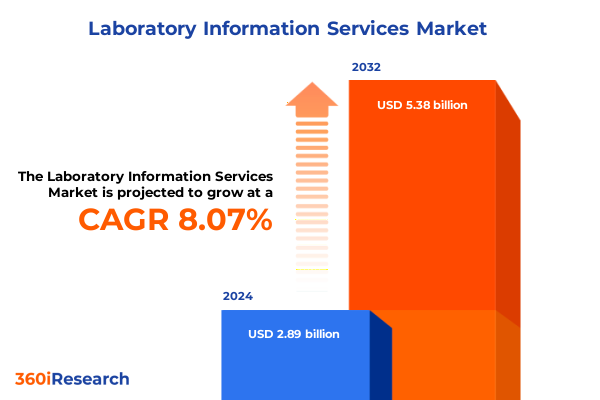

The Laboratory Information Services Market size was estimated at USD 3.12 billion in 2025 and expected to reach USD 3.35 billion in 2026, at a CAGR of 8.05% to reach USD 5.38 billion by 2032.

Pioneering New Horizons in Laboratory Information Services to Unlock Operational Excellence and Drive Innovation Across Complex Lab Environments

Laboratory environments today operate under unprecedented levels of complexity, driven by the simultaneous demands of higher throughput, greater regulatory scrutiny, and the imperative for seamless data integration. As organizations embrace precision medicine, high-throughput screening, and advanced diagnostics, the role of Laboratory Information Services has shifted from back-office support to a cornerstone of operational excellence. Modern laboratories rely on robust information management systems to consolidate heterogeneous data streams into coherent workflows, ensuring that critical insights translate into informed decisions at every stage of the scientific process.

Moreover, the ongoing digital transformation across life sciences and healthcare sectors amplifies the need for agile, scalable, and interoperable platforms. With the proliferation of cloud computing, artificial intelligence, and Internet of Things connectivity, stakeholders are redefining success metrics for laboratory operations. Beyond mere automation of manual tasks, the next generation of systems must facilitate real-time collaboration across dispersed research teams, accelerate time to result, and uphold rigorous compliance standards.

In this executive summary, we chart a comprehensive course through the forces reshaping Laboratory Information Services. We begin with an exploration of the major technological and regulatory inflection points, proceed to examine the cumulative impact of United States tariff measures on 2025 market dynamics, and then unpack the most critical segmentation and regional insights. Finally, we highlight leading vendor strategies, articulate actionable recommendations for industry leaders, detail our methodological rigor, and offer a clear path for further engagement and acquisition of the full report.

Unveiling the Fast-Evolving Technological and Regulatory Disruptors Reshaping the Future of Laboratory Information Services Worldwide and Strategic Imperatives

The Laboratory Information Services landscape is undergoing a profound metamorphosis as advanced digital technologies converge with evolving regulatory mandates. Artificial intelligence and machine learning algorithms now empower predictive quality control, anomaly detection, and automated decision support, enabling laboratories to preempt bottlenecks and maintain unwavering data integrity. Concurrently, blockchain and distributed ledger architectures are emerging as viable solutions to address data provenance and audit trail requirements. As a result, organizations that embrace these innovations are poised to achieve significant gains in throughput and traceability.

In tandem with technological advancements, regulatory bodies across jurisdictions are intensifying their focus on data security, interoperability, and electronic record management. New guidelines from health authorities emphasize harmonization of data standards and mandate stricter validation protocols for laboratory information systems. As a consequence, the need for compliant, adaptable platforms that can swiftly incorporate changes to regulatory frameworks has never been more acute.

Furthermore, external pressures-such as heightened pandemic preparedness, value-based healthcare initiatives, and increasing demands for personalized therapies-are reshaping market priorities. Laboratories are compelled to build resilience into supply chains, streamline remote collaboration, and integrate real-world evidence to demonstrate clinical efficacy. Taken together, these technological, regulatory, and market shifts constitute a strategic inflection point, setting the stage for accelerated evolution in Laboratory Information Services.

