packaging for critical laboratory consumables.

Deriving In-Depth Perspectives on Product, Material, Application, and Format Segmentation Within the Laboratory Consumables Primary Packaging Market Landscape

Product type segmentation reveals nuanced performance within the primary packaging space. Bottles, encompassing media and reagent variants, remain foundational for sample storage, while flasks-spanning Erlenmeyer and volumetric designs-support precise liquid handling and mixing. Plates and dishes, including microplates and Petri dishes, drive high-throughput screening and culture workflows, whereas tubes, whether centrifuge or test variants, integrate directly with automation platforms. Vials, differentiated into crimp-top and screw-cap formats, shoulder much of the responsibility for preserving sample integrity under stringent temperature and sterility conditions.

Material segmentation defines two primary categories: glass and plastic. Glass, in borosilicate and soda lime formulations, offers unparalleled chemical inertness and thermal stability, making it the material of choice for high-purity applications. Plastic materials such as polycarbonate, polypropylene, and polystyrene deliver advantages in weight reduction, break resistance, and cost efficiency, fueling their widespread use in single-use systems and high-volume assays.

Application segmentation underscores the diverse end-use environments for primary packaging. Clinical diagnostics, divided into in vitro diagnostics and point-of-care testing, demand fast-turnaround, traceable consumables, while pharmaceutical operations in formulation and quality control prioritize sterility and batch consistency. Research activities in biotechnology and life sciences benefit from flexible formats and rapid delivery, enabling agile experimentation in genomics, proteomics, and cell culture.

Format segmentation clarifies the significance of sterile and non-sterile presentation. Non-sterile offerings, packaged in bulk or single packs, cater to foundational workflows where external sterilization is acceptable. Sterile formats-gamma sterilized or presterilized-address high-risk protocols in aseptic processing and diagnostic sample handling, ensuring human safety and regulatory compliance.

This comprehensive research report categorizes the Laboratory Consumables Primary Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Application

- Format

Elucidating Critical Regional Dynamics Shaping Demand and Innovation in Laboratory Consumables Primary Packaging Across Major Global Markets

In the Americas, robust R&D investment in North America underpins a strong demand for high-performance primary packaging. The United States, in particular, has seen increased emphasis on domestic manufacturing to offset tariff disruptions, while Canada is tightening regulatory alignment under USMCA to preserve ease of goods movement. Latin American markets are emerging for cost-effective plastic consumables, leveraging regional free-trade agreements to access innovative packaging technologies.

Europe, the Middle East, and Africa exhibit a profound sustainability imperative, driven by the European Union’s circular economy framework and Middle East initiatives in life sciences hubs like the UAE. Countries such as Germany and Sweden lead with advanced recycling systems for cullet integration in glassware, establishing benchmarks for material recovery. Meanwhile, South Africa’s growing biotech sector is catalyzing demand for sterile single-use formats conforming to global standards, bridging local manufacturing and import strategies.

Asia-Pacific is characterized by rapid expansion in China and India, where burgeoning pharmaceutical and biotech industries are driving insatiable demand for tubes, vials, and microplates. Government initiatives to boost local production capacity, combined with regulatory harmonization efforts, are attracting foreign direct investment in packaging lines. Additionally, Japan and South Korea maintain a focus on advanced glass formulations for diagnostic and therapeutic applications, underpinned by strong domestic electronic component supply chains.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Consumables Primary Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Moves and Innovations by Leading Enterprises Transforming the Laboratory Consumables Primary Packaging Sector

Thermo Fisher Scientific maintains a commanding presence through its Nalgene brand, renowned for rugged, leak-proof plastic bottles and serum vials that balance transparency and chemical compatibility. In response to tariff volatility, Thermo Fisher has pledged over two billion dollars toward expanding U.S. manufacturing capacity, aiming to insulate its consumable lines from import surcharges while delivering consistent supply to research and diagnostic laboratories.

Sartorius has distinguished itself through a rigorous eco-design strategy, securing ISCC PLUS certifications for its filtration and pipetting consumables. By integrating renewable energy in production, reducing packaging volumes, and enabling up to 82 percent recyclability in filter cartridges, Sartorius combines sustainability with operational excellence. The adoption of refill towers for pipette tips further underscores their commitment to reducing single-use waste and logistics emissions.

Corning Incorporated has expanded its footprint in plasticware, investing in new manufacturing lines for microplates and cell culture surfaces to meet escalating biotech demand. This expansion extends to improved supply chain resilience through dual-sourcing strategies and the integration of proprietary barrier coatings that enhance shelf stability for sensitive assays. As part of its growth, Corning is streamlining logistics by leveraging regional distribution centers closer to key life sciences clusters.

