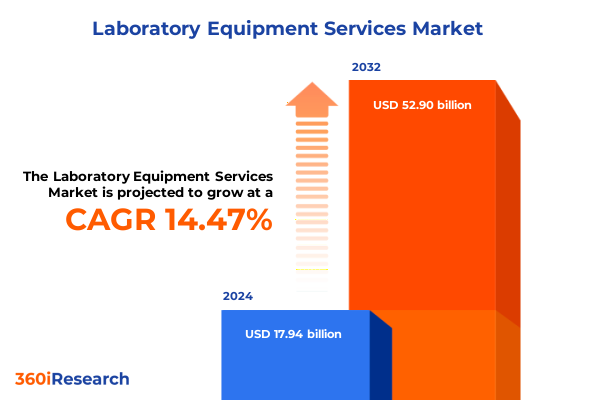

The Laboratory Equipment Services Market size was estimated at USD 20.49 billion in 2025 and expected to reach USD 23.32 billion in 2026, at a CAGR of 14.50% to reach USD 52.90 billion by 2032.

Setting the Stage for the Evolving World of Laboratory Equipment Services With Emphasis on Customer-Centric Innovation and Operational Excellence

Laboratory equipment services represent a critical backbone for research institutions, clinical diagnostics, pharmaceutical manufacturing, environmental testing facilities, and academic laboratories alike. As technological complexity continues to rise, the need for precise calibration, reliable maintenance, and rigorous validation has never been more pronounced. Service providers are not only responsible for ensuring instrument accuracy but also for supporting compliance with global regulatory frameworks, enhancing operational uptime, and enabling seamless workflow integration.

In today’s competitive environment, service excellence hinges on a proactive approach that anticipates client needs, leverages digital tools for remote diagnostics, and fosters long-term partnerships. Organizations are increasingly seeking holistic solutions that span from initial installation and commissioning through preventive maintenance, corrective repair, and specialized consultancy. The convergence of these service elements under unified offerings allows providers to deliver greater value, driving both customer satisfaction and recurring revenue.

Moreover, the landscape of laboratory equipment services is being reshaped by heightened quality standards, intensified cost pressures, and evolving end-use requirements. As new technologies such as mass spectrometry, high-throughput chromatography, and advanced microscopy permeate laboratories, service providers must continuously upgrade their technical capabilities. This report’s executive summary delves into these critical dynamics, setting the stage for an in-depth exploration of transformative shifts, tariff impacts, segmentation insights, regional nuances, competitive positioning, and strategic recommendations.

Navigating the Waves of Technological, Regulatory, and Sustainability-Driven Transformation in Laboratory Equipment Services

Over the past decade, laboratory equipment services have undergone transformative changes driven by technological advancements, digital integration, and shifting client expectations. Traditional service models centered on reactive maintenance have given way to predictive strategies that leverage the Internet of Things (IoT), advanced analytics, and cloud-based monitoring platforms. This shift enables real-time visibility into equipment performance, reducing unplanned downtime and extending instrument lifecycles.

In parallel, regulatory authorities around the globe have tightened compliance requirements, mandating more rigorous documentation, traceability of calibration records, and validation protocols. Service providers now play an indispensable role in guiding clients through complex certification processes, from GLP and GMP mandates to ISO/IEC standards. As a result, specialized consultancy and training offerings have emerged as key differentiators, empowering laboratory staff to maintain peak operational standards independently.

Furthermore, the rise of sustainability considerations is influencing service strategies, prompting providers to adopt eco-friendly calibration methods, minimize waste, and optimize energy consumption during furnace, oven, and refrigeration servicing. These environmental imperatives are complemented by the growing demand for flexible commercial models, including subscription-based services and outcome-driven contracts that align provider incentives with client performance goals. Together, these trends underscore a fundamental transformation in how laboratory equipment services are conceptualized and delivered.