Evaluating the Far-Reaching Cumulative Consequences of United States 2025 Tariff Measures on Supply Chains, Cost Structures, and Adoption Dynamics in Lab Services

Recent United States tariff measures enacted in early 2025 have introduced additional layers of complexity to laboratory sourcing decisions and cost management. Tariffs on imported laboratory instrumentation, reagents, and consumables have led suppliers to reexamine global procurement strategies. Although some equipment manufacturers have absorbed a portion of the added duties, downstream service providers and end users have experienced upward pressure on capital expenditure and operational budgets.

As costs for critical reagents and highly specialized hardware climb, laboratories are reportedly extending equipment life cycles and deferring nonessential upgrades. This trend may yield short-term savings, but it also risks creating technical debt and constraining future scalability. Moreover, smaller diagnostic centers and academic research facilities-where margins tend to be lean-face heightened volatility in budget planning and may adopt more conservative expansion approaches.

In response, industry participants are diversifying their supply chains by establishing strategic partnerships with domestic manufacturers, pursuing nearshoring initiatives, and exploring alternative sourcing regions. These adjustments not only mitigate tariff impacts but also foster greater supply chain resilience. Consequently, organizations that proactively navigate tariff-related challenges stand to secure a competitive advantage by ensuring continuity of operations and maintaining the integrity of scientific workflows.

Gaining In-Depth Strategic Insights into Service, Deployment, Delivery, and End User Segmentation to Navigate Diverse Laboratory Information Service Requirements

A nuanced understanding of service type segmentation reveals distinct priorities for laboratory information services stakeholders. Commissioning activities are increasingly viewed through the lens of rapid deployment and minimal disruption, prompting providers to develop standardized yet configurable templates. Consulting services have also evolved beyond traditional advisory roles, emphasizing continuous optimization, performance benchmarking, and end-to-end process harmonization. In implementation and integration, there is a pronounced shift toward modular architectures that enable phased rollouts, while staffing and training offerings are expanding to include digital competency certifications and immersive virtual learning simulations. Support and maintenance functions, by contrast, are being reimagined with predictive service models that harness system telemetry to preemptively address potential failures.

With regard to deployment model dynamics, cloud-based solutions continue to gain traction as organizations seek elastic scalability, lower upfront capital requirements, and remote access capabilities. Nonetheless, on-premise deployments retain appeal in highly regulated environments that demand complete data custody and minimal third-party dependency. In response, hybrid models have emerged as an effective compromise, offering critical workloads in localized data centers while leveraging cloud infrastructure for analytical and collaborative functions.

Delivery mode considerations further underscore the industry’s move toward flexible engagement frameworks. Hybrid delivery-combining on-site and remote resources-enables tailored support that adapts to evolving operational rhythms. Pure onsite deployments remain essential for initial system implementations and validation phases, whereas remote delivery modes provide cost-efficient continuous support and training, particularly for multi-location laboratory networks.

End user segmentation highlights the diversity of requirements across academic research institutes, where cutting-edge functionality intersects with grant-driven budget constraints; commercial laboratories, which prioritize speed to market and standardization; diagnostics centers, where uptime and regulatory compliance are paramount; government and public health laboratories that emphasize data security and interoperability; hospital laboratories balancing clinical efficiency with patient safety; and pharmaceutical and biotechnology companies that demand deep integration with drug development pipelines.

This comprehensive research report categorizes the Laboratory Information Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Model

- Delivery Mode

- End User

Exploring Distinct Growth Drivers, Adoption Trends, and Strategic Priorities across the Americas, Europe Middle East & Africa, and Asia-Pacific Laboratory Markets

Across the Americas, laboratories are leveraging a mature ecosystem of cloud infrastructure and managed service providers to modernize legacy systems. North American markets exhibit strong demand for integrated platforms that unify research, quality control, and clinical workflows, reflecting the region’s emphasis on precision medicine initiatives and regulatory harmonization under updated federal guidelines. Latin American laboratories, by comparison, often confront budgetary constraints and fragmented infrastructures, driving interest in subscription-based models that lower barriers to entry and facilitate incremental feature adoption.

