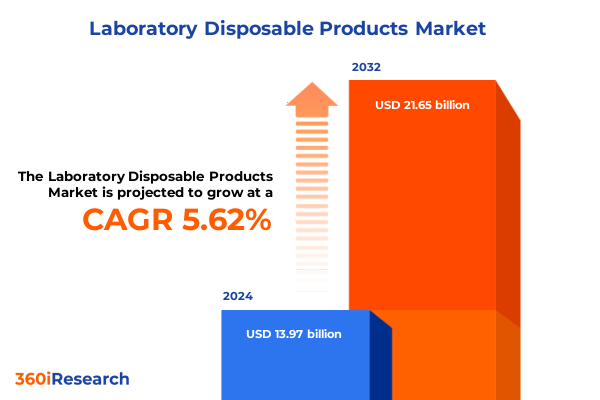

The Laboratory Disposable Products Market size was estimated at USD 14.75 billion in 2025 and expected to reach USD 15.58 billion in 2026, at a CAGR of 5.62% to reach USD 21.65 billion by 2032.

Discovering the Evolving Role of Laboratory Disposable Products in Driving Scientific Breakthroughs and Operational Excellence Across Diverse Research Environments

Laboratory disposable products have emerged as critical enablers of modern scientific breakthroughs, offering reliability and safety that streamline workflows across research and clinical environments. In recent years, advances in material science and manufacturing processes have elevated the performance of items such as pipette tips, culture plates, and cryogenic tubes, reducing contamination risks and supporting high-throughput operations. This trend has cemented disposable products as an essential component of laboratory operations, empowering scientists to focus on innovation rather than maintenance.

With rigorous regulatory standards and heightened emphasis on reproducibility, disposable products now play a pivotal role in quality assurance and compliance. As laboratories adopt single-use technologies for bioprocessing and cell culture, they benefit from reduced validation requirements and lower downtime between experiments. Consequently, research institutes, diagnostic facilities, and pharmaceutical companies increasingly rely on these products to accelerate time-to-result and maintain stringent safety protocols.

Transitioning from traditional glassware and reusable items, the industry has witnessed a paradigm shift toward single-use systems that optimize cost-efficiency when considering total lifecycle expenses. Stakeholders recognize that integrating disposables into standard operating procedures not only mitigates cross-contamination but also enhances operational scalability. This introduction sets the stage for a comprehensive examination of the transformative shifts, segmentation insights, and strategic imperatives shaping this dynamic market landscape.

Uncovering the Key Transformative Shifts Reshaping the Laboratory Disposable Products Landscape Through Sustainability Initiatives and Digital Automation

The laboratory disposable products landscape is undergoing transformative shifts driven by sustainability imperatives, automation trends, and heightened regulatory demands. Increasing environmental concerns have prompted the development of biodegradable plastics and recycled materials, enabling laboratories to reduce their ecological footprint while meeting performance criteria. Simultaneously, the integration of robotics and automated liquid handling platforms has elevated the precision and throughput of disposable components, ensuring compatibility with next-generation instrumentation and digital lab ecosystems.

Concurrently, the adoption of single-use bioprocessing systems continues to gain momentum across biologics manufacturing and cell therapy applications, reducing cross-contamination risks and streamlining validation efforts. This change has fostered collaborations between disposables manufacturers and equipment suppliers, resulting in end-to-end solutions that address both upstream and downstream processing requirements. Furthermore, supply chain resilience has become a focal point as organizations seek to mitigate disruptions from geopolitical tensions and material shortages through diversified sourcing strategies.

Looking ahead, the fusion of digital technologies with disposable products-such as embedded RFID tags for inventory management and tracking-will further enhance transparency and operational agility. As the sector embraces these transformative shifts, stakeholders must remain agile and proactive, leveraging these innovations to maintain competitive edge and drive continuous improvement in laboratory operations.