Assessing How United States Tariffs Enacted in 2025 Are Reshaping Supply Chains, Cost Dynamics, and Service Contract Structures

In 2025, the United States government enacted a series of tariffs aimed at bolstering domestic manufacturing and protecting critical supply chains for high-precision equipment. These measures have reverberated through the laboratory equipment services sector, affecting both original manufacturers and third-party service providers. With imported spare parts and calibration standards subject to increased duties, service operations have experienced upward pressure on cost structures, prompting a reevaluation of pricing and sourcing strategies.

Service providers have responded by diversifying their supplier networks, establishing new partnerships with North American and European component manufacturers, and investing in localized stocking facilities to mitigate lead-time disruptions. This nearshoring approach enhances supply chain resilience but may carry higher baseline costs, which providers must balance against client expectations for value-driven pricing. Moreover, the import tariffs have incentivized certain OEMs to shift manufacturing footprints closer to key end markets, a trend likely to influence long-term service agreements and warranty terms.

Amid these developments, the negotiation of service contracts has grown more complex, with stakeholders seeking greater transparency around pass-through tariff impacts and contingency arrangements for future policy shifts. Providers are increasingly offering flexible tariff adjustment clauses and tiered service-level agreements to accommodate cost volatility while preserving margin stability. The cumulative impact of these tariffs thus extends beyond immediate price increases, driving strategic recalibration across sourcing, inventory management, and contract design within the laboratory equipment services landscape.

Unveiling Key Insights From Service, Equipment, Pricing, End-Use, and Sales Channel Segmentation to Inform Strategic Growth

Deep insights into market segmentation reveal the multifaceted nature of laboratory equipment services and the necessity for tailored approaches across diverse service categories. Based on Service Type, offerings span calibration, installation and commissioning, maintenance and repair, training and consultancy, and validation. Calibration services further differentiate into off-site calibration performed in accredited laboratories and on-site calibration delivered directly at client sites, while maintenance and repair encompass both corrective maintenance following equipment failures and preventive maintenance aimed at reducing unplanned downtime.

Examining Equipment Type segmentation, providers must address the unique servicing requirements of centrifuges, chromatography systems, furnaces and ovens, microscopes, refrigerators and incubators, and spectrometry systems. Each instrument category demands specialized technical skills, distinct calibration standards, and customized spare parts inventory. Aligning service teams and training programs to these equipment clusters optimizes turnaround times and enhances first-time fix rates. The Pricing Model dimension further influences engagement strategies, with contract-based arrangements supporting predictable revenue streams, pay-per-service models allowing transactional flexibility, and subscription offerings driving customer loyalty through bundled service packages.

In terms of End-Use segmentation, laboratories operating within academic and research institutions, biotechnology firms, clinical diagnostic centers, environmental testing facilities, food and beverage processing plants, and pharmaceutical manufacturing sites exhibit differing compliance demands, instrument densities, and service frequency requirements. Service providers must adapt their value propositions to address the nuanced expectations of each sector, such as rapid calibration cycles for high-throughput research labs or robust validation services for regulated pharmaceutical environments. Finally, Sales Channel segmentation distinguishes offerings delivered by OEMs-often bundled with new equipment sales-from those provided by third-party providers, whose independence and potential cost advantages appeal to clients seeking alternatives to in-house or OEM-centric support.

This comprehensive research report categorizes the Laboratory Equipment Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Equipment Type

- Pricing Model

- End-Use

- Sales Channel

Exploring the Distinct Growth Drivers and Service Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific Regions

Regional dynamics in laboratory equipment services vary significantly across the Americas, Europe Middle East & Africa, and Asia-Pacific regions, reflecting distinct economic drivers, regulatory landscapes, and technological adoption rates. In the Americas, robust investment in pharmaceutical manufacturing and clinical diagnostics is fueling demand for comprehensive service agreements that integrate preventive maintenance, calibration, and validation. North American laboratories prioritize uptime and regulatory compliance, while Latin American markets are poised for growth, driven by expanding research infrastructures and increasing outsourcing of maintenance functions.

The Europe Middle East & Africa region presents a heterogeneous mix of mature markets with stringent regulatory frameworks alongside emerging markets with accelerated modernization initiatives. European service providers benefit from deep expertise in advanced instrumentation and well-established certification bodies, enabling premium consultancy and high-value training services. In the Middle East, strategic investments in life sciences research hubs are creating new service opportunities, while in Africa, nascent diagnostic networks are gradually formalizing maintenance protocols, opening avenues for third-party providers to establish local footprints and partnerships.