Haier Biomedical has strategically acquired smart laboratory solution providers while incorporating disposable plastic consumables into its portfolio. By coupling chilled storage technologies with bespoke consumable offerings, Haier is targeting end-to-end laboratory workflows, positioning itself as a one-stop partner for emerging markets seeking integrated packaging and equipment solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Consumables Primary Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Amcor plc

- Avantor Inc

- Becton Dickinson and Company

- Bellco Glass Inc

- Bio-Rad Laboratories Inc

- Borosil Limited

- BRAND GMBH + CO KG

- Citotest Labware Manufacturing Co Ltd

- Cole-Parmer Instrument Company

- CoorsTek Inc

- Corning Incorporated

- DWK Life Sciences Ltd

- Eppendorf SE

- Gerresheimer AG

- Gilson Incorporated

- Greiner Bio-One International GmbH

- Huhtamaki Oyj

- Merck KGaA

- METTLER TOLEDO

- Sartorius AG

- Savillex LLC

- Schott AG

- Thermo Fisher Scientific Inc

Crafting Actionable Strategic Recommendations to Optimize Resilience and Competitiveness in Laboratory Consumables Primary Packaging Operations

Industry leaders should prioritize diversification of their manufacturing footprint by establishing or expanding domestic production facilities to mitigate tariff exposure and ensure supply continuity. Cultivating partnerships with USMCA-compliant suppliers can further reduce dependencies on high-tariff jurisdictions and support regional economic development.

Concurrent investment in sustainable material R&D will differentiate product portfolios and align with increasingly stringent environmental regulations. By integrating bio-based polymers, recycled glass content, and compostable alternatives, companies can demonstrate environmental stewardship while meeting customer demands for greener solutions.

Implementing advanced digital traceability through smart labeling-leveraging QR codes, RFID tags, and blockchain verification-will bolster quality control, enable real-time inventory management, and enhance regulatory compliance. Such systems can reduce manual errors and optimize workflows from manufacturing to end-user application.

Finally, forging deeper collaborations with key end-users, including academic institutions and contract research organizations, will yield insights into evolving application requirements. Co-development initiatives that tailor packaging formats to unique protocols can drive product adoption and foster long-term strategic alliances in the laboratory consumables primary packaging market.

Detailing Methodological Rigor and Comprehensive Research Approaches Underpinning Insights in Laboratory Consumables Primary Packaging Analysis

This analysis is grounded in a rigorous combination of primary and secondary research methodologies. Primary insights were gathered through structured interviews with procurement managers, packaging engineers, and laboratory directors across North America, EMEA, and Asia-Pacific. These interviews were complemented by surveys targeting key decision-makers in pharmaceutical, biotechnology, and academic research settings.

Secondary research encompassed the review of authoritative databases, trade publications, industry white papers, and peer-reviewed journals. Regulatory filings from agencies such as the FDA, EMA, and national tariff authorities provided critical context for policy and compliance factors influencing market dynamics.

Data validation was achieved by triangulating inputs from multiple independent sources, ensuring consistency and accuracy. Market segmentation analyses were developed using a bottom-up approach, cross-referenced by product shipments, material usage statistics, and application-specific demand indicators.

Finally, ongoing expert consultations with industry veterans ensured that emerging trends and disruptive forces were captured in real time, enabling this report to reflect the most current insights in laboratory consumables primary packaging.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Consumables Primary Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Consumables Primary Packaging Market, by Product Type

- Laboratory Consumables Primary Packaging Market, by Material

- Laboratory Consumables Primary Packaging Market, by Application

- Laboratory Consumables Primary Packaging Market, by Format

- Laboratory Consumables Primary Packaging Market, by Region

- Laboratory Consumables Primary Packaging Market, by Group

- Laboratory Consumables Primary Packaging Market, by Country

- United States Laboratory Consumables Primary Packaging Market

- China Laboratory Consumables Primary Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings and Strategic Imperatives Emerging from the Comprehensive Examination of Laboratory Consumables Primary Packaging

The comprehensive examination of laboratory consumables primary packaging reveals a market at the intersection of regulatory complexity, sustainability imperatives, and technological innovation. Each tier of segmentation-product type, material, application, and format-uncovers specific growth drivers and areas for optimization, from eco-designed glassware to smart, connected labeling.

Regional dynamics underscore the necessity of tailored approaches: North America’s emphasis on domestic production, EMEA’s circular economy leadership, and Asia-Pacific’s rapid capacity expansion each present unique opportunities and challenges. Tariff developments in 2025 have reshaped supply chain economics, compelling stakeholders to refine sourcing strategies and enhance local manufacturing resilience.

Leading companies are responding through strategic investments in sustainability, digital traceability, and operational agility, setting new benchmarks for performance and environmental standards. These competitive moves highlight the importance of continuous innovation and collaborative engagement across the value chain.

Looking ahead, success in this sector will depend on the ability to integrate sustainable materials, leverage digital traceability, and adapt to policy changes while maintaining cost-effective, high-performance packaging solutions for critical laboratory applications.

Seizing Opportunities and Engaging with Ketan Rohom to Access In-Depth Market Intelligence on Laboratory Consumables Primary Packaging Report Purchase

Embarking on a journey toward deeper market understanding is vital for strategic advantage in the laboratory consumables primary packaging sector. To unlock comprehensive data, analyses, and bespoke insights, connect with Ketan Rohom, Associate Director of Sales & Marketing, whose expertise can guide you to the precise intelligence your organization needs. By partnering directly, you will gain immediate access to the full report, detailed segmentation breakdowns, and ongoing support tailored to your decision-making criteria. Reach out today to elevate your supply chain strategies, optimize procurement, and stay ahead of global trends through a personalized consultation with Ketan Rohom.

- How big is the Laboratory Consumables Primary Packaging Market?

- What is the Laboratory Consumables Primary Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?