Analyzing the Cumulative Impact of Recent United States Tariff Policies on Laboratory Disposable Products Supply Chains and Cost Structures

Recent adjustments in United States tariff policies have exerted a cumulative impact on the cost structures and supply chain strategies for laboratory disposable products. Tariffs enacted under Section 301 have particularly affected imports of plastic-based disposables, prompting manufacturers and end users to reassess their sourcing frameworks. As a result, some suppliers have accelerated the diversification of their supply base to include regional and nearshore facilities, thereby reducing exposure to import duties and logistical uncertainties.

The escalated duties on raw materials such as polypropylene and polyethylene have translated into higher production expenses for items like pipette tips, microcentrifuge tubes, and plastic culture dishes. In response, manufacturers are exploring alternative materials and process innovations that can maintain performance standards while alleviating cost pressures. Simultaneously, end users are evaluating total cost of ownership to balance upfront price increases against savings through reduced waste and improved quality control.

As tariff landscapes remain fluid, proactive collaboration between supply chain stakeholders has become essential. Suppliers are leveraging advanced analytics to model tariff scenarios and develop hedging strategies, while purchasing teams are renegotiating contracts to incorporate flexible pricing mechanisms. These adaptive approaches not only mitigate risk but also ensure continuity of critical supplies, safeguarding ongoing research and diagnostic operations against economic uncertainties.

Highlighting Critical Segmentation Insights to Illuminate Diverse Product Types, Applications, End Users, Materials, Distribution Channels, and Sterilization Standards

A nuanced understanding of market segmentation reveals distinct demand dynamics across product types, applications, end users, materials, distribution channels, and sterilization requirements. Within product type categorization, the spectrum ranges from bottles and culture plates to filter papers and gloves. The glove category itself subdivides into latex, nitrile, and vinyl variants, each catering to specific use cases based on chemical resistance and tactile sensitivity. Similarly, the petri dish segment encompasses both glass and plastic dishes, offering durability or disposability as required, while pipette tips are further differentiated into filter and standard options to address contamination control needs. Tubes span from cryogenic to microcentrifuge formats, facilitating diverse sample storage and processing protocols.

Application-based segmentation highlights key end uses such as biotechnology and pharmaceuticals, clinical diagnostics, environmental testing, and academic or industrial research. Each of these segments imposes unique performance criteria-ranging from sterility assurance levels to chemical compatibility-which manufacturers must address through tailored product portfolios. In terms of end user diversity, biotechnology firms, diagnostic laboratories, hospitals and clinics, pharmaceutical companies, and research institutes each drive procurement strategies aligned with their operational objectives and regulatory obligations.

Material composition further influences product selection, with glass, paper, and plastic forming the primary categories. Paper-based disposables subdivide into cellulose and nitrocellulose substrates, frequently leveraged in filtration and blotting applications. Plastic varieties include polyethylene, polypropylene, and polystyrene, each offering distinct characteristics such as transparency, chemical inertness, and structural rigidity. Distribution channels span direct sales, traditional distributors, and online retail platforms, while sterilization states bifurcate into non-sterile and sterile offerings to address varying aseptic requirements. By interrogating these segmentation layers, organizations can refine their market strategies and optimize inventory management practices.

This comprehensive research report categorizes the Laboratory Disposable Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Sterilization

- End User

- Distribution Channel

- Application

Examining Crucial Regional Dynamics Impacting the Laboratory Disposable Products Market Across the Americas, EMEA, and Asia Pacific Hubs

Regional dynamics play a pivotal role in shaping the demand and innovation trajectories for laboratory disposable products. In the Americas, robust research activities in North America and the growth of clinical diagnostics in Latin America have driven increased consumption of high-performance consumables. The emphasis on domestic manufacturing and reshoring initiatives has also boosted local capacity for critical items such as pipette tips and cryogenic tubes, enhancing supply reliability and reducing lead times.

Across Europe, the Middle East, and Africa, stringent regulatory frameworks and sustainability mandates have influenced product development and adoption. European laboratories are investing in eco-designed disposables that meet circular economy objectives, while Middle Eastern markets are expanding capacity to support biotechnology hubs. In Africa, growing public health initiatives and disease surveillance programs are catalyzing demand for clinical diagnostics disposables, underpinned by partnerships that bolster regional manufacturing capabilities.