Asia-Pacific exhibits a dynamic landscape characterized by rapid expansion in biotechnology research, food safety testing, and environmental monitoring. High-growth markets such as China and India are investing heavily in laboratory modernization, placing a premium on scalable service models and digital support tools. Meanwhile, developed markets like Japan and Australia prioritize cutting-edge validation services and sophisticated analytics capabilities. Across all Asia-Pacific markets, competitive pressure is driving service providers to innovate through remote diagnostics platforms, mobile service vans, and localized training academies to meet the diverse needs of both urban centers and regional facilities.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Equipment Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Leading Service Providers and OEMs Are Differentiating Through Technical Expertise, Digital Integration, and Strategic Collaborations

Leading companies in the laboratory equipment services market are distinguished by their robust technical expertise, strategic partnerships, and integrated service ecosystems. Global OEMs continue to leverage their deep instrumentation knowledge and brand reputation to bundle services with equipment sales, ensuring end-to-end lifecycle support. These organizations are investing in digital platforms that facilitate remote monitoring, predictive analytics, and streamlined scheduling, thereby enhancing client engagement and reducing service response times.

Third-party service providers differentiate themselves through price competitiveness, flexible contract models, and broad multi-vendor support capabilities. By certifying technicians across multiple instrument brands and maintaining diverse spare parts inventories, they offer clients impartial recommendations and cost-effective maintenance solutions. Strategic collaborations between third parties and regional distributors have expanded service coverage, enabling rapid scaling and localized expertise that matches global standards.

Furthermore, specialist consultancy firms focusing on regulatory compliance, process optimization, and validation services are carving out high-margin niches. These companies leverage subject matter expertise in FDA, EMA, and ISO requirements to guide clients through complex audit processes, risk assessments, and validation protocols. Collectively, these leading companies set the benchmark for service excellence, innovation adoption, and partnership models that shape competitive positioning within the laboratory equipment services landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Equipment Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Agilent Technologies Inc.

- Alfa Laval AB

- Anton Paar GmbH

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Danaher Corporation

- Eppendorf SE

- GE Healthcare

- Gilson Incorporated

- Hitachi High-Tech Corporation

- JEOL Ltd.

- Mettler-Toledo International Inc.

- PerkinElmer Inc.

- Roche Diagnostics

- Sartorius AG

- Shimadzu Corporation

- Siemens Healthineers AG

- SP Scientific

- Thermo Fisher Scientific Inc.

- Waters Corporation

- Zeiss Group

Delivering Actionable Strategies to Enhance Predictive Maintenance, Expand Value-Added Services, and Strengthen Supply Chain Resilience

Industry leaders must embrace a proactive strategy that aligns service offerings with evolving client expectations and regulatory imperatives. By investing in Internet of Things–enabled devices and advanced analytics platforms, providers can transition from reactive to predictive maintenance models, reducing unplanned downtime and strengthening customer trust. Moreover, integrating digital scheduling, automated reminders, and real-time performance dashboards enhances transparency and client engagement throughout the service lifecycle.

Expanding service portfolios to include specialized training, regulatory consultancy, and sustainability audits can create new revenue streams while reinforcing provider credibility. Customizing training curricula for academic researchers, clinical technologists, and bioanalytical scientists fosters deeper client partnerships and positions providers as trusted advisors. Additionally, establishing flexible pricing models-such as outcome-based subscriptions or hybrid pay-per-service contracts-allows clients to align service investments with budget constraints and performance targets.

To mitigate geopolitical and tariff-induced disruptions, service organizations should develop diversified supplier networks, maintain strategically located spare parts hubs, and incorporate tariff adjustment clauses into master service agreements. Finally, fostering a culture of continuous improvement through technician certification programs, cross-training initiatives, and quality management systems ensures that service delivery remains consistent, compliant, and capable of supporting next-generation laboratory technologies.

