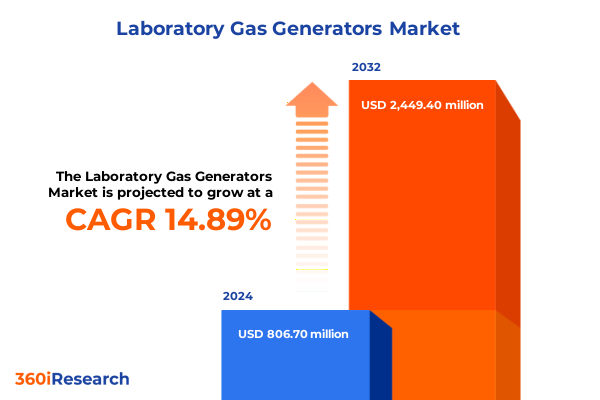

The Laboratory Gas Generators Market size was estimated at USD 509.12 million in 2025 and expected to reach USD 552.55 million in 2026, at a CAGR of 8.81% to reach USD 919.64 million by 2032.

Laboratory Gas Generation Dynamics Shaping Uninterrupted High Purity Gas Supply Amid Evolving Regulatory and Operational Demands

Laboratory gas generation has evolved into a cornerstone of modern scientific and industrial processes, ensuring that laboratories maintain uninterrupted access to high-purity gases while controlling operational costs and environmental impact. Over the past decade, the growing complexity of analytical instrumentation, tightening regulatory requirements around gas purity and safety, and an increasing focus on decentralized on-site generation have combined to redefine stakeholder expectations. Researchers, quality control laboratories in pharmaceuticals and food processing, and semiconductor fabrication facilities now require solutions that not only meet stringent purity and flow rate specifications but also align with broader corporate sustainability mandates. Transitioning from traditional cylinder-based supply chains toward integrated, on-demand generation units has introduced new opportunities for innovation across technology, service models, and energy integration.

As laboratories strive for greater operational agility, the demand for gas generators that deliver precision performance, automated diagnostics, and remote monitoring capabilities is on the rise. This introduction explores the foundational drivers underpinning market expansion, the interplay between technology advancements and end-user requirements, and the strategic considerations guiding procurement decisions. By setting the stage for deeper analysis, it highlights why stakeholders across research and industrial sectors are increasingly prioritizing bespoke gas generation platforms that deliver reliability, cost efficiency, and compliance assurance.

Innovations in Modular, Digital and Sustainable Gas Generation Architectures That Are Redefining Laboratory Operations Globally

The laboratory gas generator market is experiencing a confluence of transformative shifts that are reshaping its competitive landscape and innovation trajectory. Advanced materials and precision engineering have enabled the development of compact cryogenic distillation systems and membrane separation units with accelerated startup times and reduced energy footprints. At the same time, ongoing digitalization is delivering predictive maintenance and remote diagnostics, allowing service providers to anticipate component wear and optimize uptime with minimal intervention. These technological breakthroughs are paralleled by a strategic pivot toward modular architectures that can be scaled or reconfigured to serve expanding research and production needs without significant capital overhead.

Moreover, the imperatives of decarbonization and sustainability are driving investment in greener energy sources to power generation units. Electrolysis-based hydrogen generators are now integrating renewable power inputs, while vacuum swing adsorption systems are incorporating advanced sorbents derived from bio-based polymers. This shift is enabling laboratories to not only reduce greenhouse gas emissions but also to demonstrate compliance with corporate environmental, social, and governance criteria. As a result, alliances between gas generator suppliers and clean energy providers are proliferating, fostering ecosystems where on-site generation is seamlessly linked to solar, wind, or hydrogen pipelines. These strategic partnerships, combined with regulatory incentives for domestic manufacturing and energy efficiency, are charting a new course for the laboratory gas generator market.

Consequences of Expanded 2025 Tariffs on Imported Components That Are Forcing Supply Chain Reconfigurations and Cost Reallocations

The United States introduced new tariff measures in 2025 that have progressively increased duties on components and complete units imported from key manufacturing hubs, compelling laboratory gas generator suppliers to reevaluate their supply chains and cost structures. These tariffs encompass membrane modules used in hollow fiber and spiral wound assemblies, electrolyzer stacks for both alkaline and proton exchange membrane configurations, as well as components critical to vacuum and standard pressure swing adsorption units. As a cumulative effect, landed costs for imported modules have risen, prompting manufacturers to explore domestic sourcing of membranes and electrolysis elements or to pass incremental costs onto end users.

In response to these fiscal pressures, several suppliers have shifted final assembly and critical subcomponent production to North America, leveraging local engineering expertise and capitalizing on tax credits offered under recent industrial incentives. This reshoring trend has not only mitigated exposure to punitive duties but also reduced lead times, allowing for faster deployment of customized gas generator systems. Nevertheless, smaller distributors and end users with limited purchasing volumes have faced steeper cost increases compared to larger laboratory networks that can negotiate volume discounts or absorb tariff-related surcharges. Looking ahead, the interplay between tariff policy, domestic manufacturing capacity expansion, and strategic procurement will continue to redefine competitive positioning and pricing dynamics in the laboratory gas generator sector.