The Asia-Pacific region exhibits some of the fastest growth rates, fueled by expanding biotech and pharmaceutical sectors in China, India, and Southeast Asian economies. Manufacturers are investing heavily in establishing local production facilities to capitalize on preferential trade agreements and mitigate tariff impacts. Additionally, research institutes are embracing automated workflows, driving demand for precisely engineered culture plates and filter papers. As these regional markets continue to evolve, stakeholders must adapt their go-to-market strategies to align with local regulatory, economic, and innovation landscapes.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Disposable Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Prominent Market Players Forging the Future of Laboratory Disposable Products Through Innovation, Strategic Partnerships, and Expanding Portfolios

Key industry players are navigating competitive landscapes through strategic partnerships, portfolio diversification, and technological innovation. Thermo Fisher Scientific has leveraged its global distribution network and R&D capabilities to deliver integrated single-use solutions, positioning itself as a one-stop provider for bioprocessing and diagnostic workflows. Similarly, Merck Millipore Sigma has expanded its consumables portfolio with novel material formulations that enhance chemical resistance and reduce static charge, catering to sensitive analytical applications.

Sartorius has focused on modular system development and digital connectivity, integrating consumables with advanced instrumentation platforms to streamline laboratory automation. Corning has continued to invest in high-throughput cell culture technologies, optimizing plate geometries and surface coatings to improve cell adhesion and growth consistency. Meanwhile, Greiner Bio-One has pursued operational excellence through manufacturing footprint expansion in strategic regions, enhancing local responsiveness and cost competitiveness.

Value-added distributors such as Avantor and VWR are capitalizing on their logistics infrastructure and customer relationships to offer vendor-managed inventory and just-in-time delivery models. By combining comprehensive product assortments with digital ordering platforms, these companies facilitate seamless procurement experiences that reduce administrative burdens for laboratories and research organizations. These diverse competitive strategies underscore the multifaceted approaches companies are taking to capture market opportunities and address evolving customer needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Disposable Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Agilent Technologies, Inc.

- Avantor, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Brand GmbH + Co KG

- Cardinal Health, Inc.

- Corning Incorporated

- Danaher Corporation

- DWK Life Sciences GmbH

- Dynalon Labware

- Eppendorf AG

- Globe Scientific Inc.

- Globe Scientific Inc.

- Greiner Bio-One International GmbH

- Heathrow Scientific LLC

- Heathrow Scientific LLC

- Kimberly‑Clark Corporation

- Kimble Chase Life Science and Research Products LLC

- Labcon

- Medline Industries, Inc.

- Merck KGaA

- Narang Medical Limited

- PerkinElmer, Inc.

- QIAGEN NV

- SARSTEDT AG & Co. KG

- Sartorius AG

- Simport Scientific, Inc.

- Thermo Fisher Scientific Inc.

- VWR International, LLC

Proposing Actionable Strategies for Industry Leaders to Enhance Supply Chain Resilience, Sustainability, and Competitive Positioning in Laboratory Disposables

Industry leaders must adopt a multi-pronged approach to fortify their market position and fuel sustainable growth. First, diversifying supplier bases and fostering regional manufacturing partnerships can mitigate risks associated with tariff fluctuations and geopolitical uncertainties. By establishing secondary production sites and qualifying alternative vendors, organizations can safeguard supply continuity and maintain operational agility.

Second, investing in sustainable materials and circular economy initiatives will not only address regulatory pressures but also resonate with environmentally conscious end users. Developing biodegradable polymers and optimizing recycling programs for disposable products will reduce waste and demonstrate corporate responsibility. Coupled with this, deploying digital tracking and inventory management solutions can improve traceability and minimize stockouts, enabling leaner operations and enhanced cost control.

