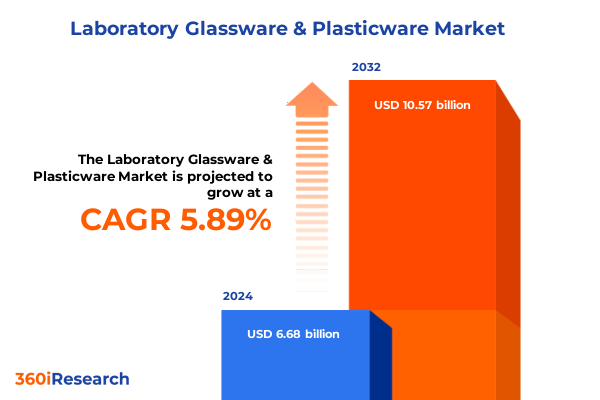

The Laboratory Glassware & Plasticware Market size was estimated at USD 7.06 billion in 2025 and expected to reach USD 7.45 billion in 2026, at a CAGR of 5.94% to reach USD 10.57 billion by 2032.

Navigating the evolving laboratory glassware and plasticware landscape where innovation, regulatory demands, and sustainability converge

Laboratory glassware and plasticware serve as the foundational tools that enable scientific discovery, diagnostic breakthroughs, and quality assurance across diverse industries. In recent years, a surge in pharmaceutical, biotechnology, and clinical research activity has elevated the importance of reliable, high-performance consumables. As laboratories worldwide expand their capacities to meet rising demand for new therapeutics and precision diagnostics, the pressure on supply chains, manufacturing quality, and regulatory compliance has intensified. Consequently, stakeholders are prioritizing product durability, contamination control, and material integrity to ensure the validity of experimental results and patient safety.

This dynamic landscape is further shaped by escalating R&D expenditure and the rapid adoption of advanced laboratory automation. Investments in life sciences have driven laboratories to integrate robotic liquid handling systems and high-throughput screening platforms, necessitating glassware and plasticware that seamlessly interface with sophisticated instrumentation. At the same time, evolving regulatory frameworks and heightened sustainability targets are prompting manufacturers to innovate with eco-friendly polymers and enhanced cleaning protocols. Together, these factors underscore the critical role of labware in underpinning scientific progress and operational resilience in an era of unprecedented technological advancement and environmental accountability.

Uncover how automation technologies, digital transformation initiatives, and eco-conscious materials are redefining the future of laboratory consumables for modern science

The laboratory consumables market is undergoing a transformative renaissance marked by the convergence of digitalization, automation, and green chemistry. Laboratories are increasingly deploying robotics-compatible glass and plastic ware equipped with integrated barcoding and RFID tagging to streamline sample tracking and minimize human error. By embedding traceability features and precision molding into beakers, pipettes, and multiwell plates, manufacturers are forging new pathways for instrument-agnostic workflows that elevate throughput and reproducibility. Concurrently, the rise of microfluidic devices and 3D-printed glass scaffolds is catalyzing novel experimental designs that demand ultra-precise tolerances and specialized geometries to facilitate droplet-based assays and organ-on-a-chip applications.

Sustainability considerations are also reshaping product portfolios as leading suppliers introduce plant-based and biodegradable alternatives to conventional plastics. Innovations in polylactic acid (PLA) labware demonstrate how renewable feedstocks can rival traditional materials in sterility and chemical resistance while reducing lifecycle carbon footprints by up to half. These developments align with regulatory incentives for waste reduction and circular economy principles, prompting a shift toward reusable glassware paired with high-efficiency sterilization protocols. As digital laboratories accelerate and environmental mandates tighten, the interplay between automation readiness and ecological stewardship is redefining product roadmaps and competitive differentiation.

Assessing the significant trade policy shifts and the cumulative impact of 2025 U.S. tariffs on laboratory glassware and plasticware supply chains

The imposition of new U.S. tariffs in 2025 has introduced substantial headwinds for laboratories reliant on imported glassware and plasticware. Under the current regime, a universal 10 percent most-favored-nation duty applies to non-specialized lab supplies while targeted Section 301 measures raise duties on China-origin goods by up to 55 percent. For items containing steel or aluminum components, ad valorem rates can reach 50 percent, further inflating landed costs. These policy shifts have extended lead times by four to eight weeks, amplified logistical complexity, and compelled laboratories to reevaluate procure- ment strategies to safeguard budgetary and operational integrity.

To mitigate these pressures, organizations are auditing supplier origin codes, consolidating orders with U.S.-based distributors, and prioritizing USMCA-compliant sources. By transitioning to domestically manufactured glassware and partnering with regional plasticware producers, labs can sidestep steep duties and reduce exposure to geopolitical volatility. In parallel, the emphasis on reusable stainless steel and borosilicate products has intensified, as institutions seek to balance upfront capital investment against recurring tariff burdens. As trade policy evolves, strategic sourcing and supplier diversification remain critical levers for maintaining uninterrupted laboratory operations and cost efficiency.