Nuanced Market Differentiation Driven by Complex Interplay of Technology Platforms Application Needs and Distribution Strategies

The market’s multidimensional segmentation reveals distinct areas of opportunity and differentiation based on technology, gas type, application, purity level, flow rate, and sales channel. Analytical instruments requiring ultra high purity gases have driven demand for both continuous and batch cryogenic distillation systems, while research institutions conducting advanced materials studies often favor the rapid start-up capabilities of PEM electrolyzers. In contrast, production environments such as food and beverage or semiconductor fabrication gravitate toward membrane separation units-whether hollow fiber or spiral wound-because of their compact footprints and on-demand delivery of nitrogen or zero air. Laboratories prioritizing cost efficiency and simplicity have adopted standard pressure swing adsorption modules, whereas high-purity research settings increasingly invest in vacuum swing adsorption solutions to achieve tighter gas specifications.

Further nuance emerges when segmenting by gas type: hydrogen generators are capturing interest from clean energy research, oxygen units are becoming integral in pharmaceutical process control, and zero air generators are essential in electronics manufacturing where trace contaminants must be rigorously managed. Flow rate distinctions similarly guide design choices, with high flow applications in pilot-scale chemical studies requiring robust high-capacity units, while low flow medical or academic desktop instruments leverage compact, low flow solutions. Finally, the route to market significantly impacts customer engagement; direct sales enable custom engineering projects with dedicated service contracts, whereas distribution partners extend regional reach for standard product lines, and online sales platforms are gaining traction for off-the-shelf, lower purity, and lower flow configurations.

This comprehensive research report categorizes the Laboratory Gas Generators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Gas Type

- Generation Technology

- Purity Level

- Output Flow Rate

- Installation Form Factor

- Output Pressure

- Application

- Sales Channel

- End User

Comparative Regional Dynamics Highlighting Americas’ Reshoring Efforts Europe’s Regulatory Innovation and Asia-Pacific’s Rapid Market Expansion

Regional landscapes exhibit divergent growth vectors and regulatory environments that shape the adoption and evolution of laboratory gas generators. The Americas market, anchored by strong laboratory infrastructure in pharmaceutical research hubs and semiconductor clusters, emphasizes domestic manufacturing and energy resilience, with recent policies incentivizing nearshore production. This landscape encourages suppliers to develop turnkey systems integrated with smart controls and remote monitoring to support wide geographic dispersion of academic and industrial laboratories.

In Europe, Middle East & Africa, stringent environmental regulations and aggressive decarbonization targets are fostering innovation in low-energy cryogenic and membrane technologies. Meanwhile, academic research centers across the European Union often partner with equipment providers on collaborative R&D projects to co-develop next-generation sorbent materials and electrolyzer catalysts. Regulatory frameworks in the Middle East emphasize industrial gas self-sufficiency, compelling regional stakeholders to invest in localized manufacturing and service ecosystems.

Asia-Pacific represents the fastest-growing arena, powered by expanding biotech clusters in China and India and by government-led initiatives to enhance self-reliance in critical technologies. Suppliers in this region are tailoring compact, modular systems to meet the diverse needs of emerging markets and are establishing joint ventures with local engineering firms to navigate complex import regulations and to deliver cost-competitive solutions.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Gas Generators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Shaped by Strategic Acquisitions and Digital-First Service Models Redefining Market Leadership

Competitive intensity in laboratory gas generation is driven by a blend of legacy multinational suppliers and agile specialized innovators. Leading industrial gas companies have reinforced their portfolios through strategic acquisitions of specialized membrane and sorbent developers, enabling them to offer vertically integrated solutions spanning cryogenic distillation to vacuum swing adsorption. Simultaneously, technology-focused entrants are capturing niche segments by delivering digital-native platforms with cloud-based analytics and subscription-based service models.

Across the board, companies are jockeying to differentiate through advanced service offerings. Predictive maintenance contracts, leveraging real-time data from embedded sensors, are becoming table stakes, while add-on modules for gas purity monitoring and automated calibration are gaining traction among high-value laboratory environments. Collaborative partnerships with academic institutions and clean energy providers are also reshaping competitive moats, as suppliers co-invest in next-generation electrolyzer chemistries and sorbent materials that promise performance gains and sustainability credentials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Gas Generators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Parker Hannifin Corporation

- Peak Scientific Instruments Ltd.

- Erre Due S.p.A.

- F-DGSi

- LNI SWISSGAS S.R.L.

- Thermo Fisher Scientific Inc

- Angstrom Advanced, Inc.

- CLAIND S.r.l.

- INMATEC Gasetechnologie GmbH & Co. KG

- Linde plc

- Nel ASA

- Nitrogenium Innovations & Filteration India Pvt. Ltd.

- Valco Instruments Co. Inc.