Lastly, forging collaborative relationships with instrumentation providers and regulatory bodies can accelerate the adoption of single-use technologies. Joint pilot programs and co-development projects foster innovation in product design and validation processes, while proactive engagement with standards organizations ensures compliance and market acceptance. By implementing these strategies, industry leaders will be well-positioned to navigate evolving market demands and maintain a competitive edge.

Detailing the Rigorous Research Methodology Employed to Gather Comprehensive Insights Through Primary and Secondary Data Sources and Robust Analytical Frameworks

The research process underpinning this analysis combined rigorous secondary research with targeted primary engagement to ensure comprehensive market coverage. Initially, extensive literature reviews and industry publications were consulted to map existing product portfolios, regulatory frameworks, and emerging trends. Data from public filings, technical white papers, and patent databases provided foundational context on material innovations and manufacturing advancements.

Complementing secondary insights, structured interviews and surveys were conducted with key stakeholders, including procurement managers, laboratory directors, and manufacturing executives. These primary engagements captured real-world perspectives on cost pressures, quality requirements, and future investment priorities. Quantitative data was triangulated with qualitative observations to validate assumptions and identify potential blind spots in market understanding.

Throughout the methodology, data integrity was maintained through cross-referencing multiple sources and applying consistent analytical frameworks. Scenario modeling and sensitivity analyses were employed to assess tariff impacts and regional variations, while expert validation sessions ensured that findings accurately reflected market realities. This robust approach delivered a fact-based, balanced view of the laboratory disposable products sector, equipping stakeholders with reliable intelligence to guide strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Disposable Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Disposable Products Market, by Product Type

- Laboratory Disposable Products Market, by Material

- Laboratory Disposable Products Market, by Sterilization

- Laboratory Disposable Products Market, by End User

- Laboratory Disposable Products Market, by Distribution Channel

- Laboratory Disposable Products Market, by Application

- Laboratory Disposable Products Market, by Region

- Laboratory Disposable Products Market, by Group

- Laboratory Disposable Products Market, by Country

- United States Laboratory Disposable Products Market

- China Laboratory Disposable Products Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Reflections on the Strategic Imperatives and Future Outlook for Laboratory Disposable Products in a Rapidly Evolving Scientific Ecosystem

In conclusion, the laboratory disposable products market stands at a pivotal juncture where sustainability, automation, and geopolitical factors converge to redefine industry norms. Stakeholders who proactively embrace material innovations and digital integration will achieve greater operational efficiency and quality outcomes. At the same time, resilient supply chain strategies and tariff mitigation efforts are critical to maintaining cost competitiveness and ensuring uninterrupted access to essential consumables.

Moreover, the nuanced segmentation and regional dynamics highlighted in this analysis serve as a roadmap for tailored market engagement, guiding organizations toward opportunities that align with their strategic priorities. By leveraging the insights on product types, end-user requirements, and distribution channel preferences, decision-makers can optimize their portfolio and refine go-to-market approaches.

Ultimately, this executive summary underscores the importance of agility and collaboration in navigating a rapidly evolving scientific ecosystem. As the sector continues to advance, ongoing monitoring of regulatory changes, technological breakthroughs, and competitive movements will be vital to sustaining growth and driving innovation in laboratory disposable products.

Engage with Ketan Rohom to Secure the Comprehensive Market Research Report Delivering In-Depth Analysis and Actionable Insights on Laboratory Disposable Products

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the full market research report that offers unparalleled depth on market drivers, segmentation insights, regional dynamics, and strategic recommendations. Through a partnership with Ketan, organizations can procure detailed analyses on tariff impacts, supply chain resilience strategies, and innovation road maps tailored specifically for laboratory disposable products stakeholders.

By connecting with Ketan Rohom, decision-makers will gain access to proprietary data sets, expert interviews, and case studies that illuminate best practices in product development and distribution channel optimization. This opportunity facilitates informed investment decisions and empowers stakeholders to capitalize on emerging trends in sustainability, automation, and regional growth markets. Reach out to Ketan to unlock the intelligence that drives competitive advantage in the laboratory disposables sector.

- How big is the Laboratory Disposable Products Market?

- What is the Laboratory Disposable Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?