Analyzing market segmentation insights that reveal how diverse product types, materials, end users, and distribution channels shape industry dynamics

Insights drawn from rigorous segmentation analyses reveal nuanced dynamics that govern demand for laboratory consumables. When examining the market through the lens of product type, it becomes clear that beakers-whether configured as low form or tall form-continue to serve as versatile vessels for general mixing and heating applications. Flasks, including Erlenmeyer, round bottom, and volumetric variants, address specialized needs ranging from titration to distillation, while petri dishes, available as standard culture plates or multiwell formats, underpin cell and microbiology workflows. Pipettes span air displacement, micropipettes, and volumetric designs to facilitate precise liquid handling, and test tubes-standard or centrifuge grade-remain indispensable for sample storage and separation. The broader category of vials and bottles further supports reagent preservation and sample transport across research, diagnostic, and industrial laboratories.

Material selection profoundly influences performance attributes, with glass delivering high chemical resistance and thermal stability and plastic offering cost-effective disposability and lightweight handling. Diverse end users-from academic and research institutions driving basic science to clinical and hospital laboratories focused on patient care, from food and beverage manufacturers ensuring quality control to pharmaceutical and biotechnology companies spearheading novel therapeutics-exercise distinct procurement priorities. Finally, distribution channels bifurcate into offline networks, where direct relationships and technical support dominate, and online platforms, which emphasize rapid fulfillment and broader product assortments. By decoding these segmentation contours, stakeholders can tailor product development, marketing, and supply strategies to align with the specific demands of each cohort.

This comprehensive research report categorizes the Laboratory Glassware & Plasticware market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- End User

- Distribution Channel

Exploring key regional insights across the Americas, EMEA, and Asia-Pacific that are driving divergent growth trajectories in labware markets

Regional markets for laboratory glassware and plasticware exhibit divergent growth patterns driven by local research ecosystems and policy landscapes. In the Americas, robust pharmaceutical and biotechnology sectors underpinned by elevated life sciences R&D investments sustain strong demand for high-performance labware. North America’s lead in novel drug development and clinical diagnostics has fostered an ecosystem where precision glass components and advanced polymer consumables are requisite. The region’s extensive network of contract research organizations and academic centers further cements its position as a primary consumer of both disposable and reusable labware.

Europe, Middle East & Africa (EMEA) is characterized by stringent regulatory oversight and ambitious circular economy targets, driving manufacturers to innovate with recyclable materials and energy-efficient production processes. European laboratories are increasingly adopting reusable glass products paired with state-of-the-art sterilization systems, while Middle Eastern nations ramp up investment in healthcare infrastructure and research institutes. Africa’s emerging research hubs are also catalyzing demand for cost-effective plasticware solutions that balance affordability with compliance to international quality standards.

Asia-Pacific stands out for its rapid rise in R&D expenditures and expansive government support for science and technology. In China, R&D spending reached nearly 3.6 trillion yuan in 2024-a year-on-year increase of 8.3 percent-propelling demand for specialized lab consumables that meet evolving research needs. India and other regional markets are mirroring this trajectory, with public-private partnerships driving the establishment of new research centers and biomanufacturing facilities. Consequently, Asia-Pacific represents a critical arena for market expansion and innovation in labware manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Glassware & Plasticware market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading companies' strategic initiatives from innovation to sustainability that define competitive positioning in the labware market

Competitive dynamics in the laboratory glassware and plasticware sector are shaped by a cadre of global leaders and innovative challengers. Thermo Fisher Scientific and Corning Incorporated leverage their extensive R&D capabilities to deliver automation-compatible pipetting systems and high-throughput plate solutions that integrate seamlessly with robotic workstations. Merck KGaA and Sartorius AG, with deep European heritage, emphasize sustainable manufacturing practices, advancing plant-based polymers and recycled glassware while maintaining compliance with stringent EU environmental standards. Meanwhile, companies such as DWK Life Sciences and Gerresheimer AG focus on customizable glass and polymer formulations tailored to niche applications, from high-pressure reaction vessels to biocontainment-grade consumables.

Strategic partnerships are also redefining the competitive landscape, as suppliers collaborate with laboratory automation vendors and digital platform providers to enhance traceability and data-integration features. Mergers and acquisitions remain prevalent, enabling firms to expand product portfolios and geographic reach while capturing synergies in procurement and logistics. With sustainability increasingly central to purchasing decisions, market leaders are intensifying investments in eco-friendly materials and closed-loop recycling systems, differentiating their offerings through carbon footprint transparency and cradle-to-grave lifecycle stewardship. This fusion of innovation, scale, and sustainability underpins the market positioning of key players as they vie for market share in a rapidly evolving environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Glassware & Plasticware market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advin Health Care Private Limited

- Agilent Technologies, Inc.

- Avantor, Inc.

- Bellco Glass Inc.

- Boeckel + Co (GmbH + Co) KG

- Borosil Limited

- Brand GMBH + CO KG

- Chemglass, Inc.

- Citotest Scientific Co.,Ltd.

- Corning Incorporated

- DWK Life Sciences GmbH

- Eppendorf SE

- Gerresheimer AG

- Glassco Laboratory Equipments Pvt. Ltd.

- GLASWARENFABRIK KARL HECHT GMBH & CO KG

- Globe Scientific Inc.