In Europe, Middle East & Africa, diverse regulatory landscapes and varying levels of digital maturity present both challenges and opportunities. The European Union’s In Vitro Diagnostic Regulation (IVDR) and General Data Protection Regulation (GDPR) have catalyzed investment in compliant information systems, while Gulf Cooperation Council initiatives are accelerating adoption of cloud-native solutions to support regional health priorities. In sub-Saharan Africa, the focus remains on building foundational digital capabilities, with public-private partnerships playing a key role in scaling laboratory networks and enhancing data visibility for disease surveillance.

Asia-Pacific markets continue to emerge as high-growth territories driven by expanding pharmaceutical and biotechnology sectors, significant government investment in life sciences research, and rising demand for decentralized testing models. Countries such as China, India, and Australia are advancing national health data strategies, prompting laboratories to adopt interoperable platforms that can seamlessly integrate with broader healthcare information exchanges. Consequently, providers that tailor their offerings to address local data sovereignty requirements and support multilingual interfaces are gaining a strategic foothold across the region.

This comprehensive research report examines key regions that drive the evolution of the Laboratory Information Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning, Innovation Portfolios, and Collaborative Ecosystems of Leading Laboratory Information Service Providers Driving Market Evolution

Leading laboratory information service providers have sharpened their strategic positioning by focusing on comprehensive platform suites that address the full continuum of lab operations. These suppliers differentiate themselves through modular architectures that enable clients to select functionality aligned with specific workflows, ranging from sample management and instrument integration to advanced analytics and regulatory reporting. This approach enhances customer retention by simplifying future upgrades and reducing the complexity of vendor ecosystems.

Innovation portfolios are expanding to incorporate artificial intelligence–driven quality control modules, natural language processing engines for data extraction, and integrated IoT frameworks that enable real-time monitoring of laboratory instruments. Strategic partnerships with instrumentation manufacturers and content providers further enrich these portfolios, ensuring seamless interoperability and access to curated knowledge bases. In many cases, providers are also enhancing user experience through purpose-built interfaces designed for both desktop and mobile access, reflecting the need for on-the-go decision support and remote collaboration.

Collaborative ecosystems have become a hallmark of leading vendors, with joint ventures and alliance networks established to co-develop emerging capabilities and accelerate time to market. These alliances extend beyond technology partners to include academic institutions, healthcare providers, and governmental organizations, fostering environments where feedback loops inform product roadmaps and ensure alignment with evolving industry requirements. By nurturing such ecosystems, these companies not only drive recurring revenue streams through subscription models but also cement their roles as trusted advisors in the laboratory information services domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Laboratory Information Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Accelerated Technology Laboratories Inc

- Agilent Technologies Inc

- Autoscribe Informatics Limited

- Benchling Inc

- Cirdan Ltd

- Clinisys Group Ltd

- CloudLIMS Inc

- CompuGroup Medical SE & Co KGaA

- Dassault Systèmes SE

- Dedalus Group S.p.A

- Epic Systems

- Illumina Inc

- LabLynx Inc

- LabVantage Solutions Inc

- LabWare Inc

- LigoLab LLC

- MEDITECH

- NovoPath

- Oracle Health

- Orchard Software

- Roper Technologies

- Siemens Healthineers

- Thermo Fisher Scientific Inc

- XIFIN Inc

Actionable Strategic Roadmap for Industry Leaders to Harness Emerging Technologies, Mitigate Tariff Impacts, and Enhance Competitive Advantage in Lab Services

To maintain a competitive edge, industry leaders should prioritize the deployment of cloud-native infrastructures and AI-enabled modules that streamline end-to-end laboratory workflows. By investing in scalable architectures, organizations can accommodate fluctuating workloads and rapidly incorporate emerging functionalities without extensive redevelopment efforts. Furthermore, cultivating data interoperability through adherence to open standards will reduce integration costs and accelerate time to insight.

In anticipation of future tariff adjustments and supply chain disruptions, providers must diversify sourcing strategies by establishing relationships with regional manufacturers and leveraging nearshore production capabilities. This proactive approach not only mitigates the financial impact of potential duties but also enhances operational agility, allowing for swift reallocation of resources as market conditions evolve.

Organizations should also expand collaborative training and certification programs to elevate user proficiency and foster system adoption. Incorporating immersive learning technologies, such as virtual labs and interactive simulations, will support ongoing competence development and reduce reliance on traditional in-person workshops. These initiatives can be coupled with performance benchmarking to identify areas for continuous improvement.