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Analab Scientific Instruments Private Limited

- Apex Gasgen

- Cole-Parmer Instrument Company, LLC.

- Dürr Aktiengesellschaft

- Generon IGS, Inc.

- Hitachi Industrial Equipment Systems Co., Ltd.

- Isolcell S.p.A.

- LabTech S.R.L.

- Leman Instruments

- Matheson Tri-Gas, Inc.

- Messer SE & Co. KGaA

- On Site Gas Systems, Inc.

- Oxymat A/S

- PCI Analytics Private Limited

Strategic Roadmap for Leveraging Modular Technologies Digital Services and Policy Engagement to Fortify Market Position

Industry leaders seeking to advance market share and enhance operational resilience should prioritize a modular innovation roadmap that aligns technology development with evolving application demands. By accelerating investment in digital platforms that integrate predictive analytics, equipment lifecycle management, and remote diagnostics, suppliers can differentiate service offerings while driving higher customer retention. It is equally critical to diversify supply chains for membranes and electrolysis components by establishing regional manufacturing partnerships, thereby mitigating tariff exposure and ensuring consistent delivery timelines.

Furthermore, actively engaging with policy makers to shape favorable incentive structures for domestic production and energy efficiency can unlock new funding avenues. Collaborating with research institutions on pilot programs for low-energy cryogenic and bio-derived sorbent technologies will strengthen product differentiation and reinforce sustainability credentials. Lastly, adopting flexible sales frameworks-combining direct engineering-led projects for high-value laboratories with streamlined online channels for lower purity and flow applications-will broaden market reach and cater to a wider spectrum of end-user needs.

Hybrid Methodological Approach Combining Primary Executive Interviews Secondary Data Triangulation and Scenario Planning

This research draws on a hybrid methodology that integrates qualitative and quantitative data streams to deliver robust, actionable insights. Primary research comprised in-depth interviews with senior executives from equipment manufacturers, distributors, and key end users across pharmaceutical, semiconductor, and academic segments. These conversations illuminated critical purchasing criteria, emerging technology priorities, and regional regulatory influences. Secondary research encompassed a comprehensive review of industry publications, patent filings, government policy documents, and corporate press releases to triangulate technology trends and tariff developments.

Data analysis employed cross-validation techniques to ensure consistency across multiple information sources, while scenario planning exercises assessed the potential impact of evolving regulatory measures and supply chain disruptions. The segmentation framework emerged from a bottom-up categorization of installed base data, enriched by expert workshops that aligned technology performance attributes with application requirements. Quality checks included peer reviews by sector specialists to validate findings and refine the interpretation of market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Gas Generators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Gas Generators Market, by Gas Type

- Laboratory Gas Generators Market, by Generation Technology

- Laboratory Gas Generators Market, by Purity Level

- Laboratory Gas Generators Market, by Output Flow Rate

- Laboratory Gas Generators Market, by Installation Form Factor

- Laboratory Gas Generators Market, by Output Pressure

- Laboratory Gas Generators Market, by Application

- Laboratory Gas Generators Market, by Sales Channel

- Laboratory Gas Generators Market, by End User

- Laboratory Gas Generators Market, by Region

- Laboratory Gas Generators Market, by Group

- Laboratory Gas Generators Market, by Country

- United States Laboratory Gas Generators Market

- China Laboratory Gas Generators Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2226 ]

Concluding Synthesis Emphasizing Integration of Technology Innovation Tariff Adaptation and Regional Strategies for Sustainable Leadership

In summary, the laboratory gas generator market stands at an inflection point characterized by rapid technological innovation, shifting policy landscapes, and evolving end-user expectations around sustainability and digital connectivity. Tariff-driven supply chain realignment has accelerated the move toward localized manufacturing and component sourcing, while modular architectures and advanced service offerings are defining new competitive battlegrounds. Regional insights underscore the importance of tailoring strategies to distinct regulatory and infrastructure contexts, from the Americas’ reshoring incentives to the Asia-Pacific’s high-growth research clusters.

As stakeholders navigate this complex environment, prioritizing investment in energy-efficient technologies, digital services, and strategic partnerships will be essential to capturing emerging opportunities. The market’s dynamic segmentation highlights the critical interplay between technology platforms, gas specifications, and application requirements-pointing toward a future where customizable, on-demand gas generation solutions become the norm. By adopting a forward-looking posture grounded in rigorous research and agile execution, industry participants can secure lasting advantages in the rapidly evolving landscape of laboratory gas generation.

Engage with Our Associate Director to Secure the Comprehensive Laboratory Gas Generator Market Study That Empowers Strategic Decision Making

To gain a comprehensive understanding of how these insights can shape your strategic initiatives and to access the full depth of our market analysis covering emerging technologies, tariff impacts, regional dynamics, and competitive intelligence, we invite you to reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain the detailed report. His expertise will ensure you have the critical data, nuanced analysis, and actionable guidance needed to navigate the laboratory gas generator market with confidence and precision.

- How big is the Laboratory Gas Generators Market?

- What is the Laboratory Gas Generators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?