- Greiner Bio-One International GmbH

- Hamilton Laboratory Glass Ltd.

- Merck KGaA

- Mettler-Toledo International Inc.

- Poulten & Graf GmbH

- Sarstedt AG & Co. KG

- Sartorius AG

- Savillex, LLC

- Sibata Scientific Technology Holdings Limited

- SP Wilmad-LabGlass

- Supertek Glassware

- Technosklo S.R.O.

- Thermo Fisher Scientific Inc.

- VITLAB GmbH

Delivering actionable recommendations for industry leaders to navigate supply chain risks, foster sustainability, and capture emerging opportunities

To thrive amid heightened trade uncertainties and sustainability imperatives, industry leaders must adopt a multi-faceted strategic playbook. First, diversifying supplier networks is critical; organizations should conduct comprehensive origin audits, prioritizing partnerships with domestic and USMCA-compliant manufacturers to insulate operations from tariff volatility. Concurrently, forging alliances with regional distributors can ensure buffer inventory and agile replenishment capabilities, reducing lead-time risks.

Second, embedding sustainability at the core of product development will deliver both regulatory compliance and brand differentiation. By investing in bio-based polymers, recyclable glass formulations, and energy-efficient manufacturing methods, companies can cater to laboratories’ growing environmental mandates. Third, deepening collaboration with automation technology providers will unlock new value propositions, as advanced consumables featuring barcoding, RFID, and AI-ready designs accelerate data-driven workflows. Finally, maintaining continuous horizon scanning of trade policies and regulatory shifts will enable proactive adjustments to pricing, sourcing, and inventory strategies. This adaptive, integrated approach positions labware suppliers to capture emerging opportunities while fortifying resilience against external pressures.

Outlining a rigorous research methodology combining primary interviews, secondary data, and triangulation to ensure comprehensive market insights

This analysis draws upon a robust research methodology designed to ensure rigor, relevance, and impartiality. Primary research components included in-depth interviews with senior procurement managers, laboratory directors, and technical experts across pharmaceutical, academic, and industrial sectors. These dialogues elucidated real-world challenges, supplier selection criteria, and future investment priorities.

Secondary research entailed a comprehensive review of industry reports, trade publications, and government tariff notices to validate macroeconomic trends and policy impacts. Data triangulation techniques reconciled insights from multiple sources-encompassing trade associations, customs databases, and environmental regulations-to construct a coherent market narrative. Segmentation analysis leveraged detailed product-level taxonomies, material classifications, and end-user categories to uncover demand drivers and competitive dynamics. Finally, qualitative findings were cross-checked with quantitative indicators such as R&D expenditure statistics, import duty schedules, and corporate sustainability disclosures to reinforce the analysis and ensure actionable precision.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Glassware & Plasticware market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Glassware & Plasticware Market, by Product Type

- Laboratory Glassware & Plasticware Market, by Material

- Laboratory Glassware & Plasticware Market, by End User

- Laboratory Glassware & Plasticware Market, by Distribution Channel

- Laboratory Glassware & Plasticware Market, by Region

- Laboratory Glassware & Plasticware Market, by Group

- Laboratory Glassware & Plasticware Market, by Country

- United States Laboratory Glassware & Plasticware Market

- China Laboratory Glassware & Plasticware Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing the executive summary’s core findings into a compelling narrative that underscores future strategic imperatives for labware stakeholders

The laboratory glassware and plasticware market stands at the intersection of technological innovation, environmental stewardship, and evolving trade frameworks. Automation and digital lab initiatives are reshaping product specifications, demanding consumables that facilitate high-throughput, data-driven workflows. Meanwhile, sustainability mandates and plant-based material innovations are catalyzing a shift toward circular-economy business models. At the same time, the imposition of new tariffs in early 2025 has underscored the importance of diversified sourcing strategies and domestic manufacturing partnerships.

Tailored segmentation analysis highlights that demand dynamics vary significantly by product type, material, end user, and distribution channel, requiring nuanced go-to-market approaches. Regional insights reveal diverging growth engines-from North America’s R&D intensity to EMEA’s regulatory and environmental considerations to Asia-Pacific’s rapid expansion. Competitive forces are defined by strategic investments in sustainability, digital integration, and portfolio diversification among leading global players.

Collectively, these observations point to a market in flux yet ripe with opportunity. By aligning sourcing strategies, product innovation roadmaps, and sustainability commitments with emerging customer priorities and policy landscapes, stakeholders can position themselves for sustained growth and competitive differentiation in the evolving laboratory consumables ecosystem.

Partner with Ketan Rohom to access the comprehensive laboratory glassware and plasticware market report and drive strategic growth initiatives

Ready to translate these insights into strategic actions and gain a competitive edge? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive laboratory glassware and plasticware market research report. Equip your organization with the in-depth analysis, exclusive data, and future-proof recommendations necessary to drive growth, optimize procurement, and stay ahead in a rapidly evolving industry. Connect today and harness the full potential of your labware investments.

- How big is the Laboratory Glassware & Plasticware Market?

- What is the Laboratory Glassware & Plasticware Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?