Demonstrating a Robust Research Framework Combining Expert Interviews, Secondary Validation, and Analytical Models to Illuminate Market Dynamics

This research employs a comprehensive methodology that integrates qualitative and quantitative approaches to produce robust, actionable insights. Primary data was gathered through in-depth interviews with senior executives, service managers, and technical specialists across leading OEMs, third-party providers, and end-user organizations. These conversations provided rich context regarding operational challenges, technology adoption patterns, and strategic priorities in laboratory equipment services.

Secondary research involved exhaustive reviews of regulatory guidelines, industry whitepapers, and academic publications, along with analysis of publicly available financial reports and technical specifications. This material was triangulated to validate findings, ensure consistency, and fill knowledge gaps. A rigorous data validation process included cross-referencing multiple sources and conducting follow-up inquiries to clarify discrepancies and confirm market dynamics.

Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and segmentation mapping were applied to assess competitive positioning, barrier-to-entry factors, and growth opportunities. Geographic and end-use cross-tabulations enabled the identification of regional hotspots and sector-specific service requirements. The resulting insights offer a clear, evidence-based foundation for strategic decision-making, ultimately guiding industry leaders in optimizing service portfolios and aligning operational capabilities with evolving market demands.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Equipment Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Equipment Services Market, by Service Type

- Laboratory Equipment Services Market, by Equipment Type

- Laboratory Equipment Services Market, by Pricing Model

- Laboratory Equipment Services Market, by End-Use

- Laboratory Equipment Services Market, by Sales Channel

- Laboratory Equipment Services Market, by Region

- Laboratory Equipment Services Market, by Group

- Laboratory Equipment Services Market, by Country

- United States Laboratory Equipment Services Market

- China Laboratory Equipment Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing the Interplay of Technological, Regulatory, and Segmentation Drivers to Illuminate Future Pathways for Service Excellence

The convergence of technological innovation, tightening regulatory landscapes, and evolving customer expectations underscores the inherent complexity of the laboratory equipment services market. Predictive maintenance and digital monitoring platforms are rapidly becoming standard practice, while regulatory consultancy and specialized training services are critical to sustaining compliance and operational excellence. Meanwhile, regional dynamics-from the Americas’ focus on clinical diagnostics to Asia-Pacific’s biotechnology surge-highlight the need for tailored service strategies.

Tariff measures implemented in 2025 have catalyzed a strategic reorientation among service providers, prompting supply chain diversification and localized inventory management. Navigating these shifts successfully demands a balanced approach that addresses cost pressures without compromising service quality. Segmentation insights across service types, equipment categories, pricing models, end-use sectors, and distribution channels provide a granular understanding of where value can be maximized and competitive differentiation achieved.

Ultimately, laboratory equipment service providers that integrate digital solutions, expand value-added offerings, and cultivate resilient supply networks will be best positioned to capture emerging opportunities. By aligning strategic initiatives with the nuanced requirements of diverse end-user segments and regional markets, industry leaders can achieve sustainable growth, strengthen client partnerships, and maintain a competitive edge in a rapidly transforming landscape.

Inviting Industry Leaders to Partner With Ketan Rohom for Bespoke Market Intelligence and Strategic Laboratory Services Insights

Decision-makers seeking to stay ahead in the rapidly evolving laboratory equipment services market are invited to engage directly with Ketan Rohom, whose extensive expertise in sales and marketing strategy can unlock tailored, data-driven solutions. By connecting with Ketan, industry leaders can access deep-dive analyses, bespoke advisory sessions, and comprehensive support to translate market insights into actionable growth plans. This collaborative partnership will ensure your organization capitalizes on emerging trends, mitigates supply chain risks, and implements best practices to drive service excellence.

Investing in a full market research report provides organizations with a competitive edge by delivering granular intelligence on segmentation dynamics, regional variances, and competitor strategies. Through this report, stakeholders will gain clarity on optimizing service portfolios, refining pricing models, and targeting high-potential end-use sectors. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to schedule a personalized consultation and secure a copy of the research report that will empower your strategic decision-making and accelerate your success in the laboratory equipment services landscape.

- How big is the Laboratory Equipment Services Market?

- What is the Laboratory Equipment Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?