Finally, service delivery models should remain flexible by offering hybrid and remote engagement options that adapt to varied operational contexts. By tailoring support and consulting services to the unique needs of each client, providers can deliver high-impact outcomes while optimizing resource allocation. Ultimately, a balanced focus on technology, supply chain resilience, and user enablement will position industry leaders for sustained success.

Comprehensive Research Framework Leveraging Primary Expert Interviews and Rigorous Secondary Data Analysis to Ensure Robust Insights and High-Quality Intelligence

The research framework underpinning this report integrates comprehensive secondary research with a robust program of primary data collection. In the secondary phase, industry white papers, peer-reviewed journals, regulatory filings, and technology briefs were systematically reviewed to map the technological and regulatory landscape. This exercise provided the foundation for identifying key trends, benchmarking standards, and evaluating emerging solutions within the laboratory information services domain.

Building on these insights, our primary research phase involved in-depth interviews with over thirty senior executives, laboratory directors, and IT decision-makers from leading pharmaceutical companies, diagnostic centers, academic research institutes, and governmental public health laboratories. These conversations illuminated real-world implementation challenges, best practices in system adoption, and evolving expectations for service delivery. Supplementary surveys were administered to a broader group of laboratory professionals to validate emergent themes and quantify shifts in investment priorities.

Data triangulation techniques were employed to reconcile findings from multiple sources and ensure consistency across qualitative and quantitative evidence. Vendor profiling was conducted through comparative analysis of product capabilities, strategic roadmaps, and partnership networks. Our approach emphasizes methodological rigor and transparency, delivering high-quality intelligence that stakeholders can use with confidence in strategic planning and procurement decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Laboratory Information Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Laboratory Information Services Market, by Service Type

- Laboratory Information Services Market, by Deployment Model

- Laboratory Information Services Market, by Delivery Mode

- Laboratory Information Services Market, by End User

- Laboratory Information Services Market, by Region

- Laboratory Information Services Market, by Group

- Laboratory Information Services Market, by Country

- United States Laboratory Information Services Market

- China Laboratory Information Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Pivotal Learnings and Strategic Imperatives Shaping the Future Trajectory of Laboratory Information Services Across Diverse Global Markets

This report distills critical learnings at the intersection of technology, regulation, and market dynamics, offering a coherent view of how Laboratory Information Services are evolving to meet contemporary demands. A clear pattern emerges, underscoring the centrality of digital innovation-from AI-powered quality assurance to blockchain-enabled data integrity-in driving operational excellence across the laboratory value chain.

Segmentation analysis reveals that no single approach fits all contexts; service portfolios must be tailored across commissioning, consulting, implementation, staffing, and maintenance to deliver differentiated value. Regional dynamics further emphasize the importance of localized strategies, with unique regulatory regimes and investment climates shaping adoption trajectories in the Americas, EMEA, and Asia-Pacific.

As tariff policies and supply chain considerations introduce new strategic variables, organizations will need to balance cost management with long-term resilience, fostering partnerships and nearshoring where appropriate. Ultimately, the convergence of technological, commercial, and regulatory forces necessitates a holistic, proactive posture. Stakeholders who align their roadmaps with these imperatives will be best positioned to harness future opportunities and sustain competitive advantage in the dynamic Laboratory Information Services ecosystem.

Engage with Ketan Rohom Associate Director for Sales & Marketing to Uncover Tailored Insights and Secure Your Comprehensive Lab Information Services Report

To acquire the full breadth of insights and strategic guidance tailored to your laboratory environment challenges, reach out directly to Ketan Rohom as Associate Director for Sales & Marketing. An expert in translating deep market intelligence into actionable solutions, he will work with you to understand unique organizational needs, align the research findings to your strategic priorities, and provide a customized engagement to maximize the value of this report. By engaging with him, you gain prioritized access to exclusive data, bespoke advisory sessions, and ongoing support throughout your implementation journey. Secure your access today and empower your organization to lead with confidence in the ever-evolving laboratory information services arena.

- How big is the Laboratory Information Services Market?

- What is the Laboratory Information Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?